Clot Management Devices Market Research, 2035

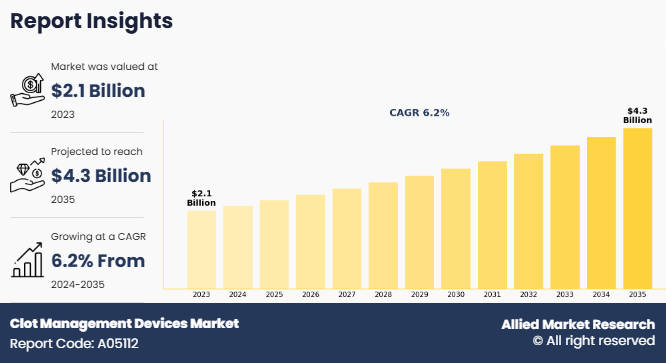

The global clot management devices market size was valued at $2.1 billion in 2023, and is projected to reach $4.3 billion by 2035, growing at a CAGR of 6.2% from 2024 to 2035. The growth of the clot management devices market is driven by several factors, such as rise in prevalence of cardiovascular diseases, surge in geriatric population, and increase in demand for minimally invasive procedures. Advancements in medical technology, such as the development of more efficient thrombectomy devices, boost market growth. In addition, increased awareness about the importance of early diagnosis and treatment of blood clots, along with supportive government initiatives, further contributes to clot management devices market growth.

Clot management devices are medical tools used to treat and remove blood clots, addressing conditions such as deep vein thrombosis, pulmonary embolism, and ischemic strokes. These devices include thrombectomy systems, embolectomy catheters, and stent retrievers, facilitating minimally invasive procedures to restore blood flow. Their application reduces the risk of complications associated with clotting disorders, improves patient outcomes, and plays a vital role in emergency & surgical settings.

Key Takeaways

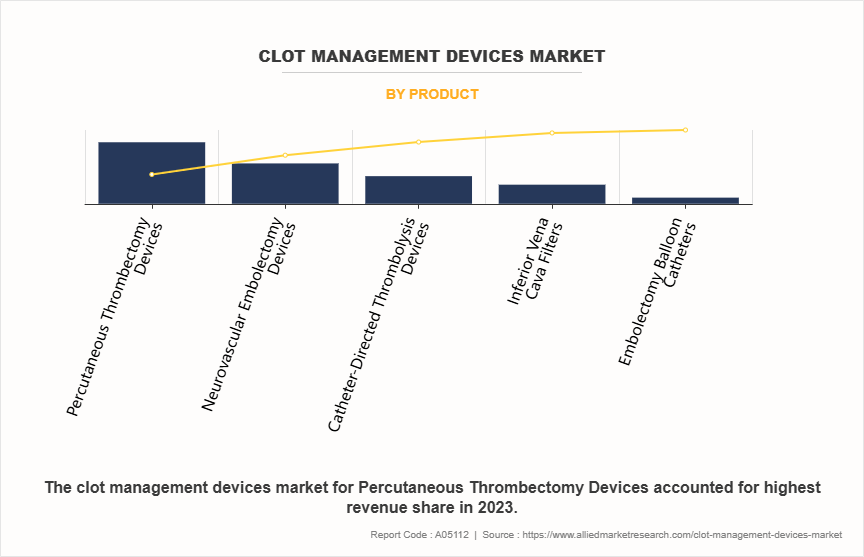

- By product, the percutaneous thrombectomy devices segment was the highest contributor to the market in 2023. However, the neurovascular embolectomy devices segment is expected to register the highest CAGR during the forecast period

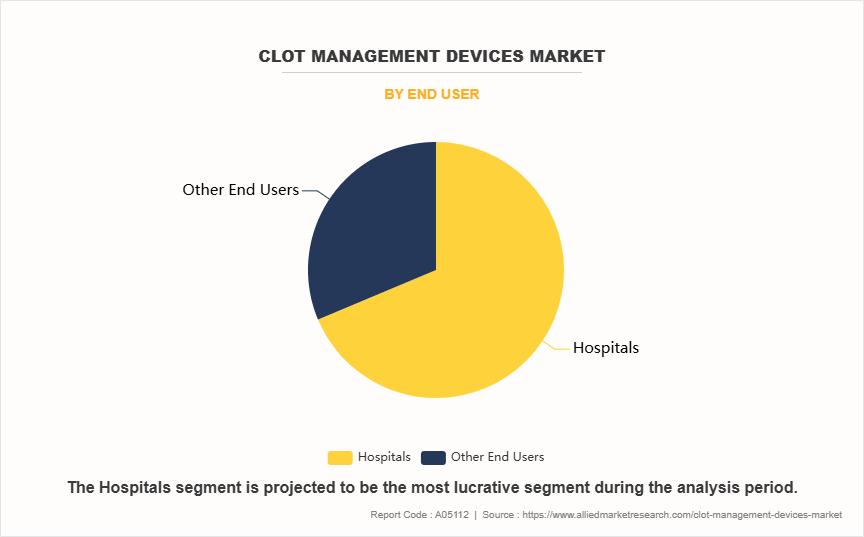

- By end user, the hospitals segment dominated the market in 2023. However, the other end user segment is expected to register the highest CAGR during the forecast period.

- By region, North America was the highest contributor to the market in 2023. However, Asia-Pacific is expected to register the highest CAGR during the forecast period.

Market Dynamics

The growth of the clot management devices market size is driven by several key factors, including rise in geriatric population, development of healthcare infrastructure, and technological advancement. The rise in the geriatric population serves as a significant driver for the clot management devices market due to the increased susceptibility of elderly individuals to various cardiovascular conditions. According to the United Nations, the number of people aged 65 years or older worldwide is projected to more than double, rising from 761 million in 2021 to 1.6 billion in 2050.

As people age, they are more prone to developing disorders such as deep vein thrombosis (DVT), pulmonary embolism, and atrial fibrillation, all of which can lead to blood clot formation. In addition, aging is often accompanied by a higher prevalence of comorbidities such as hypertension, diabetes, and obesity, which further heighten the risk of thromboembolic events. Rise in elderly population globally fuels demand for clot management devices, as these devices are crucial in preventing, diagnosing, and treating blood clots.

In addition, the development of healthcare infrastructure plays a pivotal role in driving the clot management devices market growth, reflecting a surge in recognition of the need for advanced medical technologies in the treatment of thromboembolic disorders. According to International Trade Administration, the Indian healthcare industry reached over $370 billion in 2022 and is expected to reach over $610 billion by 2026.

As healthcare systems evolve, particularly in emerging economies, there is a collaborative effort to enhance hospital facilities, upgrade medical equipment, and train healthcare professionals. This expansion increases the availability of specialized care and facilitates the adoption of innovative clot management devices, such as thrombectomy devices and intravenous thrombolytics. Improved healthcare infrastructure supports the establishment of comprehensive stroke centers and vascular care units, ensuring that patients receive timely and effective interventions. Thus, the developing healthcare infrastructure is expected to drive the growth during clot management devices market forecast.

Technological advancement serves as a significant driver of the clot management devices market, fundamentally transforming how healthcare professionals diagnose and treat thromboembolic conditions. Innovations such as enhanced imaging techniques, including high-resolution ultrasound and advanced CT & MRI modalities, have improved the ability to detect and evaluate clots, enabling timely interventions.

In addition, the development of minimally invasive devices, such as aspiration catheters and mechanical thrombectomy systems, has improved treatment approaches, offering patients safer and more effective options with reduced recovery times. For instance, in June 2021, AngioDynamics, Inc. announced that it received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for the AlphaVac Mechanical Thrombectomy System, an off-circuit, multi-purpose mechanical aspiration thrombectomy device for the non-surgical removal of thrombi or emboli from the vasculature.

These technological advancements improve clinical outcomes and expand the range of treatment possibilities, fostering greater acceptance and utilization of clot management devices across healthcare settings. Thus, technological advancements are expected to contribute significantly to the growth of the clot management devices market.

However, a key restraint in the clot management devices market is the high cost associated with these devices and related procedures. The expense can be a significant barrier, especially in low-income regions where access to advanced healthcare technologies is limited. In addition, the risk of complications such as bleeding, vessel damage, or incomplete clot removal during procedures may limit their adoption in some cases. Regulatory hurdles and strict approval processes pose challenges for market players, slowing the introduction of innovative products into the market. Despite these restraints, the market continues to grow due to the increasing need for effective clot management solutions.

Segments Overview

The clot management devices market is segmented on the basis of product, end user, and region. By product, the market is classified into neurovascular embolectomy devices, embolectomy balloon catheters, percutaneous thrombectomy devices, catheter-directed thrombolysis (CDT) devices, and inferior vena cava filters (IVCF). By end user, the market is segregated into hospitals and other end user. On the basis of region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA)

By Product

The percutaneous thrombectomy devices segment dominated the clot management devices market share in 2023. This is attributed to their effectiveness, safety, and minimally invasive nature. These devices allow for the rapid removal of clots from blood vessels, particularly in acute settings such as stroke or myocardial infarction, where time is critical. Their growing adoption is supported by advancements in device design and technology, which enhance procedural efficiency and patient outcomes.

However, the neurovascular embolectomy devices segment is expected to register the highest CAGR during the forecast period owing to the increasing incidence of ischemic strokes and a heightened awareness of the benefits of rapid intervention in such cases.

By End User

The hospital segment held the largest clot management devices market share in 2023. This is attributed to the fact that hospitals, particularly specialized centers such as stroke units and cardiac care facilities, are equipped with advanced technologies and trained personnel to manage complex thromboembolic conditions effectively. The availability of comprehensive diagnostic and treatment protocols within hospitals ensures that patients receive timely interventions, which is critical for conditions like stroke and heart attacks.

However, the other end user segment is expected to register the highest CAGR during the forecast period owing to shift towards outpatient care and a growing preference for less invasive treatment options that can be administered in non-hospital settings. As technology advances, many clot management procedures can now be performed outside traditional hospital environments such as ambulatory surgical centers, making them more accessible and cost-effective.

By Region

By region, the clot management devices industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the largest share in the clot management devices market in 2023. This is attributed to well-established healthcare infrastructure, high prevalence of thromboembolic disorders, and robust research and development initiatives. The region boasts advanced medical facilities equipped with the latest technologies, enabling healthcare providers to offer innovative treatments for conditions such as stroke and deep vein thrombosis.

In addition, the presence of key market players and significant investment in healthcare technologies contribute to the development and adoption of sophisticated clot management devices. Furthermore, the increasing awareness among healthcare professionals and patients regarding the importance of timely intervention in thromboembolic events drives demand for clot management devices.

However, the Asia-Pacific region is anticipated to register the highest CAGR during the forecast period. This is attributed to rapidly growing population, increasing urbanization, and rising incidence of lifestyle-related diseases, which contribute to a higher prevalence of thromboembolic conditions. As countries in this region invest in improving their healthcare infrastructure and access to advanced medical technologies, the adoption of clot management devices is expected to rise.

Competitive Analysis

Major key players that operate in the global clot management devices market are Boston Scientific Corporation, Edwards Lifesciences Corporation, Medtronic plc, Johnson & Johnson, Abbott Laboratories, AngioDynamics, Inc., Stryker Corporation, Terumo Corporation, Penumbra, Inc., and Koninklijke Philips N.V. Key players have adopted acquisition, product launch, product approval and clinical trials as key developmental strategies to improve the product portfolio of the clot management devices market.

Recent Developments in the Clot Management Devices Industry

- In January 2021, Abbott announced that it acquired Walk Vascular, LLC, a commercial-stage medical device company with a minimally invasive mechanical aspiration thrombectomy system designed to remove peripheral blood clots. Walk Vascular's peripheral thrombectomy systems will be incorporated into Abbott's existing endovascular product portfolio.

- In September 2024, AngioDynamics initiated the RECOVER-AV clinical trial to evaluate the safety and efficacy of its AlphaVac F18 System for treating acute, intermediate-risk pulmonary embolism (PE). This multi-center, international study will enroll patients across up to 20 hospital sites in Europe. The trial aims to support the adoption of AlphaVac in the European market, following a previous study that demonstrated its effectiveness in improving right ventricular function and reducing clot burden. The AlphaVac system is CE marked for non-surgical thromboembolic removal from pulmonary arteries. AngioDynamics emphasizes the importance of this trial in enhancing treatment options for PE patients.

- In April 2024, AngioDynamics, Inc. announced that the U.S. Food and Drug Administration (FDA) cleared the AlphaVac F1885 System for the treatment of pulmonary embolism (PE), enhancing its utility in critical medical scenarios such as PE.

- In June 2023, MicroVention, Inc., a global neurovascular company and wholly owned subsidiary of Terumo Corporation, announced that the ERIC Retrieval Device is now commercially available in the U.S. for ischemic stroke treatment. ERIC received FDA 510(k) clearance on March 31, 2022. ERIC delivers thrombus control inside and outside of the device, offers no clot integration wait-time to drive procedure efficiency, and offers versatile treatment options for thrombectomy. With the introduction of the ERIC Retrieval Device, MicroVention now offers a comprehensive and streamlined portfolio of stroke solutions, delivering compatibility, versatility, and speed unlike any other.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the clot management devices market analysis from 2023 to 2035 to identify the prevailing clot management devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the clot management devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global clot management devices market trends, key players, market segments, application areas, and market growth strategies.

Clot Management Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 4.3 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2023 - 2035 |

| Report Pages | 250 |

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | Terumo Corporation, Medtronic plc, Edwards Lifesciences Corporation, Abbott Laboratories, AngioDynamics, Inc., Johnson and Johnson, Penumbra, Inc., Stryker Corporation, Boston Scientific Corporation, Koninklijke Philips N.V. |

Analyst Review

The clot management devices market has witnessed significant growth, driven by an increase in prevalence of cardiovascular diseases and the aging population. Companies are focusing on innovation, particularly in developing advanced devices that enhance safety and efficacy, such as thrombectomy devices and clot retrieval systems. Strategic partnerships and collaborations with key stakeholders in healthcare can enhance product development and distribution networks, ensuring broader access to innovative solutions. In addition, regulatory compliance and adherence to safety standards are crucial in fostering trust among healthcare professionals and patients.

The Boston Scientific Corporation, Edwards Lifesciences Corporation, Medtronic plc, Johnson & Johnson, Abbott Laboratories, Stryker Corporation, Terumo Corporation, and Koninklijke Philips N.V. held a high market position in 2023.

The base year is 2023 in clot management devices market.

The forecast period for clot management devices market is 2024 to 2033.

The market value of clot management devices market is projected to reach $4,310.20 billion by 2033.

The total market value of clot management devices market was $2097.32 million in 2023.

Loading Table Of Content...

Loading Research Methodology...