Clomazone Market Research, 2033

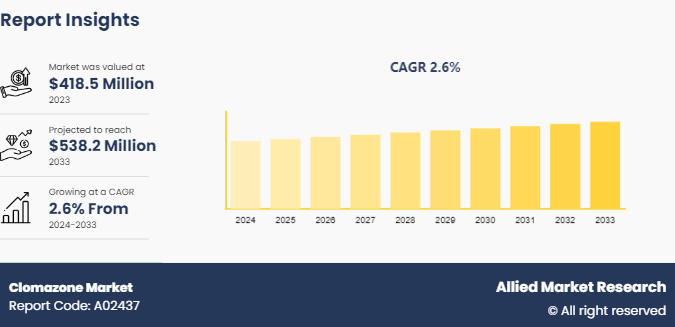

The global clomazone market was valued at $418.5 million in 2023, and is projected to reach $538.2 million by 2033, growing at a CAGR of 2.6% from 2024 to 2033.

Market Introduction and Definition

Clomazone is a widely recognized herbicide used predominantly in the agricultural sector. This chemical compound, known chemically as 2-[ (2-chlorophenyl) methyl]-4, 4-dimethyl-3-isoxazolidinone, is designed to control a broad spectrum of weeds. Clomazone operates by inhibiting the synthesis of essential plant pigments, specifically carotenoids and chlorophyll, leading to the death of the target plants

Clomazone's mode of action revolves around its ability to inhibit the enzyme 1-deoxy-D-xylulose-5-phosphate reductoisomerase (DXR) , a crucial enzyme in the non-mevalonate pathway of isoprenoid biosynthesis. This pathway is vital for carotenoids and chlorophylls, essential for photosynthesis and plant growth. By inhibiting DXR, clomazone effectively halts the production of these pigments, leading to chlorosis (whitening of plant tissues) and eventually plant death. This mechanism is particularly effective against a wide range of broadleaf and grassy weeds, making clomazone a versatile herbicide in various agricultural applications.

In agriculture, clomazone is primarily used in pre-emergence and early post-emergence herbicide applications. It is particularly effective in controlling weeds in crops such as soybeans, cotton, rice, sugarcane, and various vegetables. For instance, in soybean farming, clomazone is often applied before the crops emerge to ensure that weed competition is minimized from the onset, allowing the soybeans to grow without significant interference. Similarly, in rice cultivation, clomazone helps manage problematic weeds such as barnyard grass and broadleaf signal grass, which are known to drastically reduce crop yields if left uncontrolled.

Key Takeaways

- The clomazone industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global clomazone market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the clomazone market size.

- The clomazone market share is highly fragmented, with several players including FMC Corporation, BASF SE, ADAMA, Nufarm Australia, UPL, Sumitomo Chemical Co., Ltd., Merck KGaA, Sipcam Oxon Spa VAT, Honeywell International Inc, and King Quenson. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the clomazone market growth.

Market Segmentation

The clomazone market is segmented into formulation, crop type, and region. On the basis of formulation, the market is divided into liquid, granular, suspo emulsion, and others. On the basis of crop type, the market is classified into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

An increase in demand for herbicides for food production is expected to drive the growth of the clomazone market. The global population is experiencing unprecedented growth, projected to reach approximately 9.7 billion by 2050. This demographic shift is creating a substantial increase in demand for food, placing immense pressure on agricultural systems to enhance productivity. In response to this growing demand, the agricultural sector is adopting advanced technologies and practices aimed at maximizing crop yields. One of the key drivers behind the adoption of Clomazone is its effectiveness in managing a wide range of weed species. Weeds are known to reduce crop yields by competing with crops for resources and by harboring pests and diseases. Clomazone's ability to control these weeds efficiently allows farmers to maintain higher crop yields and, consequently, meet the increasing food demand. Its use is particularly significant in regions where labor for manual weeding is scarce or expensive, making it a cost-effective solution for farmers.

However, the potential adverse effects of clomazone on non-target species and ecosystems is expected to restraint the growth of clomazone market during the forecast period. The Clomazone market is poised to face significant challenges due to the potential adverse effects of this herbicide on non-target species and ecosystems. As agricultural practices increasingly come under scrutiny for their environmental impact, Clomazone’s effects on non-target organisms and the broader ecosystem are drawing heightened attention. These concerns are likely to lead to stricter regulatory restrictions, which could restrain the market growth of Clomazone during the forecast period. Clomazone is designed to control a broad range of weeds by inhibiting their growth and development. However, its broad-spectrum action also poses risks to non-target species, including beneficial plants, insects, and soil microorganisms. For instance, Clomazone’s residual activity in the soil can affect the growth of nearby crops that are not intended for treatment. This unintended consequence may lead to decreased biodiversity and disruptions in crop ecosystems, as non-target plants and organisms are affected by the residual chemical.

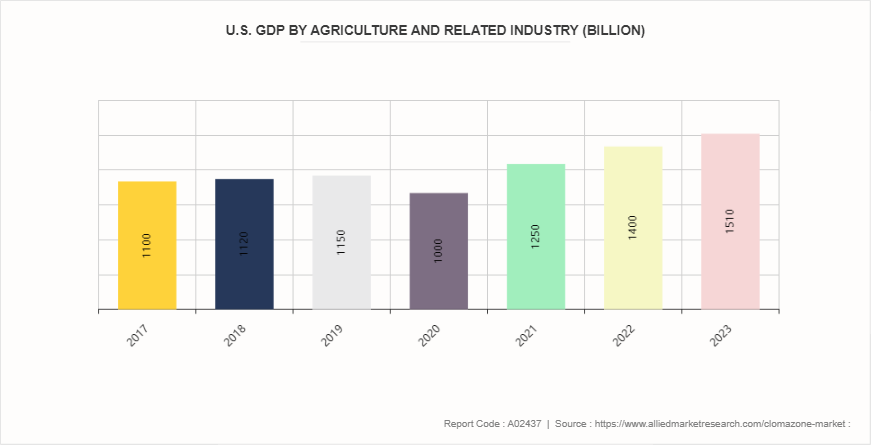

Moreover, the growth in agricultural activities in emerging economies is expected to provide lucrative opportunities in the market. Clomazone, a broad-spectrum herbicide known for its effectiveness in controlling a wide range of weed species, is well-positioned to meet this demand. Its ability to manage weeds efficiently allows farmers to maximize crop productivity, which is essential in regions where arable land is limited and the need for high yields is critical. The adoption of Clomazone in these emerging markets can significantly contribute to improving agricultural efficiency and food security. The shift towards modern farming practices in emerging markets further drives the demand for Clomazone. As farmers in these regions adopt advanced agricultural technologies, such as precision farming and integrated pest management, the need for effective herbicides becomes more pronounced. Clomazone’s compatibility with modern farming systems enhances its appeal, as it integrates seamlessly into various crop management practices. In 2023, the U.S. Department of Agriculture reported that agriculture, food, and related industries contributed approximately $1.530 trillion to the U.S. gross domestic product (GDP) , representing a 5.6% share of the total. Of this amount, $203.5 billion came directly from the output of America's farms, which accounts for around 0.7% of the U.S. GDP. The larger percentage of agriculture's contribution to GDP is due to the added value generated by industries that depend on agricultural inputs.

Competitive Analysis

Key market players in the clomazone market include FMC Corporation, BASF SE, ADAMA, Nufarm Australia, UPL, Sumitomo Chemical Co., Ltd., Merck KGaA, Sipcam Oxon Spa VAT, Honeywell International Inc, and King Quenson.

Industry Trends

- In January 2023, Bayer announced a new partnership with Oerth Bio aimed at advancing sustainable crop protection technologies. This collaboration focuses on utilizing Oerth Bio's innovative PROTAC (PROteolysis TArgeting Chimera) protein degradation technology, which has the potential to create environmentally friendly crop protection products. These products are designed to reduce the environmental impact of agriculture by allowing for lower application rates and improved safety profiles.

- In February 2023, ADAMA Canada announced the launch of new crop protection products tailored for imidazoline-tolerant lentils (such as Clearfield) , as well as all peas and soybeans, ahead of the upcoming crop year. This initiative is part of ADAMA's continuous effort to address the needs of Canadian growers while navigating the persistent global supply chain challenges.

- In May 2023, Syngenta Seeds partnered with Wilmar PADI Indonesia and the National Research and Innovation Agency (BRIN) to develop the Witagen rice variety. This collaboration aims to create a high-quality and superior rice seed that can enhance agricultural productivity in Indonesia. The initiative reflects a broader trend in the Indonesian seed sector, which is characterized by increasing competition and innovation among various players in the market.

Regional Market Outlook

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, particularly in the U.S. and Canada, clomazone is utilized primarily in soybean and corn cultivation. It is valued for its effectiveness in controlling a wide range of weeds early in the growing season. Farmers appreciate clomazone for its pre-emergent activity, which helps in managing weed competition before crops emerge. The herbicide is typically used in combination with other products to enhance efficacy and manage resistance. Regulatory approval and application guidelines in North America ensure its safe use, with strict adherence to recommended dosage and application timing to minimize environmental impact.

In the Asia-Pacific region, clomazone is increasingly used in countries with expanding agricultural sectors such as India, China, and Australia. Herbicide is applied in various crops, including rice, corn, and soybeans. The surge in adoption of clomazone is driven by its effectiveness in controlling weeds in intensive cropping systems. However, the usage patterns vary widely depending on local agricultural practices and regulatory frameworks. In some countries, clomazone is used in combination with other herbicides to enhance weed management and reduce the risk of resistance.

Key Regulations of Clomazone Market

Tolerances and Residues:

- The EPA has established tolerances for clomazone residues in various commodities, ensuring that levels remain safe for human consumption.

- The tolerances were reassessed under the Food Quality Protection Act (FQPA) in 2000, focusing on its use in crops such as sugarcane and rice.

Ecological and Human Health Assessments:

- Clomazone has been assessed for its environmental fate and ecological risks. It is moderately toxic to mammals and considered a reproductive/developmental toxin.

- The herbicide is known to cause bleaching in plants due to its mode of action, which inhibits pigment synthesis.

Key Sources Referred

- The International Trade Administration

- U.S. Environmental Protection Agency

- International Energy Agency

- Occupational Safety and Health Administration

- Department of Energy

- California Air Resources Board

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the clomazone market analysis from 2024 to 2033 to identify the prevailing clomazone market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the clomazone market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global clomazone market trends, key players, market segments, application areas, and market growth strategies.

Clomazone Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 538.2 Million |

| Growth Rate | CAGR of 2.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Formumation |

|

| By Crop Type |

|

| By Region |

|

| Key Market Players | Nufarm Australia, UPL, King Quenson, Honeywell International Inc, BASF SE, Sumitomo Chemical Co., Ltd., ADAMA, Sipcam Oxon Spa VAT, Merck KGaA, FMC Corporation |

The global clomazone market was valued at $418.5 million in 2023, and is projected to reach $538.2 million by 2033, growing at a CAGR of 2.6% from 2024 to 2033.

Key market players in the clomazone market include FMC Corporation, BASF SE, ADAMA, Nufarm Australia, UPL, Sumitomo Chemical Co., Ltd., Merck KGaA, Sipcam Oxon Spa VAT, Honeywell International Inc, and King Quenson.

Asia-Pacific is the largest regional market for clomazone.

Cereals & grains are the leading crop type of clomazone market.

The growth in agricultural activities in emerging economies are the upcoming trends of clomazone market.

Loading Table Of Content...