Coated Glass Market Research, 2033

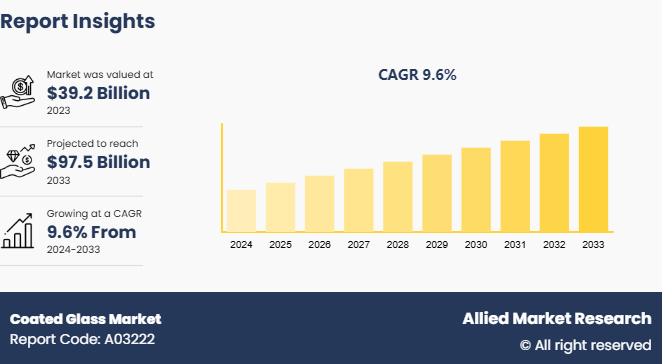

The global coated glass market was valued at $39.2 billion in 2023, and is projected to reach $97.5 billion by 2033, growing at a CAGR of 9.6% from 2024 to 2033.

Market Introduction and Definition

Coated glass refers to a type of glass that has been treated with a layer or multiple layers of material to enhance its properties. These coatings can be applied to achieve a variety of functional benefits, such as improved thermal insulation, increased durability, enhanced aesthetic appeal, or added functionalities like self-cleaning or UV protection. The coatings can be applied through various methods, including pyrolytic (hard coat) and sputter (soft coat) processes, each offering distinct advantages depending on the intended use.

In the construction industry, coated glass plays a pivotal role in modern architecture. Low-E glass is extensively used in windows, facades, and skylights to improve energy efficiency in buildings. It helps in reducing heating and cooling costs by maintaining a comfortable indoor temperature throughout the year. Reflective-coated glass is preferred for high-rise buildings and office complexes to reduce solar heat gain, minimize glare, and enhance privacy. The use of self-cleaning glass in high-rise buildings significantly reduces maintenance costs and ensures clear, unobstructed views.

Coated glass is also prominent in the automotive industry. Windshields and windows with anti-reflective coatings enhance driver visibility and reduce glare, improving safety. Low-E glass is used in automotive windows to maintain a cooler interior, thereby enhancing passenger comfort and reducing the load on the vehicle's air conditioning system. Anti-bacterial coatings on interior glass surfaces help maintain hygiene in public transport vehicles. In the solar energy industry, coated glass is essential for the efficiency and durability of solar panels. Anti-reflective coated glass maximizes light transmission to photovoltaic cells, increasing the efficiency of solar panels. Additionally, the durability of the glass protects the delicate components of the panels from environmental damage. Some solar panels also use low-E glass to reduce heat loss, further enhancing their efficiency.

Key Takeaways

- The coated glass industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global coated glass market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the coated glass market size.

- The coated glass market share is highly fragmented, with several players including Saint-Gobain, Guardian Industries, Asahi Glass Co. (AGC) , Nippon Sheet Glass Co., Ltd, Cardinal Glass Industries, Vitro, Xinyi Glass Holdings Limited, sunglass industry s.r.l., Fuyao Glass America, and SCHOTT. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the coated glass market growth.

Market Segmentation

The coated glass market is segmented into coating type, application, and region. On the basis of coating type, the market is divided into low-e coatings, solar control, anti-reflective coating, reflective coating, and others. On the basis of application, the market is classified into architectural, automotive, solar panels, electronics, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

An increase in demand for energy-efficient buildings is expected to drive the growth of coated glass market. The growing emphasis on sustainable construction and green building practices is significantly driving the demand for energy-efficient coated glass. In an era where environmental concerns and energy efficiency are at the forefront of architectural design, coated glass solutions, particularly Low-E (low emissivity) coated glass, have become highly sought after. Low-e coated glass is designed to enhance the energy efficiency of buildings by minimizing heat loss during colder months and reducing heat gain in warmer seasons. This dual functionality contributes to maintaining a comfortable indoor climate while decreasing the reliance on heating and cooling systems.

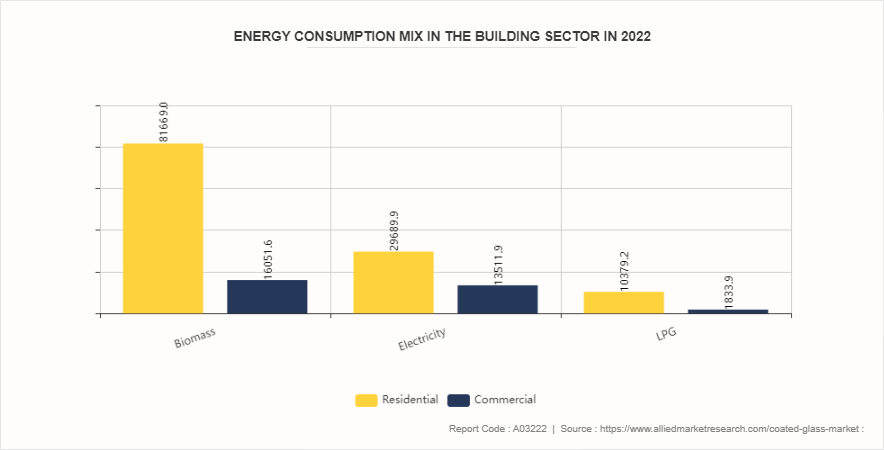

The application of Low-E coatings to glass surfaces works by reflecting infrared energy while allowing visible light to pass through. This reflective property helps in controlling the amount of heat that enters or escapes from a building, thereby improving overall thermal insulation. In 2022, emissions from the buildings sector accounted for approximately one-third of global energy system emissions. This includes emissions from building operations (26%) and embodied emissions (7%) resulting from the production of construction materials. To align with the IEA Net Zero Emissions Scenario (NZE Scenario) , operational emissions must be reduced by about 50% from 2022 levels by 2030. Additionally, embodied emissions should decrease by 25% for steel and 20% for cement by 2030.

However, high production costs of coated glass is expected to restrain the growth of the coated glass market during the forecast period. The production of coated glass, while technologically advanced and beneficial for various applications, presents significant challenges due to its high manufacturing costs. These costs stem from several factors, including the complexity of the technologies used, the quality of raw materials required, and the overall manufacturing process. The quality of raw materials used in the production of coated glass also plays a significant role in the overall manufacturing costs. The coatings themselves are often made from high-grade materials such as metal oxides, fluorides, and other specialized compounds that provide the desired optical and thermal properties. These raw materials can be costly due to their purity requirements and the complex processes involved in their production. Additionally, the glass substrates used for coating must meet strict quality standards to ensure proper adhesion and performance of the coatings. This need for high-quality materials adds to the expense of producing coated glass.

Moreover, the increase in adoption of smart glass is expected to provide lucrative opportunities in the market. Smart buildings are designed to enhance efficiency, comfort, and sustainability through the integration of advanced technologies. Smart glass plays a crucial role in these buildings by offering dynamic control over light, heat, and privacy. For example, electrochromic glass can change its tint when an electrical current is applied, allowing occupants to adjust the amount of natural light entering a space. This capability helps in regulating indoor temperatures, reducing glare, and enhancing overall energy efficiency. As the demand for green and energy-efficient buildings grows, smart glass becomes increasingly relevant. Its ability to improve building performance and comfort aligns with the goals of sustainable construction. The integration of smart glass in building designs contributes to energy savings by reducing the need for artificial lighting and HVAC systems. This trend is driving the growth of the smart glass market, as more architects and builders seek innovative solutions to meet environmental regulations and enhance building performance. In June 2022, View, Inc. announced that its smart glass technology had been installed in the "Eighth Concourse" of Phoenix Sky Harbor International Airport (PHX) , also known as T4 S1. The concourse features floor-to-ceiling Outlook Smart Glass, enhancing natural light and offering panoramic views, as designed by SmithGroup and Corgan.

Competitive Analysis

Key market players in the coated glass market include Saint-Gobain, Guardian Industries, Asahi Glass Co. (AGC) , Nippon Sheet Glass Co., Ltd, Cardinal Glass Industries, Vitro, Xinyi Glass Holdings Limited, sunglass industry s.r.l., Fuyao Glass America, and SCHOTT.

Regional Market Outlook

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, coated glass is widely used across various sectors including construction, automotive, and electronics. The U.S. and Canada are major consumers, with coated glass being employed in commercial and residential buildings for energy efficiency, such as low-emissivity (low-e) glass which improves insulation. In the automotive industry, coated glass is used to enhance vehicle safety and aesthetics, including features like anti-reflective coatings.

Europe is a leading market for coated glass, driven by stringent energy regulations and a focus on sustainability. The European Union's commitment to reducing carbon emissions has propelled the adoption of coated glass in buildings for its insulating properties. Countries such as Germany, France, and the United Kingdom are prominent users, leveraging coated glass in both new construction and renovation projects.

The Asia-Pacific region, including China, India, Japan, and South Korea, exhibits a rapidly growing demand for coated glass driven by urbanization and industrialization. In China and India, the construction sector is a major consumer, with coated glass being used in skyscrapers, commercial buildings, and residential complexes to enhance energy efficiency and aesthetic appeal. Japan and South Korea also utilize coated glass extensively in the automotive and electronics industries. The region’s growth is fueled by increasing infrastructure projects and a rising focus on energy conservation, which bolsters the demand for innovative glass solutions.

Industry Trends

- In November 2023, Vitro Architectural Glass introduced a new magnetron-sputtered vacuum deposition (MSVD) coater at its Baja California, Mexico facility. According to company officials, this MSVD machine is capable of applying solar control low-E coatings to architectural, automotive, and oversized glass in dimensions up to 130 by 240 inches. The MSVD coating process allows for the application of ultra-thin silver layers on glass, resulting in low-E coatings that effectively deflect solar energy while allowing high levels of daylight transmission. This innovation enhances the energy efficiency of homes and buildings by reducing the need for heating, air conditioning, and artificial lighting.

- In March 2024, ?i?ecam, a prominent global entity in the glass and chemicals industry, announced an investment of $114 million in three new coated glass production lines. These new lines, with a combined capacity of nearly 20 million square meters, will be established in Turkey, Italy, and Bulgaria. This strategic move aims to meet the increasing demand for coated glass in the flat glass market. By enhancing operational efficiency and expanding its product portfolio, ?i?ecam seeks to strengthen its competitive edge. Additionally, the company aims to increase the share of value-added products in its overall production.

- In November 2023, Riou Glass acquired Vidresif, a Spanish glazing manufacturer. This acquisition is part of Riou Glass's strategic initiative to expand its business portfolio in laminated, tempered, and coated glass. By reinforcing its high-performance technical capabilities, Riou Glass aims to strengthen its presence in the Spanish market.

- AGC Inc. has introduced a new line of low-carbon glass aimed at reducing environmental impact. This new production line will help AGC significantly cut carbon emissions, achieving an overall reduction of over 40%. Such initiatives reflect how leading companies are investing in research and development and launching innovative products to maintain their market share and promote sustainability.

- In December 2021, China Glass Holdings, Ltd. agreed to acquire Orda Glass Ltd LLP for $67.5 million. The acquisition was finalized in January 2022, following the transfer of ownership from Global Expansion Investment II Limited and Belt and Road Glass Management Limited.

Comparison of Coated and Tinted Glass

Tinted Glass

Body tinted glass products are created by adding small amounts of metal oxides to the composition of float or rolled glass. These additions give the glass a bronze, green, blue, or grey tint without altering its basic properties, except for changes in solar energy transmittance. The color is consistent throughout the thickness of the glass.

Typically, float glass contains small amounts of iron oxide, giving it a green tint visible when viewed from the edge. For a green tint, additional iron oxide is added, while cobalt oxide produces a grey tint, and selenium oxide results in a bronze tint. To achieve a blue tint, more cobalt oxide is incorporated into the float glass composition. These tints result in weak colors when viewed through transmitted light and do not create strong or highly colored reflections.

Coated Glass

Most low-e coated glass is typically produced through a sputter coating process, where a special coating is applied to sheets of finished glass. However, these "soft coat" products come with certain limitations. The coating can be easily scratched or damaged and may deteriorate when exposed to air, leading to a limited shelf life. Additionally, much of the fabrication process, including bending and tempering, often needs to be completed before the glass is coated, and edge deletion is usually recommended for soft coat insulating glass units.

In contrast, our low-e products are created using a patented pyrolytic process. This involves exposing hot glass to chemical vapors during the actual float glass production, resulting in the coating bonding to the glass at a molecular level. With a pyrolytic surface fired on at over 1200ºF, our pyrolytic products are notably durable, bendable, and can be tempered post-production. Furthermore, the pyrolytic coating does not degrade like sputter coatings, allowing the glass to be warehoused locally and readily available, which significantly reduces project lead times both domestically and internationally.

Key Sources Referred

- Department of Energy

- Directorate General of Trade Remedies

- U.S. Government Publishing Office

- Lawrence Berkeley National Laboratory

- National Institute of Standards and Technology

- FunGlass – Centre for Functional and Surface Functionalized Glass

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the coated glass market analysis from 2024 to 2033 to identify the prevailing coated glass market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the coated glass market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global coated glass market trends, key players, market segments, application areas, and market growth strategies.

Coated Glass Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 97.5 Billion |

| Growth Rate | CAGR of 9.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Coating Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Xinyi Glass Holdings Limited, Vitro, Saint-Gobain, Cardinal Glass Industries, Guardian Industries, Nippon Sheet Glass Co., Ltd, Fuyao Glass America, SCHOTT, Asahi Glass Co. (AGC), sunglass industry s.r.l. |

The global coated glass market was valued at $39.2 billion in 2023, and is projected to reach $97.5 billion by 2033, growing at a CAGR of 9.6% from 2024 to 2033.

Key market players in the coated glass market include Saint-Gobain, Guardian Industries, Asahi Glass Co. (AGC), Nippon Sheet Glass Co., Ltd, Cardinal Glass Industries, Vitro, Xinyi Glass Holdings Limited, sunglass industry s.r.l., Fuyao Glass America, and SCHOTT.

Asia-Pacific is the largest regional market for coated glass.

Architectural is the leading application of coated glass market.

The increase in adoption of smart glass are the upcoming trends of coated glass market.

Loading Table Of Content...