The China operational technology (OT) security market has witnessed significant growth during the forecast period. This is attributed to harmonious blend of innovation and security imperatives. With the increasing automation and interconnectivity of industrial processes, there is rise in need for strong OT security solutions. Various industries, including BFSI, manufacturing, energy & power, oil & gas, and transportation & logistics have acknowledged the vital significance of protecting their operational technology. This recognition, combined with strict regulatory mandates, propels the adoption of OT security solutions.

Moreover, continuous advancement of cyber threats serves as a driving force for innovation in the field of OT security. To outsmart the ever-growing sophistication of cybercriminals, organizations are compelled to constantly modify their security protocols. This ongoing battle against cyber threats propels the creation of cutting-edge OT security solutions and services.

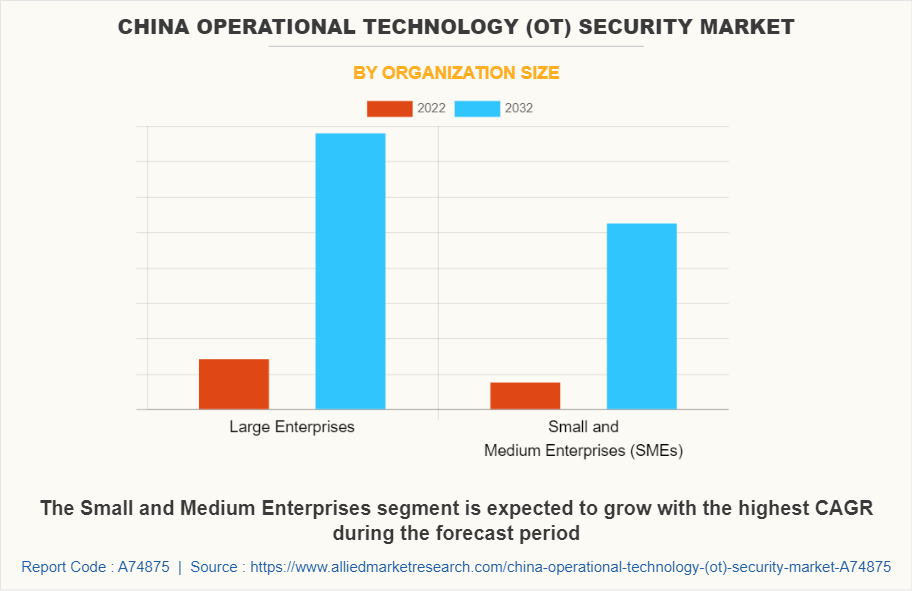

On the other hand, in the intricate realm of the China operational technology (OT) security market, progress is hindered by various challenges. One of the major restraints is lack of awareness and expertise. Numerous organizations, particularly small and medium enterprises (SMEs), are still striving to keep pace with the ever-changing threat landscape. This gap in knowledge impedes the successful implementation of OT security measures.

Moreover, the market is overshadowed by budget constraints, which poses a significant challenge for SMEs seeking to implement robust OT security. Economic uncertainties, cost pressures, and competing priorities often discourage organizations from allocating sufficient resources to their OT security initiatives. In addition, integration of OT security with existing operational technology systems is a complex and resource-intensive task, despite the necessity of seamless convergence between IT and OT for comprehensive security.

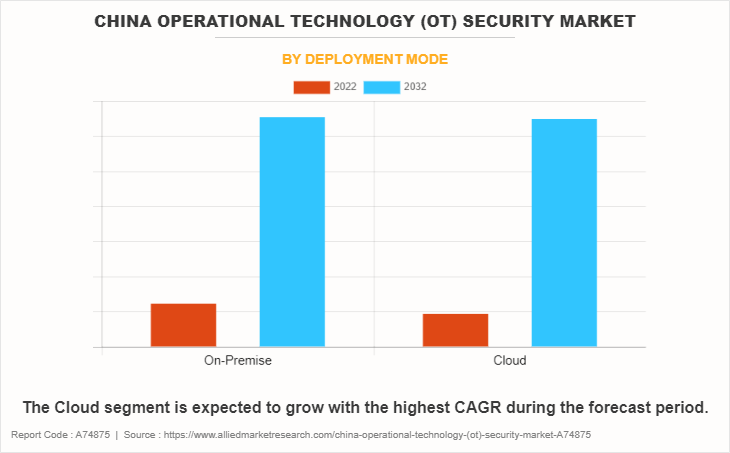

However, the China operational technology (OT) security market presents a wealth of opportunities for the market players, particularly in the realm of cloud-based deployment. The scalability and flexibility of cloud technology have led to its rapid adoption, creating a promising avenue for OT security providers. In addition, customization of solutions to meet the unique security requirements of different industry verticals is lucrative opportunity. Providers that tailor their offerings to specific industry needs are expected to find a receptive market. Furthermore, convergence of OT and IT security is an untapped area with significant potential. As organizations seek comprehensive security solutions, providers that seamlessly integrate both domains are anticipated to gain a competitive advantage.

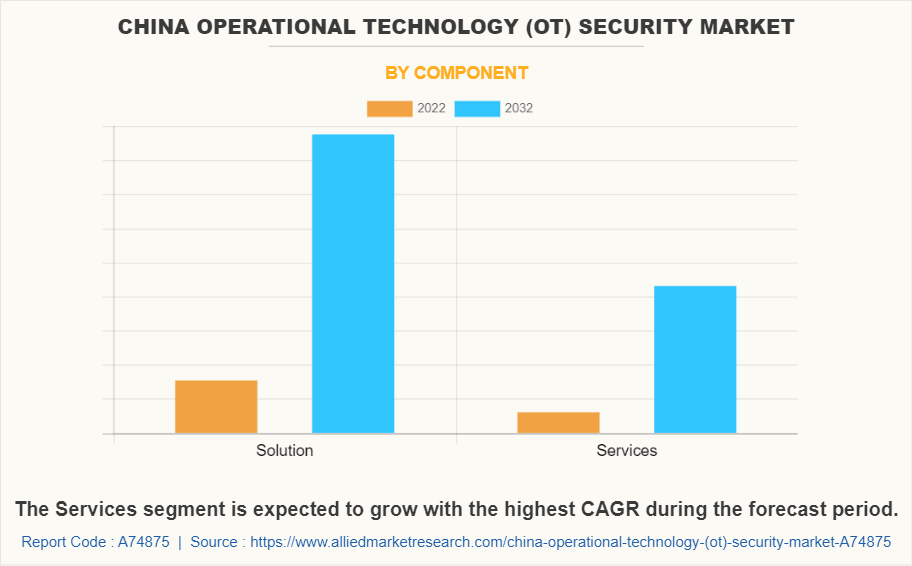

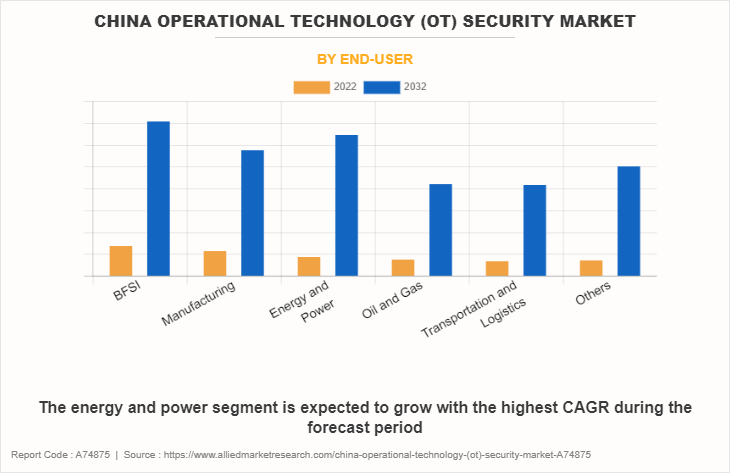

The China operational technology (OT) security market is segmented into component, deployment mode, organization size, and end user. Further, on the basis of component, the market is bifurcated into solution and services. Depending on deployment mode, it is divided into on-premise and cloud. By organization size, the market is classified into large enterprises, small and medium-sized enterprises (SMEs). According to end user, it is fragmented into BFSI, manufacturing, energy & power, oil & gas, transportation & logistics, and others.

Moreover, the market is significantly influenced by perceptions of consumers and end users, which impacts an organization's reputation and financial stability in the event of a cyber breach. As a result, investment decisions in OT security solutions are heavily influenced by these perceptions. Pricing strategies in this market cater to the diverse needs of customers, with some organizations willing to invest heavily in comprehensive security while others seek cost-effective solutions tailored to their specific requirements. Therefore, pricing strategies need to find a balance between affordability and value.

The Porter’s five forces analysis analyzes the competitive scenario of the China operational technology (OT) security market and role of each stakeholder. These forces include the bargaining power of suppliers, bargaining power of buyers, threat of substitutes, threat of new entrants, and competitive rivalry.

The threat of new entrants in the market is moderate. To establish trust and credibility in this realm, significant investments in research, development, and compliance with stringent regulations are required. The bargaining power of suppliers is strong, given rise in demand for specialized solutions, and influence pricing and terms. However, the bargaining power of buyers is high as there are several large providers in the market, allowing them to negotiate on pricing, contract terms, and service levels. The limited threat of substitutes is due to high stakes involved in safeguarding critical operations, which traditional security measures often do not adequately address. The China operational technology (OT) security market is characterized by intense competitive rivalry among numerous providers, who offer innovative solutions, tailored services, and competitive pricing, ultimately benefiting buyers.

A SWOT analysis reveals the intricacies of the market, highlighting its strengths, weaknesses, opportunities, and threats. The market's strengths include rise in awareness of OT security's importance, rapid innovation & development in the field, strong regulatory support & compliance mandates, and increase in adoption of cloud-based solutions. However, weaknesses such as lack of expertise & awareness, budget constraints for comprehensive security solutions, complex integration of IT & OT systems, and adaptable cyber threats are addressed.

Opportunities for growth include rise in demand for cloud-based deployment, customization of solutions for specific industry needs, convergence of IT & OT security, and security challenges posed by IoT devices. However, threats such as intense competition among OT security providers, advancement of cyberattacks, economic uncertainties & budget constraints, and potential for a major security breach leading to reputational and financial damage are considered.

Key players operating in the market include Huawei Technologies Co., Ltd., Alibaba Cloud, Tencent Cloud, 360 Enterprise Security Group, Baidu, Inc., Kaspersky Lab, Symantec Corporation, Palo Alto Networks, Inc., Trend Micro, Inc., and Sangfor Technologies Inc.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in China operational technology (OT) security market.

- Assess and rank the top factors that are expected to affect the growth of China operational technology (OT) security market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the China operational technology (ot) security market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

China Operational Technology (OT) Security Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 70 |

| By Component |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By End-User |

|

| Key Market Players | Tencent Cloud, Trend Micro, Inc., Baidu, Inc., Sangfor Technologies Inc., 360 Enterprise Security Group, Huawei Technologies Co., Ltd., Symantec Corporation, Palo Alto Networks, Inc., Kaspersky Lab, Alibaba Cloud |

The China Operational Technology (OT) Security Market is projected to grow at a CAGR of 19.9% from 2022 to 2032

Key players operating in the market include Huawei Technologies Co., Ltd., Alibaba Cloud, Tencent Cloud, 360 Enterprise Security Group, Baidu, Inc., Kaspersky Lab, Symantec Corporation, Palo Alto Networks, Inc., Trend Micro, Inc., and Sangfor Technologies Inc.

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in china operational technology (ot) security market.

3. Assess and rank the top factors that are expected to affect the growth of china operational technology (ot) security market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the china operational technology (ot) security market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

China Operational Technology (OT) Security Market is classified as by component, by deployment mode, by organization size, by end-user

Loading Table Of Content...

Loading Research Methodology...