Blood And Blood Components Market Research, 2033

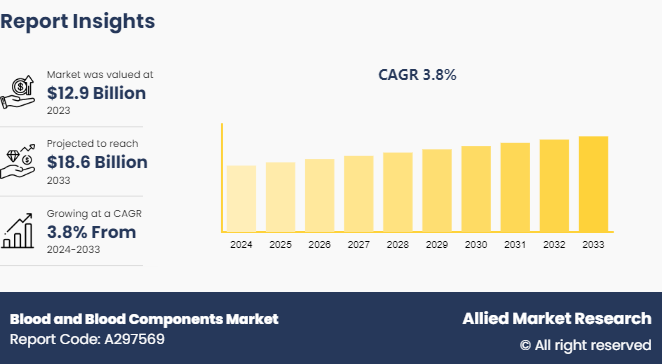

The global blood and blood components market size was valued at $12.9 billion in 2023, and is projected to reach $18.6 billion by 2033, growing at a CAGR of 3.8% from 2024 to 2033. Rising prevalence of chronic diseases and increasing demand for advanced blood therapies and transfusion technologies drive growth in the blood and blood components market.

Market Definition and Overview

Blood and blood components refer to the vital constituents of human blood that play crucial roles in maintaining bodily functions and health. Blood primarily consists of plasma, red blood cells (erythrocytes) , white blood cells (leukocytes) , and platelets (thrombocytes) . Plasma, the liquid portion of blood, contains water, electrolytes, proteins, hormones, and waste products. Red blood cells transport oxygen from the lungs to tissues and remove carbon dioxide. White blood cells are key components of the immune system, which defend the body against infections and diseases. Platelets aid in blood clotting, preventing excessive bleeding. Blood components are used in various medical treatments, including transfusions to replace lost blood, treat blood disorders, and support patients undergoing surgery or chemotherapy. Understanding blood and its components is essential for diagnosing and managing numerous medical conditions, ensuring the proper functioning of the body's physiological processes.

Key Takeaways

- The blood and blood components market size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major blood and blood components industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global blood and blood components market share and to assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The blood and blood components market is driven by a surge in demand propelled by rising incidence of accidents, surgeries, and chronic diseases. With these occurrences becoming increasingly prevalent, there is a heightened necessity for a consistent and reliable supply of blood and its components to facilitate transfusions and treatments. Accidents and surgical procedures often lead to blood loss, necessitating immediate transfusions to stabilize patients and aid in their recovery. Additionally, chronic diseases such as cancer and blood disorders require ongoing blood transfusions as part of treatment protocols. This escalating demand underscores the importance of maintaining a robust blood supply chain to meet the healthcare needs of individuals worldwide.

Stringent regulations governing blood collection, processing, storage, and distribution present significant hurdles for the expansion of the blood and blood components market. Compliance with these regulations adds complexity and costs to the entire supply chain, from donor recruitment to transfusion. Meeting rigorous standards for quality control and safety measures requires substantial investments in infrastructure and technology. Furthermore, navigating through regulatory frameworks across different dominions can create additional challenges for market players, limiting their ability to scale operations efficiently.

The blood and blood components market is poised for significant growth driven by ongoing technological innovations. Advancements in blood processing, storage, and testing technologies are enhancing the efficiency and safety of blood products. These innovations not only streamline the process of blood collection and storage but also ensure the quality and integrity of blood components, reducing the risk of transfusion-related complications. As a result, healthcare providers can confidently meet the increasing demand for blood transfusions across various medical procedures, thereby stimulating market growth. With continued research and development efforts aimed at further improving these technologies, the blood and blood components market opportunity is primed to capitalize on the opportunities presented by innovation-driven advancements.

Parent Market Overview for Global Blood and Blood Components Market

The global blood and blood components market operates within the broader healthcare industry, particularly in the field of medical supplies and services. This market encompasses the collection, processing, storage, and distribution of blood and its various components, including red blood cells, white blood cells, platelets, and plasma. It serves a critical role in supporting medical procedures such as surgeries, trauma care, cancer treatments, and management of blood disorders. The parent market, the healthcare industry, is influenced by factors such as demographics, healthcare expenditure, regulatory frameworks, technological advancements, and the prevalence of diseases requiring blood transfusions. Moreover, collaborations between healthcare institutions, blood banks, and research organizations drive innovation and market growth. With increasing awareness of blood donation, rising demand for blood products, and continuous advancements in technology, the global blood and blood components market is positioned for sustained expansion within the broader healthcare landscape.

Market Segmentation

The market is segmented into types, applications, and region. On the basis of product, the market is divided into whole blood, blood components, and blood derivatives. As per application, the market is segregated into anemia, trauma & surgery, cancer treatment, and bleeding disorders. As per end user, the market is segregated into hospitals, ambulatory surgical centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

North America is predicted to hold a major share in the global blood and blood components market growth during the forecast period. In North America, the blood and blood components market share is propelled by factors such as advanced healthcare infrastructure, increasing prevalence of chronic diseases, stringent regulatory standards, and technological innovations. These factors collectively contribute to a robust market landscape catering to the region's healthcare needs. In December 2018, HealthStream, a U.S.-based healthcare company, partnered with the American Red Cross to co-create novel resuscitation programs tailored for healthcare organizations. These programs concentrate on addressing physiological disorders in critically ill patients, particularly in traumatic surgery, intensive care, and emergency medicine settings. Given the pivotal role of blood and blood product infusion in such protocols, collaborations aimed at advancing resuscitation programs are anticipated to drive growth in the blood and blood components market in the foreseeable future.

- In July 2023, the Centers for Disease Control and Prevention (CDC) , a U.S. government agency, reported that hemophilia A affects roughly one in every 5, 000 male births in the United States, resulting in approximately 400 new cases annually. Moreover, it is estimated that there are currently between 30, 000 and 33, 000 males living with hemophilia in the United States.

- In June 2023, on World Blood Donor Day, the Pan American Health Organization (PAHO) advocates for greater blood and plasma donations, emphasizing their critical role in sustaining safe and reliable supplies across countries. PAHO stresses the importance of maintaining a secure and sustainable blood and plasma reserve to meet the ongoing needs of healthcare systems and ensure adequate support for patients requiring transfusions.

Competitive Landscape

The major players operating in the blood and blood components industry include Becton, Dickinson & Co., Kidde-Fenwal Inc., Bio-Rad Laboratories, Inc., Cerus Corporation, Immucor, Beckman Coulter, Inc., bioMérieux SA, Octapharma AG, and Abbott.

Recent Key Strategies and Developments

- In October 2023, SK plasma Co. of South Korea inked a partnership with the Indonesia Investment Authority (INA) to establish a blood products plant in Indonesia. The agreement outlines terms for constructing the facility. INA, Indonesia’s sovereign wealth fund, plans to invest up to $50 million in the project, becoming the second-largest stakeholder. SK plasma, approved by the Indonesian Ministry of Health in March, aims to complete construction by 2025.

- In March 2023, Labcorp, a provider of laboratory services, unveiled a novel blood test capable of identifying phosphorylated tau 217 (pTau217) , a biomarker indicative of Alzheimer's disease. This test is now accessible for physicians' requests, facilitating clinical trials and research endeavors. The pTau217 test aids in Alzheimer's diagnosis and patient monitoring during treatment. Labcorp's expansion of Alzheimer's testing encompasses various tests including the beta-amyloid 42/40 ratio, neurofilament light chain (NfL) , and the ATN Profile.

Industry Trends

- In April 2023, the San Diego Blood Bank, a U.S.-based blood bank, introduced its precision blood initiative. This initiative seeks to enhance the quality of care for patients requiring blood transfusions by expanding the precision blood typing procedure. The objective of the program is to bring about positive transformations and potentially save lives by raising the standard of care for individuals in need of blood transfusions.

- In January 2022, America's Blood Centers, the Association for the Advancement of Blood & Biotherapies, and the American Red Cross released a collective statement regarding the insufficient levels of blood supply across the nation. These associations united in urging individuals to contribute by donating blood and its components to meet the pressing needs within the country.

- In January 2022, the French blood service, Etablissement Français du Sang (EFS) , launched the MissingType campaign to urge individuals to step forward and donate blood, addressing the nation's demand for blood and its components. This strategic campaign rollout aims to heighten public awareness regarding the importance of blood donation.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Research Papers

- Blood and Blood Components Investment & Trade Reports

- D&B Hoovers

- Company Analyses

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the blood and blood components market analysis from 2024 to 2033 to identify the prevailing blood and blood components market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the blood and blood components market segmentation assists to determine the prevailing opportunities for blood and blood components market forecast period.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global blood and blood components market trends, key players, market segments, application areas, and blood and blood components market share growth strategies.

Blood and Blood Components Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 18.6 Billion |

| Growth Rate | CAGR of 3.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Abbott, BioMerieux SA, Immucor, Dickinson & Co., Kidde-Fenwal Inc., Octapharma AG, Becton, Cerus Corporation, Beckman Coulter, Inc., Bio-Rad Laboratories, Inc. |

Upcoming trends in the global blood and blood components market include advanced blood screening technologies, increasing demand for plasma-derived therapies, and the rise of synthetic blood substitutes to address supply challenges.

The leading application of the Blood and Blood Components Market is in transfusions for patients with trauma, surgeries, and chronic illnesses, ensuring critical support in emergency and routine medical care.

North America is the largest regional market for Blood and Blood Components.

The blood and blood components market was valued at $12.9 billion in 2023 and is estimated to reach $18.6 billion by 2033.

The major players operating in the blood and blood components market include Becton, Dickinson & Co., Kidde-Fenwal Inc., Bio-Rad Laboratories, Inc., Cerus Corporation, Immucor, Beckman Coulter, Inc., bioMérieux SA, Octapharma AG, and Abbott.

Loading Table Of Content...