Clear Brine Fluids Market Outlook – 2027

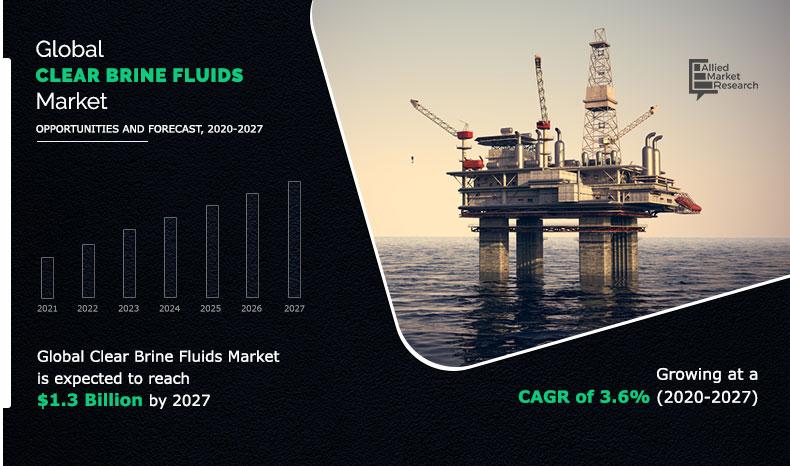

The global clear brine fluids market size was valued at $1.0 billion in 2019, and is projected to reach $1.3 billion by 2027, growing at a CAGR of 3.6% from 2020 to 2027.

Clear brine fluids are salt solutions used in the oil & gas industry as drilling and well completion fluid. It contains no solids in an aqueous solution and is based on chloride, bromide and formate salts. It is widely used in activities related to drilling, shale gas, oil, and deep water. These fluids are commercially available in various densities. It is used extensively as a completion, drill-in, workover, and packer fluid in oilfield applications. These fluids can be used as standalone fluids or can be blended with other brine to form multi-salt fluid blends. Multi-salt blends offer high fluid densities at lower costs. chloride/calcium bromide and sodium chloride/sodium bromide are the most common multi-salt blends. It is also suitable as a clay and shale inhibitor. Clear brine fluids have become an important part of oil exploration and production. These are developed for use in deep water and ultra-deep water production.

Rise in global demand for crude oil and natural gas is the major factors that drives use of clear brine fluids. Major crude oil products such as petrol, diesel, and natural gas are majority source of energy in developed as well as developing economies. Hence, the entire oil & gas industry starting from upstream operations is critical for developed as well as developing economies globally. Exploration of oil & natural gas fields is never ending and leads to discovery of new oilfields. Once, geographical survey is done on these fields, it is made ready for drilling and other production-related activities. Hence, new onshore and offshore well construction in majorly Asia-Pacific and the Middle East is expected to drive the demand for the clear brine fluids market during the forecast period. Moreover, use of clear brine fluids is necessary for lower operating costs and increased production of oilfields. Clear brine fluids are used as drill-in fluids, well completion, and workover fluids. All the aforementioned factors propel the clear brine fluids market growth, thus increasing the clear brine fluids market size.

Rise in focus on renewable energy sources such as solar and wind poses a major threat to the oil & gas industry. For instance, Europe has been an active seeker of alternative energy generation and countries in the European Union (EU), suc as Germany and France are shifting toward energy derived from solar, wind, and tidal energy. This has led to decline in petroleum and natural gas consumption. Hence, as countries shift toward renewable energy generation, demand for oilfield chemicals is expected to decline during the forecast period. This is expected to act as a restraint for the global clear brine fluids market during the forecast period.

However, rise in production of shale gas has benefited the global clear brine fluids market and growth in focus on other unconventional natural gases is expected to offer fresh opportunities for the global clear brine fluids market during the forecast period. Proved reserves of natural gas from shale increased from 68% to 71% from 2018 to 2019 in the U.S. Supply agreements between clear brine fluid producers and major upstream oil & gas operators is a key trend in the global clear brine fluids market. For instance, in 2019, Sinomine Specialty signed a supply agreement with Equinor for supply of Cesium drilling and completion fluids for Equinor’s operations on the Norwegian Continental Shelf.

The global clear brine fluids market is segmented on the basis of product type, end-use, and region. On the basis of product type, the global clear brine fluids market is segmented into potassium chloride, calcium chloride, calcium bromide, potassium formate, cesium formate, and others. By end use, it is divided into inshore oil & gas production and offshore oil & gas production. Region wise, the global clear brine fluids market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in this report include Albemarle Corporation, Clements Fluids, Egyptian Mud Engineering & Chemicals Company, Halliburton, ICL Group Ltd., Lanxess AG, Schlumberger Ltd., Sinomine Specialty Fluids, Tetra Technologies, and Zirax Ltd.

By Region

LAMEA would exhibit highest CAGR of 3.90% during 2019-2027.

Asia-Pacific is projected to grow at the fastest CAGR of 4.6%. New oil and gas discoveries in countries such as India, China, Vietnam, Indonesia, and Thailand will drive the demand for drilling and completion fluids during the forecast period. LAMEA accounted for the largest share in the global clear brine fluids market in 2019. Countries in LAMEA such as Brazil, Saudi Arabia, Venezuela, and Nigeria have a well-established upstream oil & gas operation.

By Product Type

Potassium Choride segment is the most lucrative segment

By product type, the potassium chloride segment held the largest share in the global clear brine fluids market in 2019. It is also projected to be the fastest growing segment, growing at a CAGR of 4.3% during the forecast period. Potassium chloride has many applications in the oilfield, ranging from drilling fluid to formulating solid-free workover and completion fluids.

By End-users

Offshore segment is projected as the fastest growing segment

Onshore oil & gas production segment accounted for the largest revenue share in the global clear brine fluids market, as more than 70% of crude oil production is from onshore oilfields. The offshore oil & gas production segment is the fastest growing segment at a CAGR of 4.1%. offshore oil & gas exploration and production increases the overall supply of oil & natural gas, compared to onshore production.

Key benefits for stakeholders

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current clear brine fluids market trends and future estimations from 2019 to 2027 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and clear brine fluids marketopportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Key Market Segments

By Product Type

- Potassium chloride

- Calcium chloride

- Calcium bromide

- Potassium Formate

- Cesium Formate

- Others

By End User

- Inshore Oil & Gas Production

- Offshore Oil & Gas Production

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- Russia

- UK

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- Rest of LAMEA

Key players in the global clear brine fluids market are:

- Albemarle Corporation

- Clements Fluids

- Egyptian Mud Engineering & Chemicals Company

- Halliburton

- ICL Group Ltd.

- Lanxess AG

- Schlumberger Ltd.

- Sinomine Specialty Fluids

- Tetra Technologies

- Zirax Ltd.

Clear Brine Fluids Market Report Highlights

| Aspects | Details |

| By PRODUCT TYPE |

|

| By END USER |

|

| By Region |

|

| Key Market Players | ZIRAX LIMITED, SCHLUMBERGER LIMITED, TETRA TECHNOLOGIES, LANXESS AG, .EGYPTIAN MUD ENGINEERING AND CHEMICALS, HALLIBURTON, ICL GROUP LTD., CLEMENTS FLUIDS, SINOMINE SPECIALTY FLUIDS, ALBEMARLE CORPORATION |

Analyst Review

The global demand for crude oil and natural gas as well as other non-conventional sources such as shale gas is expected to increase the demand for oilfield chemicals such as clear brine fluids during the forecast period. Upstream oil & gas operations are undergoing rapid transformation in terms of digitalization, which is anticipated to enhance oil & gas production. In addition, demand for fuels such as gasoline and diesel is expected to boost upstream operations. Oil & gas operators use drilling and completion fluids to increase productivity of oil wells. Clear brine fluids can be used as drill-in, completion, workover, and packer fluids. Hence, in order to maximize oil recovery, use of clear brine fluids is expected to benefit the global clear brine fluids market during the forecast period.

The global clear brine fluids market is segmented on the basis of product type and end user. Presently, the onshore oil & gas production segment holds the largest market share in the global clear brine fluids market.

Rising oil and gas exploration activities to meet the growing energy needs is boosting the clear brine fluids market growth

The global clear brine fluids market was valued at $1.0 billion in 2019, and is projected to reach $1.3 billion by 2027, growing at a CAGR of 3.6% from 2020 to 2027.

Albemarle Corporation, Clements Fluids, Egyptian Mud Engineering & Chemicals Company, Halliburton, ICL Group Ltd., Lanxess AG, Schlumberger Ltd., Sinomine Specialty Fluids, Tetra Technologies, and Zirax Ltd. are some of the top companies engaged in the development and production of clear brine fluids

The offshore oil & gas production segment is projected to grow at the fastest CAGR of 4.1%, thus driving the demand for clear brine fluids during the forecast period

The onshore oil & gas production segment accounted for the largest revenue share in the global clear brine fluids market

Rise in global demand for crude oil and natural gas has led to an increase in demand for drilling and completion fluids such as clear brine fluids

The use of clear brine fluids in offshore oil & gas production is expected to drive its adoption

The COVID-19 heavily impacted the operations of oil & gas companies by decreasing the demand for crude oil, thus reducing the use of drilling and completion fluids such as clear brine fluids.

Loading Table Of Content...