Bourbon Spirits Market Research, 2031

The global bourbon spirits market was valued at $7.8 billion in 2021, and is projected to reach $12.8 billion by 2031, growing at a CAGR of 5% from 2022 to 2031.

Bourbon spirits are a type of American liquor distilled from a mash made primarily of corn. It is a barrel-aged distilled liquor that originated in the 17th century in North America. Bourbon spirits are a part of the alcoholic spirits family in the overall alcoholic beverages market. The spirits market is growing decently in the global marketplace which augments the growth of the bourbon spirits market size in developing as well as developed regions worldwide. Bourbon spirits are mainly popular for its offerings of luxurious appeal to the consumers along with the high alcohol-by-volume (ABV). Consumers are seeking for quality products with good drinking experiences owing to the increase in socialization in society.

Market Dynamics

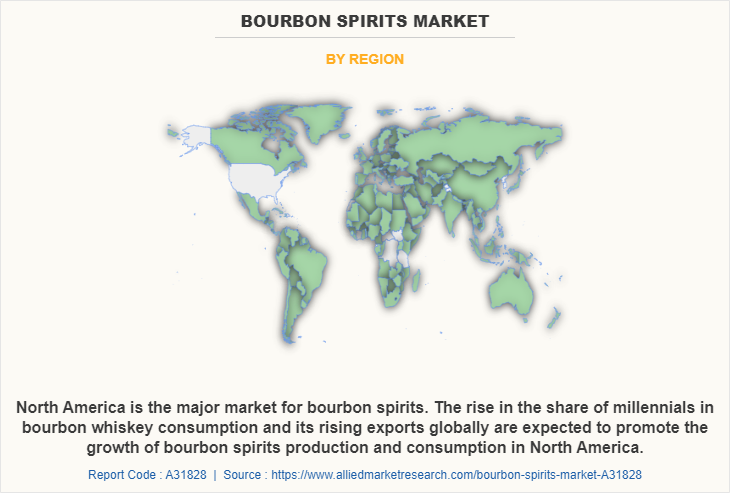

North America is one of the major consumer regions in the global marketplace that solely accounted for more than 35% of the overall bourbon spirits market in 2021.

The alcoholic beverages market is evolving with technological enhancements in the global beverages industry, owing to increase in popularity of alcohol among the young and millennials population worldwide. The market offers several alcoholic drinks to consumers such as beer, wine, and spirits. Out of these, bourbon spirits are gaining huge popularity in the overseas market. Spirits are a distilled alcoholic drink that opens up a broad range of options to cater to the growing bourbon spirits market demand. The trend to try different alcoholic drinks has led to an increase in the popularity and bourbon spirits market share in the global marketplace.

Premiumization remains to be one of the major factors expected to drive the alcoholic beverages industry across the globe. The demand for premium cocktails is attributed to the trend for mixed drinks and crafted cocktails. Pre-mixed and fresh cocktail manufacturers are shifting from utilizing artificial colorants & flavors and favoring premium ingredients to provide natural appeal in the drinks. Bourbon spirits are popular for their natural taste and offering of earthy appeal to the drink and most of the on-trade counters are utilizing a huge quantity of bourbon spirits to offer premium drinks.

According to the report published by the Bacardi Cultural Insights Network 2021, 37% of bartenders voted bourbon spirits as the top spirit globally that premiumize cocktails and other alcoholic drinks. The emergence of modern on-trade channels in developing economies and increase in disposable income further ensure higher consumption of bourbon spirits-based cocktails in the global marketplace. Young consumers are more inclined toward well-crafted, flavored spirits that are artisanally produced and have an authentic, heritage-rich brand story. For this reason, whiskey particularly has become one of the fastest selling beverages among other alcoholic beverages. Bartenders are increasingly using top-tier whiskey brands as an ingredient in cocktails. Hence, the ‘cocktail culture’ trend has become one of the driving factors for the bourbon spirits industry. Furthermore, the rise in spirit-led tourism, especially in western countries, has propelled tourists from overseas to indulge and develop taste for local beverages, including whiskeys. Countries such as the UK, France, the U.S., Scotland, and others, have developed spirit led-tourism, which enables tourists to comprehend the history and distillation processes involved in producing whiskeys. This factor is expected to drive the bourbon spirits market growth globally.

A paradigm shift has been witnessed in the consumer’s way of living for the past several years, owing to the fact that consumers are becoming more conscious of their health and intake of food and drinks. In addition, alarming rise in prevalence of ill effects on health due to alcohol consumption acts as a restraint to the market expansion. According to the IWSR Drinks Market Analysis report 2021, approximately 52% of the adult population is trying to reduce alcohol consumption in the U.S. Therefore, consumers are shifting their preference from spirits with high alcohol-by-volume (ABV) such as vodka, bourbon spirits, and others to low/zero alcoholic drinks. The IWSR further revealed that the volume of low/nonalcoholic spirits has increased by 32.7%. Thus, drinks with high ABV are expected to face significant challenges during the forecast period.

In the recent past, the number of bars, pubs, breweries, and restaurants serving alcohol has increased manifold. The major factors driving this growth are rise in consumer spending, rapid urbanization, product innovation, and rise in demand from the millennial population. The acceptance of alcoholic beverages, for social events including marriages, events, award functions, and several similar social gatherings has generated a positive growth prospect for the bourbon spirits market size. The bourbon spirits industry has developed at a fast pace in recent years, and more people now consider bourbon whisky as an affordable luxury. The increase in acceptance of bourbon whisky also led to growth in demand for different spirits such as premium and organic. The general shift in consumer consciousness and demand for innovative products has led to an increase in desire for bourbon spirits distilled with organic malted barley and grains. This consumer demand can be regarded as an opportunity for the manufacturers to broaden their market base.

Bourbon spirits originated in the 17th century in North America, and today are consumed in approximately 100 countries worldwide. Initially, it was a medicinal purpose liquor and currently has become an internationally recognized alcoholic beverage. It is frequently sipped with other beverages to enjoy in a trendy cocktail format or as a pre-dinner drink.

The proportion of bourbon spirits revenue is expected to surge by about 5% year-on-year growth globally. On the other hand, the volumetric consumption of bourbon spirits is expected to rise by the year 2031. Bourbon spirits continue to perform decently in both off-trade and on-trade channels. However, the outbreak of novel coronavirus impacted sales through on-trade channels worldwide.

Manufacturers are increasingly focusing on online retailing by dealing with e-commerce giants and developing e-delivery systems. According to the report published by IWSR Drinks Market Analysis Limited 2020, alcohol e-commerce sales rose by 42% in 2021 in the core market areas such as the U.S., the UK, Spain, Japan, Italy, Germany, France, Brazil, China, and Australia. Among these, the U.S. is the largest producer, consumer, and exporter of all types of bourbon spirits, and the consumers in the country are enjoying several options for the product. Thus, manufacturers are capitalizing on increasing production capabilities and export destinations to meet the growing demand from several overseas markets.

In developed markets, individuals prefer to “drink better, not more” and seek for products that meet their superior quality, taste, and authenticity. Thus, in response to the sustained premiumization of spirits, manufacturers are developing more premium and luxurious bourbon spirits, which is expected to increase the adoption among Asian consumers during the bourbon spirits market forecast period.

The rise in spirit tourism encourages tourists to indulge and experience innovative beverages and their distilleries and is hence considered as the cornerstone of the latest economic growth. Tourism, especially in western countries, has propelled the rise in spirits industry revenue through popular means of tourist visits to distilleries, wineries, and breweries to try bourbon whiskey. The growing acceptance of spirits consumption by overseas tourists enables to stimulate the bourbon spirits market growth.

In addition, premiumization remains to be one of the major factors expected to drive the growth of the alcoholic beverages industry. According to the report published by the Bacardi Cultural Insights Network 2021, 37% of bartenders voted spirits as the top mixer globally that premiumize cocktails and other alcoholic drinks. The emergence of modern on-trade channels in developing economies and upsurge in disposable income further ensure higher consumption of spirits-based cocktails, thus contributing toward the growth of the global bourbon spirits market.

Segments Overview

The global bourbon spirits market is segmented into type, ABV, distribution channel, and region. By type, the market is segregated into wheated, barrel finished, barrel select, and others. Depending on alcohol-by-volume (ABV), it is segmented into 40-45%, 46-55%, and 56% & above. Based on distribution channel, it is fragmented into on-trade (hotel, bar, pub, and others) and off-trade (supermarkets/hypermarkets, convenience stores, specialty stores, online retailers, and others). Region-wise, the bourbon spirits market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

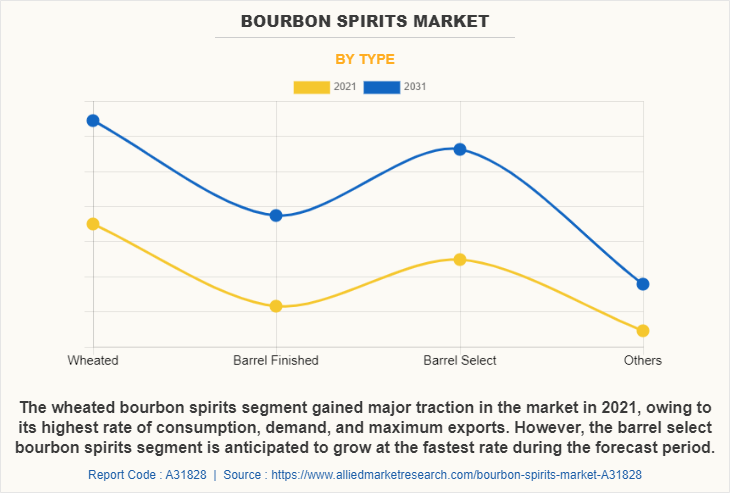

By Type

Depending on type, the bourbon spirits market is categorized into wheated, barrel finished, barrel select, and others. The barrel select bourbon spirits segment is anticipated to grow at the fastest rate during the forecast period. Consumers are opting for new and novel drinks in the market to increase their drinking experience.

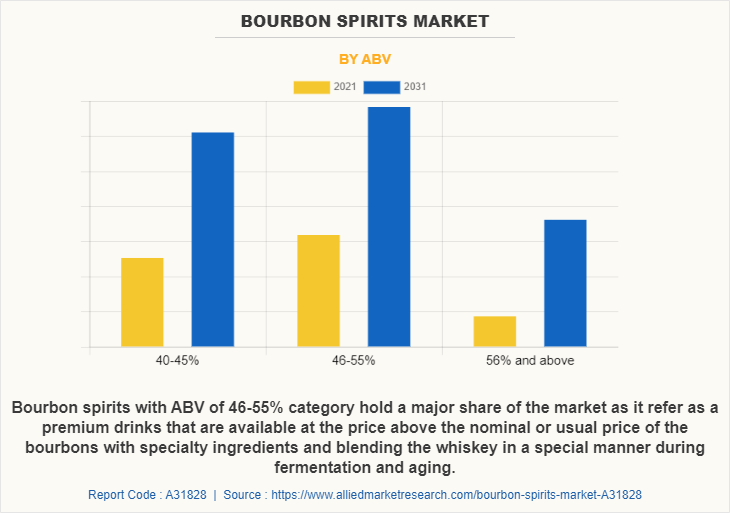

By ABV

Depending on alcohol-by-volume (ABV), the bourbon spirits market is segregated into 40-45%, 46-55%, and 56% and above. The 46-55% segment dominated the market in 2021, whereas the 40-45% segment is expected to exhibit the fastest CAGR of 5.1% during the forecast period. The consumer’s evolving taste preferences and improving lifestyles in developing regions have led them to choose quality products in the market. Thus, the revenue generation from high ABV is expected to soar during the forecast period.

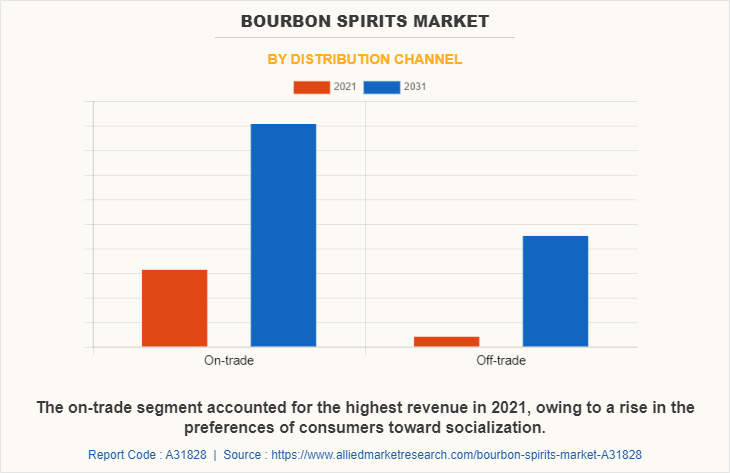

By Distribution Channel

By distribution channel, the bourbon spirits market is bifurcated into on-trade and off-trade. The on-trade segment accounted for the highest revenue in 2021. However, the off-trade is anticipated to grow at the fastest rate during the forecast period due to rapidly growing sales through online channels and emergence of modern trades.

By Region

Region wise, the bourbon spirits market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Bourbon spirits typically originated in North America in the 17th century and currently is consumed globally. The region has emerged as a hotspot in the market holding a major bourbon spirits market share in revenue generation for the past several decades. Europe is the second largest market due to the presence of a large consumer base and awareness among the consumers related to the fermentation process and ingredients used.

Competitive Analysis

Some of the key players profiled in the bourbon spirits market analysis include Suntory Holdings Limited, Brown-Forman Corporation, MGP Ingredients, Inc., Laws Whiskey House, Conecuh Brands, LLC, Distiller’s Way, LLC, Sazerac Company, Inc, Kirin Holdings Company, Limited, Bacardi Limited., Michters Distillery LLC., Heaven Hill Brands, Nashville Barrel Company, Bardstown Bourbon Company, Wyoming Whiskey, Inc., and Jos. A. Magnus & Co.

Some Examples of Product Launch in The Market

In June 2022, Laws Whiskey House released a new Bottled of Bond Centennial Straight Wheat Whiskey. This new whiskey qualifies the various criteria including 2 years aged and 51% wheat. With this new whiskey, the company will expand its product offering to its consumers.

In January 2021, Beam Suntory, Inc., a subsidiary of Suntory Holdings Limited launched its blended whiskey Oaksmith in India. With this launch, the company will increase its business presence in the country.

Some Examples of Partnerships and Acquisitions in The Market

In April 2021, MGP Ingredients, Inc., acquired Luxco Inc., a leading manufacturer of wide range of alcohol-based beverages. With this acquisition, the company will expand its product portfolio and product offering to its consumers.

In May 2020, Republic National Distributing Company (RNDC), and Young's Market Company which is engaged in distribution of alcohol beverages expanded their partnership with Conecuh Brands, LLC., for acquiring distribution rights for its beverages in Florida and South Carolina. With this partnership, the company will expand its beverage sales and business presence in Florida and South Carolina.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bourbon spirits market analysis from 2021 to 2031 to identify the prevailing bourbon spirits market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bourbon spirits market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bourbon spirits market trends, key players, market segments, application areas, and market growth strategies.

Bourbon Spirits Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.8 billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 297 |

| By Type |

|

| By ABV |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Nashville Barrel Company, Brown-Forman Corporation, Jos. A. Magnus & Co., Kirin Holdings Company, Limited, Laws Whiskey House, Bacardi Limited., Heaven Hill Brands, Suntory Holdings Limited, Michters Distillery LLC., Distiller’s Way, LLC, Bardstown Bourbon Company, MGP Ingredients, Inc., Wyoming Whiskey, Inc., Sazerac Company, Inc, Conecuh Brands, LLC |

Analyst Review

According to the CXO of leading companies, the bourbon spirits market is expected to grow at a significant rate during the forecast period, owing to various factors such as premium positioning and craft varieties through product innovations, rise in acceptance and consumption of alcoholic beverages, and growing demand from young consumers.

The bourbon whiskey consumption is led by North America and the region also has higher per capita daily consumption of alcoholic beverages, as compared to other regions. The spirit-led tourism culture and growth of whiskey producers in European countries is one of the most significant driving factors for the bourbon spirits market. To match this increasing demand, Scottish distillers have been setting up new facilities to cater to whiskey tourists. In addition, consumers in western countries have spurred great potential and demand for super-premium whiskeys.

The CXOs further added that Asia-Pacific is projected to register significant growth as compared to the mainstream markets of Europe and North America, due to factors such as rise in consumer spending, increase in consumption of whiskey and its acceptance in social gatherings and events, especially in countries such as India, China, and Singapore.

The global bourbon spirits market was valued at $7.8 billion in 2021, and is projected to reach $12.8 billion by 2031

The global Bourbon Spirits market is projected to grow at a compound annual growth rate of 5% from 2022 to 2031 $12.8 billion by 2031

Some of the key players profiled in the bourbon spirits market analysis include Suntory Holdings Limited, Brown-Forman Corporation, MGP Ingredients, Inc., Laws Whiskey House, Conecuh Brands, LLC, Distiller’s Way, LLC, Sazerac Company, Inc, Kirin Holdings Company, Limited, Bacardi Limited., Michters Distillery LLC., Heaven Hill Brands, Nashville Barrel Company, Bardstown Bourbon Company, Wyoming Whiskey, Inc., and Jos. A. Magnus & Co.

Bourbon spirits typically originated in North America

Rise in spirit tourism, Wide utilization of spirits in premium cocktails, Surge in demand for premium ready-to-drink and luxury spirits

Loading Table Of Content...

Loading Research Methodology...