Car Sharing Market Insights, 2032

The global Car Sharing Market size was valued at USD 2.9 billion in 2022, and is projected to reach USD 17.8 billion by 2032, growing at a CAGR of 20.2% from 2023 to 2032.

Report Key Highlighters:

The car sharing market study covers regions such as North America, LAMEA, Europe, and Asia-Pacific. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The market share is highly fragmented, into several car sharing services companies includes Getaround, Inc., Enterprise Holdings Inc., Avis Budget Group, Inc, sixt se, Stellantis NV, Turo Inc., ekar Car Rental LLC, Goldbell Engineering Pte. Ltd., Hertz Global Holdings, Inc., Cambio Mobility Service GmbH & Co. KG. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Car sharing is a service in which many people have on-demand access to a fleet of vehicles nearby or the vehicle can be dropped to their location. With the help of an internet application, customers can check at several locations where the car is available for pickup or choose where it can be left off after the completion of a desired activity. Unlike traditional automobile rental, where the user rents a vehicle for a set amount of time, car sharing enables different types of vehicles based on their need. Users can access vehicles for shorter, more flexible periods such as by hour, and minute.

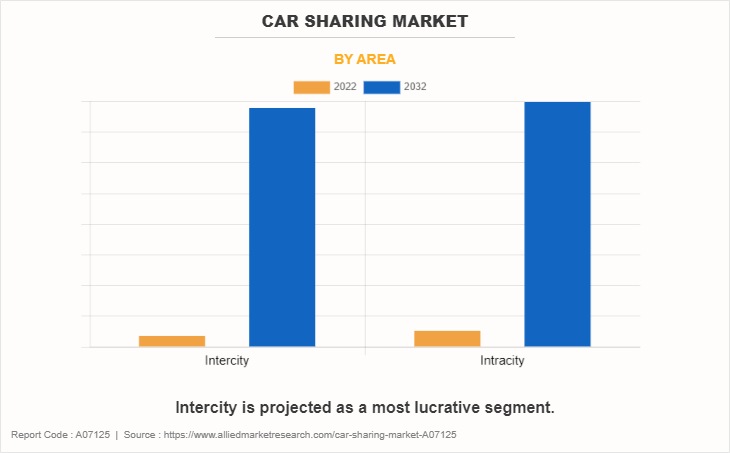

Car sharing is popular in cities and among people who do not want to own a car as there are issues such as parking concerns, traffic congestion, and there is not much use of a car on a daily basis and owning a car can be a burden to the user. The service offers an alternative to car ownership by letting customers pay only for the time they use a vehicle, and in certain situations, the distance traveled. Car sharing service can be offered within a city, which is known as intracity service and between cities, which is known as intercity service. The intercity and intracity service gives consumers the opportunity to use vehicles for a variety of purposes such as commuting to work, going on a road trip, and running errands.

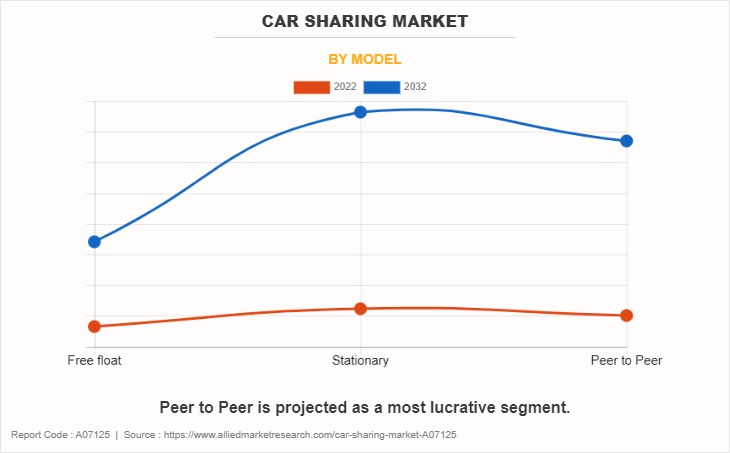

A car sharing service company uses different types of models. The free float model allows users to pick up and drop off vehicles at any designated parking spot within a defined area, offering maximum flexibility. In the stationary model, vehicles are parked at specific locations or hubs, and users must pick up and return the vehicle to the same location. Peer-to-peer car sharing involves individuals renting out their personal vehicles to others for short periods, creating a decentralized network of available cars. Turo and SIXT has a large car sharing market share in Pacific, Europe, and North America.

In simple terms, car sharing is borrowing a car when needed, paying just for the time the car is used, and returning it once the desired task has been completed. Car sharing is essential in cities where parking is limited, or expensive and traffic congestion is severe. As a result, having an automobile is unreasonably expensive. Car sharing services provide a simple and cost-effective mobility solution for people who only need a car on a few occasions such as whether for errands, a weekend getaway, or a business meeting. Car sharing offers flexibility and convenience without the commitment of owning a car.

The factors such as cost saving and partnership and collaboration with public transportation providers supplement the growth of the car sharing market. However, Insurance challenges and inadequate infrastructure development are the factors expected to hamper the growth of the market. In addition, electric & sustainable vehicles and last mile solutions create market opportunities for the key players operating in the car sharing industry.

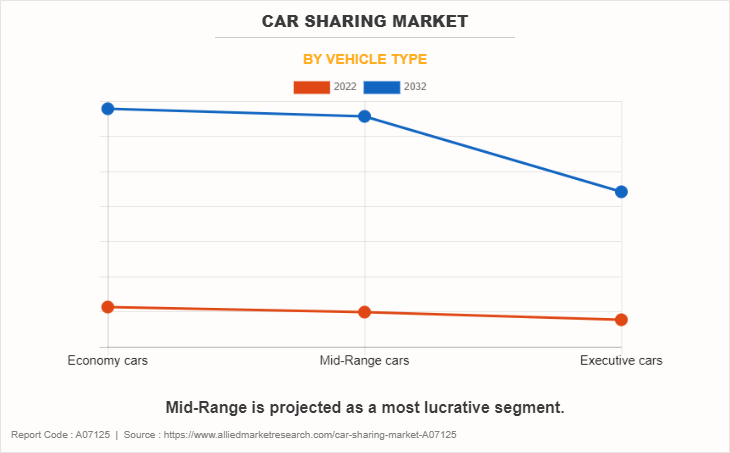

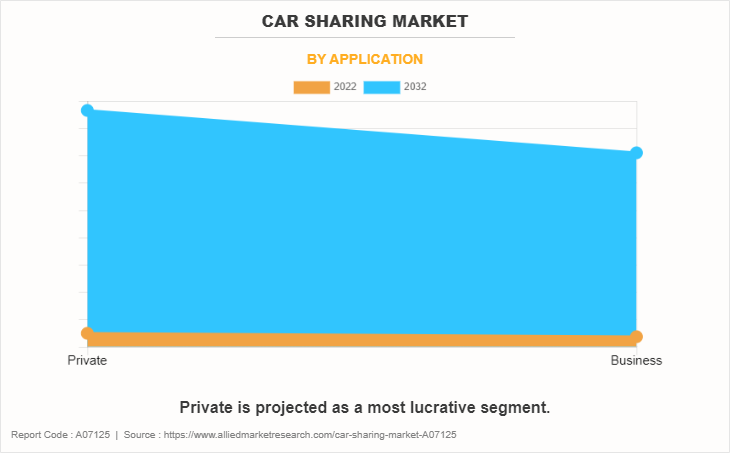

The car sharing market is segmented into vehicle type, application, model, area, and region. By vehicle type, the market is categorized into economy cars, mid- range car, and executive car. By application, the market is divided into private and business. By model, the market is categorized into free float, stationary, and peer to peer. By area, the market is categorized into intercity, and intracity. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players in the car sharing market include Getaround, Inc., Enterprise Holdings Inc., Avis Budget Group, Inc, sixt se, Stellantis NV, Turo Inc., ekar Car Rental LLC, Goldbell Engineering Pte. Ltd., Hertz Global Holdings, Inc., Cambio Mobility Service GmbH & Co. KG.

Key Developments in Car Sharing Industry

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

In May 2023, Getaround, Inc. launched TrustScore v2.0. It is a a proprietary next-generation artificial intelligence (AI) model to enhance the safety and profitability of its carsharing business. TrustScore v2.0 blends machine learning with almost a decade of data from trips taken on its platform and provide improved pricing and security deposits for each carsharing trip.

- In May 2023, Getaround, Inc. acquired HyreCar to provide strength to its car sharing business. The acquisition is expected to expand company's services, as the company is also expected to acquire food and package delivery services for the HyreCar.

- In January 2023, Hertz partnered with Uber to rent available 25,000 electric vehicles (EVs) to Uber drivers in European capital cities by 2025. This strategy is a key element of Hertz's strategy to build one of the largest fleets of rental EVs in the world and Uber's industry-leading commitment to become a zero emissions platform in Europe and North America by 2030.

- In January 2023, Hertz launched Hertz Electrifies to accelerate the transition to electric vehicles while creating economic opportunity and environmental benefits for communities. It is a public-private partnership initiative to transform the sharing car industry & accelerate mainstream consumer adoption of electric vehicles.

Cost Saving from car ownership

Individuals and organizations can save significantly by car sharing. It eliminates the need for individual car ownership, which can be a significant cost burden. Individuals can save the expenditures involved with acquiring a car by sharing vehicles, such as the initial purchase price, insurance, upkeep, and repairs. Businesses, on the other hand, can benefit from lower expenditures associated with maintaining a fleet of company automobiles, such as depreciation, parking fees, and administrative costs.

Furthermore, car sharing market trends can assist people and organizations avoid the financial effect of parking fees and fuel prices. In addition, car sharing can contribute to cost reductions by encouraging more efficient vehicle use, reducing the overall number of automobiles on the road, and the accompanying environmental and infrastructure expenses.

Partnership and collaboration with public transportation providers

Partnerships with public transportation providers can significantly drive the car sharing business in several ways. For instance, partnerships such as these can provide customers with a seamless and integrated transportation experience, allowing them to easily transition from public transportation to car sharing services, thereby expanding the reach and convenience of both modes of transportation.

Integrating car sharing services with public transportation can also assist reduce automobile ownership and usage, resulting in less traffic congestion, parking demand, and environmental impact. Partnerships with public transportation providers can also give car sharing firms with access to premium areas for vehicle parking, increasing the availability and convenience of their services.

Collaboration with public transportation can also lead to increased brand visibility and customer base for car sharing businesses, as well as potential financial incentives or subsidies for users who combine public transit with car sharing, making these services more appealing and affordable. The synergy between car sharing and public transportation through strategic partnerships and collaborations not only enhances the overall transportation experience for users but also drives the growth and success of the car sharing business by expanding its reach, accessibility, and appeal to a wider audience.

Insurance challenges

Insurance challenges can hinder or restrict the market growth of the car sharing industry in several ways. For instance, obtaining insurance for car sharing vehicles can be more complex and costly compared to traditional personal vehicle insurance. Car sharing vehicles are often subjected to higher usage and diverse drivers, leading to increased risk factors that insurance companies may perceive as higher. This can result in higher premiums and more stringent insurance requirements, which can directly impact the operational costs of car sharing businesses and potentially deter their expansion. These development shows the challenges in car sharing industry.

Moreover, the lack of standardized insurance policies tailored specifically for car sharing services can create uncertainty and inconsistency in coverage across different regions, making it challenging for car sharing companies to navigate and comply with varying insurance regulations. Furthermore, the evolving regulatory environment and the need to adapt insurance policies to accommodate new mobility models like car sharing can pose additional hurdles and delays, potentially impeding the growth and scalability of the car sharing market.

Electric & Sustainable vehicles

Electric and sustainable vehicles present significant future for car sharing market opportunities. As the growing emphasis on environmental sustainability and the seamless transition towards greener transportation solutions requires the adoption of electric and sustainable vehicles in the car sharing industry. Adoption of electric vehicles (EVs) and other sustainable solutions coincides with worldwide measures to reduce carbon emissions and battle climate change. The advancements in battery technology and improving charging station infrastructure are increasing the feasibility and practicality of electric vehicles, hence increasing their potential in the market.

The financial benefits associated with operating electric vehicles, such as lower charging prices and lower maintenance requirements, can add to the overall affordability and competitiveness of car sharing services, making them more appealing to a wider client base.

Similarly, including sustainable vehicles into car sharing fleets, such as hybrid and electric models, can help vary the variety of available options, catering to the increasing preferences and demands of consumers seeking ecologically friendly and efficient transportation solutions.

Impact of the recession on the car sharing market

A recession's impact on the car sharing sector can be multidimensional. Individuals and organizations frequently seek cost-effective mobility alternatives during economic downturns, which may raise demand for car sharing services. Car sharing may become an appealing alternative to car ownership and standard rental services as individuals seek more flexible and economical mobility options. The recession may change the consumer behavior which results in an increase in the use of car sharing platforms, particularly in urban areas where public transportation may be limited, and people can explore car sharing services as it is cost-effective and provide a source of income to the local car owners. Furthermore, during a recession, the economic impact on individuals and businesses may encourage them to explore ways to decrease transportation costs, making car sharing a practical and tempting choice for short-term or occasional use.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the car sharing market analysis from 2022 to 2032 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Car Sharing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.8 billion |

| Growth Rate | CAGR of 20.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 412 |

| By Area |

|

| By Vehicle Type |

|

| By Application |

|

| By Model |

|

| By Region |

|

| Key Market Players | Stellantis NV, Hertz Global Holdings, Inc., Getaround, Inc., Ekar Car Rental LLC, Enterprise Holdings Inc., Goldbell Engineering Pte. Ltd., SIXT, Avis Budget Group, Inc, Cambio Mobility Service GmbH & Co. KG, Turo Inc. |

The global Car Sharing Market size was valued at USD 2.9 billion in 2022, and is projected to reach USD 17.8 billion by 2032.

The global car sharing market is projected to grow at a compound annual growth rate of 20.2% from 2023 to 2032 to reach USD 17.8 billion by 2032.

The key players that operate in the car sharing market such as Getaround, Inc., Enterprise Holdings Inc., Avis Budget Group, Inc, sixt se, Stellantis NV, Turo Inc., ekar Car Rental LLC, Goldbell Engineering Pte. Ltd., Hertz Global Holdings, Inc., Cambio Mobility Service GmbH & Co. KG.

North America is the largest regional market for car sharing.

The factors such as cost saving and partnership and collaboration with public transportation providers supplement the growth of the car sharing market. However, Insurance challenges and inadequate infrastructure development are the factors expected to hamper the growth of the market.

Loading Table Of Content...

Loading Research Methodology...