Composites In Passenger Rail Market Research, 2033

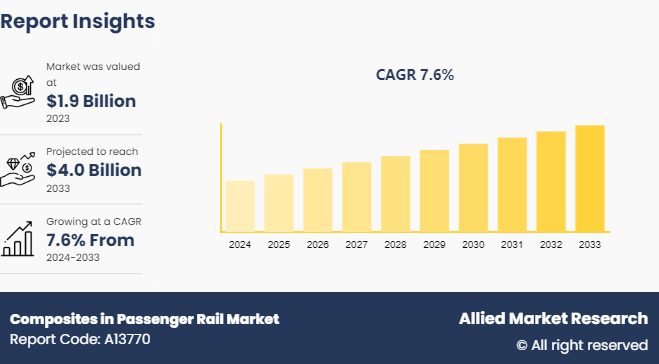

The global composites in passenger rail market was valued at $1.9 billion in 2023, and is projected to reach $4.0 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033.

Market Introduction and Definition

Composites in the passenger rail market refer to materials made from two or more distinct components, typically including a matrix such as resin and reinforcement fibers such as carbon or glass, designed to enhance the performance, durability, and efficiency of rail components. These materials are increasingly utilized in the manufacture of passenger railcars due to their lightweight nature, which helps reduce overall train weight and energy consumption. In addition, composites offer superior strength-to-weight ratios compared to traditional materials such as steel, contributing to improved fuel efficiency and reduced emissions.

Key Takeaways

The composites in passenger rail market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

More than 1,800 product literatures, industry releases, annual reports, and other such documents of major composites in passenger rail industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The increase in lightweighting for improved efficiency is a significant driver behind the growing demand for composites in the passenger rail market. Rail operators and manufacturers are increasingly focusing on reducing the weight of rail vehicles to achieve several key benefits such as composites enable rail vehicles to consume less energy during operation. This reduction in weight translates directly into lower energy consumption and operational costs, making rail travel more cost-effective and environmentally sustainable. As governments and rail operators worldwide push for greener transportation solutions, lightweighting through composites aligns with stringent energy efficiency regulations and emission reduction targets. In addition, lightweight composites contribute to enhanced performance characteristics of rail vehicles. They improve acceleration, braking, and overall maneuverability, providing a smoother and more comfortable ride for passengers. Reduced vehicle weight also extends the lifespan of components such as brakes and suspension systems, leading to lower maintenance costs and improved reliability of rail services. All these factors are expected to drive the demand for the composites in passenger rail market during the forecast period.

However, maintenance and repair complexity present significant challenges that hamper the widespread adoption of composites in the passenger rail market. While composites offer numerous benefits such as lightweighting, durability, and design flexibility, their integration into rail vehicles comes with distinct challenges related to maintenance and repair processes. In addition, the primary concern is the specialized expertise and equipment required for the maintenance of composite materials. As compared to traditional materials such as steel or aluminum, composites often require specific knowledge and techniques for inspection, repair, and replacement. This specialized skill set leads to higher training costs for maintenance personnel and longer downtimes for repairs, impacting operational efficiency and service reliability. All these factors are expected to hamper the growth of the composites in passenger rail market during the forecast period.

Rail operators are increasingly prioritizing the satisfaction and experience of passengers, aiming to attract more travelers and improve overall service quality. Composites play a pivotal role in achieving these goals through several key aspects that enhance passenger comfort. Composites offer superior vibration damping capabilities compared to traditional materials such as steel or aluminum. By reducing the transmission of vibrations and noise from the track and surroundings into the passenger cabin, composites contribute to a quieter and more pleasant traveling environment. This noise reduction enhances the overall comfort of passengers, reducing fatigue and enhancing the perceived quality of rail travel. All these factors are anticipated to offer new growth opportunities for the composites in passenger rail market during the forecast period.

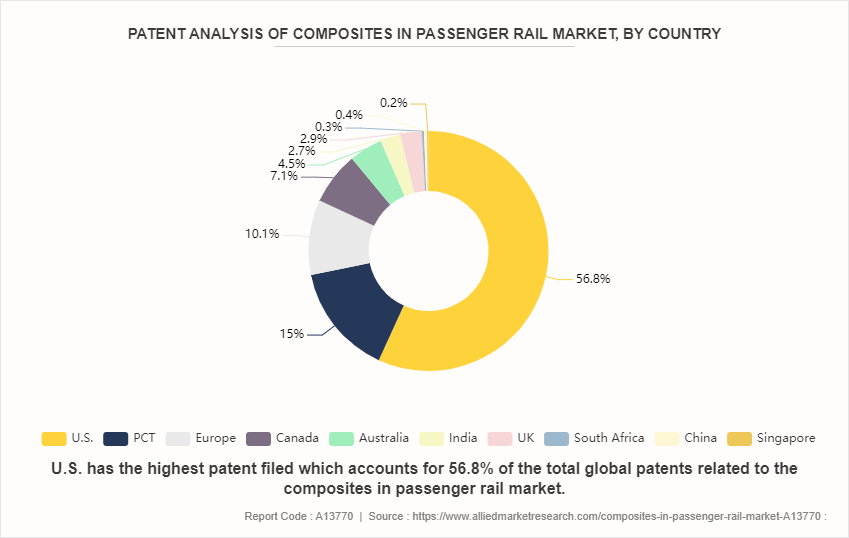

Global Composites In Passenger Rail Market - Patent Outlook, by Country

The U.S. collectively hold more than half of the total composites in passenger rail patents that indicate strong innovation and investment in this technology in U.S. countries. This suggests fierce competition and a significant focus on composites in passenger rail R&D in these leading economies. U.S. has the highest patent filed those accounts for 56.8% of the total global patents related to the composites in passenger rail market. Europe and PCT, although holding smaller percentages of composites in passenger rail patents individually, collectively contribute to the overall Asian dominance in composites in passenger rail innovation. This reflects the region's strong presence in materials science and engineering R&D.

Market Segmentation

The composites in passenger rail market is segmented into type, resin type, application, and region. By type, the market is classified into carbon fiber, glass fiber, and others. By resin type, the market is classified into epoxy resin, polyester, phenolic, vinyl ester, and others. By application, the market is divided into exterior and interior. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

In the Asia-Pacific region, particularly in countries such as China, India, and Japan, rapid population growth and urbanization fuel surge in demand for enhanced connectivity and expanded rail networks. These nations are experiencing robust economic expansion and urban migration, spurring a greater need for efficient transportation solutions, notably rail travel. China, for instance, is prioritizing the advancement of core technologies and application-oriented innovations this year, with a particular focus on developing a new generation of high-speed trains capable of speeds up to 450 kilometers per hour and integrating intelligent high-speed rail technologies. By 2035, China plans to expand its railway network to 200, 000 kilometers, including approximately 70, 000 kilometers of high-speed lines, including inter-city routes. As China advances its rail infrastructure to meet the demands of urbanization and connectivity, the adoption of composite materials is expected to grow, fostering innovation and efficiency within the passenger rail sector.

Competitive Landscape

The major players operating in the composites in passenger rail market include Hexcel Corporation, Solvay S.A., Toray Industries, Inc., Kawasaki Heavy Industries Ltd, TEIJIN LIMITED, Owens Corning, BASF SE, Mitsubishi Rayon Co., Ltd., SGL Carbon, ZOLTEK Corporation, and Others.

Innovations and Ambitions

Traction systems: It develops new traction components and subsystems using mainly silicon carbide technologies which lead to new architectures. The work will produce TDs including a traction system based on independently rotating wheels to implement into a Metro, a regional train and a High-Speed Train.

Train control and monitoring system: Development of a new-generation TCMS will allow current bottlenecks caused by physically coupled trains to be overcome. The new drive-by-data concept for train control, along with wireless information transmission, aims to make new control functions possible it involves interaction between vehicles and consists, with high safety and reliability levels, through very simple physical architectures.

The new generation of car body shells: It is using composite or other lightweight materials will be a step change in the sector, leading to significantly lighter vehicles that carry more passengers within the same axle load constraints, use less energy and have a reduced impact on rail infrastructure.

Running gear: It develops innovative combinations of new architectural concepts, new actuators in new lighter materials leading to new functionalities, and significantly improved performance levels with the possibility of vibration energy recovery. A mechatronic bogie able to steer through points and crossings will open huge possibilities for a new design philosophy in collaboration with IP3.

New braking systems: New braking system with higher brake rates and lower noise emissions will provide major capacity gains in terms of mass and volume in bogies, paving the way for a fresh revisit of bogie design. When these are combined with traction innovations, the next generation of passenger rolling stock will be able to offer improvements in acceleration and deceleration rates, leading to greater overall line capacity for trains.

Innovative doors: It aims to move away from current access solutions based on honeycomb and aluminum or steel sheets their drawbacks relate to energy consumption, and noise and thermal transmission. New lightweight composite structures could be made to react faster at existing safety and reliability levels, reducing platform dwell times and increasing overall line capacity. Customer-friendly information systems and improved access for people with reduced mobility using sensitive edges and light curtains are part of this new development.

Train modularity in use: It will develop new modular concepts for train interiors that allow operators to adapt the vehicle layout to the actual usage conditions, and will improve passenger flows, thus optimizing both the capacity of the vehicle and dwell times.

Heating, Ventilation, Air conditioning and Cooling (HVAC) systems: It helps limit the climatic impact from these systems within rail vehicles by helping develop systems using natural refrigerants such as air or CO2. These HVAC units will be ready for application within new trains and for the refurbishment of existing ones. The work is expected to also focus on activities for the pre-standardization of mechanical, electrical, and control interfaces of HVAC units as well as on fundamental work on alternative refrigerants.

Industry Trends

According to India Brand equity foundation, the government has laid an ambitious target to allocate US$ 1.4 trillion between 2019 and 2023, including investment to the tune of US$ 750 billion on the railway infrastructure by 2030.

According to the national plan, by 2035, the railway network in China will reach 200, 000 km, with about 70, 000 km of high-speed lines, including some high-speed inter-city railways. the scale of China's rail expansion plan is likely to spur innovation and investment in composite materials specifically designed for high-speed applications, further driving growth of composites in passenger rail market.

The Indian railways' plan to export 'made in India' semi-high speed 'Vande Bharat' trains to European, South American, and East Asian markets by 2025-26 could significantly impact the composites in the passenger rail market. These trains are known for their lightweight construction and aerodynamic design, utilizing advanced composite materials extensively. As Indian Railways expands its export reach, there will likely be a growing demand for high-performance composites in the global passenger rail sector.

Key Sources Referred

Invest India

International Renewable Energy Agency (IREA)

India brand Equity foundation (IBEF)

International Energy Agency

Asian Development Bank

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the composites in passenger rail market analysis from 2024 to 2033 to identify the prevailing composites in passenger rail market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the composites in passenger rail market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global composites in passenger rail market trends, key players, market segments, application areas, and market growth strategies.

Composites in Passenger Rail Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.0 Billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Type |

|

| By Resin Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | ZOLTEK Corporation, Owens Corning, Hexcel Corporation, TEIJIN LIMITED, SGL Carbon, Kawasaki Heavy Industries Ltd, Mitsubishi Rayon Co., Ltd., Solvay S.A., Toray Industries, Inc., BASF SE |

Increased demand for lightweight materials, growing adoption of sustainable and recyclable composites are the upcoming trends of Composites in Passenger Rail Market in the world.

Interior is the leading application of Composites in Passenger Rail Market.

Asia-Pacific is the largest regional market for Composites in Passenger Rail

$4.0 Billion is the estimated industry size of Composites in Passenger Rail by 2033.

Hexcel Corporation, Solvay S.A., Toray Industries, Inc., Kawasaki Heavy Industries Ltd, TEIJIN LIMITED, Owens Corning, BASF SE, Mitsubishi Rayon Co., Ltd., SGL Carbon, ZOLTEK Corporation are the top companies to hold the market share in Composites in Passenger Rail.

Loading Table Of Content...