The global cables and wires for aerospace and defense market size was valued at $27.8 billion in 2022, and is projected to reach $47 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032

Cables and wires are designed to transmit signals & electricity and are made of cutting-edge technology to meet the needs of military and aerospace systems, which are trending toward more compact, high-throughput, and rugged designs. Military & defense wire and cables are segmented into coaxial cables, power cable, shipboard cable, and others. Moreover, the demand for marine cables in shipbuilding is increasing due to their low weight and high efficiency.

The main purpose of cables and wires for aerospace and defense is to ensure reliable and secure communication, power distribution, and data transmission within complex systems. These critical components play a crucial role in connecting various electronic and electrical components, including radar systems, avionics, navigation equipment, and weapons systems. They must withstand extreme environmental conditions, including high temperatures, vibrations, electromagnetic interference, and potential exposure to harsh chemicals or radiation. Moreover, in defense applications, cables and wires often need to provide secure data transfer to protect sensitive information from interception or tampering.

The global cables and wires for aerospace & defense market demand s expected to witness notable growth during the forecast period, owing to digitalization and electrification of aerospace & defense systems. Furthermore, the rise in military expenditure has driven the global cables and wires for aerospace & defense market growth. The development of innovative aircraft solutions is expected to propel market growth during the forecast period.

However, the high development and maintenance cost of infrastructure to support satellite wiring and assemblies is one of the prime factors that restrain the global cables and wires for aerospace and defense market growth. On the contrary, a rise in government investment in defense and space agencies is expected to provide lucrative opportunities for the growth of the market during the forecast period.

The cables and wires for aerospace and defense market forecast is segmented into Type, Voltage, Application, and Region.

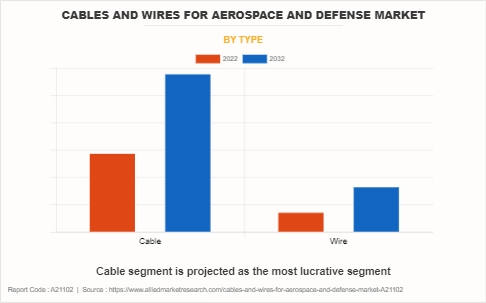

On the basis of type, the market is divided into cable and wire. In 2022, the cable segment dominated the market, in terms of revenue, and is expected to follow the same trend during the forecast period.

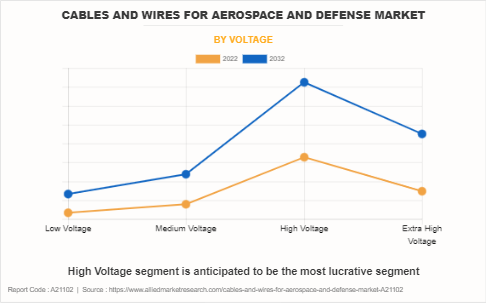

By voltage, the market is segmented into low voltage, medium voltage, high voltage, and extra high voltage. The high voltage segment dominated the market in 2022, and the medium voltage segment is expected to dominate the market during the forecast period.

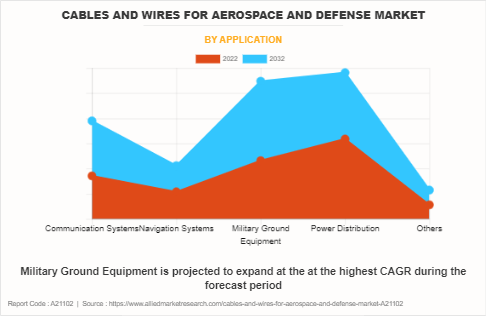

Based on application, the cables and wires for aerospace and defense market outlook is segregated into communication systems, navigation systems, military ground equipment, power distribution, and others. The power distribution segment acquired the largest share in 2022 and is expected to grow at a significant CAGR from 2023 to 2032.

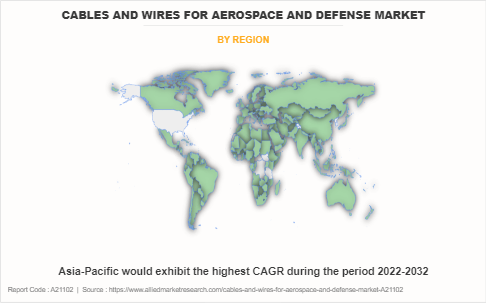

By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, Spain, Italy, UK, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia and rest of Asia-Pacific), and LAMEA (Latin America, Middle East and Africa). Asia-Pacific region, especially India remains a significant participant in the cables and wires for aerospace and defense market opportunity.

COMPETITIVE ANALYSIS

Competitive analysis and profiles of the major global cables and wires for aerospace & defense market players that have been provided in the report include, A.E. Petsche, Amphenol Corporation Apar Industries Ltd., Carlisle Interconnect Technologies, Collins Aerospace, Ensign-Bickford Aerospace & Defense Company, Galaxy Wire & Cable, Gem Cable, Jiuzhou Wire & Cable Co., Ltd., Miracle Electronics Devices Pvt. Ltd., Nexans SA, PIC Wire & Cable, Radiant Cables Pvt. Ltd., Sumitomo Electric Industries, TE Connectivity Ltd., Thermo Cables Limited, and Tyler Madison, Inc.

COUNTRY ANALYSIS

North America-wise, the U.S. acquired a prime share in the cables and wires for aerospace and defense market in the North American region and is expected to grow at a CAGR of 4.11% during the forecast period of 2023-2032. In the U.S., there are approximately 1,737 aircraft, engine & parts manufacturing businesses, as of 2023, which is an increase of 5.7% from 2022. The nation imports around 28% of cables and wires from across the globe. However, Mexico is expected to exhibit to be the fastest growth during the forecast period.

In Europe, France dominated the Europe Cables and wires for aerospace and defense market share in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. Furthermore, the UK is expected to emerge as one of the fastest-growing countries in Europe's Cables and wires for aerospace and defense industry with a CAGR of 6.24%, owing to the presence of advanced technology adoption in this region. For instance, Tratos, a UK-based company manufactures defense & military cables, including fiber-optic cables and components, delivering power, control and signaling functions for a range of international applications.

In Asia-Pacific, China holds a dominant market share in the Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to its large and growing market, growing popularity of cables and wires for aerospace and defense in defense sector, and presence of leading Cables and wires for aerospace and defense manufacturers. However, India is expected to emerge as a dominated country in the cables and wires for aerospace and defense market in the Asia-Pacific region.

In LAMEA, Latin America is growing the fastest in the Cables and wires for aerospace and defense. In Latin America, the growth of the cables and wires for aerospace & defense market is driven by rise in the adoption of fiber optics, RF cables, and Mil-Spec wire harnesses, owing to rapid innovation in technology manufacturers such as Marmon, Nexans, and others willing to invest in manufacturing units of high voltages and extra high voltages cables and wires. Moreover, the Africa region is expected to grow at a high CAGR of 8.4% from 2023 to 2032, owing to its economic growth, and presence of key solution provider for aerospace and defense-related equipment in this region.

TOP IMPACTING FACTORS

The cables and wires for the aerospace and defense market are expected to witness notable growth during the forecast period, owing to the digitalization and electrification of aerospace and defense systems, rising military expenditure globally, and the development of innovative aircraft solutions. Moreover, the rise in government investment in defense and space agencies is expected to provide a lucrative opportunity for the growth of the market during the forecast period. On the contrary, the high development and maintenance cost of infrastructure and complex government framework and policies limit the growth of the cables and wires for the aerospace and defense market.

HISTORICAL DATA & INFORMATION

The cables and wires for aerospace and defense market demand have witnessed a high competition, owing to the strong presence of existing vendors. Vendors of Cables and wires for aerospace and defense machines with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

KEY DEVELOPMENTS/ STRATEGIES

Nexans SA, Amphenol Corporation, Radiant Cables Pvt. Ltd., Sumitomo Electric Industries, and TE Connectivity Ltd. are the top 5 companies holding a prime share in the Cables and wires for the aerospace and defense market. Top market players have adopted various strategies, such as product launch, contract, acquisitions, and agreements, to expand their foothold in the Cables and wires for aerospace and defense market.

In May 2022, Nexans has been awarded a contract with a value of more than €100 million to supply Enedis with medium-voltage power distribution cables and services for the next four years. This contract reinforces Nexans' position in France as a long-term partner of Enedis and as a major player of sustainable electrification. The project combines technological innovation, environmental benefits, superior plant capability, and digital services such as full deployment of ULTRACKER.

In July 2022, Boom Supersonic signed an expanded agreement with Collins Aerospace, a subsidiary of Raytheon Technologies. This partnership is expected to see Collins Aerospace providing major aircraft systems for Boom's Overture, a supersonic commercial airliner. Collins Aerospace's expertise in avionics, power, and control systems is anticipated to play a crucial role in advancing the development of Overture, which aims to revolutionize the future of air travel by enabling faster and more efficient supersonic flights.

In June 2022, Carlisle Interconnect Technologies announced two new high-voltage composite wire families for aerospace applications, a high-voltage composite wire family, and an ultra-flexible high-voltage shielded composite wire family. These 1,000-volt composite wire families offer lighter weight and smaller diameters compared to similar extruded constructions in applications up to 260°C.

.Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cables and wires for aerospace and defense market analysis from 2022 to 2032 to identify the prevailing cables and wires for aerospace and defense market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cables and wires for aerospace and defense market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cables and wires for aerospace and defense market trends, key players, market segments, application areas, and market growth strategies.

Cables And Wires For Aerospace And Defense Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 47 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 321 |

| By Type |

|

| By Voltage |

|

| By Application |

|

| By Region |

|

| Key Market Players | Amphenol Corporation, Thermo Cables Limited, Collins Aerospace, Radiant Cable, Apar Industries Ltd, Nexans SA, Miracle Electronics Devices Pvt Ltd, Carlisle Interconnect Technologies, Sumitomo Electric Industries, TE Connectivity Ltd |

Analyst Review

The global cables and wires for the aerospace & defense market is witnessing significant growth owing to growing investments in R&D by aircraft original equipment manufacturers. Further, the rise in government investment in defense & space agencies is significantly boosting the growth of the global cables and wires for aerospace & defense market. The market for cables and wires for aerospace & defense is expanding due to the rising global need for new aircraft manufacturers. Commercial aircraft, military airplanes, civil helicopters, and military helicopters all use aviation cables to set up an electrical system and transmit signals into electrical power. As a result, the demand for the fabrication of aviation wires is positively impacted by the rise in aircraft demand. Therefore, the competitive environment in this market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The rise in demand in investment by prime government agencies in aerospace & defense solutions such as communication, lighting, flight control system, power transfer, data transfer, and avionics are enhancing cable and wire solutions. Among the analyzed segments, power distribution exhibits the highest adoption rate of cable and wire in aerospace & defense sectors. Globally, various key players and government agencies have invested in cables and wires for the aerospace & defense market that strengthens their share in the market.

The key players profiled in the report include A.E. PETSCHE, Amphenol Corporation Apar Industries Ltd, Carlisle Interconnect Technologies, Collins Aerospace, Ensign-Bickford Aerospace & Defense Company, Galaxy Wire & cable, Gem Cable, Jiuzhou Wire & Cable Co., Ltd, Miracle Electronics Devices Pvt Ltd., Nexans SA, PIC WIRE & CABLE, Radiant Cables Pvt. Ltd., Sumitomo Electric Industries, TE Connectivity Ltd., Thermo Cables Limited and TYLER MADISON, INC.

Asia-Pacific is the largest regional market for Cables And Wires For Aerospace And Defense.

Power Distribution followed by Military Ground Equipment are the leading application of Cables And Wires For Aerospace And Defense Market.

Fiber optic technology is the upcoming trends of Cables And Wires For Aerospace And Defense Market.

The global cables and wires for aerospace and defense market was valued at $27755.6 million in 2022.

A.E. PETSCHE, Nexans, Apar Industries Ltd, Carlisle Interconnect Technologies and Collins Aerospace are the top companies to hold the market share in Cables And Wires For Aerospace And Defense.

Loading Table Of Content...

Loading Research Methodology...