Closed System Drug Transfer Device (CSTD) Market Research, 2033

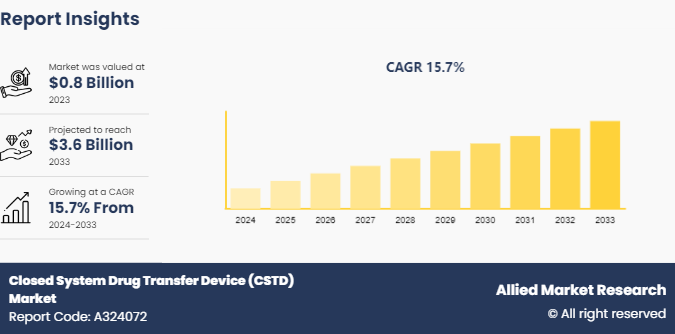

The global closed system drug transfer device market size was valued at $0.8 billion in 2023, and is projected to reach $3.6 billion by 2033, growing at a CAGR of 15.7% from 2024 to 2033. One of the primary drivers of the CSTD Market is the increasing awareness of the health risks associated with handling hazardous drugs, such as cytotoxic agents used in chemotherapy.

Market Introduction and Definition

A Closed System Drug Transfer Device (CSTD) is a medical device designed to safely transfer hazardous drugs from one container to another while preventing the escape of drug vapors, aerosols, or droplets into the environment and preventing contaminants from entering the system. CSTDs are critical in protecting healthcare workers and patients from exposure to toxic drugs, particularly in chemotherapy, by ensuring a sealed and airtight transfer process. These devices typically include components such as vial adapters, syringe safety devices, and bag/line access devices, employing mechanical or physical barriers to maintain drug sterility and integrity throughout the transfer process.

Key Takeaways

- The Closed System Drug Transfer Device Market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected closed system drug transfer device market forecast period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Closed System Drug Transfer Device industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Healthcare workers are at significant risk of exposure to these toxic substances, which can lead to serious health issues, including cancer and reproductive disorders. This heightened awareness has led to stringent regulatory requirements and guidelines from organizations such as the Occupational Safety and Health Administration (OSHA) and the National Institute for Occupational Safety and Health (NIOSH) , mandating the use of CSTDs to minimize exposure risks. These regulations not only compel healthcare facilities to adoption and closed system drug transfer device Market growth but also drive market growth as institutions seek to comply with safety standards and protect their staff.

However, the adoption of CSTDs faces a notable restraint due to their high cost. CSTDs, which include various components such as vial access devices, syringe safety devices, and line access devices, are often expensive to purchase and maintain. The initial investment and ongoing costs can be prohibitive, especially for smaller healthcare facilities or those in developing regions with limited budgets. This financial burden can limit the widespread adoption of CSTDs, particularly in areas where budget constraints force facilities to prioritize essential over ancillary safety measures, thereby restraining market growth.

The CSTD market holds substantial opportunities through technological advancements and innovation. Continuous improvements in CSTD technology, such as enhanced barrier systems, automated features, and integration with other safety technologies, offer the potential to increase device effectiveness and reduce costs. Innovations such as user-friendly designs and more affordable models can make CSTDs more accessible to a broader range of healthcare facilities. Furthermore, the development of new applications and customizable solutions tailored to specific needs can drive market expansion, presenting significant opportunities for manufacturers and stakeholders to enhance safety and efficiency in drug handling.

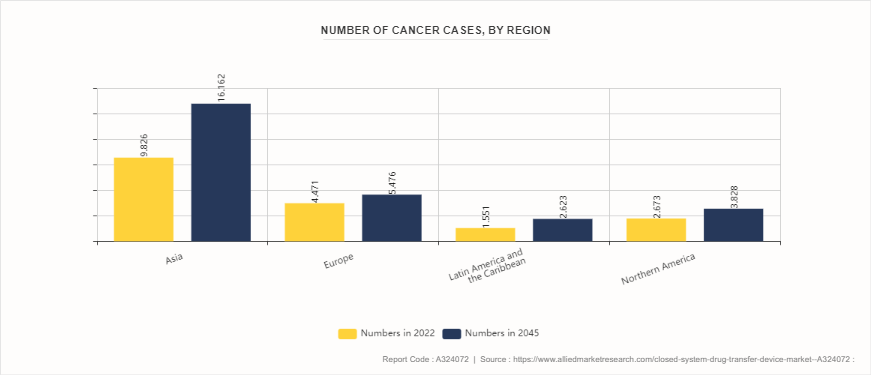

Number of Cancer Cases, by Region

The World Health Organization data highlights a significant rise in oncology cases across various regions from 2022 to 2045. In Asia, the number of cases is projected to increase from 9.826 million to 16.162 million, reflecting a substantial growth. Europe will see a modest rise from 4.471 million to 5.476 million, while Latin America and the Caribbean will grow from 1.551 million to 2.623 million. Northern America’s cases are expected to rise from 2.673 million to 3.828 million. This growing incidence highlights the need for effective Closed System Drug Transfer Devices (CSTDs) to ensure safe handling and administration of oncology drugs.

Market Segmentation

The closed system drug transfer device market Share is segmented into type, technology, end user, and region. On the basis of type, the market is bifurcated into membrane to membrane, and needleless. On the basis of component the market is segmented into barrier type CSTDs, and air cleaning CSTDs. On the basis of end user, the market is segmented into hospitals and clinics, oncology center, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In the closed system drug transfer device market size, North America leads with significant growth due to stringent regulations and high adoption rates in healthcare settings, driven by awareness of worker safety. Europe follows, with strong regulatory frameworks and increasing use in oncology and pharmacy settings. The Asia-Pacific region shows rapid growth potential as healthcare infrastructure expands and regulatory standards evolve, although adoption rates may vary by country. Latin America and the Middle East & Africa present emerging markets, with growing healthcare investments and rising awareness of safety standards. Overall, the global market exhibits diverse growth patterns influenced by regional regulatory environments and healthcare advancements.

Industry Trends

- According to an article published in National Library of Medicine, in November 2021, successful design and working model of an air-driven needle-free jet injector, which is a type of needleless Closed System Drug Transfer Device, was used during the large-scale COVID-19 vaccinations.

Competitive Landscape

The major players operating in the Closed System Drug Transfer Device Market share include B. Braun Holding GmbH & Co. KG, Baxter International, Inc., Becton, Dickinson and Company, Caragen Ltd., Corvida Medical, Equashield LLC., FIMI Opportunity Funds (Simplivia Healthcare) , ICU Medical, Inc., JCB Co., Ltd. (JMS Co., Ltd.) , and Yukon Medical. Other players in the Closed System Drug Transfer Device (CSTD) Market include Cardinal Health, Practivet, Terumo Corporation and so on.

Recent Key Strategies and Developments

- In October 2023, EQUASHIELD LLC (US) received additional FDA clearance for the full-volume use of its Syringe Unit. This approval provides a cost-effective solution for medication compounding and administration needs.

- In September 2021, ICU Medical, Inc. and Smiths Group plc, announced that ICU Medical has committed1 to acquire the Smiths Medical division in a transaction that is superior to the existing proposed sale of Smiths Medical to Trulli Bidco Limited. The Smiths Medical business includes syringe and ambulatory infusion devices, vascular access, and vital care products.

Key Sources Referred

- World Health Organization (WHO)

- Centers for Medicare & Medicaid Services (CMS)

- B. Braun Holding GmbH & Co. KG

- National Health Service (NHS)

- National Health Mission (NHM)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the closed system drug transfer device market analysis from 2024 to 2033 to identify the prevailing closed system drug transfer device market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the closed system drug transfer device industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global closed system drug transfer device market trends, key players, market segments, application areas, and market growth strategies.

Closed System Drug Transfer Device Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.6 Billion |

| Growth Rate | CAGR of 15.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By Component |

|

| By End User |

|

| By Region |

|

| By Type |

|

| Key Market Players | ICU Medical, Yukon Medical, Caragen Ltd., FIMI Opportunity Funds (Simplivia Healthcare), Becton, Dickinson and Company, JCB Co Ltd., Baxter International, Equashield, B. Braun Holding GmbH & Co. KG, Corvida Medical |

The total market value of Closed System Drug Transfer Device market is $0.84 billion in 2023.

The forecast period for Closed System Drug Transfer Device market is 2024 to 2035

The market value of Closed System Drug Transfer Device market in 2035 is $3.61 billion

The base year is 2023 in Closed System Drug Transfer Device market .

Top companies such as B. Braun Holding GmbH & Co. KG, Baxter International, Inc., Becton, Dickinson and Company, held a high market position in 2023. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LAMEA.

The major factor that fuels the growth of the Closed System Drug Transfer Device market are Rise in incidence of cancer, enhanced focus on worker safety, and technological advancements

Closed System Drug Transfer Device is a structured therapeutic approach aimed at addressing and modifying negative behaviors through various evidence-based techniques.

Loading Table Of Content...