Colorectal Cancer Screening Market Research, 2033

The global colorectal cancer screening market size was valued at $17.1 billion in 2023, and is projected to reach $25.6 billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033. The growth of the colorectal cancer screening market is driven by rise in prevalence of colorectal cancer, advancements in diagnostic technologies, and a rise in awareness about early detection. Supportive government initiatives and screening programs further boost adoption of advanced cancer screening technology. The aging population, which is more susceptible to colorectal cancer, contributes significantly to colorectal cancer screening market growth. In addition, the growing availability of non-invasive screening methods, such as stool DNA tests and blood-based biomarkers, enhances patient compliance, supporting market expansion. Improved healthcare infrastructure in emerging economies further accelerates growth of the market.

Market Introduction and Definition

Colorectal cancer screening involves detecting early signs of colorectal cancer or precancerous polyps in the colon or rectum. Early detection through screening significantly improves treatment outcomes and reduces mortality. Common screening methods include stool-based tests, such as the fecal immunochemical test (FIT) and guaiac-based fecal occult blood test (gFOBT) , which detect blood in the stool, and DNA-based stool tests that identify genetic markers of cancer. Visual examinations, including colonoscopy and sigmoidoscopy, allow direct visualization of the colon and rectum to identify and remove polyps. Virtual colonoscopy, or CT colonography, uses imaging to examine the colon. Screening typically begins at the age of 45 or earlier for individuals with risk factors such as family history, inflammatory bowel disease, or hereditary syndromes such as Lynch syndrome. Regular screening is crucial, as colorectal cancer often develops without symptoms in its early stages. Advancements in screening technologies continue to improve accuracy and accessibility.

Key Takeaways

- The colorectal cancer screening market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major colorectal cancer screening industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives

Key Market Dynamics

According to colorectal cancer screening market opportunity analysis, the key factors driving the growth of the market include rise in incidence of colorectal cancer, rise in aging population, increase in government and private initiatives, and improved healthcare infrastructure. Rise in prevalence of colorectal cancer (CRC) is a significant driver for the colorectal cancer screening market growth. For instance, according to the National Library of Medicine, colorectal cancer (CRC) is the third most commonly diagnosed malignant neoplasm and the second cause of death due to cancer globally. Colorectal cancer is one of the leading causes of cancer-related deaths globally, and its increasing incidence has prompted greater focus on early detection and prevention.

The aging population is a major driver for the growth of the colorectal cancer screening market. As individuals age, the risk of developing colorectal cancer increases, making early detection and prevention crucial. The incidence of colorectal cancer is significantly higher in individuals aged 50 and older, prompting healthcare systems to implement routine screening measures for early diagnosis. With the global population aging rapidly, particularly in regions such as North America, Europe, and parts of Asia-Pacific, the demand for colorectal cancer screening is growing. The geriatric population is more likely to be advised to undergo regular screenings such as colonoscopies, fecal immunochemical tests (FIT) , and other diagnostic procedures. In addition, many countries are expanding screening programs as part of public health initiatives to combat the rise in cancer rates among the geriatric population.

In addition, according to colorectal cancer screening market forecast analysis government and private initiatives play a crucial role in driving the growth of the market. Governments across various regions have been implementing screening programs and campaigns aimed at early detection, which significantly contribute to increased demand for screening services and products. National health organizations, such as the U.S. Preventive Services Task Force (USPSTF) , recommend regular screenings for individuals aged 45 and above, encouraging widespread participation. Public health initiatives that offer subsidized or free screenings for high-risk populations further enhance accessibility and raise awareness about the importance of early detection. In addition to these public sector efforts, private sector initiatives, including partnerships with healthcare providers and insurance companies, have also expanded screening access. Private health insurers increasingly cover CRC screening as part of preventive care packages, further incentivizing individuals to undergo regular screenings. In addition, private organizations and non-profits contribute to rise in awareness through campaigns, educational programs, and the development of innovative screening technologies.

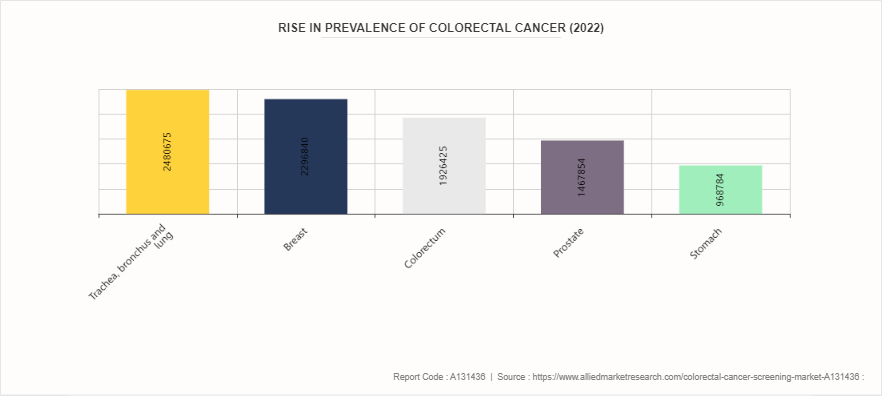

Rise in Prevalence of Colorectal Cancer

Rise in the prevalence of cancer, particularly colorectal cancer (CRC) , significantly impacts the colorectal cancer screening market size. In 2022, there were 1, 926, 425 new cases of colorectal cancer, making it the third most common cancer globally. This increase in cases increases the demand for screening services and diagnostic technologies. Early detection of colorectal cancer is crucial for improving survival rates, which in turn boosts awareness and encourages individuals, especially those in high-risk groups, to seek regular screenings.

As the number of cases rises, the demand for innovative and non-invasive screening methods, such as fecal occult blood tests (FOBT) and multi-target stool DNA tests, also grows. Advancements in colonoscopy and other imaging technologies further contribute to the market growth by making screenings more accurate and comfortable, resulting in higher adoption of cancer screening. Rise in colorectal cancer cases drives the need of early detection, prompting healthcare systems and governments to invest more in preventive measures and screening programs. Regions with aging populations or higher cancer prevalence, such as the U.S. and Europe, are particularly affected by rise in incidence of colorectal cancer. These regions are likely to witness an increase in screening demand as the population ages and healthcare providers prioritize preventive care. The age-standardized rate (ASR) of colorectal cancer, at 18.4 per 100, 000 people, indicates a moderately high global incidence, which is expected to lead to sustained growth in the colorectal cancer screening market.

Thus, healthcare systems are likely to implement or expand colorectal cancer screening programs, especially for individuals over the age of 50, as the geriatric population is at higher risk of colorectal cancer. Thus, increased government funding and healthcare investments in early detection technologies are driving the market growth. In conclusion, the increase in prevalence of colorectal cancer is expected to fuel the demand for screening services and innovations in detection technologies. With nearly 2 million new cases annually, the colorectal cancer screening market is set to grow as more people undergo regular screenings, and healthcare providers focus on improving detection methods and accessibility.

Market Segmentation

The colorectal cancer screening industry is segmented on the basis of type, end user, and region. By type, the market is classified into Stool Based, Colonoscopy, and Others. By end user, the market is divided into hospitals & clinics, clinical laboratories, diagnostics imaging centers, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the colorectal cancer screening market share in 2023. This was attributed to well-established healthcare facilities, rise in the prevalence of colorectal cancer, and high healthcare spending in North America.

However, Asia-Pacific is expected to register the highest CAGR during the forecast period. The region is experiencing a rise in incidence of cancer due to lifestyle changes, urbanization, and an aging population. This trend is leading to a rise in demand for minimally invasive procedures, thereby driving the need for colorectal cancer screening. Countries such as India and Thailand are becoming popular destinations for medical tourism. The growing number of international patients seeking advanced medical care is boosting the demand for colorectal cancer screening in Asia-Pacific.

- According to the National Cancer Center of Japan, there were estimations of 1, 019, 000 new cancer cases and 380, 400 cancer deaths in 2022.

- According to the Government of India, medical tourism in India increased by 175.41% from 2020 to 2023.

- According to the European Commission, as of January 1, 2023, around 21.3% of the total European population was aged 65 years and over.

- According to Invest India’s Investment Grid, there are nearly 600 investment opportunities worth $32 billion in the country’s hospital/medical infrastructure sub-sector.

- According to a 2022 article by Global Cancer Observatory, colorectum cancer accounted for 11% of new cancer cases

Industry Trends

- According to a 2024 article by American Cancer Society, about 106, 590 new cases of colon cancer were diagnosed in 2023 in the U.S.

- According to a 2024 article by National Cancer Institute, colorectal cancer accounted for 7.6% of all new cancer cases in 2023.

- According to the 2023 article by National Library of Medicines, artificial intelligence has played a key role in early diagnosis and prediction of cancers including colorectal cancer.

Competitive Landscape

Colorectal Cancer Screening market report summarizes top key players overview as Abbott Laboratories, BioMerieux SA, Becton Dickinson and Company, GE Healthcare, Qiagen N.V, F. Hoffmann-La Roche Ltd, Siemens Healthineers, Sysmex Corporation, and Thermo Fischer Scientific. Other players in the colorectal cancer screening market are Hologic Inc and Epigenomics AG.

Recent Key Strategies and Developments

- In September 2022, Epigenomics AG announced the launch of multi-center clinical trial for “Next-Generation” blood-based diagnostic screening test for the detection of colorectal cancer (CRC) . This Next-Gen” test will help patients, physicians, and providers with an easy-to-use non-invasive option that will increase screening rates and improve overall diagnostic outcomes. This strategic launch helped the company to enhance their customer base, thereby generating noteworthy business revenue for the company.

- In February 2024, Reese Pharmaceutical launched ColoTest, a home-based FIT colorectal cancer screening test.

- In November 2023, Guardant Health and Samsung Medical Center launched Shield, a blood-based CRC test, in South Korea.

- In May 2022, New Horizon Health and Prenetics announced their strategic partnership to launch ColoClear by Circle in China.

- In March 2021, Olympus Corporation announced the approval of Narrow Band Imaging (NBI) to assess the neoplastic potential of colorectal polyps by FDA 510 (k) . By applying the NBI International Colorectal Endoscopic (NICE) classification during a screening colonoscopy, physicians can make high-confidence predictions of histology for polyps 5mm or smaller, known as diminutive polyps.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the colorectal cancer screening market analysis from 2024 to 2033 to identify the prevailing colorectal cancer screening market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the colorectal cancer screening market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global colorectal cancer screening market trends, key players, market segments, application areas, and market growth strategies.

Colorectal Cancer Screening Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 25.6 Billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Siemens Healthineers AG, Hologic Inc., Becton Dickinson and Company, BioMerieux SA, Thermo Fischer Scientific Inc., Sysmex Corporation, Qiagen N.V, GE Healthcare, F. Hoffmann-La Roche Ltd., Abbott Laboratories |

The total market value of Colorectal Cancer Screening market is $17.1 billion in 2023

The market value of Colorectal Cancer Screening market is projected to reach $25.6 billion by 2033

The forecast period for Colorectal Cancer Screening market is 2024-2033.

The base year is 2023 in Colorectal Cancer Screening market.

The Colorectal Cancer Screening market growth is driven by rise in incidence of colorectal cancer, rise in aging population, increase in government and private initiatives, and improved healthcare infrastructure

Loading Table Of Content...