Business Process Management (BPM) Market Statistics, 2032

The global business process management (bpm) market was valued at $15.4 billion in 2022, and is projected to reach $65.8 billion by 2032, growing at a CAGR of 15.8% from 2023 to 2032.

One of the primary growth drivers for BPM is the relentless pursuit of operational excellence. Organizations are increasingly adopting BPM methodologies to optimize their processes, reduce operational costs, and improve overall efficiency. This emphasis on efficiency has been further fueled by the need to adapt to the rapidly changing business landscape, driven by digital transformation and the growth of business process management market. However, resistance to change within organizations is a significant restrain.

Implementing BPM often requires a cultural shift, and some employees may be hesitant to embrace new methodologies. Further, the upfront costs and the time required for BPM implementation is hampering the growth of business process management market. On the contrary, the growth of emerging technologies like artificial intelligence, robotic process automation, and blockchain offers exciting possibilities for BPM automation and innovation. Moreover, the increasing focus on customer experience and the rising demand for personalized services provide fertile ground for BPM-driven enhancements. This is expected to fuel the growth of market in upcoming years.

Business process management (BPM) is a comprehensive approach for enhancing efficiency and effectiveness of the organization by optimizing, documenting, and controlling its business processes. It entails the systematic design, execution, monitoring, and continuous improvement of these processes to achieve specific goals and objectives. It involves identifying, mapping, and analyzing these processes to understand their inputs, outputs, and interactions. Once processes are documented, BPM aims to streamline them by eliminating bottlenecks, redundant steps, and inefficiencies.

Further, monitoring and measurement are integral to BPM, allowing organizations to track performance, identify areas for improvement, and make data-driven decisions. By continuously evaluating processes, BPM helps adapt to changing business conditions and customer demands.

The report focuses on growth prospects, restraints, and trends of the business process management market. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the business process management market outlook.

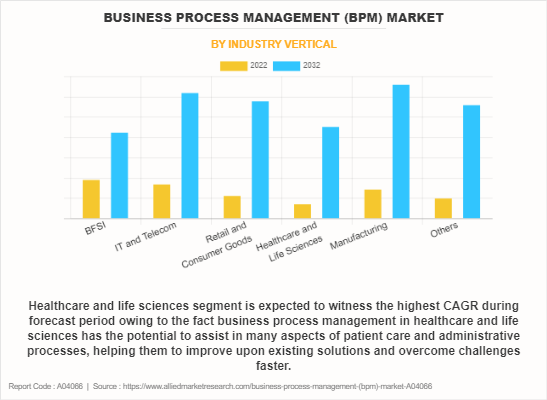

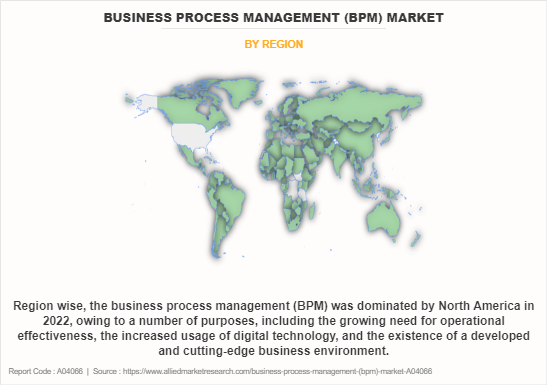

The business process management is segmented on the basis of component, business function, industry vertical and region. On the basis of component, it is categorized into solution and service. On the basis of business function, the business process management market is segmented into human resource management (HRM), procurement and supply chain management (SCM), sales and marketing, account and finance, customer service support, and others. On the basis of industry vertical, it is classified into BFSI, IT and telecom, retail and consumer goods, healthcare and life sciences, manufacturing and others. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By industry vertical, the BFSI segment acquired a major BPM market size in 2022. The is attributed to , the surge in adoption of artificial intelligence in the BFSI sector which provides better customer service, fraud detection, and faster data processing.

By region, the North America dominated the business process management market share in 2022. This is attributed to the fact that the BPM industry is growing in the North American region owing to a developed and well-established corporate environment.

The key players operating in the global business process management market forecast include Pegasystems Inc., Appian, IBM Corporation, Oracle, Software AG, Open Text Corporation, Genpact, ProcessMaker, Kofax Inc., and BP Logix, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the Business process management industry.

Top Impacting Factors

Increase in Digitization in Various Industry Verticals

The increasing need for organizations to digitally transform their operations and processes has been a significant driver for the adoption of business process management market. As businesses seek to become more agile and efficient, BPM solutions provide the tools to optimize and automate their processes. In addition, BPM helps organizations streamline their operations, reduce manual work, and cut costs. It allows for better resource allocation, reducing operational expenses in the long run. Further, the availability of cloud-based BPM solutions has made it easier for organizations to adopt BPM without heavy infrastructure investments. Cloud BPM also allows for scalability and flexibility. Furthermore, BPM tools often include analytics and reporting features, enabling organizations to gather data about their processes and use it for informed decision-making.

Moreover, the key players in the business process management market are increasingly partnering with technology firms to enhance their business operations and boost efficiency. For instance, in January 2020, Appian APPN announced a technology partnership and integration initiative with Celonis, a provider of AI-enhanced process mining and process excellence software. The partnership allowed Appian to integrate its low code automation platform with Celonis’ powerful process mining technology, Intelligent Business Cloud (IBC), and accelerate digital business process transformation and joint customers. Thus, the increasing digitization in various industry verticals is fueling the growth of the BPM market.

Increase in Integration of BPM in Healthcare Industry

The healthcare industry's integration of business process management has also played a significant role in the BPM market growth. Using BPM platform in the healthcare sector has several advantages, such as improving clinical procedures, expediting administrative work, guaranteeing compliance, boosting operational effectiveness, reducing mistakes and delays, and enhancing patient care. The industry has grown since so many businesses, such Infosys Limited, Kissflow Inc., and BP Logix, Inc., offer BPM solutions for healthcare services.

Furthermore, governments across the globe have been spending more money to digitize the healthcare system, which has accelerated the development of business process management in the healthcare sector. For example, the Liberal Government of Tasmania stated in May 2022 that it will invest USD 150 million to modernize its digital health infrastructure. The government plans to use the investment to improve communication about appointments, decrease waiting times for services, reduce duplication of forms and care, and provide easy and convenient access to healthcare for local communities. The government will distribute the funds over the four years following the announcement.

Surge in Emphasis on Operational Efficiency and Agility

The global businesses' increasing focus on operational efficiency and agility is one of the main factors propelling the growth of the business process management market. In the contemporary corporate landscape, enterprises are perpetually exploring methods to streamline their workflows, curtail overhead expenses, and promptly adapt to evolving market dynamics. Complex business processes can be automated, redesigned, and analyzed using an organized framework that is offered by BPM solutions. Organizations can increase their efficiency and agility by using business process management to remove manual activities, redundancies, and bottlenecks. In order to remain competitive and satisfy customers, operational excellence must be prioritized.

Market Trends and Landscape

Increase in product launched to enhance business process management solutions and adoption of the advance technologies are some of the trends flourishing the business process management market growth. For instance, in September 2022, AGS Health, a leading revenue cycle management (RCM) solutions provider and strategic growth partner to some of the largest healthcare systems in the U.S., announced the launch of the AGS AI Platform, a connected solution that blends artificial intelligence (AI) and automation with human-in-the-loop services and expert support to maximize revenue cycle performance.

The platform allows healthcare organizations to gain enhanced visibility into day-to-day operations and the overall performance of the revenue cycle, including intelligent worklists, productivity reports, customizable dashboards, root cause analyses, and executive reporting. Performance trends and predictive analytics help to prevent bottlenecks, reduce denials, and mitigate revenue leakage.

Furthermore, increasing partnerships in the market by key players is expected to boost the growth of business process management market during the forecast period. For instance, in April 2023, Appian announced that it joined Guidewire Partner Connect as a new solution partner alongside Accenture. The new partnership enabled the Appian Platform to directly integrate with Guidewire Cloud APIs and the Jutro Digital Platform. The insurers would be able to rapidly create and manage compelling cloud-based digital experiences for an ever-changing market and business landscape.

The pandemic has accelerated the adoption of digital transformation initiatives, making BPM even more crucial. As businesses realized the need for agility and resilience, they turned to BPM solutions to streamline their operations, automate manual tasks, and enhance overall efficiency. This trend has led to a recovery and growth in the BPM market, as organizations recognize the value of BPM in maintaining business continuity and competitiveness in a rapidly changing global landscape. The pandemic underscored the importance of BPM as an essential tool for managing and adapting to unforeseen disruptions. Thus, these factors overall had a positive impact on business process management industry.

Regional Insights

North America

North America leads the BPM market, driven by the early adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) in business operations. The U.S. is a major contributor due to the presence of large enterprises across industries like BFSI, healthcare, IT, and telecom. The region also benefits from a well-established IT infrastructure, increased cloud adoption, and the demand for process optimization solutions to remain competitive. Companies in the U.S. and Canada are leveraging BPM to enhance customer experience and operational agility.

Europe

Europe is another significant market for BPM, with countries like Germany, the UK, and France at the forefront. The region’s regulatory landscape, including GDPR compliance, encourages organizations to adopt BPM solutions to ensure efficiency while maintaining strict governance and risk management processes. The manufacturing, automotive, and financial sectors in Europe are key adopters of BPM as they aim to streamline production processes, optimize supply chains, and improve service delivery. Additionally, the rise of digital transformation initiatives and cloud-based BPM solutions is driving business process management market growth in this region.

Asia-Pacific

Asia-Pacific is expected to witness the fastest growth in the business process management market, fueled by rapid economic expansion, industrialization, and digitalization in countries like China, India, Japan, and South Korea. Organizations across sectors such as BFSI, telecom, manufacturing, and retail are adopting BPM to improve process efficiency and reduce operational costs. In India, the rise of IT outsourcing services has accelerated the demand for BPM to manage large-scale processes. Meanwhile, China’s focus on automation and smart technologies is driving BPM adoption in manufacturing and supply chain management.

Latin America and Middle East & Africa

In Latin America, Brazil and Mexico are key markets, driven by the growing adoption of cloud technologies and BPM solutions in sectors like banking, telecom, and manufacturing. Organizations are increasingly focused on automating and optimizing processes to improve productivity. Similarly, in the Middle East & Africa, countries like the UAE, Saudi Arabia, and South Africa are seeing increased BPM adoption as businesses in these regions are undergoing digital transformation to improve operational efficiency and meet global standards. The growth of smart city projects and e-governance initiatives is further boosting BPM demand in the Middle East.

Recent Devlopments in the BPM Market

Recent Product Launches

In May 2023, Pegasystems Inc. launched Pega Process Mining, which will make it easier for Pega users of all skill levels to find and fix process inefficiencies hindering their business operations.

In May 2023, IBM unveiled IBM Hybrid Cloud Mesh, a SaaS offering that is designed to enable enterprises to bring management to their hybrid multicloud infrastructure. Driven by “Application-Centric Connectivity”, IBM Hybrid Cloud Mesh is engineered to automate the process, management and observability of application connectivity in and between public and private clouds to help modern enterprises operate their infrastructure across hybrid multicloud and heterogeneous environments.

In April 2021, OpenText launches new content management platform. to enable organizations to modernize and simplify complex information management challenges.

Recent Partnerships

In December 2022, Ernst andamp; Young LLP (EY India) partnered with Software AG, the EY-Software AG Alliance helps organizations improve growth through digital transformation. The alliance is also active in Germany, where Software AG is headquartered, with further global expansion planned.

In August 2023, OpenText partnered with Google Cloud to deliver AI-powered integrations that will help organizations unlock the power of their data on Google Cloud to their competitive advantage.

In August 2021, ProcessMaker partnered with Gnosis, a consulting and analytics firm based in Cyprus, to take Process Maker's leading digital process automation platform to the Greece, Cyprus, and South European markets.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Business process management market analysis from 2022 to 2032 to identify the prevailing BPM market share.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the business process management market size segmentation assists to determine the prevailing Business process management market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- business process management Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global business process management market trends, key players, market segments, application areas, and market growth strategies.

Business Process Management (BPM) Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 65.8 billion |

| Growth Rate | CAGR of 15.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Industry Vertical |

|

| By Component |

|

| By Business Function |

|

| By Region |

|

| Key Market Players | Open Text Corporation., Software AG, Kofax Inc., Genpact, Pegasystems Inc., Appian Corporation., BP Logix, Inc., Oracle, IBM Corporation, ProcessMaker |

Analyst Review

The business process management (BPM) market is witnessing several key trends, however, digital transformation remains at the forefront, with organizations embracing BPM to adapt to a digital-first landscape, improving efficiency and customer experiences. In addition, robotic process automation (RPA) is increasingly integrated into BPM, automating routine tasks and enhancing productivity. Further, cloud-based BPM solutions are on the rise for scalability and cost-effectiveness, while process mining tools offer in-depth insights. Furthermore, customer-centric BPM and IoT integration are growing trends, shaping how organizations optimize their workflows to meet evolving customer demands and leverage emerging technologies.

The key market players are adopting strategies such as partnership for enhancing their services in the market and improving customer satisfaction. For instance, in January 2020, Nintex, the global standard for process management and automation, announced that Auswide Bank was driving process excellence and further improving the employee and customer experience at its banks by leveraging the process mapping, management and automation capabilities of the Nintex Process Platform. Since implementing Nintex Promapp, Auswide Bank has mapped and published nearly 1,000 processes across the organization and driven process collaboration across teams and branch locations, as employees can now easily access processes and provide process feedback. Nintex Promapp has also helped the bank identify opportunities to automate processes with Nintex Workflow and Nintex Forms.

Moreover, some of the key players profiled in the report are Pegasystems Inc., Appian, IBM Corporation, Oracle, Software AG, Open Text Corporation, Genpact, ProcessMaker, Kofax Inc., and BP Logix, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The business process management (BPO) market is projected to reach $65.75 billion by 2032.

The business process management (BPO) market is estimated to grow at a CAGR of 15.8% from 2023 to 2032.

Increase in digitization in various industry verticals, increase in integration of BPM in healthcare industry, and surge in emphasis on operational efficiency and agility majorly contribute toward the growth of the market.

The key players profiled in the report include business process management (BPO) market analysis includes top companies operating in the market such as Pegasystems Inc., Appian, IBM Corporation, Oracle, Software AG, Open Text Corporation, Genpact, ProcessMaker, Kofax Inc., and BP Logix, Inc.

The key growth strategies of business process management (BPO) players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...