Cultured Meat Market Research, 2033

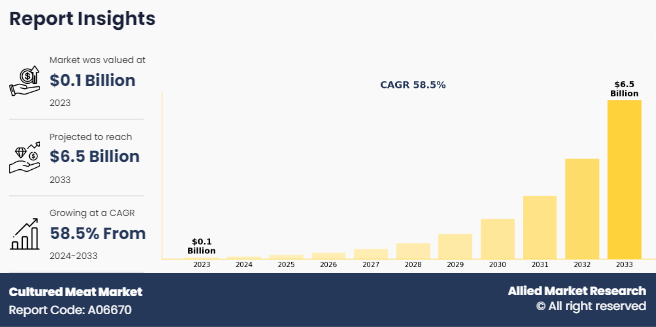

The global cultured meat market size was valued at $65.2 million in 2023 and is projected to reach $6,501.8 million by 2033, growing at a CAGR of 58.5% from 2024 to 2033. Cultured meat, also known as the law, grown meat, and clean meat is cultivated by in vitro cell culture instead of slaughtering of animals, in a controlled medium. It replicates the taste, texture, and aroma of farmed meat. In the process of culturing, farm animals’ cells are transferred into a controlled medium, which contains nutrients and growth factors required for the growth and transformation of stem cells into mature muscle cells within the bioreactor. Cultured meat production uses numerous conditions and substances to provide the requisite nutrition for the growth of tissues.

Key Takeaways

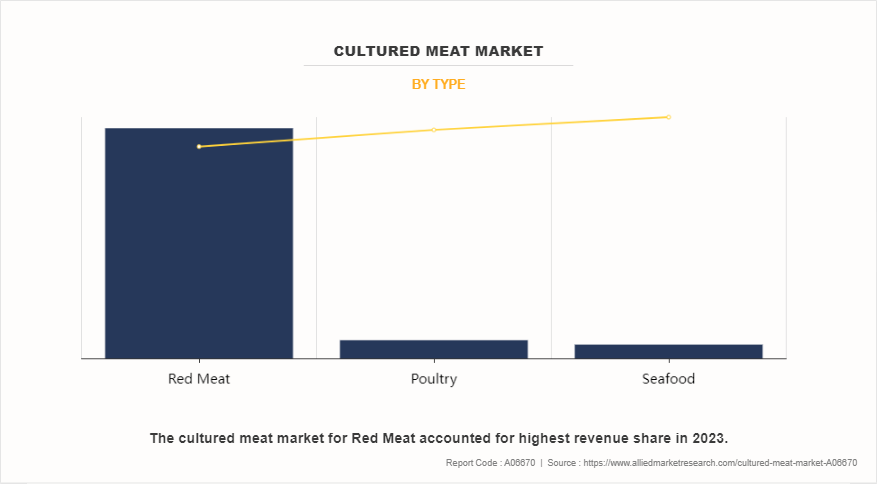

- By type, the red meat segment dominated the global market in 2023.

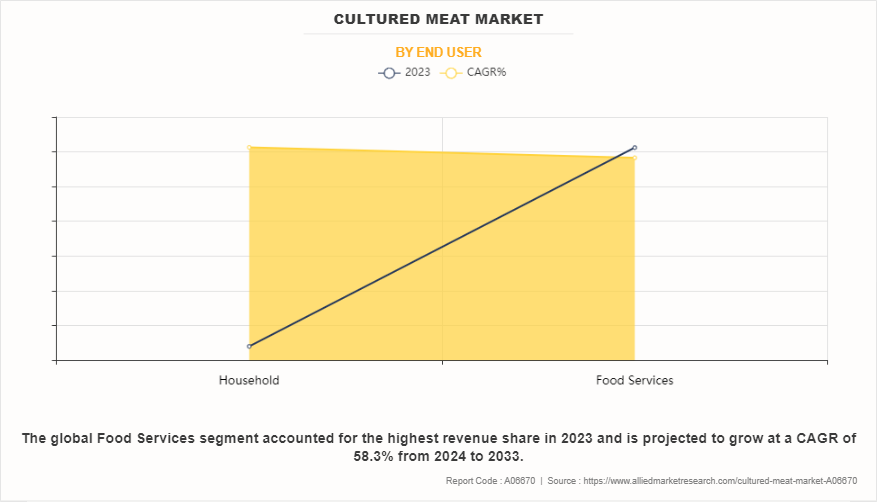

- By end user, the food services segment dominated the market in terms of revenue in 2023.

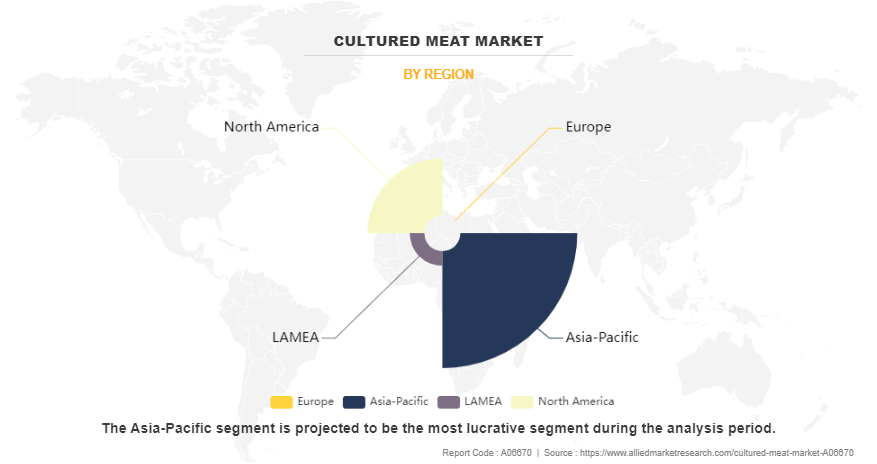

- By region, Asia-Pacific dominated the market in terms of revenue in 2023. However, Europe is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

Alternative protein refers to the protein sources that are derived from plants. This protein is associated with a meat-free and dairy-free diet. Alternative proteins are majorly composed of plant-based and lab-grown meat; thus, they have been gaining traction among consumers who are concerned about animal welfare and the environment.

Furthermore, changes in consumer preferences have showcased a growing consumer shift toward adapting to a more nutritional diet centered toward a more sustainable lifestyle and lower dependency on animal proteins. In addition, individuals who are allergic to animal-based proteins are the major consumer base for alternative proteins. Thus, the increase in the number of such individuals acts as a major driver of the global market. Furthermore, alternative protein products can overcome the negative environmental impact faced by industrial meat processing industry associated with red meat creation.

Red meat is a major contributor to greenhouse gas emissions, therefore, a rise in environmental awareness is accelerating the demand for plant-based protein products. Hence, the surge in demand for alternative protein is expected to support the shift of consumer preference from conventional meat to cultured meat. For instance, according to the Jeremy Coller Foundation, the $1.4 billion meat alternatives industry in the U.S. increased by 22% in 2017, and nearly 40% of Americans preferred plant-based food. The growth of the plant-based food market suggests that there will be favorable opportunities for the cultured meat market. According to the Plant-Based Food Association (PBFA), the U.S. retail sales of plant-based food increased by 11.4% in 2019, bringing the total plant-based market value to $5 billion.

A rise in concerns about animal welfare and environmental awareness is expected to boost the demand for lab-grown or cultured meat. In the context of the environment, animal agriculture considerably contributes to climate change. For instance, according to the Food and Agriculture Organization (FAO), 2006, the total CO2 emission from livestock is 7.1 Gigatons per year, which represents 14.5% of all anthropogenic greenhouse gas emissions.

Various animal welfare and nonprofit organizations raise their voices against the brutal killing of animals for consumption, thereby supporting the sales of cultured meat. In 2008, the People for the Ethical Treatment of Animals (PETA) organization offered a $1 million prize for whoever could develop commercially available cultured meat first. Furthermore, in some research, the production of cultured meat was found to be an eco-friendly process. For instance, according to the American Chemical Association, cultured meat would emit 78–96% lower greenhouse gases, require 99% lower land, 2–96% lower water use and furthermore, result in 7-45% lower energy use.

Demand for food and other agricultural products is projected to increase by 50% between 2012 and 2050. Demand will undergo structural changes, owing to factors such as population growth, rapid urbanization, and per capita increases in income, while the natural resource base upon which agriculture depends will become increasingly stressed. High production with low resources to preserve and enhance the livelihoods of small-scale and family farmers acts as a key challenge for the market.

In addition, various factors influence the decreasing production of meat, such as animal diseases, weaker domestic demand, and higher animal & bird feed prices. For instance, according to the USDA, global chicken meat production for 2021 was revised by 1% lower to 101.8 million tons and this was driven by a sharp decline in Europe and China. Europe is battling widespread highly pathogenic avian influenza (HPAI) outbreaks across several member states, weaker domestic demand, and higher grain prices.

Animal welfare concerns are a significant driver behind the burgeoning growth of the cultured meat market. Traditional livestock farming practices often involve overcrowded and stressful conditions for animals, leading to ethical dilemmas and consumer backlash. Cultured meat offers a humane alternative by eliminating the need to raise and slaughter animals for food. This appeals to a growing segment of consumers who prioritize the welfare of animals and seek cruelty-free protein options. As awareness of the ethical implications of meat consumption continues to rise, more consumers are turning to cultured meat as a guilt-free alternative that aligns with their values.

Moreover, the transparency and traceability of cultured meat production further reinforce its appeal to ethically conscious consumers. By removing the need for animal farming altogether, cultured meat reduces the suffering of animals while also addressing environmental concerns associated with conventional meat production. This alignment with ethical and sustainability principles not only drives consumer demand but also attracts investment and support from regulatory bodies and advocacy groups, paving the way for the continued growth and adoption of cultured meat as a mainstream protein source.

Health consciousness plays a pivotal role in propelling the growth of the cultured meat market. With increasing awareness of the health risks associated with consuming traditional meat products, consumers are actively seeking healthier alternatives. Cultured meat offers a compelling solution, as it is produced in controlled environments without the use of antibiotics, hormones, or other harmful additives commonly found in conventional livestock farming. This cleaner production process resonates with health-conscious consumers who prioritize nutritious and safer food options for themselves and their families.

Moreover, cultured meat often has lower levels of saturated fats and cholesterol compared to conventional meat, making it an attractive choice for those looking to improve their diet and reduce the risk of diet-related diseases such as heart disease and obesity. As consumers become more informed about the nutritional benefits of cultured meat and its potential to contribute to a healthier lifestyle, the demand for these products is expected to soar. This growing preference for healthier protein sources not only drives market growth but also reinforces the broader shift towards sustainable and ethical food choices in today's health-conscious society.

Segments Overview

The cultured meat market analysis is segmented into type, end user, and region. By type, the market is divided into red meat, poultry, and seafood. By end user, the market is segmented into household and food services. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, the UK, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, Indonesia, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (South Africa, Saudi Arabia, UAE, and rest of MEA).

By Type

By type, the red meat segment held the major share of the market in 2023. Red meat refers to all mammalian muscle meat, including beef, lamb & mutton, pork, veal, venison, and goat. Cultured red meat is produced by harvesting muscle cells from living cattle. Cultured red meat is projected to gain major traction in the global cultured meat market during the forecast period. This is majorly attributed to the popularity of conventional red meat among non-vegetarian people. Red meat is one of the most consumed meat forms in the world. This is attributed to the fact that enormous benefits are associated with red meat consumption such as it helps in muscle growth and supports muscle mass, provides essential vitamins and minerals that support good health and well-being, and helps to strengthen the immune system which is expected to propel the growth during cultured meat market forecast

By End User

By end user, the food service segment held the major cultured meat market share in 2023 and is expected to maintain its dominance during the forecast period. The food service industry is among the major consumers of cultivated meat. The food service industry includes hotel chains, fast food restaurants, cash & carry outlets caterers, and other business buyers. The food service industry is expected to dominate the market in the years ahead, owing to rapid urbanization, an upsurge in disposable income, and an increase in the trend of dining out. Furthermore, the rise in food delivery apps has resulted in more restaurants and hotels, globally, which promotes the cultured meat market growth.

By Region

Region-wise, Asia-Pacific held the major market share of the market in 2023. It has witnessed an increase in the number of players entering the market. These players are focusing on new product development and increasing production capabilities, projecting the upcoming demand for cultured meat products. Recently in December 2020, cultured meat that is produced in bioreactors of Eat Just, Inc. without the slaughter of animals has been approved for sale by a regulatory authority for the first time in Singapore. It is the first product in the cultured meat industry that has received approval for commercial sale. The cells that were used to start the process of meat creation came from a cell bank and did not require the slaughter of chickens and taken from biopsies of live animals.

Competitive Analysis

Competitive analysis provides valuable insights into the competitive landscape of a market by evaluating key players, their strengths, weaknesses, strategies, and market positioning. It involves assessing factors such as market share, product offerings, pricing strategies, distribution channels, and customer perception. By analyzing competitors' actions and reactions, businesses identify opportunities, anticipate threats, and make informed decisions to gain a competitive advantage.

This analysis helps in understanding market trends, customer preferences, and industry dynamics, enabling companies to refine their strategies, innovate products, improve customer experiences, and effectively position themselves in the market. Competitive analysis facilitates strategic planning and enhances competitiveness in a dynamic business environment.

Major players such as Memphis Meats and Mosa Meat BV have adopted partnership, agreement, and acquisition as key developmental strategies to improve the product portfolio of the cultured meat market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cultured meat market analysis from 2023 to 2033 to identify the prevailing cultured meat market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cultured meat market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cultured meat market trends, key players, market segments, application areas, and market growth strategies.

Cultured Meat Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 305 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Redefine Meat, Aleph Farms Ltd., Vow Group Pty Ltd., Cubiq Foods S.L., Meatable B.V., Memphis Meats, Inc., Future Meat Technologies, Mosa Meat BV, Mission Barns |

Analyst Review

Various CXOs from leading companies perceive that flavored processed cultured meat and innovation in cultured meat processing is the main area for market growth in the cultured meat market. Most companies are currently focusing on muscle cells because it is much easier to optimize a system when there is only one cell type involved. Also, certain types of intermediate stem cells default to adipocytes just by adding certain fatty acids to the growth media, so it is a bit easier than getting cells to differentiate into muscle. Researchers have demonstrated co-cultures of skeletal muscle with fat cells. However, companies may find it more efficient to incorporate plant-based fats into clean meat. Some of the major hurdles faced by the cultured meat industry are scalability, cost of production and expanding the cells in serum-free media.

The global cultured meat market was valued at $65.2 million in 2023, and is projected to reach $ 6,501.8 million by 2033, registering a CAGR of 58.5% from 2024 to 2033.

The cultured meat market analysis is segmented into type, end user, and region. By type, the market is divided into red meat, poultry, and seafood. By end user, the market is segmented into household and food services. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, the UK, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, Indonesia, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (South Africa, Saudi Arabia, UAE, and rest of MEA).

Asia-Pacific is the largest regional market for cultured meat

The key players operating in the global cultured meat market include Aleph Farms Ltd., Cubiq Foods S.L., Future Meat Technologies, Meatable B.V., Memphis Meats, Mission Barns, Mosa Meat BV, Redefine Meat, and Vow Group Pty Ltd.

The global cultured meat market report is available on request on the website of Allied Market Research.

Loading Table Of Content...

Loading Research Methodology...