Compact C-Arm Market Research, 2033

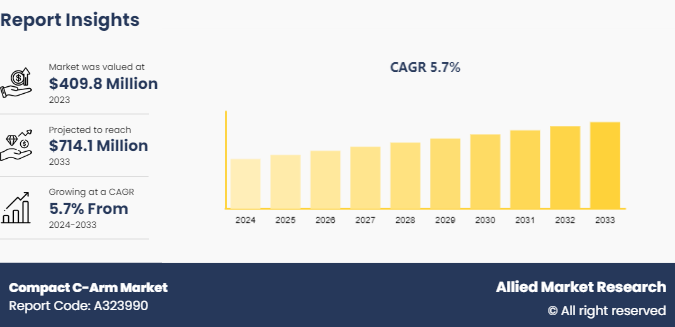

The global compact c-arm market size was valued at $409.8 million in 2023, and is projected to reach $714.1 million by 2033, growing at a CAGR of 5.7% from 2024 to 2033. The increasing demand for minimally invasive surgical procedures, which benefit from the enhanced imaging capabilities of compact C-arms, advances in technology, rise in prevalence of chronic diseases are the factors which drives the market growth.

Market Introduction and Definition

A compact C-arm is a portable medical imaging device used primarily in orthopedic, pain management, and emergency procedures. It features a C-shaped arm that connects the X-ray source and detector, allowing for flexible positioning around a patient. Compact C-arms offer high-resolution imaging in a smaller, more maneuverable format compared to full-size C-arms, making them ideal for use in outpatient clinics, ambulatory surgical centers, and smaller hospital settings. Their portability and ease of use facilitate precise, real-time imaging, essential for minimally invasive surgeries and diagnostic procedures.

Key Takeaways

The compact C-arm market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major compact C-arm industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The compact C-arm market growth is driven by an increase in preference for minimally invasive procedures (MIPs) across various medical specialties and a rise in prevalence of chronic diseases, such as cardiovascular diseases and orthopedic conditions. Unlike traditional open surgeries, MIPs offer several advantages, including smaller incisions, reduced risk of infection, shorter hospital stays, and faster recovery times for patients. Compact C-Arms facilitate real-time imaging guidance during these procedures, allowing surgeons to navigate complex anatomical structures more accurately and effectively. Procedures such as fracture fixation, joint arthroplasty, and spine surgeries often require intraoperative imaging to verify implant placement, alignment, and overall surgical outcomes. Compact C-Arms provide orthopedic surgeons with high-resolution images in a compact form factor, making them suitable for use in operating rooms with limited space.

In addition, the rise in prevalence of orthopedic injuries and trauma cases continues led to growing need for advanced diagnostic imaging tools that can support accurate diagnosis and treatment planning for orthopedic and trauma patients which drives the demand for compact C-arms solutions. Compact C-Arms are increasingly being deployed in emergency departments, trauma centers, and orthopedic clinics to facilitate rapid assessment and timely interventions. These systems enable healthcare providers to obtain immediate imaging results, which is crucial in critical care settings where quick decision-making can significantly impact patient outcomes therevy drives the growth during compact C-arm market forecast period.

However, the high initial costs associated with acquiring and maintaining these advanced imaging systems can deter adoption of compact C-arms, especially among smaller healthcare facilities which may restrain the market growth. In addition, regulatory challenges and compliance requirements pose barriers, impacting the speed of market entry and product approvals, limiting compact C-arm market size.

Moreover, the advancements in imaging technology, such as higher resolution and real-time imaging capabilities, enhance their appeal for orthopedic and vascular procedures which provides compact C-arm market opportunity. In addition, growing healthcare infrastructure in emerging markets provides new avenues for market expansion. Innovations in software integration, including AI and machine learning applications for image analysis, could differentiate products and attract tech-savvy healthcare providers. Further, rising healthcare expenditure and supportive government initiatives aimed at enhancing medical infrastructure further bolster market growth.

Parent market overview

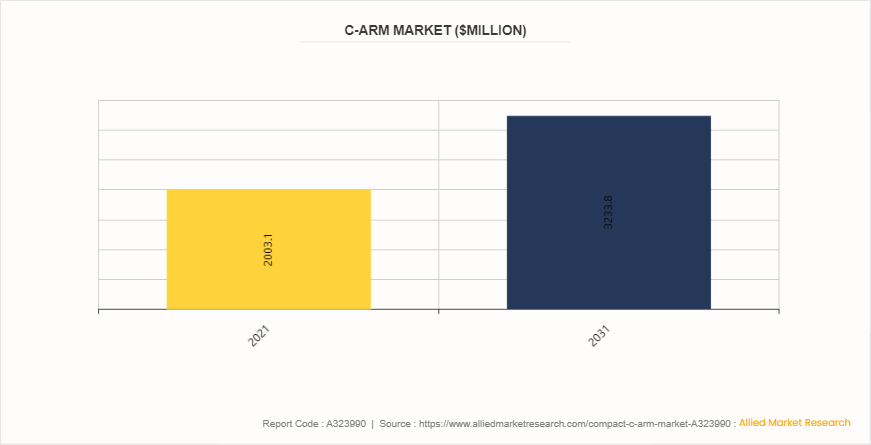

The parent market for the compact C-arm market is the C-Arm market, which encompasses all types of C-Arm imaging systems utilized across various medical specialties. The global c-arm market was valued at $2, 003.12 million in 2021, and is projected to reach $3, 233.76 million by 2031, registering a CAGR of 4.9% from 2022 to 2031. C-arm systems are essential in providing real-time imaging during surgical, diagnostic, and interventional procedures, offering clinicians detailed views of internal structures with minimal invasion. The C-Arms systems come in different sizes including mMini C-Arms, compact C-Arms, and full-Size C-arms. Within this framework, the compact C-Arm market specifically focuses on smaller, more portable iterations of these systems. These compact devices are particularly advantageous in environments where space is limited or mobility is essential, such as outpatient clinics, ambulatory surgical centers, and emergency rooms. They are designed to provide high-quality imaging capabilities comparable to larger C-Arm systems but with added flexibility and ease of use. Key factors propelling the growth of the compact C-arm market include advancements in imaging technology, rising prevalence of chronic diseases requiring surgical interventions, and the push towards healthcare efficiency and patient comfort. As healthcare facilities seek versatile solutions that enhance diagnostic accuracy and procedural efficacy, the demand for compact C-Arm systems is expected to rise in the coming years.

Market Segmentation

The compact C-arm market is segmented into technology, application, end user, and region. On the basis of the technology, the market is bifurcated into fluoroscopy systems and flat detector systems. By application, the market is classified into pain management, gastroenterology, neurology, orthopedic and trauma, and others. By end user, the market is divided into hospitals, diagnostic centers, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America leads with a significant compact C-arm market share, driven by advanced healthcare systems and high adoption rates of innovative medical technologies. In addition, increasing demand for minimally invasive procedures and supportive healthcare policies further supports the market growth in this region. The Asia-Pacific region, particularly countries such as China and India, offers significant opportunities due to expanding healthcare infrastructure and rising prevalence of chronic diseases. In addition, growing healthcare facilities and increased investments in medical technology further propels the market growth.

Industry Trends

According to the Ministry of Chemicals and Fertilizers, the Union Cabinet approved the National Medical Devices Policy, 2023, which aims to accelerate the growth of the medical devices sector and help it grow from the current $11 billion to $50 billion by 2030. The policy aims to achieve a 10-12% share in the global medical devices market over the next 25 years. This policy will foster innovation, manufacturing, and export of medical devices, including compact C-arms thereby supporting the market growth.

Competitive Landscape

The major players operating in the compact C-arm market include Allengers, FUJIFILM Corporation, Ziehm Imaging GmbH, Siemens, GE HealthCare, ALMAX IMAGING srl, Koninklijke Philips N.V., Nanjing Perlove Medical Equipment Co., Ltd., Shimadzu Corporation, and Xindray Medical International Co., Ltd.??

Recent Key Strategies and Developments in Compact C-Arm Industry

In November 2023, Ziehm Imaging, the innovation leader for mobile C-arms, is expanding its product line of Ziehm Solo FD. These versatile all-in-one mobile C-arms represent the most compact systems for even the smallest treatment scenarios, eliminating the need for a separate monitor cart.

?In July 2022, FUJIFILM Healthcare Americas Corporation, ?a leading provider of diagnostic and enterprise imaging solutions announced the U.S. launch of the?FDR Cross, ?an innovative hybrid c-arm and portable x-ray solution built for hospitals and ambulatory surgery centers (ASC) .?

In February 2019, Koninklijke Philips N.V., a global leader in health technology announced the launch of Philips?Zenition, its new mobile C-arm imaging platform.

Key Sources Referred

- National Center for Biotechnology and Information (NCBI)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- Australian Government Department of Health and Aged Care

- Government of Canada's Health and Wellness

- Ministry of Health and Family Welfare (MoHFW)

- National Health Mission (NHM)

- Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- World Health Organization (WHO)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the compact c-arm market analysis from 2024 to 2033 to identify the prevailing compact c-arm market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the compact c-arm market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global compact c-arm market trends, key players, market segments, application areas, and market growth strategies.

Compact C-Arm Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 714.1 Million |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 228 |

| By Technology |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Allengers , FUJIFILM Corporation, Koninklijke Philips N.V., ALMAX IMAGING srl, GE HealthCare, Nanjing Perlove Medical Equipment Co., Ltd. , Shimadzu Corporation, Ziehm Imaging GmbH, Siemens , Xindray Medical International Co., Ltd. |

The total market value of compact C-arm market is $409.8 million in 2023.

The market value of compact C-arm market in 2033 is $714.1 million.

The forecast period for compact C-arm market is 2024 to 2033.

The market growth is driven by the increasing demand for minimally invasive surgical procedures, advancements in imaging technology, improved image quality, and the portability of compact C-arms, which enhance their usability in various clinical settings.

Key trends include advancements in imaging technology for improved resolution and functionality, increased adoption of compact C-arms in outpatient settings, and the development of m

A compact C-arm is a portable medical imaging device used primarily for intraoperative imaging during minimally invasive procedures. It provides real-time X-ray imaging to guide surgical procedures with high precision.

Loading Table Of Content...