Crowdfunding Market Overview

The global crowdfunding market was valued at $1.9 billion in 2021, and is projected to reach $6.8 billion by 2031, growing at a CAGR of 14.3% from 2022 to 2031. Growing demand for alternative financing, rise in digital fundraising platforms, increase in entrepreneurial ventures, greater use of social media, and supportive regulatory frameworks, contribute toward the growth of the market

Market Dynamics & Insights

- The crowdfunding industry in North America held a significant share of 38% in 2021.

- The crowdfunding industry in China is expected to grow significantly at a CAGR of 11.7% from 2022 to 2031.

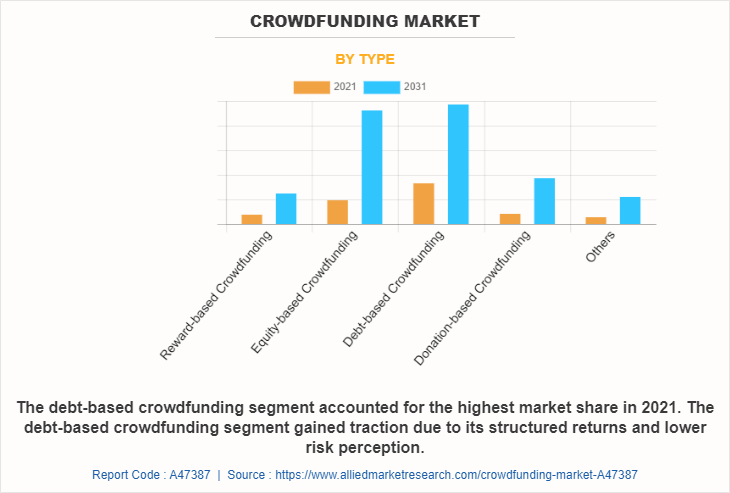

- By type, the debt-based crowdfunding segment is one of the dominating segment in the market, accounting for the revenue share of over 45% in 2021.

- By application, the food and beverage segment dominated the industry in 2021 and accounted for the largest revenue share of 38%.

Market Size & Future Outlook

- 2021 Market Size: $1.9 Billion

- 2031 Projected Market Size: $6.8 Billion

- CAGR (2022-2031): 14.3%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

What is meant by Crowdfunding

Crowdfunding is a way for entrepreneurs, businessmen, and other creators such as filmmakers, musicians, and artists to raise money for their enterprises, businesses, and projects by appealing directly to the public for support. It makes it possible for fundraisers to use online platforms to collect money from a large number of individual investors. Moreover, startup firms and growing companies most frequently use crowdfunding as a method of gaining access to alternative capital.

Crowdfunding platforms have made it easier for entrepreneurs, artists, and other creatives to access funding for their projects, without having to go through traditional channels such as banks or venture capitalists. Moreover, rise of crowdfunding platforms has made it easier for individuals and small businesses to access funding for their projects, regardless of their location, credit score, or net worth.

Furthermore, crowdfunding platforms provide a level of transparency that is not typically available in traditional funding methods. Project creators are able to share detailed information about their project and goals, allowing potential investors to make informed decisions. In addition, in some countries, governments have implemented regulations to protect investors and to make it easier for entrepreneurs to access funding via crowdfunding platforms. Thus, these are some of the factors that propel the growth of the crowdfunding market.

However, lack of awareness of crowdfunding among the general public is a significant restraint for the growth of the crowdfunding market. Many people are still not familiar with the concept of crowdfunding and how it works, which is limiting the number of potential investors. On the contrary, crowdfunding allows individuals and businesses to access capital that may not be available through traditional channels such as banks or venture capital firms. Moreover, such access to capital is particularly beneficial for startups and early-stage companies that may not have access to traditional forms of funding or have difficulty securing a loan or investment from traditional sources. Thus, such factors are likely to propel the crowdfunding market growth.

The report focuses on growth prospects, restraints, and trends of the crowdfunding market. The study provides the Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the crowdfunding market.

Crowdfunding Market Segment Review

The crowdfunding market is segmented on the basis of type, investment size, application and region. By type, it is segmented into reward-based crowdfunding, equity-based crowdfunding, debt-based crowdfunding, donation-based crowdfunding, and others. Depending on investment size, it is segmented into small & medium investment and large investment. As per application, it is segmented into food & beverages, technology, media & entertainment, real estate, healthcare, and others. According to region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the debt-based crowdfunding market segment attained the highest growth in 2021. This is because it can be a useful alternative for borrowers who may not qualify for traditional forms of financing, such as bank loans, and for investors looking for a relatively low-risk investment opportunity with a fixed rate of return. However, the equity-based crowdfunding market is considered to be the fastest growing segment during the forecast period. This is because here in this segment investors become shareholders in the company and receive a portion of the ownership in exchange for their money. Moreover, it can be beneficial for startups and small businesses that may have difficulty in accessing traditional forms of funding, as well as for investors who are interested in early-stage investing and want to have a stake in a startup's growth. Therefore, these are the major growth factors for equity-based crowdfunding in upcoming years.

By region, North America attained the highest growth in 2021. This is attributed to the fact that increase in competition among platforms has driven innovation and improvements in the crowdfunding experience for users. In addition, the amount of funding raised in North America has reached billions of dollars in recent years. This has been driven by growth in popularity of crowdfunding, as well as increase in number of successful projects & campaigns, in this region.

The report analyzes the profiles of key players operating in the crowdfunding market such as ConnectionPoint Systems Inc. (CPSI) (FundRazr), Crowdcube Capital Ltd, Fundable, Fundly, GoFundMe, Indiegogo, Inc., Kickstarter, PBC, Seedrs Limited StartSomeGood, and Wefunder Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the crowdfunding market.

Crowdfunding Market Landscape and Trends

The crowdfunding market has grown rapidly in recent years, with increase in number of platforms and campaigns catering to different sectors and types of funding. In addition, the COVID-19 pandemic has had a significant impact on the crowdfunding market, with some platforms reporting an increase in fundraising activity as traditional funding sources became less accessible. Moreover, the option of alternative lending besides investors and raising shares among the business and firms has led to growth of the crowdfunding market. Moreover, increase in crowdfunding regulations through governments & regulatory bodies such as, regulations to protect investors and ensure fair play, could have a positive impact on the crowdfunding market. In addition, collaboration between companies and new startups will give rise to the crowdfunding market. Furthermore, digitalized workplaces, new innovative business, and simplified operations along with accelerated performance are expected to drive the growth of the global crowdfunding market forecast.

What are the Top Impacting Factors in Crowdfunding Sector

Easier Access to Funding

Crowdfunding platforms have made it easier for entrepreneurs, artists, and other creatives to access funding for their projects, without having to go through traditional channels such as banks or venture capitalists. Moreover, rise of crowdfunding platforms has made it easier for individuals and small businesses to access funding for their projects, regardless of their location, credit score, or net worth.

Furthermore, crowdfunding provides a platform for entrepreneurs and projects owners to pitch their ideas, connect with potential investors & backers, and to raise awareness of their projects. This has made it easier for entrepreneurs and project owners to reach a large audience, which can increase the chances of their projects being successfully funded. In addition, the use of online platforms has made the process of crowdfunding more accessible, as it can be done from anywhere, at any time, and with the use of various online tools to help individuals and small businesses to create a compelling & attractive campaign.

Moreover, the process has been made more accessible by the introduction of different types of crowdfunding models, such as rewards-based, donation-based, equity-based, and debt-based, which have enabled a wider range of projects and entrepreneurs to access funding. Therefore, these are the major factors that propel the growth. of crowdfunding industry

Growth in Government Support

Governments play a significant role in promoting the growth of the crowdfunding market by implementing supportive policies and regulations. Furthermore, governments can provide tax incentives to individuals and organizations who invest in crowdfunding projects, encouraging more people to participate in the crowdfunding market. In some countries, governments have implemented regulations to protect investors and to make it easier for entrepreneurs to access funding via crowdfunding platforms.

Moreover, governments have established legal frameworks to regulate crowdfunding, which outlines the rules & regulations that crowdfunding platforms must follow. Such regulations help to ensure that crowdfunding investments are legitimate, and investors' funds are protected. In addition, some governments have implemented tax incentives for individuals and businesses that invest in crowdfunding campaigns. This can include tax credits, deductions, and exemptions, which make investing in crowdfunding more attractive.

Moreover, at present, government has implemented measures to protect investors from fraud and other types of investment risks. This can include background checks on campaign organizers, disclosure requirements, and limits on the amount that can be invested. Therefore, such factors are driving the growth of the crowdfunding market size during the forecast period.

Potential for Higher Returns in Crowdfunding

One of the main factors for the investor to invest in crowdfunding is it can potentially offer higher returns than traditional forms of investing. Crowdfunding offers the potential for a return on investment, making it an attractive option for those looking to generate a financial return from their investments. Moreover, crowdfunding investments are not subject to the same regulatory oversight as traditional investments, which can further increase the risk for investors. Despite the higher risk, some investors are drawn to crowdfunding owing to the potential for higher returns and the opportunity to invest in innovative companies and ideas. Thus, these factors boost the crowdfunding market among the investors who want to take more risk and earn more in upcoming years.

Lack of Awareness of Crowdfunding

Lack of awareness of crowdfunding among the general public is a significant restraint to the growth of the crowdfunding market. Many people are still not familiar with the concept of crowdfunding and how it works, which is limiting the number of potential investors. Moreover, there are many reasons for less awareness of crowdfunding among the general public. Among them, one being a relatively new concept and industry, and therefore has not yet become mainstream. In addition, there is less advertising or education about crowdfunding, which makes it difficult for people to learn about it. Furthermore, in many countries crowdfunding is still not widely understood. It is a complex concept, and many people are still not able to grasp it easily. Besides, there are some people who do not trust the concept of crowdfunding as a way of making investments due to lack of regulatory oversight & potential frauds or misuse of funds. Therefore, such factors are restraining the growth of the crowdfunding market share.

High Failure Rate

A high percentage of crowdfunding campaigns fail to meet their funding goals, which can discourage potential investors from participating in future campaigns. Unlike traditional investments, crowdfunding investments are often not protected by law. This can leave investors vulnerable to fraud and other types of financial risks. Furthermore, with the growing popularity of crowdfunding, the market has become increasingly competitive, making it difficult for individual campaigns to stand out and attract funding. Moreover, even if a campaign is successfully funded, there may be challenges in delivering the promised products or services, which can negatively impact the reputation of the platform and the credibility of future campaigns. Therefore, this is one of the major factors that hampers the growth of crowdfunding market outlook.

Offers Access to Capital

Crowdfunding allows individuals and businesses to access capital that may not be available through traditional channels such as banks or venture capital firms. Furthermore, crowdfunding for business platforms enable entrepreneurs and small businesses to raise funds from a large number of people, often through the internet, in exchange for rewards, equity, or other forms of compensation. Moreover, such access to capital is particularly beneficial for startups and early-stage companies that may not have access to traditional forms of funding or have difficulty securing a loan or investment from traditional sources. In addition, crowdfunding is a way to raise funds for specific projects or product development, allowing entrepreneurs & businesses to finance their ideas and bring them to market. Therefore, these factors will provide opportunities for the growth of the crowdfunding market in upcoming years.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the crowdfunding market analysis from 2022 to 2031 to identify the prevailing crowdfunding market opportunity.

- The crowdfunding market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the crowdfunding market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global crowdfunding market trends, key players, market segments, application areas, and market growth strategies.

Crowdfunding Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 6.8 billion |

| Growth Rate | CAGR of 14.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 354 |

| By Type |

|

| By Investment Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Fundable, Indiegogo, Inc., Fundly, StartSomeGood, ConnectionPoint Systems Inc. (CPSI) (FundRazr), Seedrs Limited, GoFundMe, Crowdcube Capital Ltd, Wefunder Inc., Kickstarter, PBC |

Analyst Review

Crowdfunding is a method of raising funds for a project or venture by gathering small contributions from a large number of people, typically via the internet. Crowdfunding platforms, such as Kickstarter and GoFundMe, allow individuals and businesses to create campaigns to raise money for a specific purpose, and supporters can pledge money in exchange for rewards or equity. Moreover, there are different types of crowdfunding, among which prominent ones include rewards-based, where backers receive a tangible reward for their pledge; and equity-based, where backers receive an ownership stake in the company.

Furthermore, market players are adopting strategies such as product launch for enhancing their services in the market and improving customer satisfaction. For instance, in August 2022, Rare, a crowdfunding solution provider, launched Rare FND, a crowdfunding platform based on the Blockchain space. Such Blockchain-based product launches are anticipated to create more growth opportunities for the market.

Moreover, some of the key players profiled in the report include are ConnectionPoint Systems Inc. (CPSI) (FundRazr), Crowdcube Capital Ltd, Fundable, Fundly, GoFundMe, Indiegogo, Inc., Kickstarter, PBC, Seedrs Limited StartSomeGood, and Wefunder Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The Crowdfunding Market will expand from 2021 - 2031 at a CAGR of 14.3%

The market value of Crowdfunding Market by the end of 2031 will be $6.82 billion

Easier access to funding Growth in Government support Potential for higher returns in crowdfunding

ConnectionPoint Systems Inc. (CPSI) (FundRazr), Crowdcube Capital Ltd, Fundable, Fundly, GoFundMe, Indiegogo, Inc., Kickstarter, PBC, Seedrs Limited StartSomeGood, and Wefunder Inc

The crowdfunding market is segmented on the basis of type, investment size, application and region. By type, it is segmented into reward-based crowdfunding, equity-based crowdfunding, debt-based crowdfunding, donation-based crowdfunding, and others. Depending on investment size, it is segmented into small & medium investment and large investment. As per application, it is segmented into food & beverages, technology, media & entertainment, real estate, healthcare, and others. According to region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...

Loading Research Methodology...