Cocoa Fillings Market Research, 2034

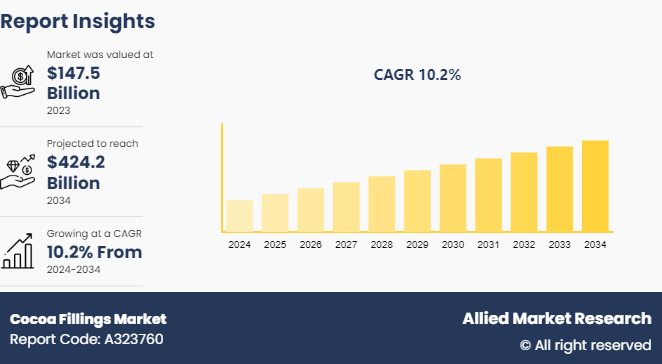

The global cocoa fillings market was valued at $147.5 billion in 2023, and is projected to reach $424.2 billion by 2034, growing at a CAGR of 10.2% from 2024 to 2034.

Market Introduction and Definition

Cocoa fillings typically refer to various creamy or solid mixtures containing cocoa as a primary ingredient, used to fill confectionery items such as chocolates, pastries, or cookies. These fillings often incorporate cocoa powder, cocoa butter, or chocolate in different proportions to achieve desired flavors and textures. They can range from smooth ganache and velvety creams to nutty pralines and crunchy truffles. Cocoa fillings may also include additional ingredients like sugar, milk solids, nuts, fruits, or flavorings to enhance taste and add complexity. The richness and depth of cocoa flavor contribute to the indulgent experience of consuming these treats, making cocoa fillings a component in a variety of desserts enjoyed worldwide.

Key Takeaways

The cocoa fillings market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The surge in consumer demand for premium and indulgent chocolate products significantly boosts the market demand for cocoa fillings. There is a rise in preference for products that offer rich and indulgent flavors, textures, and overall sensory experiences as consumers increasingly seek higher-quality and more sophisticated chocolate experiences, which has helped boost the cocoa fillings market share. Cocoa fillings play a major role in meeting these demands by providing the creamy, decadent centers found in premium chocolates, truffles, pralines, and other confectionery items. Moreover, the versatility of cocoa fillings allows manufacturers to create a wide range of innovative and upscale chocolate products, catering to diverse consumer preferences and trends. Thus, the increased demand for premium chocolate products drives the growth of the cocoa fillings market and also encourages manufacturers to invest in research and development to enhance product quality, flavor profiles, and overall consumer satisfaction, further fueling cocoa fillings market size.

However, fluctuations in cocoa bean prices pose a significant restraint on the cocoa fillings market growth by directly impacting production costs. Cocoa beans are the primary raw material for cocoa fillings, thus any fluctuations in their prices can lead to considerable cost variations for manufacturers. When cocoa bean prices rise, production costs also increase, forcing manufacturers to either absorb the increased expenses, thus reducing profit margins, or pass on the costs to consumers through higher prices, potentially hampering the market demand. Contrarily, during periods of lower cocoa bean prices, profit margins may improve, but the situation can be temporary and unpredictable. Such volatility in production costs creates uncertainty for manufacturers, inhibiting long-term planning and investment in the cocoa fillings market. In addition, it can lead to supply chain disruptions as manufacturers may struggle to maintain consistent supply amid fluctuating raw material costs. Overall, the instability in cocoa bean prices acts as a significant restraint to market demand during the cocoa fillings market forecast.

Furthermore, the development of healthier cocoa filling options with reduced sugar and fat content presents significant opportunities in the cocoa fillings market. There is a growing demand for healthier alternatives in the chocolate industry as consumers become increasingly health-conscious and seek out products aligned with their dietary preferences. Manufacturers are responding by innovating cocoa fillings formulations to reduce sugar and fat content while maintaining taste, texture, and indulgence. These healthier options cater to a broader consumer base, including those looking to manage weight, reduce sugar intake, or address dietary restrictions. Moreover, as public awareness of the health risks associated with excessive sugar and fat consumption grows, there is a burgeoning market for products perceived as healthier choices. By offering such options, manufacturers can tap into this demand, differentiate their products, and expand their customer reach. This shift towards healthier cocoa fillings not only creates new market opportunities but also contributes to the overall sustainability and longevity of the cocoa fillings industry.

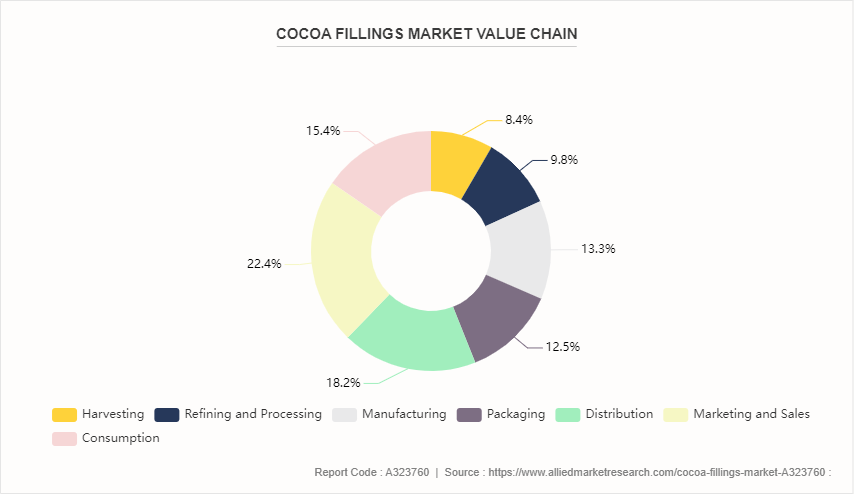

Value Chain of Global Cocoa Fillings Market

The value chain of the cocoa fillings market encompasses several key stages. It begins with cocoa farming and harvesting, where cocoa beans are cultivated, primarily in tropical regions. These beans are then processed through fermentation and drying to enhance flavor. The next stage involves processing and refining, where beans are roasted, ground, and transformed into cocoa liquor, butter, and powder. The intermediate product is supplied to manufacturers who create cocoa fillings by blending cocoa with other ingredients like sugar, milk, and stabilizers. The finished cocoa fillings are then distributed to food manufacturers and retailers, who use them in various products such as baked goods, confectionery, and desserts, before finally reaching consumers. However, throughout this chain, quality control and sustainability practices are crucial.

Market Segmentation

The cocoa fillings market is segmented into type, application, distribution channel, and region. On the basis of type, the market is divided into cocoa beans, unsweetened cocoa powder, cocoa butter, cocoa paste, and cocoa liquid. As per application, the market is classified into bakery & confectionery, dairy products, beverages, personal care, and pharmaceuticals. On the basis of distribution channel, the market is categorized into offline and online. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The demand for cocoa fillings in the U.S. is vigorous and growing, driven by several key factors. There is a significant consumer preference for indulgent and premium confectionery products, which often feature cocoa fillings as a central ingredient. The expanding bakery industry, including both artisanal bakeries and large-scale producers, relies heavily on high-quality cocoa fillings to enhance the appeal of their offerings. Health-conscious consumers are also influencing the market, with an increasing demand for organic, low-sugar, and clean-label cocoa fillings. The trend toward home baking, amplified by the pandemic, has further boosted the market, as more consumers seek professional-quality ingredients for their homemade treats. Moreover, the rise of specialty diets, such as vegan and gluten-free, has led to the development of diverse and innovative cocoa filling products tailored to these needs. All these factors contribute to the strong and sustained demand for cocoa fillings in the U.S. market.

The strong tradition and high consumption of bakery and confectionery products in Europe has significantly contributed to the demand for cocoa fillings. European consumers prefer premium, high-quality, and artisanal products, which often feature rich and diverse cocoa fillings. Additionally, the rise in trend of health and wellness has led to an increased demand for organic, low-sugar, and functional cocoa fillings, aligning with consumer preferences for healthier indulgences. The expanding retail and foodservice sectors further bolster demand, as more cafes, patisseries, and specialty stores offer products with innovative cocoa fillings. Moreover, European manufacturers emphasize sustainability and ethical sourcing, driving demand for fillings made from sustainably sourced cocoa. This combination of tradition, consumer preferences for quality and health, and sustainability concerns underscores the strong and evolving demand for cocoa fillings in Europe.

Industry Trends:

Innovation in product formats has significantly shaped the cocoa fillings market by the introduction of diverse and convenient options that cater to evolving consumer preferences. The development of ready-to-use fillings has simplified the application process for both home bakers and professional chefs, enabling consistent quality and efficiency. Customizable fillings, tailored to specific textures, flavors, and nutritional profiles, have met the growing demand for personalized products, which has further enhanced the appeal across various demographics. The innovation extends to unique delivery formats such as squeezable pouches and spreadable jars, providing consumers with versatile and easy-to-use options for multiple culinary applications. In addition, advancements in shelf-stable fillings have increased product longevity without compromising taste or quality, aligning with the modern consumer's busy lifestyle. These innovations drive market growth by expansion of usage occasions and applications, which has fostered brand loyalty by meeting the diverse and dynamic needs of today’s consumers.

The growth in the bakery and confectionery segments has influenced the cocoa fillings market by driving the demand for diverse and innovative cocoa-based ingredients. As consumers increasingly seek indulgent and high-quality baked goods and confections, manufacturers are expanding their product lines to include a variety of cocoa fillings that enhance flavor, texture, and overall product appeal. The trend is propelled by the rise in popularity of premium and artisanal products, which often feature rich, decadent fillings as key components. In addition, the surge in home baking and the penetration of specialty bakeries and patisseries have further fueled the demand for versatile and easy-to-use cocoa fillings. The trend has prompted producers to innovate and offer more specialized, customizable, and health-oriented options, such as organic, low-sugar, and functional cocoa fillings. Consequently, the dynamic expansion of the bakery and confectionery sectors is setting a robust growth trajectory for the global cocoa fillings market, reinforcing the importance of these fillings in delivering premium consumer experiences.

Competitive Landscape

The major players operating in the cocoa fillings market include Barry Calleabaut, Archer Daniels Midland Company, Clasen Quality Coatings, Tate & Lyle PLC, Argan Beteiligung, Ashland Global, Zeelandia, Highlander Partners, L.P., Cargill Inc., and DuPont.

Other players in cocoa fillings market includes Nestle S.A., Ferrero Group, Mondelez International, The Hershey Company, Mars, Incorporated, Lindt & Sprüngli, Olam International, Puratos Group, and others.

Recent Key Strategies and Developments

In May 2022, Blommer Chocolate teamed up with the Israeli/American food technology business DouxMatok to introduce cocoa based chocolate and confectionary items.

In February 2022, Dawn Foods launched fat-based, pre-and post-bake, ready-to-use cocoa fillings for croissants, cookies or muffins, and other sweet bakery items.

Key Sources Referred

Food Safety and Standards Authority of India (FSSAI)

U.S. Food and Drug Administration (FDA)

Organic Trade Association (OTA)

Euromonitor International

Plant Based Foods Association

Food and Agriculture Organization of the United Nations (FAO)

National Restaurant Association (NRA)

Agricultural & Processed Food Products Export Development Authority (APEDA)

U.S. Department of Agriculture (USDA)

Bureau of Labor Statistics (BLS)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cocoa fillings market analysis from 2024 to 2034 to identify the prevailing cocoa fillings market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cocoa fillings market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cocoa fillings market trends, key players, market segments, application areas, and market growth strategies.

Cocoa Fillings Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 424.2 Billion |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2024 - 2034 |

| Report Pages | 302 |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Barry Calleabaut, Argan Beteiligung, Cargill Inc., Ashland Global, Clasen Quality Coatings, Highlander Partners, L.P., Archer Daniels Midland Company, Tate & Lyle PLC, zeelandia, DuPont |

cocoa fillings market was valued at $147.5 billion in 2023, and is estimated to reach $424.2 billion by 2034.

The global cocoa fillings market is projected to grow at a compound annual growth rate of 10.2% from 2024 to 2034 reach $424.2 billion by 2034.

Some of the key players in the cocoa fillings market include Barry Calleabaut, Archer Daniels Midland Company, Clasen Quality Coatings, Tate & Lyle PLC, Argan Beteiligung, Ashland Global, Zeelandia, Highlander Partners, L.P., Cargill Inc., and DuPont.

North America region was the highest revenue contributor to the market and is expected to grow at a significant CAGR during the forecast period

Increasing demand for premium and organic fillings, the rise of sustainable and ethically sourced cocoa, innovations in flavors and textures, and the growth of health-conscious and plant-based options.

Loading Table Of Content...