Commercial Satellite Imaging Market Research, 2032

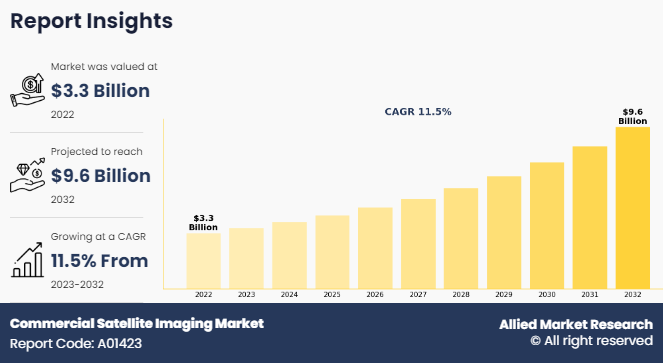

The global commercial satellite imaging market size was valued at $3.3 billion in 2022, and is projected to reach $9.6 billion by 2032, growing at a CAGR of 11.5% from 2023 to 2032.Satellite imaging mainly deals with capturing images of the earth through satellite, also known as earth observation, and utilizing these images for various commercial purposes, which is known as commercial satellite imaging. Some of the foremost applications of commercial satellite imaging include acquisition & mapping, disaster management, energy & natural resource management, urban planning & development, and security & surveillance. There is an increase in the importance of images captured through satellite due to rise in use of these images in environmental forecasting. It also helps provide a quick response during emergencies such as defense security events and natural calamities.

Key Takeaways

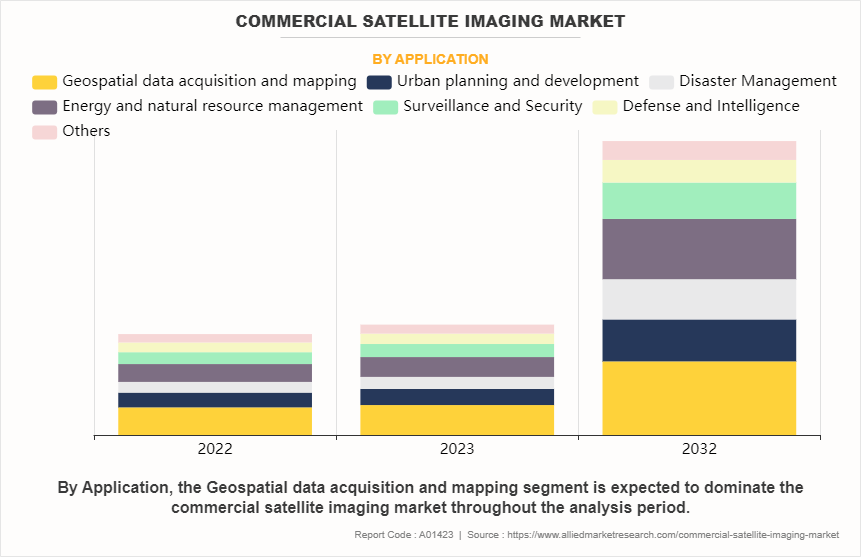

- On the basis of application, the geospatial data acquisition and mapping segment held the largest share in the commercial satellite imaging market size in 2022.

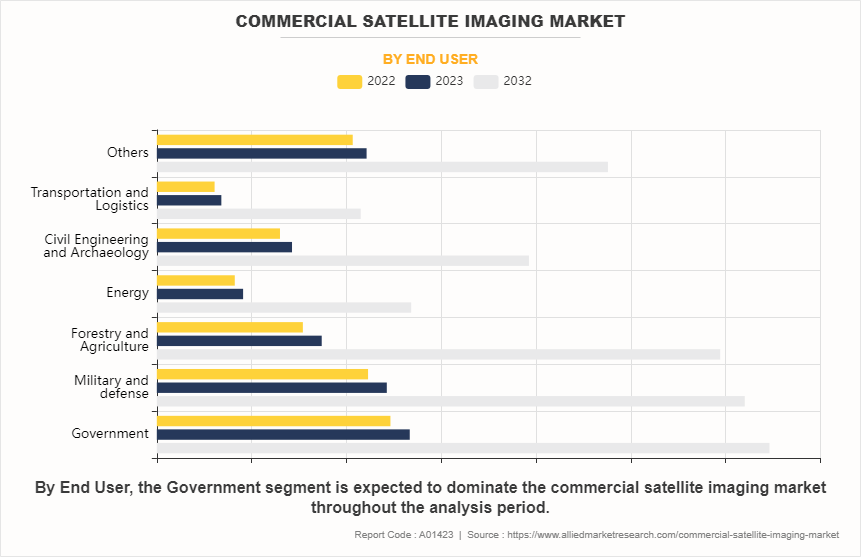

- By end user, the government segment held the largest share in the market in 2022.

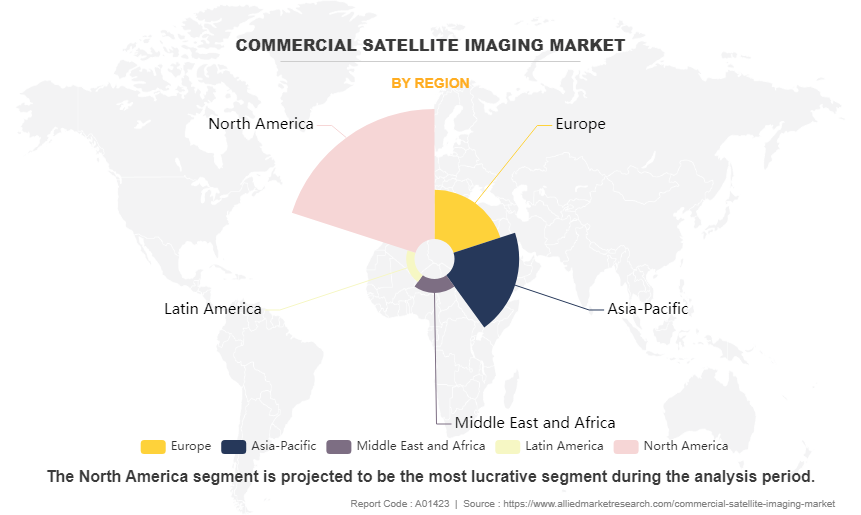

- On the basis of region, North America held the largest market share in 2022.

Commercial Satellite Imaging Market in the U.S.

The U.S. is anticipated to emerge as a significant satellite data services market due to the presence of prominent satellite data service providers and space organizations in the region. Several government agencies in the region are actively involved in significant investments for supporting the launch of commercial satellites, which is expected to boost the growth of the commercial satellite imaging market in the future.

Moreover, the U.S. government agencies have used commercial sensor satellites to identify the illegal activities in maritime. For instance, in August 2023, U.S. Space Force imagery specialists utilized commercial sensor satellites to detect illegal fishing boats and monitor other activities during a military exercise in South America. 1st Lt. McKenna Medina, head of the Space Systems Command’s surveillance, reconnaissance, and tracking team, highlighted how unclassified data from commercial satellites can be utilized for maritime security and various military applications.

Moreover, satellite imaging deals with capturing images of Earth or other planets with the assistance of imaging satellites. Utilizing these images for commercial purpose is known as commercial satellite imaging, which includes various applications such as environment monitoring & management, security of energy resources, surveillance of border areas, and mapping of constructional projects. One of the key advantages of satellite imaging is faster image delivery, which provides comprehensive earth coverage, thus making commercial satellite imaging service a preferred choice over other imaging services. In addition, commercial satellite imaging market forecast indicates a shift towards more frequent and higher-resolution data acquisition, fueling the need for advanced satellite constellations.

The global commercial satellite imaging market's growth is expected to be majorly driven by an increase in dependence on location-based services (LBS). This is attributed to the fact that location-based services play an important role by providing real-time geographical data with the use of smart devices. In addition, commercial satellite imaging is applicable in various sectors, including defense, construction, transportation, and others, which acts as a key driver for the global market. Increase in security concerns and introduction of new technologies such as GPS satellites, advanced remote sensing technology, high-resolution cameras, light detection & ranging (LIDAR) technology, and electric propulsion technology further contribute toward the overall market growth. However, availability of aerial imaging services, which provide similar facilities and high-resolution images as compared to commercial satellite imaging at relatively lower cost act as a key growth restraint for the market.

In addition, the European government and other countries are collaborating with market players to use this technology. For instance, in February 2022, Maxar Technologies, a provider of space solutions and secure, precise, geospatial intelligence, announced a five-year agreement with European Space Imaging and Space Imaging Middle East, which are strategic partners serving customers in Europe, Northern Africa, and the Middle East. With the help of Maxar high-resolution satellite imagery, European Space Imaging and Space Imaging Middle East provide a wide range of government and commercial organizations for many applications such as border security, disaster response, and agriculture.

Similarly, in November 2021, European Space Agency (ESA) said, Satellite communications are critical for governmental communications ranging from crisis management to border control to election monitoring, as well as managing critical infrastructure such as power plants. ESA is supporting to develop the end-to-end protection of government data exchanged via commercial satellites with CYSEC, a cybersecurity company based in Switzerland. The growing demand for high-resolution imagery and geospatial data presents a significant commercial satellite imaging market opportunity for satellite operators and service providers.

Factors such vital applications in government and defense services, growth dependence on commercial monitoring services, and rise in use of satellite data in development of smart cities and connected vehicles are driving the growth of the commercial satellite imaging market across the globe. However, availability of aerial imaging services and stringent government regulations for implementation and use of satellites hamper the growth of the market. Furthermore, growing adoption of new technologies and growing integration of artificial intelligence (AI), machine learning (ML), and cloud computing in the space sector are expected to create ample opportunities for the growth of the market during the forecast period.

Segment Review

The commercial satellite imaging market is segmented into application, end user, and region. By application, the market is categorized into geospatial data acquisition & mapping, urban planning & development, disaster management, energy & natural resource management, surveillance & security, defense & intelligence, and others. By end user, it is segregated into government, military & defense, forestry & agriculture, energy, civil engineering & archaeology, transportation & logistics, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By Application

On the basis of application, the geospatial data acquisition and mapping segment generated maximum revenue in 2022, owing to the need for precise data in areas such as urban planning, infrastructure development, and environmental monitoring.

By End User

On the basis of end user, the government segment generated maximum revenue in 2022, owing to the need for reliable and up-to-date geospatial data to support decision-making processes and ensure public safety.

By Region

Based on region, North America dominated the commercial satellite imaging market in 2022 as the region is home to several major satellite operators and service providers, as well as a strong demand from government agencies, defense sectors, and various industries.

Competitive Analysis

Some of the major companies that operate in the global commercial satellite imaging market are BlackSky, European Space Imaging, Galileo Group, Inc., ImageSat, L3Harris Technologies, Inc., Maxar Technologies Inc., Planet Labs Inc., Airbus S.A.S., SpaceKnow Inc. and Telespazio France.

Vital applications in government and defense services

Satellite imaging offers geospatial products and services for most of the government agencies and defense authorities for various applications, wherein security concern is important. It is a proven source of information for any government or defense authorities, which helps in maximizing security programs with high image quality and precise information. In addition, the information extracted from satellite images is further helping local government to better assess the real-life situations, which helps in developing programs to save lives, protect properties, and enhance future economic stability of their respective communities.

Furthermore, in the defense sector, current threats of terrorism and attack on critical infrastructure can be tracked through geographical mapping and can be protected by adopting preventive measures. It eases decision making and helps in precise mapping for mission planning, search, and rescue operations, and formulating future developments. For instance, in March 2022, the WorldView-3 satellite extracted 3D video displays of Russian military in the Kyiv area to give viewers an understanding of the on-the-ground situation along the road. The fleet is parked along the tree lines, farmland, and fields. WorldView-3 satellite imagery provides 30cm panchromatic, 1.2m 8-band multispectral, and 3.7m 8-band short wave infrared (SWIR) resolution. The WorldView-3 satellite has an average revisit time of <1 day and is proficient at collecting data up to 680,000 km2 per day. Therefore, vital applications in the government & defense sector have collectively emerged as a major growth driver for this market.

Growth in dependence on commercial monitoring services

Rise in need for commercial monitoring services is a significant driving force behind the growth of the commercial satellite imaging market. This increased reliance on monitoring services stems from various sectors, including agriculture, urban planning, environmental monitoring, disaster management, and infrastructure development. In agriculture, farmers and agricultural businesses utilize satellite imaging to monitor crop health, assess soil conditions, and optimize irrigation practices. By regularly monitoring fields from space, farmers can identify areas that require attention, such as pest infestations or drought stress, enabling them to take timely corrective measures.

Urban planning authorities and city developers rely on satellite imaging to gather accurate and up-to-date information about urban areas. This information includes land use patterns, population density, infrastructure development, and environmental factors. By analyzing satellite imagery, urban planners can make informed decisions regarding zoning regulations, transportation networks, and disaster preparedness strategies.

Furthermore, government agencies are adapting commercial satellite imagery for monitoring objects and activities in real time. For instance, in February 2024, the National Geospatial-Intelligence Agency (NGA) announced plans of utilization of commercial satellite imagery and analytics through a new procurement initiative called "Luno." With an allocated budget of $290 million, the Luno program aims to harness commercial satellite imagery and data analytics to bolster NGA's global monitoring capabilities. Luno will engage commercial monitoring services to track various aspects such as economic activity, environmental conditions, and military capabilities of foreign nations. This includes observing factors like shipping, construction, energy infrastructure, agricultural production, natural disasters, climate patterns, resource extraction, equipment, troop movements, base construction, and other national security indicators. Thus, the trend of commercial monitoring services across various sectors is expected to drive the commercial satellite imaging market growth.

Rise in use of satellite data in development of smart cities and connected vehicles

Satellite images are used for urban management or planning and for smart city development using satellite imagery datasets containing useful information regarding annotated objects. Urban planners are using such data to understand settlement trends and ensure efficient infrastructure management.

In addition, rise in use of remote sensing technology for zoning and city infrastructure modelling has helped to meet the rise in demands from city-based populations toward better management of sustainable urban development. Further, growth in urban agglomeration and monitoring urbanization of adjoining areas to enable smart city planning and implementation is further propelling satellite imagery adoption.

Furthermore, geospatial data companies adopted Synthetic Aperture Radar (SAR), an active sensing system used in satellite imaging for more accurate results. For instance, in May 2023, Abu Dhabi-based Bayanat, known for its AI-driven geospatial data solutions, anticipated that its new satellite venture and self-driving vehicles pilot program will greatly advance the emirate's smart city goals. The initiative includes plans to launch at least five Synthetic Aperture Radar (SAR) satellites into low Earth orbit, ensuring a continuous flow of data. SAR technology uses active sensing to produce high-resolution images by illuminating the Earth's surface and capturing reflected signals, offering advantages over traditional optical imaging satellites as it operates day and night, irrespective of weather conditions or sunlight. Such development fruther increases the commercial satellite Imaging market share of manufactures.

Moreover, the ability of connected and self-driving vehicles to use seamless internet access, high-definition (HD) maps, and roadside assistance during an emergency from space using commercial satellite imagery propels the market growth. Therefore, an increase in use of satellite data used in the development of smart cities and connected vehicles is anticipated to support the growth of the commercial satellite imaging market.

Availability of aerial imaging services

Aerial imaging services are majorly adopted for business and personal commercial use, owing to their low cost as compared to satellite imagery. Furthermore, the data captured by these services is most recent as old satellites may not be able to reflect most recent changes or developments. In addition, resolution and clarity of aerial images is likely to be higher, which makes real-time situation easier to understand. These advantages of aerial imaging services are expected to restrain the growth of the global commercial satellite market.

Satellites usually provide images with a resolution of 10 cm; however, efforts are being made by the leading players in the market to decrease the image resolution limit to 5 cm in the coming years. On the other hand, digital aerial cameras can capture images with a resolution of up to 10 mm (1 cm). Thus, advanced features offered by aerial imaging as compared to satellite imaging majorly restrain the growth of the commercial satellite imaging industry.

Stringent government regulations for implementation and use of satellites

Various government authorities globally have imposed stringent regulations on implementation of commercial satellites to avoid harmful interference of satellite data usage. In addition, several governments have been regulating satellite-imaging companies, owing to worries about geopolitical adversaries buying images for malicious purposes and compromising national security. Furthermore, each national authority may have a different regulatory framework, making it difficult for private companies to offer cost effective and qualitative commercial satellite imaging. Moreover, there are different regulatory obligations for operators who want to launch satellites such as satellite landing rights, frequency licensing, telecommunication licensing, and type approval. Therefore, stringent regulations for implementation and use of satellite data are expected to hinder the growth of the commercial satellite imaging market.

Growing adoption of new technologies

Introduction of several technologies in the market and their incorporation in satellite imaging is expected to enhance satellite imagery technology; thereby, providing lucrative opportunities for market growth. Some of the newly introduced technologies include electric propulsion technology, high-resolution cameras, advanced remote sensing technology, next generation GPS satellites, light detection and ranging (LIDAR) technology, hyperspectral sensors, and multispectral sensors. Apart from these, the most recently developed technologies such as aerospace digital signal processor and large-scale anti-radiation field programmable gate array are projected to make real-time image processing easy and overcome the limitation in satellite imaging. Satellite imagery is projected to become the preferred option for nearly all commercial applications, presenting significant growth opportunities for the market. In addition, companies are also collaborating with each other to develop new technologies during the forecast period which is helpful for different organizations.

Recent Developments in the Commercial Satellite Imaging Industry

- In January 2024, Maxar Technologies secured a contract from the National Geospatial-Intelligence Agency (NGA) for the provision of advanced satellite imagery and data tailored for creating 3D maps and models. Maxar Intelligence, renowned for its high-resolution satellite imagery, will supply a comprehensive 3D data package encompassing 160,000 square kilometers within the U.S. Indo-Pacific Command's jurisdictional area. The U.S. Indo-Pacific Command is responsible for overseeing all the U.S. military activities in the expansive Indo-Pacific region, spanning South Asia, Southeast Asia, Oceania, and the Pacific Islands.

- In April 2022, L3Harris Technologies signed a contract by the Japan Meteorological Agency (JMA) for an advanced study which will significantly improve the accuracy and timing of Japan’s weather forecasting.

- In April 2022, Planet Labs Inc. signed a strategic agreement with Moody’s, a leading global integrated risk assessment firm serving financial markets, to explore and address the growing demand for assessing and monitoring solutions on Environmental, Social, and Governance (ESG) risks.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial satellite imaging market analysis from 2022 to 2032 to identify the prevailing commercial satellite imaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial satellite imaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial satellite imaging market trends, key players, market segments, application areas, and market growth strategies.

Commercial Satellite Imaging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.6 billion |

| Growth Rate | CAGR of 11.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | EUROPEAN SPACE IMAGING, TELESPAZIO FRANCE, HARRIS CORPORATION, IMAGESAT INTERNATIONAL N.V, SPACEKNOW, GALILEO GROUP, INC, PLANET LABS INC, MAXAR TECHNOLOGIES INC, BLACKSKY GLOBAL LLC, URTHECAST CORP |

Analyst Review

Commercial satellite imaging is the process of capturing real-time images of Earth, which are used for several commercial purposes such as urban planning & development, geospatial mapping, disaster management, energy & natural resource management, and surveillance & security. In addition, satellite imagery is used by various commercial sectors including civil engineering, government, defense, forestry, agriculture, media & entertainment, insurance, and real estate. Commercial satellite imaging has gained increased adoption in the defense sector over the years. The imagery obtained from satellites are used for a variety of applications in the defense sector such as surveillance, battlefront analysis, strategy formulation, and situation analysis on border areas. Rise in incidents of terrorism, illegal migration, human trafficking, and the need for updated geographical maps are expected to boost the commercial satellite imaging market growth in the defense sector during the forecast period. For instance, in December 2014, Airbus Defence and Space launched an Earth observation satellite named SPOT 7, which provides multiple resolution geospatial maps used in defense sector. The imagery provided by SPOT 7 satellite is used for civil and military mapping during the incidents of wars, maritime surveillance, and security of border.

Higher resolution images offered by aerial imagery as compared to satellite imaging restricts the growth of the commercial satellite imaging market. However, advancements in next-generation GPS satellites, advanced remote sensing technology, high-resolution cameras, light detection and ranging (LIDAR) technology, electric propulsion technology are expected to enhance the market growth in the coming years. Leading players have collaborated with other companies to enhance their product portfolios to increase their market potential in terms of geographical and customer base. In May 2016, Harris Corporation collaborated with Esri, which is a prominent provider of geographic information system (GIS) solutions. This collaboration assisted Harris Corporation in enhancing the commercial imagery from small satellites (Small-Sats), unmanned aerial system (UAS) platforms and open-data sources. North America is the leading revenue contributor to the global commercial satellite imaging market during the forecast period due to increase in investment by military and defense sector in the region. In the near future, Asia-Pacific is expected to grow rapidly, owing to frequent incidents of terrorist attacks and natural calamities in countries such as Japan, India, and China.

BlackSky, European Space Imaging, Galileo Group, Inc., ImageSat, L3Harris Technologies, Inc., Maxar Technologies Inc., Planet Labs Inc., Airbus S.A.S., SpaceKnow Inc. and Telespazio France

The global commercial satellite imaging market was valued at $3.3 billion in 2022, and is projected to reach $9.6 billion by 2032, registering a CAGR of 11.5% from 2023 to 2032.

Largest regional market for Commercial Satellite Imaging is North America.

Leading application of Commercial Satellite Imaging Market is geospatial data acquisition and mapping.

Upcoming trends of Commercial Satellite Imaging Market are growing adoption of new technologies and growing integration of artificial intelligence (AI), machine learning (ML), and cloud computing in the space sector.

Loading Table Of Content...

Loading Research Methodology...