Catering And Food Service Contract Market Research, 2032

The global Catering And Food Service Contract Market Size was valued at $288.8 billion in 2022, and is projected to reach $497.7 billion by 2032, growing at a CAGR of 5.3% from 2023 to 2032. Catering and food service contract industry refers to the food services provided by a catering company for an event, organization, corporate, educational institution, healthcare, industrial, hospitality services, sports and leisure, and others on a contractual basis. Catering and food service contracts are the business of providing food service at various locations. The global catering services market is driven by the recent food safety-related incidents, due to which the FDA has come up with strict and tighter norms and regulations for monitoring the quality and standards of food being served. Thus, along with the global concern for food safety, it also drives the demand for outsourcing catering services, further enhancing the global catering services market.

Catering and food services contract businesses add more services such as birthday parties, wedding receptions and others. Companies with greater reliance on the service part of their business focus on a better return on sales that can improve their value. Based on high-quality products, companies invest more in service differentiation to achieve competitive advantages. Moreover, the increase in popularity of online contract catering and food service is one of the major factors driving the growth of the contract catering and food service market. Rise in business-related travel and increase in the number of food joints such as hotels & restaurants fuel the gCatering And Food Service Contract Market Growth. According to the Restaurant Performance Index of the National Restaurant Association, the U.S. restaurant industry is expected to reach $863 billion in 2019 with over 1 million restaurants operating in the U.S. cross-border investments, experiments & innovations in varieties of cuisines, and growth in travel & tourism industry is anticipated to provide lucrative opportunities for the market expansion. However, the COVID-19 outbreak has led to the closure of a significant proportion of the food service industry, including hotels & restaurants, pubs & bars. This, in turn, has hampered the growth of the catering and food service contract market during the pandemic.

Technology is the second-largest area of investment. While 13% of restaurant leaders invest in catering management software (CMS) to help alleviate scheduling issues, the major share of technology investment goes to online ordering. Approximately, 42% of restaurants stated they invest in online ordering, which is three times larger than any other tech investment type, all such factors improve the user experience and surge the demand of the catering and food service market. Moreover, Bartlett Mitchell is a niche contract caterer based in Surrey with over 70 catering clients in business and industry, education, healthcare, and the service sectors. Its IT partner, Indicator, provides modular SaaS (Software as a Service) web-based IT modules covering anything from accounts and stock control to marketing and HR, which are personalized for every company and outlet.

Increase in catering business owners cause tough competition in attracting customers as much as possible. Catering businesses must maintain a sense of quality and service to consumers at affordable price to attract consumers in large numbers. Moreover, ensuring food safety is also a major issue with catering industry, making sure that proper processes for time and temperature control, cross-contamination prevention and cleaning and sanitization procedures are in place. This can be challenging when preparing food at different venues because caterers may be unfamiliar with the space, and the proper facilities may not always be available as they would be at a restaurant.

The change in socio-economic scenario coupled with rise in consumer living standards, particularly across the developing regions is further driving the market growth. Moreover, contract catering services also gain popularity in the healthcare sector due to the growth in need for wellness and a balanced diet. Apart from this, the increase in demand for hygienic and nutritional food across educational institutions and geriatric care centers also foster the market growth for contract catering. Moreover, various caterers are focused on providing premium table services, exotic ingredients, live food counters and aesthetic delicacies in a profound manner, thereby transforming the growth of the global catering and food service contract market.

The market in the Asia-Pacific region offers lucrative growth opportunities for market players. The presence of large population base increase in household income, and rise in the middle-class population in this region are the major factors that supplement the market growth In April 2017, the government of Singapore introduced Whole-of-Government (WOG) Healthier Catering Policy. The policy was introduced to encourage healthier eating in homes, workplaces, and communities in Singapore; such factors surge the catering and food service contract market demand.

Moreover, countries in Latin America, such as Brazil, are anticipated to unfold attractive opportunities during the Catering And Food Service Contract Market Forecastperiod due to favorable government policies, large-scale privatization, and combating unfair competition. The catering and food service contract market in Middle Eastern countries has witnessed significant growth, owing to the development of the tourism industry and considerable economic growth. Countries such as Saudi Arabia, Qatar, and UAE offer lucrative growth opportunities for the hospitality industry, owing to significant investment in tourism and infrastructure.

Segmental Overview

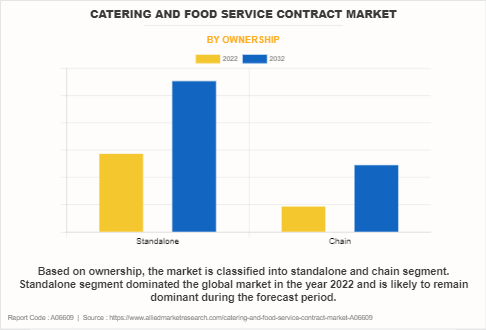

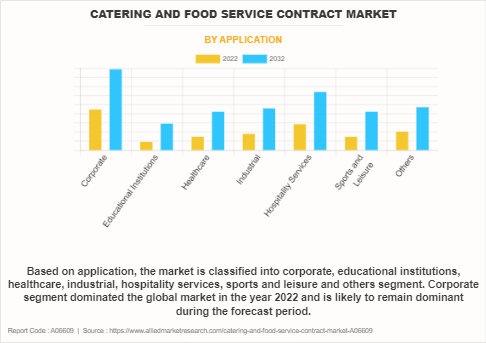

The catering and food service contract market is segmented into ownership, application, and region. On the basis of ownership, the market is divided into standalone and chain. On the basis of application, it is classified into a corporate, educational institution, healthcare, industrial, hospitality services, sports and leisure, and others. On the basis of region, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Ownership

By ownership, the catering and food service contract market share is classified into standalone and chain catering and food service market. Among these, the standalone catering and food service contract market segment occupied the major market share in 2022 and is projected to maintain its dominance during the forecast period.

By Appliation

By application, the corporate catering and food service contract market segment occupied the major share of the market in 2022 and is projected to maintain its dominance during the forecast period. In the corporate catering and food service contract market “Corporate Town Hall Concept” can be taken to a broader level. Corporate caterers opt to serve guests individually packed meals during the event. Guests can also have the option to customize their boxed meals by indicating their food preference Moreover, to reduce inconveniences and save time, the caterer uses food trucks to bring the food close to the company without entering the premises; the employees can pick up their order and have it within proximity.

Furthermore, the sports and leisure segment is expected to grow with the highest CAGR during the forecast period, owing to self-service ordering, required in sports and leisure catering and the food service contract market improving the experience. The frictionless approach combines the ethos of a range of convenience and safety-enhancing techniques – pre-ordering and collection, interactive screens, and cashless payments – to deliver something truly seamless to the customer.

Moreover, in recent years, the development of the global catering and food service industry maintains a rapid momentum in hospitality service development. A wide variety of catering products and different styles of food culture are the key trend of the catering and food service contract market in the hospitality service sector.

By Region

By region, Europe held the major share in the catering and food service contract market in 2022, owing to the sustained high rate of GDP growth in Europe over a long period of time has resulted in growth in the per capita income. The growth in disposable income has also facilitated a rise in the spending pattern of households in this region. People have started spending more on dining out and on securing high-quality catering services for their social gatherings.

Competition Analysis

The players in the catering and food service contract market have adopted acquisition and product launch as their key development strategies to increase profitability and improve their position in the market. The key players profiled in the catering and food service contract market include The RK Group, Gulf Catering Company, Delaware North Companies, Inc., Comprehensive Support Services PTE., Ltd., Australian Camp Services, Of Food Catering, Conntrak Catering Service., National Catering Services & Foodstuff, NCC Group, Compass Group PLC., Sodexo, Elior Group, Aramark, ISS A/S, Thompson Hospitality Corporation, NTUC Foodfare Co-operative Limited, SATS Ltd., Catering Solutions Pte. Ltd., Neo Group Limited, Algosaibi Services Company, Ltd., Cater Care Holdings Pty., Ltd., Catering HQ, Gnocci Holdings Pty. Ltd., WSH Investments Limited., Fusion Foods & Catering Pvt. Ltd.

Recent Developments in the Catering and Food Service Contract Industry

Expansion

October 2023, Aramark - Aramark (Aramark Sports + Entertainment) launched new food and beverage programs at the Seven NBA and NHL Venues for 2023-24 Arena Season. This offering comprises limited-time concessions items, elevated premium services, and exclusive retail merchandise.

- November 2021, SATS Ltd.- SATS Ltd. opened a new central kitchen in India to provide nutrition and safe food by incorporating new technology and offer services to its customer in India.

- August 2022, Conntrak Catering Services. - Conntrak Catering Services has established new division PT Conntrak Catering Indonesia to increase operational support for the services in the Indonesia.

Collaboration

July 2022, SATS Ltd. - SATS Ltd., collaborated with hawker brands, Qiu Lian Ban Mee and Chew Kee Soy Sauce Chicken, and with this collaboration the company aims to expand its new signature dishes and are available exclusively to seven to eleven stores across Singapore.

Agreement

December 2022, Sodexo - Sodexo renewed its five-year agreement with Tetra Pak, which is a leading food processing and packaging solutions company, in order to provider integrated facilities management services including food services.

- April 2023, SATS Ltd.- SATS Ltd., signed a multi-year memorandum of understanding (MOU) to form a strategic alliance with Mitsui & Co., Ltd. This MOU focuses on strengthening the food value chain.

Acquisition

January 2022 , Sodexo - Sodexo has acquired Frontline Food Services which offers convenience services, with this acquisition the company has expanded its services offering and will offer various services including click and collect, take-out and delivery services and further it is anticipated to contribute towards market growth in North America.

- July 2023, Sodexo-Sodexo announced to acquire A.H. Management, which is a leading provider to corporate food service, in order to accelerate its food transformation strategy.

- June 2021, SATS Ltd.- SATS Ltd., acquired Food City Company Limited a frozen food producer based in Thailand. The company is expected to increase its production capacity and improve services offering to grow consumer base with this acquisition.

- March 2021, Compass Group PLC- Compass Group India, a division company of Compass Group PLC., has acquired SmartQ which offers services to digital cafeteria segment. The company is expected to offer new solutions to eliminate waiting time and contribute towards operating with social distancing practices with this acquisition.

- May 2021,Compass Group PLC -Compass Group USA a division company of Compass Group PLC., has acquired EAT Club which offers meals services. The company is anticipated to expand its digital catering business and service offering with this acquisition.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the catering and food service contract market analysis from 2022 to 2032 to identify the prevailing catering and food service contract market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the catering and food service contract market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global catering and food service contract market trends, key players, market segments, application areas, and market growth strategies.

Catering And Food Service Contract Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 497.7 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Ownership |

|

| By Application |

|

| By Region |

|

| Key Market Players | Cater Care Holdings Pty., Ltd., Comprehensive Support Services PTE., Ltd., Delaware North Companies, Inc., Sodexo, Catering Solutions Pte. Ltd., WSH Investments Limited., Neo Group Limited, Thompson Hospitality Corporation, Gnocci Holdings Pty. Ltd., ISS A/S, Elior Group SA, Gulf Catering Company, National Catering Company Limited WLL, Fusion Foods & Catering Pvt. Ltd., SATS Ltd., Of Food Catering, NTUC Foodfare Co-operative Limited, The RK Group, Conntrak Catering Services., Catering HQ Pty Ltd., Compass Group PLC, Algosaibi Services Company, Ltd., Australian Camp Services, National Catering Services & Foodstuff, Aramark |

Analyst Review

The market players have adopted key developmental strategies such as new product launch and acquisition to maintain their position in the catering and food service contract market, in terms of value sales. They also emphasize on continuous innovations in their products to maintain a strong foothold in the market and to boost the sales of catering and food service contract market.

Moreover, as per the key players, the increase in adoption of automation in the industry has contributed to drive the growth of the market amidst COVID-19. For instance, services such as automated cooking & beverage systems, touchless pick-up & delivery equipment, cloud-based IoT solution, and other automated equipment are in demand as they address the evolving foodservice environment accelerated due to the COVID-19 pandemic. This, in turn, is also anticipated to offer immense opportunity for the growth of the catering and food service contract market. Key players in the market have adopted new product launch, continuous innovation, and acquisition as their key developmental strategies to fulfill the rise in demand for advanced and improved catering and food service which helps market to grow significantly. However, increase in numbers of catering business owners causes tough competition and are anticipated to hamper the market growth.

According to the CXO, the contract catering service market has experienced a remarkable surge in demand, particularly in developing countries, during special occasions and events. This growth is attributed to the evolving consumer preferences and rising disposable incomes in these regions. With an increasing emphasis on convenience and quality dining experiences, consumers are turning to contract catering services to meet their event needs. This trend reflects the desire for hassle-free event planning and diverse culinary offerings. The contract catering industry is responding by offering customizable and cost-effective solutions, contributing to its rapid expansion within these emerging markets.

The global catering and food service contract market size was valued at USD 288.8 billion in 2022, and is projected to reach USD 497.7 billion by 2032

The global catering and food service contract market is projected to grow at a compound annual growth rate of 5.3% from 2023-2032 to reach USD 497.7 billion by 2032

The key players profiled in the reports includes The RK Group, Gulf Catering Company, Delaware North Companies, Inc., Comprehensive Support Services PTE., Ltd., Australian Camp Services, Of Food Catering, Conntrak Catering Service., National Catering Services & Foodstuff, NCC Group, Compass Group PLC., Sodexo, Elior Group, Aramark, ISS A/S, Thompson Hospitality Corporation, NTUC Foodfare Co-operative Limited, SATS Ltd., Catering Solutions Pte. Ltd., Neo Group Limited, Algosaibi Services Company, Ltd., Cater Care Holdings Pty., Ltd., Catering HQ, Gnocci Holdings Pty. Ltd., WSH Investments Limited., Fusion Foods & Catering Pvt. Ltd.

Europe dominated in 2021 and is projected to maintain its leading position throughout the forecast period.

Service Diversification and Differentiation, Popularity of Online Contract Catering and Food Services, Business Travel and Growing Number of Food Outlets, Technological Advancements, Food Safety and Hygiene Standards, Socio-Economic Changes and Improved Consumer Standards majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...