BPA Free Plastic Market Research, 2031

The global bpa free plastic market was valued at $187.3 billion in 2021, and is projected to reach $299.6 billion by 2031, growing at a CAGR of 5% from 2022 to 2031.

Report Key highlighters:

- The BPA free plastic market has been analyzed in value (Million). We have given values (Million) data in more than 15 countries.

- Conducted primary interviews with raw material suppliers, wholesalers, suppliers, and manufacturers of BPA free plastic market to understand the market trends, growth factors, pricing, and key players competitive strategies.

- Regarding the growth prediction, we look at the historical development of end-use sectors, government technology efforts, and significant business player activities including expansion, acquisition, agreements, and new product launches, among other things.

BPA free plastic are the products that do not contain bisphenol A (BPA) in their composition. Bisphenol A is a man-made industrial chemical used to harden polycarbonate plastics and make epoxy resin. The substance is present in most hard plastic household items, including water bottles, infant bottles, and food containers. In addition, epoxy resins, which are used to line food and beverage cans, contain BPA. However, BPA is an endocrine disrupter which interferes with the body's normal hormonal processes. Therefore, BPA free plastic products are used as an alternative in various end-use industries.

Growing demand in food and beverage industry

The BPA free plastic market is driven by the high utilization of BPA free products in food and beverage industry. The rising health concerns owing to the use of BPA derived products is a major driving factor of BPA free plastic market. BPA free plastics gained importance in the food industry due to its non-leaching property. The contamination of food substances is avoided by the use of BPA free plastics. It is considered safe as it does not allow the packaging material to leach into the products.

Moreover, the BPA free packaging is economical and convenient. Food storage solutions that are more flexible and unrestrictive were made possible by plastic containers that had never been used before. The food sector has taken a variety of innovative methods to BPA-free plastics. Many manufacturers have employed BPA-free plastics to reduce costs, while others used them to create unique packaging.

Additionally, the changing lifestyle and emergence of various online delivery apps & grocery apps have boosted the market. For instance, PPG Industries, Inc. launched PPG Innovel Pro, an enhanced internal spray coating that uses no bisphenol-A (BPA) or “bisphenol starting substances” and provides more robust application properties for the infinitely recyclable aluminum beverage can. This product is a next-generation, high-performance acrylic coating which complies with global food contact standards for consumer safety and its improved application properties provide operational benefits for can plants worldwide.

BPA derived products are used to manufacture plastics containing polycarbonate, such as food and drink containers. However, the serious health effects of BPA led to the increased demand for BPA free plastic market. Human exposure to this chemical can occur orally, inhaled, or trans dermally. The primary sources of BPA exposure are toys, clothing for babies and children, dental supplies, medical equipment, thermal paper, and food packaging and dust. Also, when heat is used to sterilize cans, the epoxy covering allows BPA to leak into the food within the can, increasing human exposure to BPA.

BPA's phenolic structure has been found to interact with estrogen receptors. Therefore, it has been demonstrated that BPA contributes to the pathogenesis of a number of endocrine illnesses, such as male and female infertility, premature puberty, hormone-dependent tumors including breast and prostate cancer, and a number of metabolic disorders like polycystic ovary syndrome (PCOS). Owing to these ill effects gradually BPA free plastics gained importance and are used in day-to-day life. This stimulated the market’s growth.

The availability of various substitutes for BPA derived products is one of the restraining factors which hampers the market growth. Bisphenol F (BPF), bisphenol S (BPS), bisguaiacol F (BGF) and bisphenol AF (BPAF) are some of the substitutes which are used extensively. These compounds are like the parent compound and possess the same properties. For instance, BGF has thermal and mechanical qualities, and it is quite economical. Owing to these factors, the market growth is shrinking to a small extent.

Favorable government regulations to boost the demand for BPA free plastics

The implementation of various regulations on the use of BPA derived products have witnessed an opportunity for the growth of BPA free plastic market. For instance, on December 21, 2021, the European Food Safety Authority (EFSA) published new safety guidelines for BPA, drastically reducing the advised exposure limit by a factor of 100,000 to only 0.018 nanograms per pound of body weight each day. This has drastically decreased the usage of BPA eventually leading to the market growth.

Moreover, on July 11, 2022, the U.S. Food and Drug Administration (FDA) declared that it has submitted a food additive petition requesting that the food additive regulations be changed to remove or limit the authorization for the use of bisphenol A (BPA) in applications involving food contact. All these regulations and restrictions imposed by different government authorities have stimulated the demand of BPA free plastic.

The raw materials required for the manufacturing of BPA free plastic are quite expensive which can be a challenge for the market. Some of the raw components used to make BPA-free plastic include tritan, polyethylene terephthalate (PETE), and polypropylene (PP). For instance, the copolyester polymer Tritan has no aftertaste, a clear, durable, and vibrant color. It is composed of BPS and BPA-free plastic, having no additional bisphenol compounds or either bisphenol A (BPA) or bisphenol S (BPS). It is safe and conforms with all FDA criteria for substances that frequently come into contact with food, claims FCN (Food Contact Substance Notification). On the other hand, compared to the other raw materials, it is the most expensive at around 30% to 45%. In order to produce BPA-free plastics, this presents a challenge for the manufacturers.

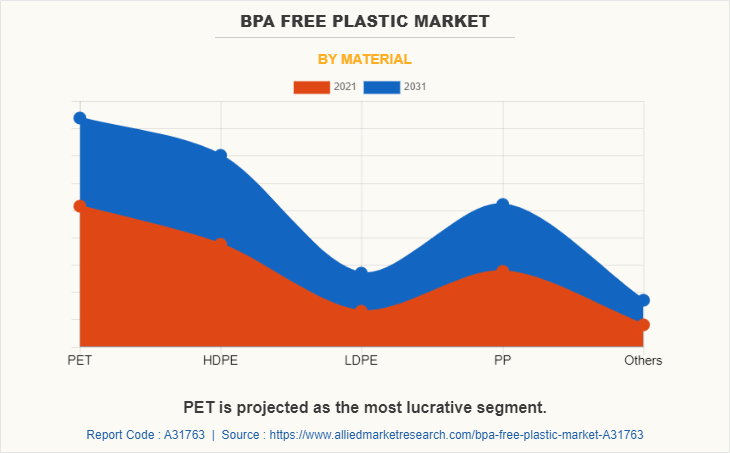

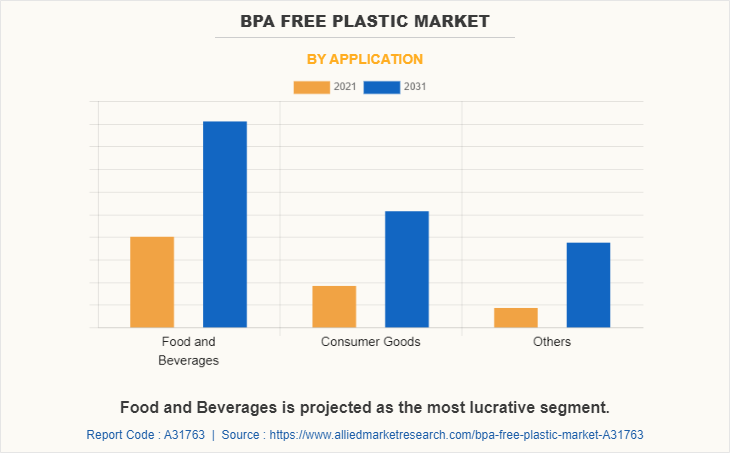

The BPA free plastic market is segmented on the basis of material type, application, and region. On the basis of material type, the market is divided into polyethylene terephthalate (PET), high density polyethylene (HDPE), low density polyethylene (LDPE), polypropylene (PP), and others. Depending on the application, the market is classified into food & beverages, consumer goods, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global BPA free plastic market are Altium Packaging, Amcor plc, Conagra Brands, Inc., Eastman Chemical Company, Orthex Group, PLASTIPAK HOLDINGS, INC., PPG Industries, Inc., Taiyuan Lanlang Technology Industrial Corp., Thermo Fisher Scientific Inc. and Water Boy, Inc.

On the basis of material, polyethylene terephthalate (PET) is expected to lead the global BPA free plastic market during the forecast period. PET refers to a thermoplastic polymer resin of the polyester family that is commonly utilized in the production of plastic bottles. PET bottles are more durable, clear, lightweight, non-reactive, cost-effective, and thermally stable than Polypropylene (PP), and (Polyvinyl chloride) PVC bottles.

On the basis of application, food and beverages segment accounted for around 42.8% of the global BPA free plastic market share in 2021. Food packaging is one of the most essential aspects of BPA-free plastic. To preserve the required shelf life of food products, almost all types of food items consumed are sold in BPA-free packaging forms. PET has been certified as safe for food and beverage contact by health and regulatory agencies worldwide, including the U.S. Food and Drug Administration, Health Canada, and the European Food Safety Authority of the European Union.

On the basis of region, Asia-Pacific is expected to account for the largest share in the global BPA free plastic market during the forecast period. The BPA free plastic market is driven by rise in consumption of BPA free plastic products from cosmetics & personal care, healthcare and food industry. For instance, Amcor plc offer its Alufix which is 100% BPA free peel off end membrane, which fulfils the recent recommendation of the Food and Drug Administration (FDA) regarding baby food can linings. Owing to the increase in utilization of BPA free plastic in various sectors, the market has flourished in this region.

COVID-19 impact analysis on the BPA-free plastic market

COVID-19 responses have boosted the usage of items such as masks, BPA-free plastic bottles, and some forms of packaging produced from long-lasting single-use plastics, resulting in greater greenhouse gas and other emissions. Some of these items wind up as trash on land and in the oceans across the world, potentially harming ecosystems and wildlife. An additional 2.4-5.7 million tons of CO2e were released in Europe as a result of increased plastic bottle usage from April to September 2020.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the BPA free plastic market analysis from 2021 to 2031 to identify the prevailing bpa free plastic market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the BPA free plastic market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global BPA free plastic market trends, key players, market segments, application areas, and market growth strategies.

BPA Free Plastic Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 299.6 billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 230 |

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | Amcor PLC, Conagra Brands, Inc., Thermo Fisher Scientific Inc., Eastman Chemical Company, PLASTIPAK HOLDINGS, INC., Water Boy, Inc., PPG Industries Inc., Taiyuan Lanlang Technology Industrial Corp., Orthex Group, Altium Packaging |

Analyst Review

As per the CXO perspective, plastic bottles have been found to leach toxins into water, most notably bisphenol A (BPA). Although studies have shown the amount of BPA leached into water from bottles exposed to extreme temperatures is minimal, consumers prefer to err on the side of caution, reaching for BPA free bottles.

BPA free water bottles can reduce the risk of BPA leaching into drinking water. BPA can leach into drinking water when it is exposed to high temperatures such as microwaving and dish washing. There are many alternative materials available for water bottle usage, such as aluminum, BPA free plastics, and glasstic. Glasstic is a durable glass and plastic hybrid that has many advantages over other water bottle materials. The inside of the container is glass, so there are no worries about BPA or other toxins finding its way into drinking water. Glasstic is produced with safe and non-toxic materials.

Using a BPA free water bottle is environmentally friendly as well. A large percentage of plastic bottles do not get recycled. Over time, these bottles can begin to leach BPA and other harmful chemicals into the environment. Using a BPA free water bottle helps reduce hundreds of plastic bottles from winding up in the dump or elsewhere.

One of the key drivers fueling the market's expansion is the growing use of BPA-free plastic in personal care and cosmetic products and Customers are aware of BPA's harmful consequences are key factors driving revenue growth of the global BPA-free plastic market.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Asia-Pacific region will provide more business opportunities for BPA-free plastic market in coming years.

Altium Packaging, Amcor plc, Conagra Brands, Inc., Eastman Chemical Company, Orthex Group, PLASTIPAK HOLDINGS, INC., PPG Industries, Inc., Taiyuan Lanlang Technology Industrial Corp., Thermo Fisher Scientific Inc. and Water Boy, Inc. are the top players in BPA-free plastic market.

Food & beverages, consumer goods, and others application are the potential customers of BPA-free plastic industry

Loading Table Of Content...