Construction Additives Market Research, 2033

The global construction additives market was valued at $34.5 billion in 2023, and is projected to reach $64.5 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033. Rapid urbanization, increase in investments in smart cities, and large-scale commercial and residential construction activities are driving the need for durable, energy-efficient, and sustainable building solutions. In addition, the emphasis on green buildings and stringent environmental regulations are pushing the adoption of advanced additives that reduce carbon emissions and improve structural longevity.

Introduction

Construction additives are chemical or natural substances added to construction materials, such as concrete, mortar, or cement, to enhance their properties and performance. These additives are designed to improve strength, workability, durability of construction materials such as concrete, mortar, or cement and provide resistance to environmental conditions or specific challenges such as water infiltration, heat, or chemical exposure. Common types of construction additives include plasticizers, superplasticizers, accelerators, retarders, air-entraining agents, and waterproofing agents, each tailored to meet specific requirements of construction projects.

Key Takeaways

- The global construction additives market has been analyzed in terms of value ($Billion). The analysis in the report is provided on the basis of type, end use, 4 major regions, and more than 15 countries.

- The global construction additives market report includes a detailed study covering underlying factors influencing industry opportunities and trends.

- The construction additives market is fragmented in nature with few players such as BASF, UltraTech Cement Ltd., Tolsa, Sika AG, Saint-Gobain, MAPEI S.p.A., Pidilite Industries Limited, Ashland, Dow, and Bostik.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the industry.

- Countries such as China, the U.S., India, Germany, and Brazil, hold a significant share in the global construction additives market.

Market Dynamics

The rapid growth in infrastructure development projects across the globe has significantly fueled the demand for construction additives. According to the India Brand Equity Foundation, India has to enhance its infrastructure to reach its 2025 economic growth target of $5 trillion. Urbanization, population growth, and economic expansion are driving governments and private sectors to invest heavily in large-scale infrastructure projects such as roads, bridges, airports, railways, and commercial complexes. These projects require advanced construction materials with enhanced performance characteristics that make construction additives indispensable. In addition, the emphasis on sustainable construction has contributed to the increased adoption of additives. All these factors are expected to drive the demand for construction additives during the forecast period.

However, construction additives, which are crucial for improving the properties of concrete and other building materials, rely on a wide range of raw materials such as chemicals, polymers, and minerals. The price volatility of these materials directly impacts the cost structure of construction additives, leading to price instability for manufacturers and end-users alike. Moreover, supply chain disruptions, geopolitical tensions, and natural disasters impact price fluctuations, which is more challenging for companies to secure a consistent supply of essential raw materials. All these factors hamper construction additives market growth.

Increase in demand for low-carbon alternatives in construction materials, driven by regulatory pressures and rise in consumer awareness creates opportunities for the construction additives market growth. According to the World Resource Institute, India aims to reduce the emissions intensity of its economy by 45% by 2030, compared to 2005 levels, and to achieve net-zero emissions by 2070. Construction additives enable manufacturers to produce materials with lower carbon footprints, such as low-emission concrete, which is crucial for meeting global sustainability targets. Surge in demand for these types of materials creates new market opportunities for construction additive suppliers, allowing them to align their product offerings with the broader industry shift toward sustainability.

Segments Overview

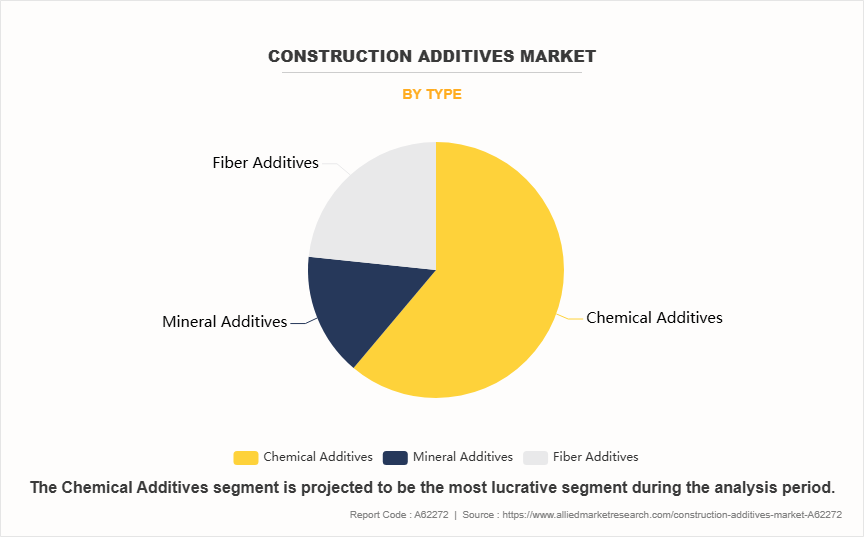

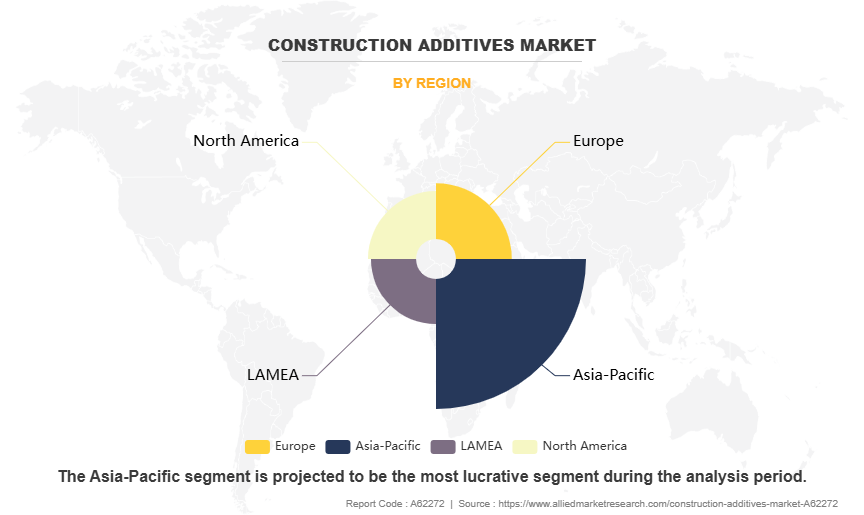

The construction additives market is segmented into type, end use, and region. On the basis of type, the market is classified into chemical additives, mineral additives, and fiber additives. On the basis of end use, the market is divided into residential, industrial, infrastructure, and commercial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the market is classified into chemical additives, mineral additives, and fiber additives. The chemical additives segment accounted for more than three-fifths of the construction additives market share in 2023 and is expected to maintain its dominance during the forecast period. The rapid technological advancements in additive manufacturing and the rise of nanotechnology drive the demand for chemical additives. In sectors such as electronics and biotechnology, the development of more sophisticated additives leads to improved performance and smaller, more precise applications. For instance, in the electronics industry, chemical additives are used to enhance the conductivity, flexibility, and longevity of components, which are essential for the development of advanced consumer electronics.

On the basis of end use, the market is segmented into residential, industrial, infrastructure, and commercial. The residential segment accounted for less than half of the construction additives market share in 2023 and is expected to maintain its dominance during the forecast period. The growing trend of smart homes and the adoption of advanced technologies in residential buildings drive the demand for construction additives. As the focus shifts toward incorporating technology into residential construction, additives improve the performance of high-tech building materials or integrate seamlessly with energy-efficient systems. All these factors drive the growth and development of the construction additives market in the residential sector.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region accounted for less than half of the construction additives market share in 2023 and is expected to maintain its dominance during the forecast period. Countries such as China &India, and Southeast Asian nations have witnessed a construction boom, with large-scale infrastructure projects, residential complexes, and commercial buildings being developed to cater to the growing population and expanding economies. These projects require high-performance construction materials, which is where additives come in, enhancing the quality, durability, and sustainability of the building materials used. Furthermore, advancements in construction technology and innovation are playing a critical role in driving the adoption of construction additives in Asis-Pacific.

Technology Trend Analysis

The construction additives market is experiencing rapid technological advancements, driven by the need for enhanced performance, sustainability, and efficiency in modern construction. Innovations in nanotechnology are leading to the development of nano-additives that improve concrete strength, durability, and self-healing properties. In addition, bio-based and eco-friendly additives such as biodegradable plasticizers and low-VOC admixtures, are gaining traction as sustainability becomes a key industry focus.

Competitive Analysis

Key players in the construction additives market include BASF, UltraTech Cement Ltd., Tolsa, Sika AG, Saint-Gobain, MAPEI S.p.A., Pidilite Industries Limited, Ashland, Dow, and Bostik.

In the global construction additives market, companies have adopted expansion and acquisition strategies to expand the market or develop new products. For instance, in May 2024, BASF invested in the expansion of its additives plant in Nanjing. This new investment in the additives plant in Nanjing strengthened BASF’s local production footprint in China, which is the world’s largest and fastest growing chemical market. Moreover, in February 2024, Sika AG acquired Vinaldom, S.A.S in the Dominican Republic. This acquisition added a manufacturing facility in the Dominican Republic where Sika previously did not have its own plant. This is the sixth factory in the Caribbean, increasing Sika’s presence in the region.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the construction additives market analysis from 2023 to 2033 to identify the prevailing construction additives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the construction additives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global construction additives market trends, key players, market segments, application areas, and market growth strategies.

Construction Additives Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 64.5 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 346 |

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Ashland, Pidilite Industries Limited, Tolsa, Saint-Gobain, Bostik SA, UltraTech Cement Ltd., Dow Inc., Sika AG, BASF SE, MAPEI S.p.A. |

Analyst Review

According to the opinions of various CXOs of leading companies, construction additives are expected to witness an increase in demand during the forecast period. Growth in number of infrastructure development projects and surge in demand for high-performance building materials are expected to increase the demand for construction additives during the forecast period. As cities expand and modernize, there is a growing need for durable, sustainable, and efficient materials that withstand the challenges posed by heavy traffic, extreme weather, and the general wear and tear of urban environments. Construction additives such as plasticizers, accelerators, retarders, and other specialty chemicals, are integral to improving the performance of construction materials that makes them more resistant to stress, weathering, and aging. These additives help enhance the properties of cement, concrete, and other building materials that allow them to meet the specific demands of large-scale infrastructure projects, such as highways, bridges, tunnels, and airports.

Moreover, the surge in demand for high-performance building materials fuels the growth of the construction additives market. As the focus of the construction industry shifts toward more energy-efficient, sustainable, and high-quality buildings, the need for advanced materials that offer improved strength, durability, and thermal properties become increasingly important. Construction additives enable the development of materials that are stronger and more adaptable to varying environmental conditions. For instance, additives are used to create self-healing concrete, which repairs cracks over time, or to improve the insulation properties of building materials that contribute to energy efficiency and lowering long-term operating costs.

The construction additives market was valued at $34.5 billion in 2023, and is estimated to reach $64.5 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

Asia-Pacific is the largest regional market for construction additives.

Residential is the leading industry of construction additives market.

Increase in focus on sustainable construction practices are the upcoming trends of construction additives market in the globe.

Key players in the construction additives market include BASF, UltraTech Cement Ltd., Tolsa, Sika AG, Saint-Gobain, MAPEI S.p.A., Pidilite Industries Limited, Ashland, Dow, and Bostik.

Loading Table Of Content...

Loading Research Methodology...