Contact Lenses Market Statistics, 2032

The global contact lenses market size was valued at $15.5 billion in 2022, and is projected to reach $24.2 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032. A contact lens is a thin, curved lens that is placed directly on the surface of the eye. It is usually made of a polymeric material and is typically prescribed by an ophthalmologist or optometrist to correct vision, or to help manage certain conditions of the cornea. Contact lenses are most commonly used to correct refractive errors, such as myopia (nearsightedness), hyperopia (farsightedness), and astigmatism. They can also be used to correct presbyopia, a condition that affects people over 40 and causes them to become increasingly farsighted, and to treat certain eye conditions, such as keratoconus, an eye disorder that causes the cornea to become increasingly curved. Contact lenses are typically prescribed based on the patient's visual needs and lifestyle. They are available in a variety of sizes, shapes, and material, including soft lenses, rigid gas permeable (RGP) lenses, and hybrid lenses.

Market Dynamics

Growth of the global contact lenses market size is majorly driven by rise in prevalence of eye disorder and increase in number of minimal invasive aesthetic procedures. Contact lenses can be used to treat a variety of vision impairments. For nearsightedness and farsightedness, contact lenses can be used to correct refractive errors, allowing the wearer to see clearly. For astigmatism, toric lenses may be prescribed to correct the shape of the cornea. For color blindness, there are special enhancer lenses that can help the wearer distinguish between colors. For age-related macular degeneration, special low-vision lenses can be used to magnify and enhance the wearer’s central vision.

For instance, in October 2022, according to World health Organization (WHO), it was also reported that around 8 million geriatric population over the globe is suffering from age-related macular degeneration. Thus, rise in geriatric population is attributed to drive the growth of the market.

Increase in number of development strategies such as product launch, and acquisition, by different contact lenses industry is anticipated to propel the market growth. For instance, in April 2021, Cooper Vision, global manufacturer of soft contact lenses, announced the acquisition of No7 Contact Lenses, which designs and manufactures specialty contact lenses distributed primarily in the UK. Moreover, in June 2020, Bausch + Lomb, a leading global eye health business of Bausch Health Companies Inc., announced that BAUSCH + LOMB ULTRA monthly silicone hydrogel contact lenses have received approval from the National Medical Products Administration in China. Thus, increase in product approval of contact lenses propel the growth of the market.

Rise in adoption of contact lenses for vision correction and cosmetic purpose and availability of different contact lenses such as polymethylmethacrylate (PMMA) lenses, gas-permeable lenses, and hybrid lenses are attributed to boost the growth of market.

On the other hand, side effect caused due to the use of contact lens such as inflammation, corneal edema, superficial keratitis, swollen eyes, excessive mucus production, epithelial microcysts, infiltrates, giant papillary conjunctivitis (GPC), and corneal vascularization hinder the growth of the market. According to Harvest Health Publishing, in August 2021, it was reported that, keratitis occurs in 2 to 20 per 10,000 contact lens wearers in U.S. The increase in number of adoptions of key strategies by major manufacturer, rise in product launch provides an opportunity for the contact lenses market growth.

The COVID-19 outbreak had a negative impact on the growth of the global contact lens market. Owing to the COVID-19 pandemic's effects, major market companies reported a drop in their revenues from the selling of lenses. For instance, Alcon, pharmaceutical and medical device company specialized in eye care products, reported decrease in revenue of 7% in contact lenses segment from 2019 to 2020. Moreover, the general public's preference for glasses over the contact lenses during the lockdown was blamed for the drop in revenues.

According to American Society of Plastic Surgeons, in 2020, it was reported that around cosmetic procedures decreased by 15% from 2019 to 2020 due to COVID-19 pandemic in the U.S. In addition, decrease in number of visits for aesthetic appearance to dermatology clinics, during pandemic hampered the growth of the market. Furthermore, facial rejuvenation procedures, such as contact lenses, are non-emergency aesthetic procedures that were postponed during the pandemic, which significantly hampered revenue of aesthetic companies. In addition, sudden sharp cut in monthly income of population had a negative impact on the market. Many contact lens wearers stopped wearing them to minimize the risk of the virus spreading from person to person. With the increased risk of infection associated with contact lens wear, many optometrists recommended that contact lens wearers switch to daily disposables or even switch to glasses during the pandemic.

Global Contact Lenses Market Segmental Overview

The contact lenses market share is segmented on the basis of material, design, usage, application, distribution channel, and region. On the basis of material, the market is bifurcated into silicon hydrogel, hydrogel, and others. On the basis of design, the market is classified into spherical, toric, and others. On the basis of usage, the market is categorized into daily disposable lens, disposable lens, frequently replacement lens, and traditional lens. On the basis of application, the market is categorized into vision correction and cosmetic. On the basis of distribution channel, the market is divided into online stores & pharmacy, retail pharmacy, and hospital stores & pharmacy .

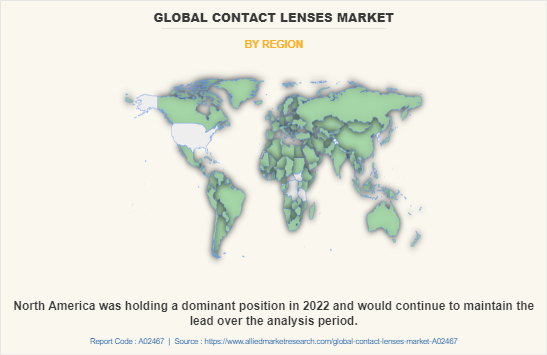

Region wise, the contact lenses market share is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, Spain, Italy, and rest of Europe), Asia-Pacific (India, China, Australia, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Colombia, and rest of LAMEA).

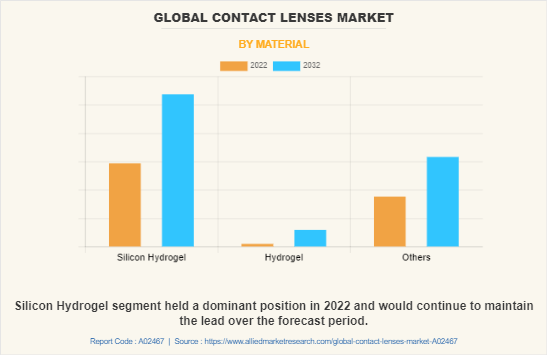

By Material

By material the contact lens market is bifurcated into silicon hydrogel, hydrogel and others. The silicon hydrogel segment dominated the market in 2022, due to rise in number of product launch and product approvals for soft contact lenses and rise in number of market players who manufacture soft contact lenses.

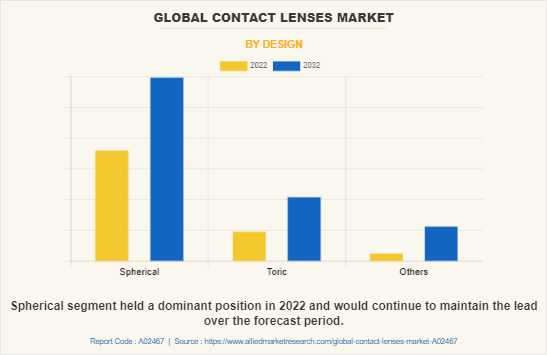

By Design

Based on design, the contact lenses market is classified into spherical, toric, and others. The spherical segment was the highest revenue contributor to the market in 2022, owing to rise in adoption of spherical lenses and increase in prevalence of vision impairment.

By Usage

Based on usage, the contact lenses market is classified into disposable lens, disposable lens, frequently replacement lens and traditional lens. The daily disposable lens segment was the highest revenue contributor to the market in 2022 and is projected to be the fastest growing segment during the forecast period, owing to rise in awareness among the people regarding effectiveness of daily disposable lens lenses and increase in adoptability of contact lens daily.

By Application

Based on application, the contact lenses market is classified into vision correction and cosmetic. The vision correction was the largest growing segment in 2022 and is projected to be the fastest growing segment during the forecast period owing to rise in usage of lenses for therapeutic purpose and advantage associated with lenses in vision correction.

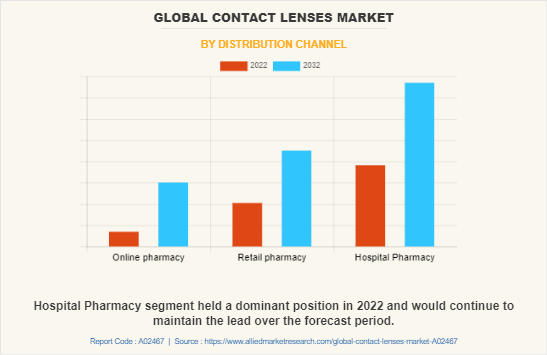

By Distribution Channel

Based on distribution channel, the contact lens market is classified into online stores and pharmacy, retail stores and pharmacy and hospital pharmacy. The hospital pharmacy segment was the largest growing segment in 2022, owing to rise in number of patient’s visit in hospital for vision impairment treatment and increase in the prevalence of vision impairment.

By Region

Region wise, North America has the highest market share in 2022, and is expected to maintain its lead during the contact lenses market forecast period, owing to increase in number of contact lenses industry, availability of well-developed healthcare infrastructure, and surge in prevalence of vision impairment in this region. However, Asia-Pacific is expected to exhibit fastest growth during the forecast period, owing to increase in awareness among the people regarding availability and advantages of contact lenses, rise in prevalence of refractive error, and increase in disposable income.

Competition Analysis

Some of the major companies that operate in the contact lenses market include Johnson & Johnson, The Cooper Companies, Inc., Alcon, Baush & Lomb, Hoya Corporation, Carl Zeiss AG, EssilorLuxottica SA, Menicon Co. Limited, SynergEyes Inc. and SEED Co. Limited

Recent product launches in the Contact Lenses Market

- In March 2023, CooperVision, world’s leading contact lens company, announced the product launch of MyDay Energys in the U.S. MyDay Energys is the first and only 1-day contact lens combining a CooperVision-exclusive aspheric design and material technology to help tiredness and dryness associated with digital eye strain, providing extraordinary comfort.

- In January 2023, Alcon, the global leader in eye care products, announced the launch TOTAL30 for astigmatism, the first-and-only reusable contact lens with water gradient material for astigmatic contact lens wearers.

Collaboration in the Contact Lenses Market

- In April 2021, Johnson & Johnson Vision, a global leader in eye health and part of the Johnson & Johnson medical devices companies, announced a global strategic collaboration with Menicon, a leading manufacturer of innovative contact lenses. The collaboration is part of a broader commitment from Johnson & Johnson Vision to lead with science and help reshape the future of myopia and bring forward a novel portfolio of products and services to manage the progression of myopia in children.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the global contact lenses market analysis from 2022 to 2032 to identify the prevailing global contact lenses market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the global contact lenses market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global contact lenses market trends, key players, market segments, application areas, and market growth strategies.

Contact Lenses Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 24.2 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 156 |

| By Distribution Channel |

|

| By Material |

|

| By Design |

|

| By Usage |

|

| By Application |

|

| By Region |

|

| Key Market Players | Menicon Co. Limited, BenQ Materials Corporation, Cooper Companies, Inc., Carl Zeiss AG, Alcon, EssilorLuxottica SA, Johnson & Johnson, Seed Co. Limited, Hoya Corporation, Bausch Health Companies, Inc. |

Analyst Review

A contact lens is a thin, curved lens placed on the film of tears that covers the surface of the eye. The contact lenses market is expected to witness growth during the forecast period owing to rise in prevalence of vision impairment disorders, increase in geriatric population, and surge in awareness among the people regarding advantages of contact lenses.

Moreover, rise in number of market players who manufacture contact lenses and increase in adoption of key strategies such as acquisition, partnership, agreement, and others are anticipated to drive the growth of contact lenses market. In addition, rise in the number of new product development, product launch, and product approval for contact lenses are expected to witness growth of market during the forecast period. For instance, in March 2023, CooperVision, world’s leading contact lens company, announced the product launch of MyDay Energys in the U.S. MyDay Energys is the first and only 1-day contact lens combining a CooperVision-exclusive aspheric design and material technology to help tiredness and dryness associated with digital eye strain, providing extraordinary comfort. Moreover, in September 2022, Johnson & Johnson Vision Care, Inc., a global leader in eye health and part of Johnson & Johnson MedTech, announced the launch of its newest innovation, Acuvue Oasys Max 1-Day contact lenses and Acuvue Oasys Max 1-Day ultifocal contact lenses for presbyopia.

The top companies that hold the market share in contact lenses market are include Johnson & Johnson, The Cooper Companies, Inc., Alcon, Baush & Lomb, Hoya Corporation, Carl Zeiss AG, EssilorLuxottica SA, Menicon Co. Limited, SynergEyes Inc. and SEED Co. Limited.

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to increase in awareness among the people regarding availability and advantages of contact lenses, rise in prevalence of refractive error, and increase in disposable income.

The key trends in the contact lenses Market are due to rise in prevalence of eye disorder and increase in number of minimal invasive aesthetic procedures

The base year for the report is 2022.

North America is the largest regional market for contact lenses Market

The total market value of contact lenses Market is $15,538.5 million in 2022 .

The forecast period in the report is from 2023 to 2032

Major restraints in the contact lenses Market are side effect caused due to the use of contact lens

Loading Table Of Content...

Loading Research Methodology...