Construction Paints And Coatings Market Research, 2033

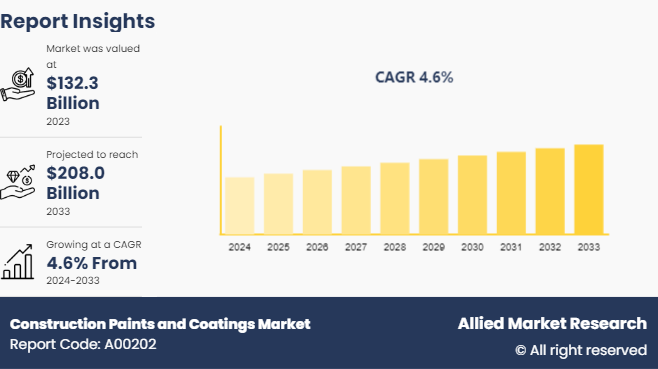

The global construction paints and coatings market was valued at $132.3 billion in 2023, and is projected to reach $208.0 billion by 2033, growing at a CAGR of 4.6% from 2024 to 2033.

Market Introduction and Definition

Construction paints and coatings are protective and decorative materials applied to buildings, infrastructure, and other construction surfaces. These products serve multiple purposes, including protecting surfaces from environmental damage (such as UV rays, moisture, and corrosion) , enhancing durability, and improving aesthetics. They are used on various materials, including concrete, steel, wood, and masonry, and come in different types, such as primers, sealants, and topcoats. Construction paints and coatings are essential in both residential and commercial construction for maintaining the structural integrity and appearance of buildings. Advances in technology have also led to the development of specialized coatings with additional properties, such as fire resistance, thermal insulation, and antimicrobial protection.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence, and key strategic developments by prominent manufacturers.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global construction paints and coatings such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3, 300 construction paints and coatings-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global construction paints and coatings market.

Key Market Dynamics

Urbanization is a significant driver of the construction paints and coatings market. In India, urbanization is occurring at an unprecedented rate. According to a report published by the Indian Ministry of Housing and Urban Affairs in 2023, the urban population in India is expected to grow from 377 million in 2011 to 600 million by 2031. This rapid urbanization necessitates the development of new residential, commercial, and infrastructural projects, all of which drive the demand for construction paints and coatings. The Government of India has launched several initiatives to support infrastructure development, such as the Smart Cities Mission, which aims to create 100 smart cities across the country. The budget for this mission is $13 billion. In addition, the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) scheme that focuses on improving urban infrastructure in 500 cities. These initiatives have a direct impact on the construction sector, increasing the demand for high-quality paints and coatings that provide durability, aesthetic appeal, and environmental protection.

Furthermore, government policies and regulations play a crucial role in shaping the construction paints and coatings market. The Indian government has implemented various policies aimed at promoting sustainable and energy-efficient construction practices. For instance, the Energy Conservation Building Code (ECBC) mandates the use of energy-efficient materials in building construction, including paints and coatings that enhance thermal insulation and reduce energy consumption.

The introduction of the Goods and Services Tax (GST) also streamlined the taxation system, making it easier for businesses in the construction sector to operate. The GST rate for paints and varnishes was set at 18%, which is lower than the previous tax rates under the Value Added Tax (VAT) regime. This reduction in tax burden has made construction paints and coatings more affordable, thereby boosting their demand in the market. Moreover, the government's focus on promoting "Make in India" and "Vocal for Local" campaigns has encouraged domestic production of paints and coatings, reducing dependency on imports and fostering innovation in the industry. This, in turn, has contributed to the growth of the market by making quality products more accessible to consumers.

However, the construction paints and coatings market is increasingly constrained by stringent environmental regulations aimed at reducing the environmental impact of chemical products. In India, regulatory bodies such as the Central Pollution Control Board (CPCB) and the Ministry of Environment, Forest and Climate Change (MoEFCC) have imposed strict guidelines on the production, use, and disposal of paints and coatings, especially concerning volatile organic compounds (VOCs) and other hazardous substances. For instance, the Central Pollution Control Board (CPCB) has implemented regulations limiting the VOC content in paints to reduce air pollution and health risks. These regulations require manufacturers to invest in the development of low-VOC or VOC-free products, which often involves higher production costs. Compliance with such regulations can be particularly challenging for smaller companies with limited R&D capabilities and financial resources.

In addition, the government’s push towards a circular economy and sustainable practices necessitates significant changes in production processes, including waste management and the use of eco-friendly raw materials. These changes, while beneficial in the long term, present short-term challenges and increase operational costs, thereby restraining market growth.

On the contrary, technological advancements in the paints and coatings industry are opening new avenues for growth. Innovations such as nanotechnology, self-cleaning coatings, and antimicrobial paints are gaining traction, driven by the need for high-performance products that meet the evolving demands of the construction sector. The Indian government's support for research and development (R&D) in the chemical and materials sectors further enhances this opportunity. The Department of Science and Technology (DST) has been funding R&D initiatives aimed at developing new materials and technologies, including those relevant to the paints and coatings industry. This support fosters innovation, allowing companies to create products that offer enhanced durability, protection, and aesthetic qualities. For instance, nano coatings provide superior protection against environmental factors like UV radiation and moisture, making them ideal for use in both residential and commercial construction. Antimicrobial paints, which inhibit the growth of bacteria and mold, are becoming increasingly popular in hospitals, schools, and other public spaces. These innovations not only meet the growing demand for high-performance products but also enable companies to enter new market segments and increase their competitiveness.

Parent Market Analysis

Parent Market Name | Global Paints and Coatings Market |

Market Value in 2021 | $175.8 billion |

Drivers | Increasing demand from aerospace sector, rising demand from automotive sector, and escalating demand from building and construction sector |

Restraints | Environmental Constrains and volatility in prices |

Market Segmentation

The construction paints and coatings market is segmented on the basis by resin type, product type, application, and region. By resin type, the market is classified into epoxy, acrylic, polyurethane, and others. By product type, the market is classified into powder coatings, waterborne coatings, solvent-borne coatings, and others. Based on application, the market is segmented into residential, commercial, and industrial. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The construction paints and coatings market in Asia-Pacific is driven by robust infrastructure development and rapid urbanization. Government initiatives like the National Infrastructure Pipeline (NIP) , which aims to develop infrastructure in India by 2025, and the Smart Cities Mission, focusing on the development of 100 smart cities, have significantly boosted demand for construction paints and coatings. These projects require advanced coatings for durability, weather resistance, and aesthetic appeal, driving growth in the market. In addition, the government’s push for affordable housing under the Pradhan Mantri Awas Yojana (PMAY) is further propelling the demand for paints and coatings, with over 20 million homes targeted for construction.

In addition, another major driver is the increasing emphasis on sustainability and environmental regulations. The Indian Green Building Council (IGBC) and the Bureau of Energy Efficiency (BEE) are promoting the use of eco-friendly and energy-efficient building materials, including low-VOC paints and coatings. This shift towards sustainable construction practices is creating a growing market for green paints and coatings, which are aligned with the government's environmental policies. The combination of infrastructure expansion and the rising demand for sustainable products is fueling significant growth in the construction paints and coatings market in India.

Competitive Landscape

The major players operating in the construction paints and coatings include Asian Paints Ltd, Kansai Paint Co., Ltd., Kwality Paints and Coatings Pvt. Ltd., Indigo Paints Ltd, Axalta Coating Systems, LLC, Nippon Paint Holdings Co., Ltd., Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, and RPM International Inc.

Industry Trends

- The major trend in the construction paints and coatings manufacturing industry is material innovation that includes the development of sustainable construction paints and coatings. This factor has led several key manufacturers to constantly develop sustainable construction paints and coatings without negatively impacting the environment. This factor may further augment the growth of the construction paints and coatings market during the forecast period.

- In addition, construction paints and coatings are in the limelight in the growing construction sector worldwide, as building’s appearance is becoming more important with customers wishing to tailor the aesthetics of their buildings based on modern theme architecture. With such rapid enhancement, there is a rapid surge in utilization of a wide range of construction paints and coatings used for enhancing the aesthetics and for protection purposes, creating space for construction paints and coatings market during the forecast period.

- Construction sector is the largest industry in the world, contributing to around 13% of the global GDP has undergone various technological evolvements such as emergence of bio-based paints and coatings for constructing modern-theme-based buildings. This factor may augment the utilization of sustainable construction paints and coatings in the growing building and construction sector during the forecast period.

Key Sources Referred

- The World Building Council

- American Building Association

- National Promotion and Facilitation Agency

- United States Bureau of Statistics

- U.S. Development Authority

- United States Environmental Protection Agency

- Invest In India

- Press Information Bureau

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the construction paints and coatings market analysis from 2024 to 2033 to identify the prevailing construction paints and coatings market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the construction paints and coatings market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global construction paints and coatings market trends, key players, market segments, application areas, and market growth strategies.

Construction Paints and Coatings Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 208.0 Billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 480 |

| By Resin Type |

|

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Asian Paints Ltd, RPM International Inc, Kwality Paints and Coatings Pvt. Ltd., Kansai Paint Co., Ltd., Indigo Paints Ltd, PPG Industries, Inc., Akzo Nobel N.V., The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, LLC |

Loading Table Of Content...