Contract Logistics Market Insights, 2031

The global contract logistics market size was valued at USD 243.6 billion in 2021, and is projected to reach USD 505.3 billion by 2031, growing at a CAGR of 7.5% from 2022 to 2031.

Logistics refers to the flow of goods from one place to another. Contract Logistics is defined as the comprehensive process from production to distribution at the final point of sale. It is a broader course of action that integrates conventional logistics with supply chain management processes. The companies that operate in the contract logistics industry handle activities such as supply chain management, warehousing, transporting & distributing goods, processing orders & collecting payments, managing inventory, and even providing certain aspects of customer service. This refers to the outsourcing of resource management tasks to third-party service providers.

Currently, the market requires a wide range of services and precise logistics practices. Therefore, contract logistics has become an ideal solution for companies that wish to monitor and manage their operations. For instance, in December 2021, A.P. Moller – Maersk one of contract logistics market leader announced the signing of an international freight supply chain management partnership with Unilever, which is a significant player in the FMCG space to combine the execution of its global ocean and air transport, intending to enhance visibility, increase efficiency, and drive reductions in emissions across its operations.

The contract logistics industry is estimated to witness significant growth, owing to increase in trade activities across the world, surge in trade related contracts, and technological advancements in the transportation sector during the forecast period. In addition, the contract logistics market growth is linked to the advancement of the flow of foreign trade and the current economic climate. It involves integrating information, transport, inventory, warehousing, handling materials, packaging, and protection. Moreover, rise in demand for fresh consumable goods from various regional markets helps to build better trade relations within neighboring regions, thereby fueling the growth of the market during the forecast period. Furthermore, favorable government trade policies have resulted in increased demand for logistics services, thereby creating opportunities for the expansion of the market.

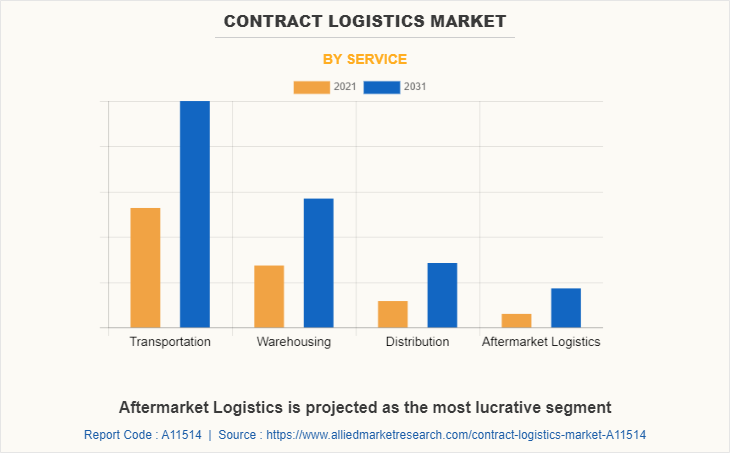

Moreover, aftermarket logistics services used in the logistics industry offers numerous advantages such as optimization of supply availability through forward default calculations is easily done and helps to determine the reliable stock volume & on-time deliveries. In addition, the aftermarket logistics services offer full control of the value chain as well as the internal storage cost is reduced overall. These factors create many opportunities for the growth of the global contract logistics market. In addition, introduction of distribution services in logistics offers numerous advantages such as reduction of distribution cost, optimization of financial resources, price stabilization and numerous other benefits. Further, the increased inclination toward owing a distribution service in a logistics industry offers huge profit to the owner which eventually proves to be a factor supplementing the growth of the contract logistics market.

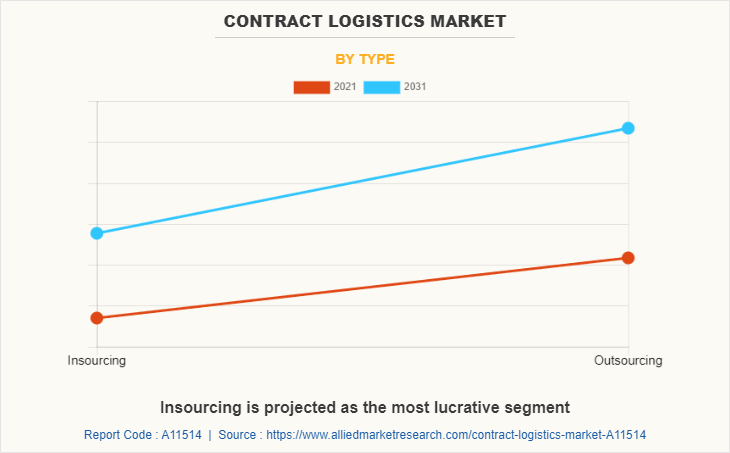

Insourcing is the process of adding a new stock of goods within the portfolio of the company. This includes online campaigns designed by the company, social media marketing and other sources through which the consumption of products is increased. It is frequently used in the logistics sector, has many benefits including improved product quality control, reduced shipping costs, and the ability to distinguish products based on their manufacturing. Such offerings create opportunities for the growth of the segment in the global contract logistics market.

Rise in cross-border trade & transportation activity in the country is the primary factor that drives the growth of the contract logistics market in Canada. In addition, most e-commerce companies award contracts to logistics service providers in the country for warehousing and distribution services. In 2021, there were over 27 million e-commerce users in Canada, accounting for 72.5% of the Canadian population. Increased online shoppers are leading to a continuous increase in retail e-commerce sales in Canada, both in real terms and as a proportion of total retail.

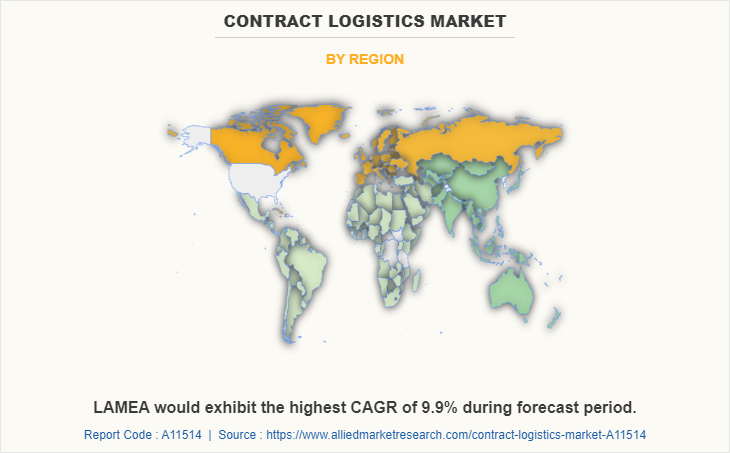

Moreover, the contract logistics market trends include increase in demand for transport services, economic development, rise in customer demand fueled by e-commerce, and surge in number of new start-ups are expected to drive the growth of the logistics market in LAMEA. Further, various expansion plans by market players to fulfill growth in demand fuel the expansion of the market. In addition, the surge in the use of information technologies (IT) solutions & software and the emergence of last-mile deliveries coupled with logistics automation provide remarkable growth opportunities for the players operating in the Latin America contract logistics market.

The factors such as expansion in the e-commerce industry, rise in trade related agreements, and growth in the manufacturing industry supplement the growth of the contract logistics market. However, poor infrastructure for logistics, higher logistics costs, and lack of control of manufacturers on logistics services are the factors expected to hamper the growth of the market. In addition, the emergence of last-mile deliveries coupled with logistics automation and a surge in the use of information technologies (IT) solutions & software creates market opportunities for the key players operating in the market.

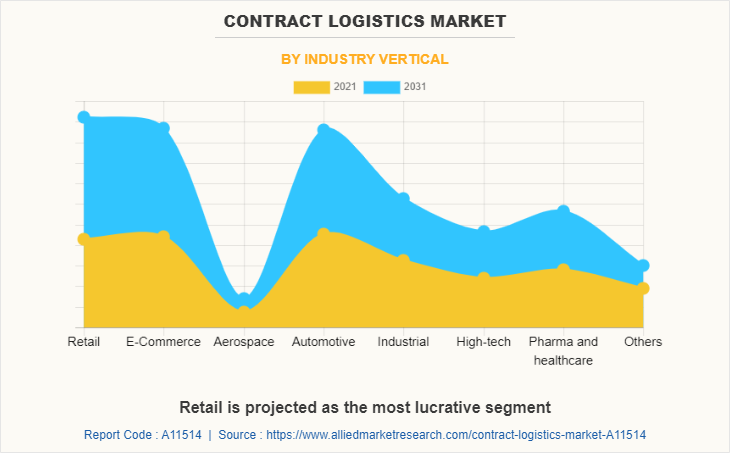

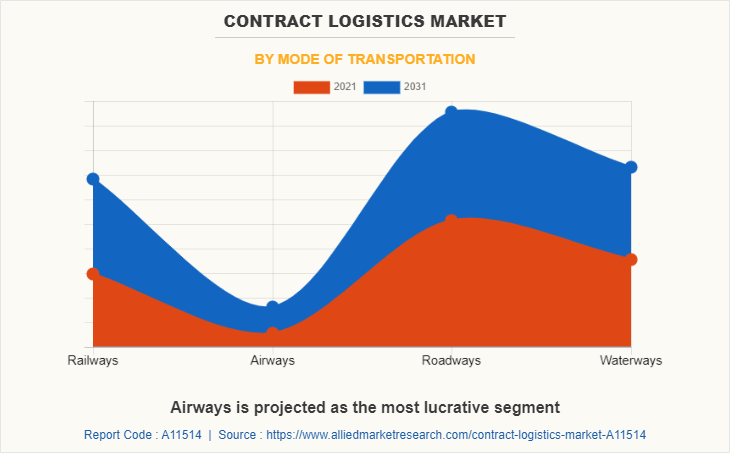

The contract logistics market is segmented on the basis of service, type, industry vertical, mode of transportation, and region. By service, the market is divided into transportation, warehousing, distribution, and aftermarket logistics. By type, it is bifurcated into insourcing and outsourcing. By industry vertical, it is categorized into retail, e-commerce, aerospace, automotive, industrial, high-tech, pharma & healthcare, and others. By mode of transportation, it is classified into railways, airways, roadways, and waterways. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players that operate in the contract logistics market are A.P. Moller - Maersk, Agility, CEVA Logistics AG, CJ Logistics Corporation, DB Schenker, Deutsche Post AG, DSV, GEODIS, Hellmann Worldwide Logistics, Logisteed, Ltd., Kuehne+Nagel International AG, Neovia Logistics Services, LLC, Penske, Ryder System, Inc., United Parcel Service, Inc. (UPS), XPO Logistics, Inc., and Yusen Logistics Co., Ltd. Business expansion, partnership, agreement, and acquisition are the extensively adopted strategies among the market players, followed by collaboration and product launch.

Growth in the e-commerce industry

E-commerce refers to the buying and selling of goods by using the Internet. Third-party logistics service providers encompass the shipping of products to consumers. In addition, the e-commerce industry utilizes contract logistics services to manage and oversee the supply chain of e-commerce companies, which allows these companies to focus on marketing and other business operations.

Thus, due to the numerous benefits provided by logistics to the e-commerce industry, the adoption of logistics services has increased at a significant rate, which drives the growth of the contract logistics market. For instance, in January 2022, Penske collaborated with Röhlig Logistics, a provider of logistics services to form a new joint venture company called Rohlig Penske Logistics GmbH, operating primarily in Germany and the Netherlands.

This new joint venture incorporated 55,000 sqm of additional warehousing, transport management operations, and e-commerce logistics with plans to accelerate additional growth across Europe. Furthermore, in September 2020, the e-commerce giant Mercado Libre bought a minority stake in Kangu, a Brazilian logistics startup to boost e-commerce. Kangu enables small retailers to collect and withdraw products purchased via e-commerce. Thus, the growth in e-commerce sector is expected to propel the growth of the contract logistics market.

Rise in trade related agreements

Dynamic market conditions and improvement in the global economy are the key factors that drive globalization. Owing to rise in globalization, various trade-related activities have witnessed an increase. Therefore, it has become difficult for manufacturers or retailers to keep track of these activities efficiently.

Contract logistics services are vital for price-sensitive customers who require a wider choice of high-quality products with timely delivery. This factor is expected to drive the contract logistics market growth for key players. Moreover, the development of the overseas market is a significant factor that fuels the market's growth. For instance, in 2019, Nepal and China signed the Protocol on Implementing Agreement on Transit and Transport along with 6 other agreements to enable Nepal to access Chinese sea and land ports. China has agreed to let Nepal use Tianjin, Shenzhen, Lianyungang, & Zhanjiang open seaports; and Lanzhou, Lhasa, & Xigatse dry ports for trading with other countries. Thus, an increase in trading activities due to globalization fuels the growth of the market.

Poor infrastructure and higher logistics costs

Contract logistics demand good infrastructure, supply chain, and trade facilitation. Without these, firms have to build up more stock reserves and working capital, which can strongly affect national and regional competitiveness due to high financial costs. In addition, the lack of infrastructure hinders the contract logistics market as it increases costs and reduces supply chain reliability. These include significant inefficiencies in transport, poor condition of storage infrastructure, complex tax structure, low rate of technology adoption, and poor skills of logistics professionals. For instance, according to a report by the Economist, an international newspaper, Latin America lacks adequate infrastructure. More than 60% of the region’s roads are unpaved. Thus, due to poor transport infrastructure, firms need high inventories to account for contingencies, which can result in higher overall logistics costs. Therefore, factors such as poor infrastructure, high inventory prices, and insufficient warehousing space are expected to hamper the contract logistics market growth.

Emergence of last-mile deliveries coupled with logistics automation.

Last-mile logistics refers to the final step of the delivery process from a distribution center or facility to the end user. With continuous increase in proliferation of e-commerce companies, the provision of efficient last-mile deliveries has witnessed a major upswing in the contract logistics industry. Furthermore, the continuous effort of contract logistics companies to offer efficient last-mile deliveries is another opportunity expected to fuel the contract logistics market growth in the near future. For instance, in September 2021, United Parcel Service, Inc. (UPS) acquired Roadie, an on-the-way delivery service provider within the U.S. which reduced the transit times for same-day deliveries as well as last-mile delivery services across the U.S.

In addition, automation has gained traction in the logistics industry. The inception of logistics 4.0 is one of the key logistics trends opening lucrative opportunities in the contract logistics industry. For instance, in July 2020, Movile Group, a mobile commerce platform company, announced a new investment in a Colombian last-mile delivery startup Mensajeros Urbanos. It aims to expand its operations in 10 major cities in Colombia and Mexico. The company is anticipated open 50 urban warehouses within the 10 cities it serves to reduce delivery time windows further and provide certain items for same-day delivery. Hence, the emergence of last-mile deliveries coupled with logistics automation is expected to create lucrative opportunities for the contract logistics market during the forecast period.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global contract logistics market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall contract logistics market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global contract logistics market with a detailed impact analysis.

- The current contract logistics market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Contract Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 505.3 billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 356 |

| By Service |

|

| By Type |

|

| By Industry Vertical |

|

| By Mode of Transportation |

|

| By Region |

|

| Key Market Players | Hellmann Worldwide Logistics, DSV, Penske, GEODIS, Agility, Kuehne Nagel, YUSEN LOGISTICS CO., LTD., Neovia Logistics Services, LLC., Ryder System, Inc., CEVA LOGISTICS, LOGISTEED, Ltd., DB Schenker, XPO Logistics Inc., United Parcel Service of America, Inc., Deutsche Post AG, A.P. Moller - Maersk, CJ Logistics Corporation |

Analyst Review

The contract logistics market is expected to witness remarkable growth in the future owing to the increase in government initiatives for economic diversification of energy-based industries into sectors has led to infrastructure development, industrialization, and digitization. Moreover, rapid growth in the e-commerce sector, rise in foreign direct investment, and improved focus on risk management in the supply chains attract various non-asset entrants and existing players, which leads to an increase in the market revenue of contract logistics. For instance, in October 2020, CEVA Logistics AG signed a three-year contract with Brazil’s largest toy retailer, Ri-Happy Group. This contract includes warehousing, logistics, and e-commerce services. It is expected to support all Ri-Happy Group’s omnichannel capabilities in the coming years.

However, by using contract logistics services, manufacturing or end-distribution centers or companies must rely on logistics service providers' reliability, competency, and honesty. In this scenario, the end-distribution centers must rely on contract logistics service providers, which results in a lack of direct control. In addition, the distribution centers cannot monitor the warehouse operations, which seriously threatens the quality of products. Moreover, outsourcing to a third-party logistics (3PL) could potentially lead to a breach of confidentiality, resulting in the exposure of customers’ personal data or the sharing of commercially sensitive information. Thus, the lack of control of manufacturers on logistics services is anticipated to hinder the growth of the contract logistics market.

The global contract logistics market is projected to grow at a compound annual growth rate of 7.5% from 2022-2031.

The global contract logistics market size was valued at USD 243.6 billion in 2021, and is projected to reach USD 505.3 billion by 2031,

Asia-Pacific is the largest regional market for contract logistics

The factors such as expansion in the e-commerce industry, rise in trade related agreements, and growth in the manufacturing industry supplement the growth of the contract logistics market. However, poor infrastructure for logistics, higher logistics costs, and lack of control of manufacturers on logistics services are the factors expected to hamper the growth of the market. In addition, the emergence of last-mile deliveries coupled with logistics automation and a surge in the use of information technologies (IT) solutions & software creates market opportunities for the key players operating in the market.

The leading players that operate in the contract logistics market are A.P. Moller - Maersk, Agility, CEVA Logistics AG, CJ Logistics Corporation, DB Schenker, Deutsche Post AG, DSV, GEODIS, Hellmann Worldwide Logistics, Logisteed, Ltd., Kuehne+Nagel International AG, Neovia Logistics Services, LLC, Penske, Ryder System, Inc., United Parcel Service, Inc. (UPS), XPO Logistics, Inc., and Yusen Logistics Co., Ltd

Loading Table Of Content...

Loading Research Methodology...