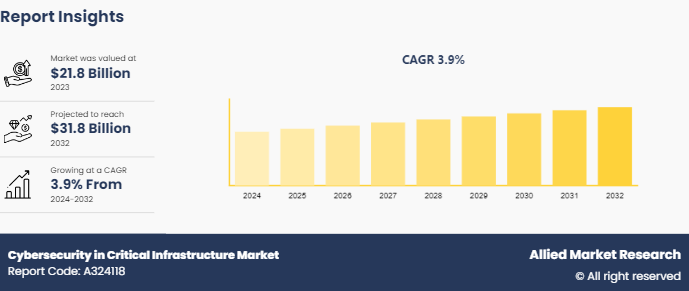

The global cybersecurity in critical infrastructure market was valued at $21.8 billion in 2023, and is projected to reach $31.8 billion by 2032, growing at a CAGR of 3.9% from 2024 to 2032. This market plays a crucial role in securing the foundational elements of modern societies from evolving cyber risks.

Market Introduction and Definition

The cybersecurity in critical infrastructure market involves the protection of essential systems and networks that support vital societal functions, such as energy, transportation, water supply, and healthcare. It includes strategies, technologies, and services designed to defend against cyber threats that could disrupt operations, compromise sensitive data, or cause physical harm. Key priorities include safeguarding infrastructure assets from malicious cyber activities, ensuring resilience against emerging threats, adhering to regulatory standards, and fostering collaboration among stakeholders to maintain operational continuity and public safety.

Key Takeaways

The cybersecurity in critical infrastructure markets market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected cybersecurity in the critical infrastructure market forecast period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major cybersecurity in critical infrastructure market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights and cybersecurity in critical infrastructure market share.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives and cybersecurity in critical infrastructure market size.

Key market dynamics

Cybersecurity in critical infrastructure is driven by several key factors. Firstly, the increasing frequency and sophistication of cyber threats pose significant risks to essential services such as energy, transportation, and healthcare. Attacks such as ransomware and advanced persistent threats (APTs) target vulnerabilities in interconnected systems, highlighting the urgent need for robust defense mechanisms. Secondly, regulatory compliance mandates, such as NERC CIP in North America and the NIS Directive in Europe, compel infrastructure operators to adopt stringent cybersecurity measures. These regulations ensure resilience against cyber-attacks and enforce accountability & transparency in security practices. Thirdly, the ongoing digital transformation of critical infrastructure, including the adoption of IoT devices, cloud computing, and smart technologies, expands the attack surface and necessitates proactive security strategies to safeguard sensitive data and operational continuity. Moreover, the advancements in artificial intelligence (AI) and machine learning (ML) offer predictive analytics and automated threat detection capabilities, enhancing the ability to detect and respond to cyber threats in real-time. Moreover, one significant restraint is the complexity of securing legacy systems and infrastructure that were not originally designed with cybersecurity in mind. Retrofitting older systems with modern security measures can be costly and disruptive, requiring careful planning and investment. In addition, the interconnected nature of critical infrastructure poses integration challenges when implementing comprehensive cybersecurity solutions across diverse sectors. Moreover, the shortage of skilled cybersecurity professionals capable of understanding both operational technology (OT) and information technology (IT) environments limits effective implementation and monitoring of cybersecurity measures in critical infrastructure settings. Furthermore, the adoption of cloud-based security solutions provides scalable and cost-effective options for infrastructure operators to manage and protect data across distributed environment factors leveraging the opportunities for the market. Collaborative efforts between industry stakeholders, government agencies, and cybersecurity providers create opportunities for knowledge sharing, threat intelligence collaboration, and development of standardized security frameworks. Furthermore, the growing market demand for integrated cybersecurity solutions tailored to specific infrastructure sectors, such as energy grids or transportation networks, opens avenues for innovation and specialization among cybersecurity vendors.

Government Policy for Global Cybersecurity in Critical Infrastructure Market

In the U.S, the North American Electric Reliability Corporation (NERC) sets standards under the Critical Infrastructure Protection (CIP) framework, which mandates cybersecurity requirements for the electric utility sector. NERC CIP standards include measures for securing critical cyber assets, conducting vulnerability assessments, and implementing controls to protect against unauthorized access and cyber incidents. These regulations are regularly updated to address new cybersecurity challenges and vulnerabilities in the electric grid. For example, NERC CIP version 5 became effective on July 1, 2020, introducing stricter requirements for incident reporting, supply chain risk management, and mandatory cyber security training for personnel.

Similarly, in Europe, the Network and Information Systems (NIS) Directive is a key regulatory framework aimed at enhancing the cybersecurity resilience of operators of essential services and digital service providers. Implemented across EU member states, the NIS Directive requires organizations in sectors such as energy, transport, banking, and healthcare to adopt risk management practices, report significant cyber incidents, and implement appropriate security measures. The directive was transposed into national law by each member state, with the deadline for implementation set for May 9, 2018.

In addition to sector-specific regulations, governments worldwide issue cybersecurity guidelines and best practices to promote a proactive approach to cybersecurity across critical infrastructure sectors. These guidelines often include recommendations on threat detection and response, information sharing among stakeholders, and collaboration with cybersecurity experts and government agencies to strengthen defenses against cyber threats.

Market Segmentation

The cybersecurity in critical infrastructure market is segmented into type, application, and region. On the basis of type, the market is divided into encryption, network access control & firewalls, threat intelligence, and others. On the basis of application, the market is classified into BFSI, government & defense, transport & logistics, energy & power, commercial sector, telecommunications, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In the U.S., opportunities abound in advancing technologies such as AI-driven threat detection, blockchain for secure data management, and cloud-based security solutions tailored to critical infrastructure needs. Continuous investments in cybersecurity research and development foster innovation and resilience across sectors such as energy, transportation, and healthcare. Similarly, the UK focuses on expanding cybersecurity capabilities through public-private partnerships and regulatory compliance enhancements under the Network and Information Systems (NIS) Directive. This approach stimulates market growth in cybersecurity consulting, managed security services, and incident response solutions for essential service providers.

In February 2024, Motorola Solutions partnered with Google Cloud, a multi-year collaboration aimed at advancing cloud solutions within Motorola Solutions’ safety and security technologies. The partnership aimed to use Google Cloud’s infrastructure to develop assistive intelligence, video content delivery, mapping, and AI capabilities, addressing real-world safety challenges. Motorola Solutions and Google Cloud aim to improve safety and security processes.

- In November 2023, CISA officially announced the formation of the Joint Cyber Defense Collective (JCDC) , a CISA initiative that brought together government and private industry to work together on coordinated U.S. cyber-defense operation plans for protecting and responding to cyberattacks and threats. The aim of the JCDC is to establish a "shared situational awareness of the threat environment" for a jointly created national cyber-defense plan.

- In May 2023, the U.S. Cybersecurity & Infrastructure Security Agency (CISA) revealed the Ransomware Vulnerability Warning Pilot (RVWP) program to help secure critical infrastructure organizations that can protect their systems from ransomware attacks. The RVWP pilot aims to keep agencies updated on possible attack targets so their security teams can act accordingly.

- In May 2022, Motorola Solutions acquired Videotec—a Schio, Italy-based maker of rugged video-security cameras—to expand the manufacturing and design capabilities of its Pelco brand of video-security cameras. Videotec is the fourth company that Motorola Solutions has bought in the last 10 weeks, following the acquisitions of Ava Security and TETRA Ireland in March, as well as the April purchase of Calipsa. Motorola Solution invested $569 million in the four acquisitions.

Industry Trends:

Moving away from perimeter-basic security and embracing a “trust no one” approach is one of the industrial trends of the market. Critical infrastructure organizations implement a zero-trust principle to verify and authenticate every user and device accessing their system, regardless of location. For instance, in October 2023, the U.S. Department of Homeland Security (DHS) released a Zero Trust Maturity Model specifically for critical infrastructure. This model provides a framework for organizations to access their correct zero-trust posture and identify areas for improvement.

AI and ML are used to analyze vast amounts of data, detect anomalies, and identify potential cyber threats in real-time. This allows for proactive threat detection and faster response time. For instance, in June 2023, the National Institute of Standards and Technology (NIST) released a guide on using AI and ML for cybersecurity in critical infrastructure. This guide provides recommendations and best practices for implementing these technologies effectively.

Competitive Landscape

The major players operating in the cybersecurity in critical infrastructure industry include Huawei, Cisco Systems, Inc., NortonLifeLock, Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., RSA Security LLC, FireEye, Inc., and Trend Micro, Inc.

Recent Key Strategies and Developments

In May 2024, Palo Alto Network, the global cybersecurity leader, partnered with IBM, a leading provider of hybrid cloud and AI, to deliver AI-powered security outcomes for customers. The announcement is a testament to Palo Alto Networks' and IBM's commitment to each other's platforms and innovative capabilities.

In June 2022, Check Point® Software Technologies Ltd., a leading provider of cybersecurity solutions globally, collaborated with Everphone, a leading provider of Device as a Service (DaaS) , for advanced threat prevention for corporate smartphones. The collaboration is expected to see Everphone enhance its DaaS solution by integrating Check Point Harmony Mobile, an industry-leading Mobile Threat Defense (MTD) solution that offers comprehensive protection against a wide range of cyber threats.

- In November 2021, Kyndryl, the world’s largest IT infrastructure services provider, partnered with Microsoft Corp., to combine their market-leading capabilities in service of enterprise customers. Since Kyndryl recently went public, this is the first agreement the company has made. It offers both parties additional multi-billion dollar income prospects.

Key Sources Referred

advenica.com

verveindustrial.com

deloitte.com

cisa.gov

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2023 to 2032 to identify the prevailing cybersecurity in critical infrastructure market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Cybersecurity in critical infrastructure market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global cybersecurity in critical infrastructure market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players of Cybersecurity in Critical Infrastructure Industry

- The report includes the analysis of the regional and global cybersecurity in critical infrastructure market trends, key players, market segments, application areas, and cybersecurity in critical infrastructure market growth strategies.

Cybersecurity in Critical Infrastructure Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31.8 Billion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 231 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | RSA Security LLC, Huawei, Cisco Systems, Inc., FireEye, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Trend Micro, Inc., NortonLifeLock, Check Point Software Technologies Ltd. |

The cybersecurity in critical infrastructure market was valued at $21.8 billion in 2023 and is estimated to reach $31.8 billion by 2032, exhibiting a CAGR of 3.9% from 2024 to 2032.

Increasing cyber threats and a rise in regulatory compliance are the upcoming trends of Cybersecurity in the Critical Infrastructure Market around the globe.

Advancements in technology are the leading application of Cybersecurity in the Critical Infrastructure Market.

North America is the largest regional market for Cybersecurity in Critical Infrastructure.

Huawei, Cisco Systems, Inc., NortonLifeLock, Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., RSA Security LLC, FireEye, Inc., and Trend Micro, Inc. are the top companies to hold the market share in Cybersecurity in Critical Infrastructure.

Loading Table Of Content...