Blockchain In Insurance Market Research, 2031

The global blockchain in insurance market was valued at $496.9 million in 2021, and is projected to reach $32.9 billion by 2031, growing at a CAGR of 52.4% from 2022 to 2031.

A blockchain is a distributed register to store static records or dynamic transaction data without central coordination by using a consensus-based mechanism to check the validity of transactions. The primary goal of blockchain in the insurance industry is to protect against fraud in automated transactions by allowing them to track and manage physical data digitally. Insurers and customers can use blockchain technology to create smart contracts that manage claims in a transparent and timely manner.

Adoption of technologically advanced software platforms is driving the blockchain in insurance market growth. Over the years, a steep rise has been noticed in the technology adoption rate by insurance which is driving the growth of the insurance industry. Moreover, AR apps-based tutorials and games can be valuable marketing tools and can help gather customer insights and reduce the cost of training by enhancing the learning experience. In addition, growing number fraudulent insurance claims and increasing demand for secure online platforms. Thus, these factors drive the growth of the blockchain in insurance size.

However, high initial setup costs and lack of standardization and awareness in blockchain technology are hampering the growth of the blockchain in insurance. On the contrary, growth of smart contracts in insurance will provide major lucrative opportunities for growth of the blockchain in insurance.

The report focuses on growth prospects, restraints, and trends of the blockchain in insurance outlook. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the blockchain in insurance market size.

The blockchain in insurance market is segmented into Component, Application and Enterprise Size.

Segment Review

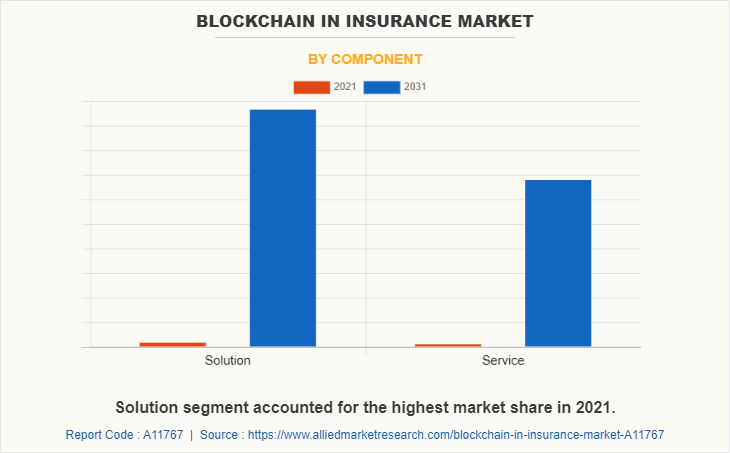

The blockchain in insurance is segmented on the basis of component, application, organization size, provider, and region. By component, it is segmented into solution and service. By application, it is segmented into GRC management, claims management, identity management and fraud detection, payments, and others. By organization size, it is segmented into large enterprises and small and medium-sized enterprises. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on component, the solution segment attained the highest blockchain in insurance market share in 2021. This is attributed to the fact that blockchain solutions can be decisive in transforming and simplifying the insurance industry to break free from outdated traditions with efficiency. Further, Increased customer distrust in centralized financial services, resulting in high underinsurance rates, is driving its reluctant yet solid interest in blockchain in insurance solution innovations.

By region, North America attained the highest blockchain in insurance market size in 2021. This is attributed to the fact that major retail banking service companies in North America are using blockchain services for the betterment of the customers and also to prevent fraud. Furthermore, the surge in adoption of blockchain technology for KYC/ID fraud prevention and risk scoring, as well as the rise in internet penetration rate, is expected to boost blockchain in insurance industry.

The report analyzes the profiles of key players operating in the blockchain in insurance market outlook such as Consensys, Auxesis Services & Technologies (P) Ltd., Amazon Web Services, Inc., ChainThat, IBM, Microsoft, Oracle, SafeShare Global, RecordsKeeper and Symbiont. These players have adopted various strategies to increase their market penetration and strengthen their position in the blockchain in insurance market.

Market Landscape and Trends

The use of blockchain technology in the insurance industry has been gaining momentum in recent years. Blockchain is a distributed ledger technology that allows for secure, transparent and immutable record-keeping, making it a promising solution for the insurance market. Moreover, blockchain is being used to extend insurance services to underserved markets, such as small and medium-sized businesses, freelancers, and individuals without access to traditional banking services. In addition, the insurance industry is increasingly focused on delivering a better customer experience, by leveraging new technologies and data analytics to improve customer engagement and satisfaction. This includes developing new products and services that are tailored to specific customer needs, as well as offering a more streamlined and personalized claims process.

Furthermore, the blockchain in insurance is expected to continue to grow in the future as more companies and organizations adopt these technologies to improve efficiency, reduce costs and deliver a better customer experience, ultimately transforming the insurance industry for the better. Therefore, these are the major market trends for blockchain in insurance market forecast.

Top Impacting Factors

Adoption of Technologically Advanced Software Platforms

Over the years, a steep rise has been noticed in the technology adoption rate by insurance which is driving the growth of the insurance industry. Over the years, a steep rise has been noticed in the technology adoption rate by insurance which is driving the growth of the insurance industry. Moreover, chatbot is transforming the insurance sector by personalizing customer interactions via human-like interfaces. In addition, AR apps-based tutorials and games can be valuable marketing tools and can help gather customer insights and reduce the cost of training by enhancing the learning experience.

Furthermore, with conversational AI, chatbots and voicebots come into the picture. A Conversational approach towards various use cases such as buying insurance online, customer support and premium quotations is easily achievable with minimum efforts. It saves time & money for both insurers and companies, it can transform the way of operation and give a seamless experience. Therefore, these factors in insurance are driving the growth of the blockchain in insurance.

Growing Number Fraudulent Insurance Claims

The insurance industry is one of the most vulnerable sectors subject to various frauds and data thefts Implementing blockchain in insurance is one of the novel ways to reduce fraud, minimize risks, and increase customer satisfaction. Fraudulent activities in the insurance industry are increasing. Hence, it makes a compelling reason to adopt the blockchain technology in its processes. As a result, insurance companies have to replace their inefficient legacy systems integrated in the insurance systems with belter systems for efficient prevention of fraudulent claims.

Moreover, blockchain offers decentralized public ledger across multiple untrusted parties. Thus, it can be used to eliminate errors and identify fraudulent activities. In addition, blockchain technology, which can be used to verify the authenticity of insurance customers' policies by providing a complete historical record of a policy holder's past transactions, is built on the concept of validation. Therefore, blockchain technology improves the efficiency of fraud detection & prevention and with the adoption of blockchain technology in insurance.

Increasing Demand for Secure Online Platforms

The adoption of secure online platforms is driving growth in the blockchain in insurance, as the insurance industry is increasingly leveraging digital technologies to improve customer experience, streamline processes, and enhance their operations. This has led to a growing demand for secure online platforms that can provide a seamless and secure digital experience for customers.

Moreover, the COVID-19 pandemic has accelerated the trend towards remote work and remote access to services, including insurance. As more people are working from home and access insurance services online, there is an increasing need for secure online platforms that can provide reliable and secure access to data and services. In addition, the insurance industry is subject to strict regulations around data privacy and security, and non-compliance can result in serious consequences. This has led to an increased demand for secure online platforms that can meet these regulatory requirements. Therefore, insurers are investing in secure online platforms to meet the needs of their customers and ensure the security of their data, which is driving the growth of blockchain in insurance market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the blockchain in insurance market analysis from 2021 to 2031 to identify the prevailing blockchain in insurance market share.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the blockchain in insurance market size segmentation assists to determine the prevailing blockchain in insurance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global blockchain in insurance market trends, key players, market segments, application areas, and market growth strategies.

Blockchain in Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 32.9 billion |

| Growth Rate | CAGR of 52.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 380 |

| By Component |

|

| By Application |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Consensys, RecordsKeeper, SafeShare Global, Symbiont, Amazon Web Services, Inc., Microsoft, IBM, Oracle, Xceedance, Auxesis Services & Technologies (P) Ltd. |

Analyst Review

Blockchain is a data structure that enables the creation of a digital ledger of transactions and the ability to share them among a distributed network of computers. The core benefit of blockchain is that it builds trust between parties sharing information. The information shared is encrypted as an electronic list of records or blocks. It cannot be erased, which helps to ensure trust between users. Moreover, blockchain has the ability to help automate claims functions by verifying coverage between companies and reinsurers. It will also automate payments between parties for claims and thus lower administrative costs for insurance companies.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, in Nov 2022, flac Incorporated (NYSE: AFL), a Fortune 500 company that helps protect more than 50 million people in Japan and the United States, and Trupanion, Inc. (Nasdaq: TRUP), a leader in medical insurance for cats and dogs, are announcing a joint venture between Aflac Life Insurance Japan and Trupanion to provide high-value pet insurance in Japan. The joint venture, Aflac Pet Insurance, will leverage Aflac's strong brand, insurance expertise, and broad distribution network in Japan with Trupanion's expertise and leadership in pet insurance. This product partnership helped both the companies to grow its market in terms of revenue and attract more customers.

Some of the key players profiled in the report include Consensys, Auxesis Services & Technologies (P) Ltd., Amazon Web Services, Inc., IBM, Microsoft, Oracle, SafeShare Global, RecordsKeeper and Symbiont. These players have adopted various strategies to increase their market penetration and strengthen their position in the blockchain in insurance market.

The blockchain in insurance market is estimated to grow at a CAGR of 52.4% from 2022 to 2031.

The blockchain in insurance market is projected to reach $32.9 billion by 2031.

Adoption of technologically advanced software platforms, growing number fraudulent insurance claims and increasing demand for secure online platforms majorly contribute toward the growth of the market.

The key players profiled in the report include reinsurance market analysis includes top companies operating in the market such as Consensys, Auxesis Services & Technologies (P) Ltd., Amazon Web Services, Inc., ChainThat, IBM, Microsoft, Oracle, SafeShare Global, RecordsKeeper and Symbiont.

The key growth strategies of blockchain in insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...