Composites In Oil & Gas Industry Market Research, 2033

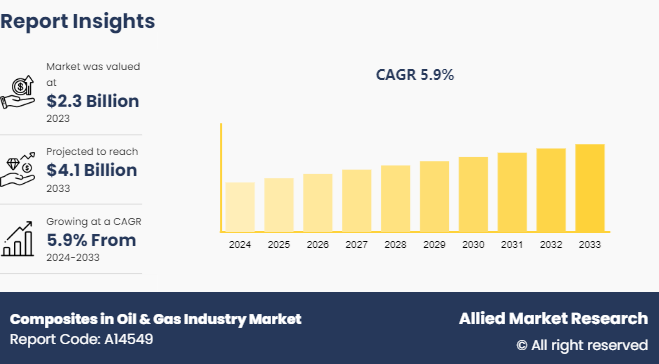

The global composites in oil & gas industry market was valued at $2.3 billion in 2023, and is projected to reach $4.1 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

Market Introduction and Definition

Composites in the oil and gas industry refer to engineered materials made from two or more constituent materials with differing physical or chemical properties. When combined, these materials create a composite with enhanced characteristics that are distinct from the individual components. Typically, composites used in this industry consist of a matrix often a polymer resin and a reinforcement such as fibers made of glass, carbon, or aramid. These composites offer a superior combination of strength, weight, durability, and resistance to corrosion, which are critical attributes in the challenging environments typical of oil and gas operations.

Key Takeaways

The composites in oil & gas industry market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

More than 1,350 product literatures, industry releases, annual reports, and other such documents of major composites in oil & gas industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The rising adoption of advanced technologies is driving robust demand for composites in the oil & gas industry. As exploration and production techniques advance, there's a growing need for materials capable of withstanding extreme conditions, enhancing operational efficiency, and ensuring safety. Composites, renowned for their unique properties, are increasingly preferred across various applications in this sector. According to India Brand Equity Foundation oil demand in India is projected to register a 2x growth to reach 11 million barrels per day by 2045. In addition, the evolution of drilling technologies demands more sophisticated materials. Composites are now pivotal in drill pipes, casings, and production tubing, owing to their resilience against high stresses and corrosive drilling fluids. This durability translates into extended service life and reduced downtime, crucial for maintaining profitability and safety in drilling operations. All these factors are expected to drive the demand for composites in oil & gas industry market.

However, the oil & gas industry imposes rigorous demands on materials due to its harsh operational conditions, such as high pressures, corrosive fluids, and wide temperature fluctuations. Although composites offer compelling benefits such as corrosion resistance, reduced weight, and versatile design options, their widespread adoption in this sector is impeded by significant challenges. A prominent issue is the risk of delamination and material failure, where layers of composite materials separate, compromising structural integrity. This risk is amplified in oil & gas applications due to cyclic loading, thermal cycling, and exposure to aggressive chemicals. Delamination often arises from insufficient bonding between layers, manufacturing defects, or flaws that develop during service, underscoring the need for robust material solutions and meticulous quality control in these demanding environments. All these factors are expected to hamper the growth of composites in oil & gas industry market.

Composite coatings present significant opportunities in the oil & gas industry, particularly for enhancing the durability, efficiency, and safety of tanks and pipes used in various operations. These coatings, typically made from advanced composite materials, offer superior corrosion resistance compared to traditional coatings such as paint or metal. In harsh environments such as offshore platforms or pipelines, where exposure to corrosive substances and extreme weather conditions is common, composite coatings significantly extend the lifespan of equipment. In addition, composite coatings contribute to reducing maintenance costs and downtime by minimizing the need for frequent inspections and repairs. Their lightweight nature also facilitates easier handling and installation, that makes them ideal for applications in remote or difficult to access locations. In addition to corrosion resistance, composite coatings provide excellent thermal insulation properties, protecting tanks and pipes from temperature fluctuations and reducing energy consumption in heating or cooling processes. All these factors are anticipated to offer new growth opportunities for the composites in oil & gas industry market during the forecast period.

Historical Oil Price Change

The fluctuating crude oil prices from 2018 to 2023 have had a significant impact on the composites market in the oil and gas industry. The initial decline in prices in 2020, driven by reduced demand and global economic disruptions, led to decreased investments in new oil and gas projects, which, in turn, slowed the demand for composites used in exploration and production. However, the subsequent recovery and peak in 2022 boosted industry confidence and investment in infrastructure, increasing the demand for high-performance composite materials known for their durability and resistance to harsh environments. Despite the slight decrease in prices in 2023, the overall trend of increased investment from 2021 to 2022 has likely solidified the composites market's growth, as these materials are essential for improving efficiency and reducing maintenance costs in oil and gas operations.

Market Segmentation

The composites in oil & gas industry market is segmented by type, application, and region. Based on type, the market is classified into glass fiber, carbon fiber, and others. By resin type, the market is classified into epoxy resin, polyester resin, phenolic resins, and others. By application, the market is divided into topside tanks, pressure vessels, pipes, offshore drilling and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The North America region has a robust presence of oil and gas exploration and production activities, such as shale gas and tight oil extraction, which often require advanced materials like composites for their durability and performance in harsh environments. In addition, stringent regulatory requirements in North America regarding environmental impact and safety drive the adoption of composites, which offer superior corrosion resistance and structural integrity compared to traditional materials. Moreover, the region's focus on optimizing operational efficiency and reducing lifecycle costs further supports the demand for composites in various applications within the oil & gas sector. All these factors are expected to drive demand for composites due to rigorous environmental regulations and the need for durable, efficient materials in challenging operational environments, boosting adoption and composites in oil & gas industry market growth.

Competitive Landscape

The major players operating in the composites in oil & gas industry market include NOV Inc, Baker Hughes Company, Toray Advanced Composites, Syensqo, Trelleborg Group., Hexagon Composites ASA, Prysmian Group, Enduro, BASF SE, Teijin Carbon Europe GmbH.

Industry Trends

In May 2022, the government's approval to advance the target for 20% ethanol blending with petroleum to 2025-26 from 2030 will have notable implications for the oil and gas industry, particularly concerning the use of composites. As the industry adapts to increased ethanol blending, there will be a growing demand for materials that can withstand the chemical interactions between ethanol and petroleum. Composites, with their superior corrosion resistance and durability, will become essential in the construction and maintenance of storage tanks, pipelines, and other infrastructure.

According to the IEA (India Energy Outlook 2021) , primary energy demand is expected to nearly double to 1, 123 million tons of oil equivalent, as India's gross domestic product (GDP) is expected to increase to US$ 8.6 trillion by 2040. This surge in energy demand will significantly impact the oil and gas industry, driving the need for advanced materials such as composites.

India’s oil and gas production is expected to achieve a mid-decade peak between 2023-2032, around 2027, driven by the KG-Basin projects operated by Reliance Industries Limited and Oil and Natural Gas Corporation (ONGC) .

Key Sources Referred

Invest India

International Renewable Energy Agency (IREA)

India brand Equity foundation (IBEF)

American Petroleum Institute

International Energy Agency (IEA)

The Essential Chemical Industry

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the composites in oil & gas industry market analysis from 2024 to 2033 to identify the prevailing composites in oil & gas industry market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the composites in oil & gas industry market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global composites in oil & gas industry market trends, key players, market segments, application areas, and market growth strategies.

Composites in Oil & Gas Industry Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.1 Billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Type |

|

| By Resin Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Syensqo, Trelleborg Group., NOV Inc, Prysmian Group, Toray Advanced Composites, Baker Hughes Company, Hexagon Composites ASA, Teijin Carbon Europe GmbH., Enduro, BASF SE |

Demand for lightweight materials, design flexibility requirements are the upcoming trends of Composites in Oil & Gas Industry Market in the world.

Pipes is the leading application of Composites in Oil & Gas Industry Market

North America is the largest regional market for Composites in Oil & Gas Industry

$4.1 billion is the estimated industry size of Composites in Oil & Gas Industry, by 2033

NOV Inc, Baker Hughes Company, Toray Advanced Composites, Syensqo, Trelleborg Group., Hexagon Composites ASA, Prysmian Group, Enduro, BASF SE, Teijin Carbon Europe GmbH are the top companies to hold the market share in Composites in Oil & Gas Industry.

Loading Table Of Content...