Cyber Security Technology Market Research, 2032

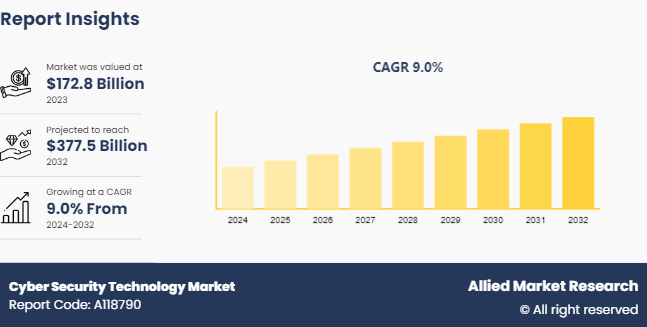

The global cyber security technology market size was valued at $172.8 billion in 2023, and is projected to reach $377.5 billion by 2032, growing at a CAGR of 9% from 2024 to 2032. Cybersecurity technology refers to the specific tools, systems, and software used to protect digital environments from cyber threats. These technologies are implemented to enforce cybersecurity measures and enhance the security solutions of an organization. Cybersecurity technology focuses on the technical aspects and innovations that support cybersecurity efforts. It includes hardware, software, and services specifically designed to detect, prevent, and respond to cyber threats.

Key Takeaways

The cyber security technology industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major cyber security technology industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

The global cyber security technology market growth is significantly rising due to several factors such as technological advancements, the rise in malware and phishing threats among enterprises and the increase in adoption of IoT and BYOD trends are some of the main factors anticipated to propel the growth of the market. However, budget constraints among organizations and complexities of device security act as restraints for the cybersecurity technology market. In addition, the high penetration of 5G and IoT technology will provide ample opportunities for the market's development during the forecast period.

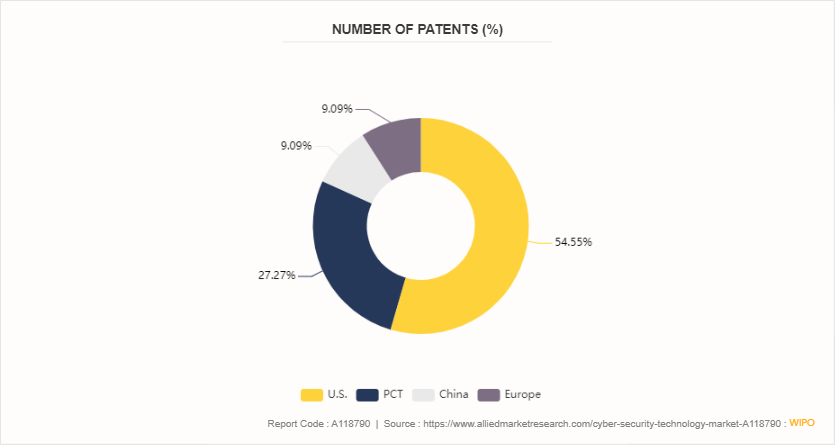

Patent Analysis of Cybersecurity Technology

Cybersecurity solutions, which integrate advanced technologies such as DLP, zero-trust security, firewalls, and others into security processes, have seen significant patent activity across various regions. According to the World Intellectual Property Organization, in 2024, the U.S. leads in cybersecurity technology patents, driven by significant contributions from companies like Microsoft Tech Licensing LLC, Capital One Services LLC, and WIZ Inc. PCT (Patent Cooperation Treaty) also contributing, with the various states focusing on adopting advanced cybersecurity technologies supported by government initiatives. While China and Europe encourage investments from global market players aiming to expand their manufacturing capabilities.

FIGURE 1: Patent Analysis (%)

Market Segmentation

The cyber security technology market share is segmented into solution type, deployment mode, organization size, industry vertical, and region. On the basis of solution type, the market is divided into network security, endpoint security, application security, cloud security, identity & access management and data security. As per deployment mode, the market is segregated into cloud and on-premise. On the basis of organization size, the market is bifurcated into, small and medium-sized enterprises and large enterprises. On the basis of industry vertical, the market is bifurcated into BFSI, manufacturing, healthcare, retail, government & defense, IT & telecom and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The global cybersecurity technology market is experiencing substantial growth, with North America playing a pivotal role in this expansion. North America leads the market, propelled by robust technological infrastructure, significant investments in next-generation security technologies, and stringent safety regulations that encourage the integration of advanced security solutions. In Europe, countries like Germany and the UK are at the forefront, leveraging 5G networks in sectors such as manufacturing and transportation. In the Asia-Pacific region, rapid industrialization and increasing awareness of network safety are driving the adoption of the global market, particularly in China and Japan, where government initiatives support technological advancements.

In May 2024, The U.S. government unveiled a new $50m program to develop cybersecurity tools to protect hospital environments from damaging cyber-attacks. The initiative aims to enable hospitals to automate vulnerability management across all systems and devices used in their environments, ensuring patches are quickly deployed with minimum disruption to critical healthcare services.

In January 2024, the U.S. Department of Energy (DOE) launched an initiative to ensure cybersecurity is integrated into the development of clean energy solutions. These investments, made possible by the President’s Bipartisan Infrastructure Law, will be provided through a $30 million funding opportunity to support the research, development, and demonstration (RD&D) of next-generation tools to protect clean energy delivery infrastructure from cyber-attacks.

Industry Trends

In July 2023, CISA and the National Security Agency published 5G Network Guidelines, which consist of security considerations for design, deployment, and maintenance. Developed by the Enduring Security Framework (ESF) , a cross-sector, public-private working group, the guidance focuses on addressing some identified threats to 5G standalone network, and provides industry-recognized practices for the design, deployment, operation, and maintenance of a hardened 5G standalone network solution.

In October 2021, the National Security Agency (NSA) and the Cybersecurity and Infrastructure Security Agency (CISA) published cybersecurity guidance to securely build and configure cloud infrastructures in support of 5G. Security Guidance for 5G Cloud Infrastructures: prevent and detect lateral movement and provide cybersecurity guidance that addresses high-priority cyber-based threats to the nation’s critical infrastructure.

Competitive Landscape

The major players operating in the cyber security technology market size include Accenture, Broadcom Inc., Capgemini, Cognizant, F5 Networks Inc., FireEye Inc., HCL Technologies Limited, IBM Corporation, Infosys Limited, and L&T Technology Services Limited.

Recent Key Strategies and Developments

In February 2024, Palo Alto Networks launched private 5G security solutions and services in collaboration with leading Private 5G partners. Bringing together Palo Alto Networks enterprise-grade 5G Security and Private 5G partner integrations and services allows organizations to easily deploy, manage, and secure networks throughout their entire 5G journey.

In February 2023, Atos launched its new ‘5Guard’ security offering for organizations looking to deploy private 5G networks and for telecom operators looking to enable integrated, automated, and orchestrated security to protect and defend their assets and customers.

In December 2022, SecurityGen launched its new 5G Cyber-security Lab. This Lab is an innovative solution designed to help MNO security teams study and understand 5G networks, thus enabling them to prepare and protect their networks against potential security threats.

Key Sources Referred

Cybersecurity & Infrastructure Security Agency

Center for Internet Security

National Institute of Standards and Technology

ResearchGate

Journal of Theoretical and Applied Information Technology

Key Benefits For Stakeholders

This report provides a quantitative analysis of the cyber security technology market forecast segments, current trends, estimations, and dynamics of the cyber security technology market analysis from 2023 to 2032 to identify the prevailing cyber security technology market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the cybersecurity technology market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global cyber security technology Market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global cyber security technology market trends, key players, market segments, application areas, and market growth strategies.

Cyber Security Technology Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 377.5 Billion |

| Growth Rate | CAGR of 9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Solution Type |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Cognizant, Broadcom Inc., IBM Corporation, FireEye Inc., HCL Technologies Limited, Capgemini, Accenture, F5 Networks Inc., Infosys Limited, L&T Technology Services Limited |

Increasing awareness of cyber risks is driving demand for cyber insurance policies to mitigate financial losses from cyber incidents.

Network security is the leading solution type of Cyber Security Technology Market.

North America is the largest regional market for Cyber Security Technology 2023.

$377.5 billion is the estimated industry size of Cyber Security Technology in 2032.

Accenture, Broadcom Inc., Capgemini, Cognizant, F5 Networks Inc., FireEye Inc., HCL Technologies Limited, IBM Corporation, Infosys Limited, and L&T Technology Services Limited are the top companies to hold the market share in Cyber Security Technology.

Loading Table Of Content...