Ceramide Market Outlook – 2027

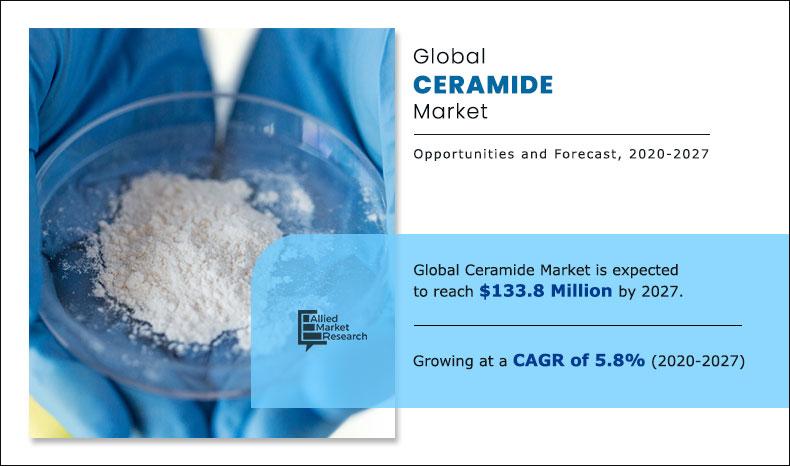

The global ceramide market size was valued at $85.0 million in 2019, and is projected to reach $133.8 million by 2027, growing at a CAGR of 5.8% from 2020 to 2027.

Ceramide, a type of lipid complex, is present in the intercellular spaces of the epidermis layer of skin. Glycosphingolipids, a type of glycolipid found in plants, contain the ceramide compound. Basically, ceramide consists of sphingosine and fatty acid. Ceramide is of two types, which include natural ceramide and synthetic ceramide. Natural ceramide can be extracted from various plant resources such as rice, wheat, and soybeans. In addition, synthetic ceramide can be produced through microbial fermentation of various microorganisms. Ceramide is majorly used in cosmetics and skincare products to improve skin hydration rate and to improve the moisturizing ratio.

Growing prominence of antiaging skincare products and increase in disposable income are the major drivers in the market. In addition, rise in aging population in countries such as the U.S., Japan, and UK fuels the demand for various cosmetics and dietary supplements. Ceramide used in skincare and food products can improve skin hydration rate and is effective against various age-related skin disease. Moreover, with rise in disposable income, large number of consumers are spending on personal care and cosmetics products. The application of such products is often considered to improve the quality of life and self-confidence of consumers. Such factors are expected to boost the growth of the ceramide market. Furthermore, with surge in demand for internet and mobile network, the e-commerce and online sales channels are expected to gain traction in the market. For instance, North America and Europe have over 80% internet users, who largely contribute to the online sales of various cosmetics and food supplements.

Moreover, with availability of various online sales channels, rural consumers can purchase specific product at affordable price, which improved consumer engagement. In addition, expansion of supermarket and hypermarket stores in countries such as Canada and the U.S. is targeting new consumer demographics, which is further expected to enhance the ceramide market growth. For instance, supermarkets such as Galleria Supermarket and T&T Supermarket offer various imported beauty and personal care products from South Korean brands, which are majorly purchased by Asia consumers.

However, excessive concentration of ceramide in human tissue can lead to various health issues such as diabetes and cardiovascular diseases. Moreover, it has negative impact on metabolism and it is associated with other comorbidities. Such factors may restrict the growth of the market.

Nonetheless, shifting consumer trend toward natural products coupled with robust investment in Europe cosmetics industry is expected to create new market opportunities. In Europe, industry players spend at least 5% of their annual revenue in R&D, which consists of 77 innovation facilities and over 28,000 scientists.

The global ceramide market is segmented on the basis of type, process, and application. On the basis of type, it is divided into natural and synthetic. By process, it is categorized into fermentation ceramides and plant extract ceramides. By application, the market is classified into cosmetics, food, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Major players have adopted business expansion, merger, and acquisition to sustain the intense market competition. Some of the key players profiled in the report include Evonik Industries, Toyobo, Cayman Chemical, Arkema, and Doosan Corporation.

Global Ceramide Market, By Region

Asia-Pacific accounted for the highest revenue share in 2019. This is attributed to large consumption of rice, wheat, and soybean products through food supplements and various cosmetics products. China is the highest consumer of rice of around 149 million tons followed by India. In addition, China and India have significant demand for wheat and soybean oil products, which are prominent natural sources of ceramide.

By Region

Europe exhibits highest CAGR of 6.7%

Global Ceramide Market, By Type

Synthetic ceramide segment is expected to witness highest market growth. This is attributed to rise in demand for ceramide in antiaging skincare products and various haircare products. Moreover, most of these synthetic ceramides are cost-effective and are easily available compared to natural ceramide.

By Type

Synthetic is projected as the most lucrative segment

Global Ceramide Market, By Process

Based on process, the fermentation ceramide segment accounted for the highest revenue share in 2019. This is attributed to growing demand of synthetic ceramide and ceramide by products in cosmetics and personal care application. As the production cost of natural ceramide or plant extracted ceramide is high, fermentation is often used as cost-effective process.

By Process

Fermentation ceramide is projected as the most lucrative segment

Global Ceramide Market, By Application

Application wise, the cosmetics segment is expected to witness the highest market growth in 2019. This is attributed to increase in application of cosmetics product in meetings or social gatherings. Moreover, rise in demand for antiaging skincare products in aging population is one of the crucial factors influencing the ceramide market growth.

By Application

Others is projected as the most lucrative segment

COVID-19 scenario analysis

- The rapid spread of COVID-19 pandemic largely impacted the demand from end users of ceramide such as cosmetics and skincare products manufacturers. Lockdown measures and travel restrictions hindered the offline sales of cosmetics and personal care products. Moreover, due to limited social gathering, consumers are leaving home only for essential products. In addition, due to social distancing norms large number of direct sales channels and retail stores witnessed sharp decline in sales of cosmetics product. Countries across the globe imposed ban on cross-border imports of various goods, which largely impacted the supply chain of ceramide market. Delayed supply of raw materials and increase in lead time affected the production of ceramide and various end products.

- However, the restriction on offline sales channels created new market opportunities for e-commerce, direct-consumer, and click-and-collect sales channels. Many cosmetics products manufacturers reported 200% increase in online sales compared to that of pre-Covid period. Moreover, with new promotion and discounts on online products, the market will slowly improve moving the unsold inventories.

Key benefits for stakeholders

- The global ceramide market analysis covers in-depth information of major industry participants.

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- Major countries have been mapped according to their individual revenue contribution to the regional market.

- The report provides in-depth analysis of the global ceramide market forecast for the period 2020–2027.

- The report outlines the current global ceramide market trends and future estimations of the market from 2019 to 2027 to understand the prevailing opportunities and potential investment pockets.

- The key drivers, restraints, & market opportunity and their detailed impact analysis are explained in the study.

Key market segments

By Type

- Natural

- Synthetic

By Process

- Fermentation Ceramides

- Plant Extract Ceramides

By Application

- Cosmetics

- Food

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Ceramide Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By PROCESS |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | EVONIK INDUSTRIES, CAYMAN CHEMICAL, ASHLAND INC., TOYOBO, VANTAGE SPECIALTY INGREDIENTS, ARKEMA, DOOSAN CORPORATION, CRODA INTERNATIONAL, KAO GROUP, INCOSPHARM CORPORATION |

Analyst Review

According to CXOs of leading companies, the global ceramide market is expected to witness considerable growth. This is attributed to significant surge in demand for cosmetics products in aging population as well as in young population. Growth in awareness of skincare products and shifting consumer trend toward natural products are expected to support the market growth. In countries such as the UK, France, and Italy over 80% of the survey respondents are using various facial creams and hair creams (shampoos and hair gel). Moreover, growing prominence of internet facilities in countries such as China, India, and other emerging nations is anticipated to create new market opportunities through online sales platforms.

Surge in demand for antiaging skincare products and increase in disposable income are the key factors boosting the market growth.

The ceramide market was valued at $85.0 million in 2019, and is projected to reach $133.8 million by 2027, growing at a CAGR of 5.8% from 2020 to 2027.

Evonik Industries, Toyobo, Cayman Chemical, Arkema, and Doosan Corporation are the top companies in the market.

Cosmetics application is projected to increase the demand for Ceramide Market.

The plant extract segment accounted for the largest ceramide market share.

Rise in demand for antiaging skincare products, coupled with increase in disposable income are the main drivers influencing the market growth.

Other applications (pharmaceutical and healthcare) are expected to drive the adoption of ceramide.

• The rapid spread of COVID-19 pandemic largely impacted the demand from end users of ceramide such as cosmetics and skincare products manufacturers. • Lockdown measures and travel restrictions hindered the offline sales of cosmetics and personal care products. Moreover, due to limited social gathering, consumers are leaving home only for essential products. • In addition, due to social distancing norms large number of direct sales channels and retail stores witnessed sharp decline in sales of cosmetics product. Countries across the globe-imposed ban on cross-border imports of various goods, which largely impacted the supply chain of ceramide market. Delayed supply of raw materials and increase in lead time affected the production of ceramide and various end products.

Loading Table Of Content...