Calcite Market Research, 2033

The global calcite market was valued at $12.7 billion in 2023, and is projected to reach $21.3 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

Market Introduction and Definition

Calcite is a widespread and versatile mineral composed of calcium carbonate (CaCO₃) . It is the primary constituent of sedimentary rocks, such as limestone and marble, formed through both biological and geological processes. Renowned for its varied crystal forms, such as rhombohedral, scalenohedral, and prismatic shapes, calcite exhibits unique properties including birefringence and fluorescence. It finds applications across numerous industries: as a filler and coating pigment in paper, plastics, and paints; a raw material in cement and construction; a soil conditioner in agriculture; and a dietary supplement in pharmaceuticals. Calcite's abundance, chemical stability, and ease of processing contribute to its vital role as an industrial mineral, influencing its global economic significance and widespread use.

Key Takeaways

- The calcite market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,250 product literatures, industry releases, annual reports, and other such documents of major calcite industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The calcite market is significantly driven by the developing construction and infrastructure sectors, where calcite, particularly in the form of limestone, is essential for cement and concrete production. Its role as a filler enhances material strength and durability, which is vital for large-scale projects. Simultaneously, the rise in demand for paper and packaging products fuels market growth, with calcite being a critical component in paper manufacturing. As a coating and filling agent, it improves paper's brightness, opacity, and printability. The combination of robust construction activities and the expanding need for high-quality paper products ensures steady growth in the calcite market.

However, environmental regulations on mining and extraction pose significant constraints on the growth of the calcite market. These regulations aim to mitigate environmental impacts such as habitat destruction, water pollution, and carbon emissions associated with mining activities. Compliance with stringent regulations increases operational costs and procedural complexities for calcite mining companies. Moreover, restrictions on land use and biodiversity conservation measures further limit access to calcite-rich areas. Thus, the calcite industry faces challenges in expanding production capacities and meeting growing global demand, particularly in regions where environmental protections are rigorously enforced.

The development of high-performance coatings and paints presents a lucrative opportunity for the calcite market. Calcite, particularly in its precipitated form (PCC) , is valued for its ability to enhance properties such as opacity, brightness, and durability in coatings and paints. The demand for calcite-based additives is expected to rise as industries seek eco-friendly alternatives and products with superior performance characteristics. These additives not only improve product performance but also contribute to reducing production costs, making them increasingly attractive to manufacturers looking to meet stringent regulatory standards and consumer preferences for sustainable, high-quality coatings and paints.

Market Segmentation

The calcite market is segmented into source, form, end-use industry, and region. By source, the market is categorized into natural deposits, and artificially produced. By form, the market is bifurcated into powder and granule. As per end-use industry, the market is divided into construction, cosmetic, paints and coatings, pharmaceuticals, plastics and polymers, paper, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

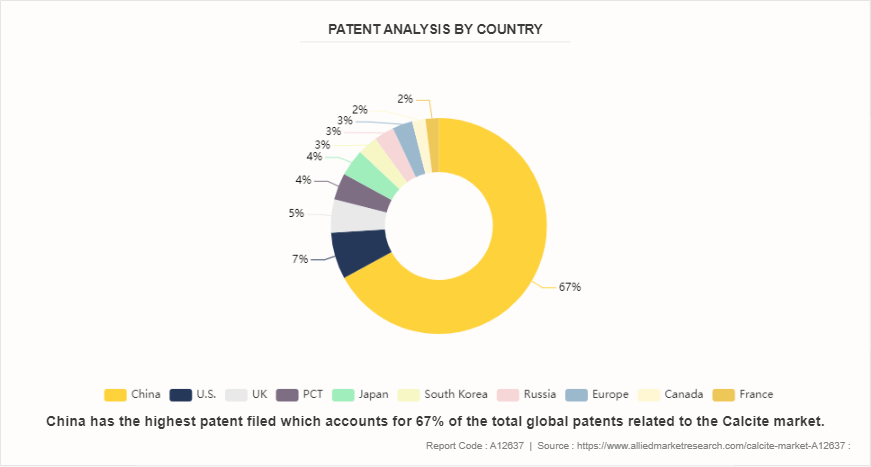

Patent Analysis of Calcite Market

The patent analysis for the calcite market reveals notable contributions from several key regions. China emerges as the dominant player, holding 67% of the total patents, underscoring its significant focus and investment in calcite-related innovations. Following closely are the U.S. and the UK, each with 7% and 5% shares respectively, reflecting substantial contributions to patent filings in this sector. The Patent Cooperation Treaty (PCT) and Japan each hold 4% of patents, highlighting competitive dynamics in patent activities. In addition, South Korea, Russia, Europe, Canada, and France collectively contribute 3% to 2% of the patents, indicating a diversified global effort in advancing technologies and applications related to calcite. This distribution of patents indicates a robust and competitive landscape in the calcite market across various regions. China's dominant position suggests continued leadership in innovation and technology development, potentially influencing market trends and setting standards in calcite-related industries.

Competitive Landscape

The key market players operating in the calcite market include Imerys S.A., Omya AG, J. M. Huber Corporation, Minerals Technologies Inc., Gulshan Polyols Ltd., ACCM, Jay Minerals, Wolkem, Columbia River Carbonates, and Mississippi Lime Company.

Regional Market Outlook

In the Asia-Pacific and North America regions, countries such as the U.S., China, and India are witnessing significant growth in sectors crucial to the calcite market. In construction and infrastructure, rapid urbanization and industrial development drive demand for calcite in cement and concrete production. The paper and packaging industry benefits from calcite's use as a coating pigment to enhance brightness and smoothness. Meanwhile, the plastics and polymers industry utilize calcite as a filler to improve mechanical properties and reduce costs. This robust growth across these sectors underscores calcite's vital role in supporting economic development and industrial expansion in these regions.

- According to The Construction Association, construction is a major contributor to the U.S. economy. There were more than 919, 000 construction establishments in the U.S. in the 1st quarter of 2023. The industry employs 8.0 million employees and creates nearly $2.1 trillion worth of structures each year. Thus, the growth in construction industry further drives the growth of calcite market in U.S.

- The surge in the construction activities drives the growth of calcite market in China. The International Trade Administration predicts a consistent 8.6% average growth rate in China's construction sector from 2022 to 2030. In addition, the Make in India campaign, spearheaded by the Government of India, aims to achieve infrastructural investments totaling $965.5 million by the year 2040.

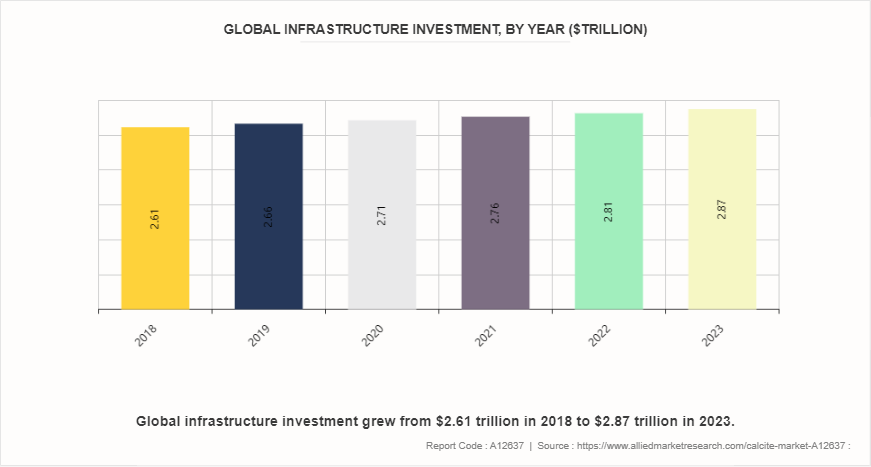

Global Infrastructure Investment

The gradual increase in global infrastructure investment from $2.61 trillion in 2018 to $2.87 trillion in 2023 positively impacts the calcite market. As infrastructure projects expand, there is a growing demand for construction materials, including calcite, which is used in various applications such as cement production, road construction, and as a filler in construction materials. This rising investment supports the expansion of construction activities and infrastructure development, driving the demand for calcite to enhance material quality and durability. Consequently, the calcite market benefits from increased consumption driven by ongoing and future infrastructure investments.

Industry Trends

- Technological advancements in precipitated calcium carbonate (PCC) production have revolutionized industries such as paper, plastics, and paints. For instance, improved particle size control and surface chemistry in PCC manufacturing have led to enhanced paper opacity and printability. In plastics, finer PCC particles improve mechanical properties and reduce material costs. Similarly, tailored PCC formulations in paints achieve better coverage and durability, illustrating the transformative impact of advanced production techniques.

- In agriculture, calcite is utilized as a soil conditioner to neutralize acidic soils and enhance nutrient availability for crops. For instance, in regions where soil acidity affects crop productivity, farmers apply calcite to adjust pH levels and improve soil structure. This practice not only promotes healthier plant growth but also supports sustainable farming practices by reducing the need for synthetic fertilizers, thereby minimizing environmental impact.

Key Sources Referred

- Invest India

- India Brand Equity Foundation

- The Associated General Contractors (AGC) of America

- Occupational Safety and Health Administration

- World Trade Organization

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the calcite market analysis from 2024 to 2033 to identify the prevailing calcite market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the calcite market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global calcite market trends, key players, market segments, application areas, and market growth strategies.

Calcite Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 21.3 Billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 360 |

| By Source |

|

| By Form |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | J. M. Huber Corporation, Wolkem, Gulshan Polyols Ltd., ACCM, Omya AG, Imerys S.A., Columbia River Carbonates, Minerals Technologies Inc., Mississippi Lime Company, Jay Minerals |

| | Jay Minerals, Zantat Sdn. Bhd., Ajanta Industries, Wolkem, Shiraishi Calcium Kaisha Co., Ltd |

The calcite market was valued at $12.7 billion in 2023 and is estimated to reach $21.3 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

Asia-Pacific is the largest regional market for Calcite

Construction is the leading application of Calcite Market

Development of high-performance coatings and paints is the upcoming trends of Calcite Market in the globe

The key market players operating in the calcite market include Imerys S.A., Omya AG, J. M. Huber Corporation, Minerals Technologies Inc., Gulshan Polyols Ltd., ACCM, Jay Minerals, Wolkem, Columbia River Carbonates, and Mississippi Lime Company.

Loading Table Of Content...