Cytotoxic Drug Market Research, 2033

The global cytotoxic drug market size was valued at $15.8 billion in 2023, and is projected to reach $19.5 billion by 2033, growing at a CAGR of 2.1% from 2024 to 2033. The increase in prevalence of various cancers, advancements in drug delivery systems enhancing efficacy and reducing side effects, and rising investments in cancer research and development for innovative treatments are the major factors, which drives the market growth.

Market Introduction and Definition

Cytotoxic drugs, also known as antineoplastic, are medications that inhibit or kill rapidly dividing cells, including cancer cells. They work by disrupting cell division and DNA replication processes, preventing cancer cells from multiplying and spreading. These drugs are crucial in cancer treatment but can also affect healthy cells, leading to side effects. Cytotoxic drugs are administered in various forms, including oral tablets, and injections. Their selection and dosage depend on the specific type and stage of cancer, aiming to achieve therapeutic efficacy while managing potential toxicity to improve patient outcomes in oncology treatments.

Key Takeaways

The cytotoxic drug market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major cytotoxic drug industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The increasing incidence of cancer globally is a major factor which drives the market growth, as cytotoxic drugs are important in the treatment of various cancers, including lung, breast, and colorectal cancers among others. Rise in geriatric population lead to increase in prevalence of cancer, necessitating greater demand for effective chemotherapy options thereby supporting the cytotoxic drug market growth.

Moreover, advancements in biotechnology and pharmacology led to the development of novel cytotoxic agents with improved efficacy and reduced side effects, further driving market expansion. In addition, ongoing research and development efforts focused on personalized medicine and targeted therapies are enhancing the specificity and effectiveness of cytotoxic drugs, making them a more viable treatment option across different cancer types which supports growth during the cytotoxic drug market forecast period.

Furthermore, the expansion of healthcare infrastructure in emerging economies, coupled with increasing healthcare expenditure, is bolstering market growth by improving access to cancer treatments. Regulatory initiatives and supportive policies aimed at accelerating drug approvals and enhancing patient access to oncology treatments also contribute significantly to market expansion. However, the concerns regarding long-term safety and efficacy, along with the increasing adoption of targeted therapies and immunotherapy, are shifting treatment preferences away from traditional cytotoxic agents thereby restraining the market growth.

Moreover, emerging markets in Asia-Pacific and LAMEA present untapped opportunities owing to increasing healthcare infrastructure and rising prevalence of cancer. In addition, technological innovations in drug development, such as nanotechnology and biologics, offer new avenues for improving drug efficacy and reducing side effects which provides cytotoxic drug market opportunity.

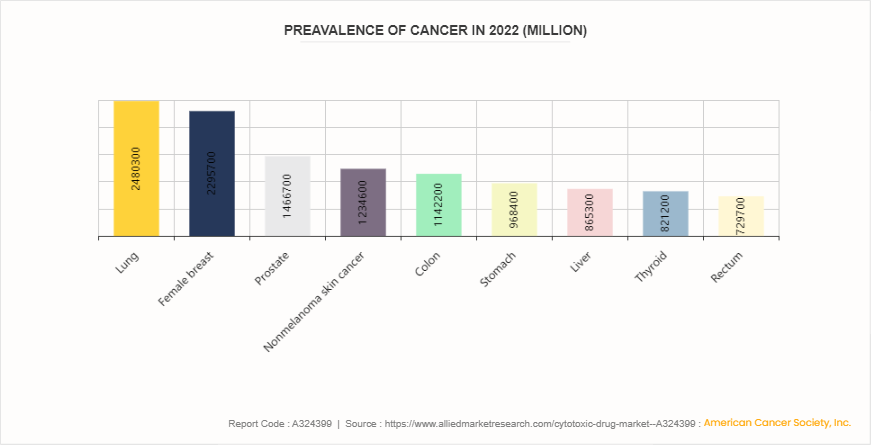

Prevalence Statistics of Cancer

According to the American Cancer Society's 2022 statistics, several cancer types top the list in terms of incidence globally. Lung cancer leads with 2, 480, 300 cases, followed closely by female breast cancer at 2, 295, 700 cases, and prostate cancer with 1, 466, 700 cases. These figures highlight the significant prevalence of these diseases on healthcare systems worldwide. Cytotoxic drugs play a crucial role in the treatment of these cancers by targeting rapidly dividing cancer cells throughout the body. They are pivotal in reducing tumor size, preventing metastasis, and improving patient survival rates. The demand for cytotoxic drugs is therefore heavily influenced by the prevalence of these high-incidence cancers, driving substantial market growth. In addition, research continues to advance and new therapeutic modalities emerge, including targeted therapies and immunotherapies. The landscape of cytotoxic drugs is evolving to offer more personalized and effective treatment options. This alignment between cancer incidence rates and the development of cytotoxic drugs drives the critical interplay between medical need and pharmaceutical innovation in oncology.

Market Segmentation

The cytotoxic drug market is segmented into drug type, application, route of administration, distribution channel, and region. On the basis of the drug type, the market is segmented into alkylating agents, antitumor antibiotics, antimetabolites, plant alkaloids, and others. As per application, the market is classified into breast cancer, prostate cancer, lung cancer, pancreatic cancer, and others. By route of administration, the market is bifurcated into oral and parenteral. According to distribution channel, the market is classified into hospital pharmacies, drug stores and retail pharmacies, and online providers. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America plays a pivotal role in cytotoxic drug market share in 2023, owing to extensive research and development capabilities, and high adoption rates of advanced oncology treatments. In addition, strong regulatory framework ensures timely drug approvals, fostering a competitive market environment. Furthermore, a significant healthcare expenditure and favorable reimbursement policies enhance patient access to cytotoxic drug thereby driving the market growth.

According to the American Medical Association, the health spending in the U.S. increased by 4.1% in 2022 ($4.4 trillion) . This significant rise in healthcare expenditure allows for greater investment in advanced cancer treatments, including cytotoxic drugs, enhancing their accessibility and adoption.

Asia-Pacific is witnessing rapid growth driven by the increasing prevalence of cancer in the region, and rising healthcare expenditures enhance accessibility to advanced cancer therapies. In addition, supportive government initiatives aimed at improving cancer care and treatment outcomes further stimulate the cytotoxic drug market size.

Industry Trends

In 2023, The National Cancer Institute (NCI) launched a large precision medicine cancer initiative to test the effectiveness of treating adults and children with new drug combinations that target specific tumor alterations. Known as the Combination Therapy Platform Trial with Molecular Analysis for Therapy Choice (ComboMATCH) , the initiative is the largest of its kind to test combinations of cancer drugs guided by tumor biology. The endeavor aims to identify promising treatments that can advance to larger, more definitive clinical trials. Thus, the heightened research activity and collaborations in cytotoxic drug development is shaping future market growth.

The Rastriya Arogya Nidhi - Health Minister's Cancer Patient Fund (HMCPF) is a scheme set up in 2009 to provide financial assistance of up to Rs. 2, 00, 000 (around $2, 500) to poor cancer patients living below the poverty line for their treatment at 27 Regional Cancer Centers in India. This includes assistance for radiation therapy, chemotherapy, bone marrow transplants, and other cancer treatments. This initiative not only improves patient outcomes but also stimulates demand for cytotoxic medications thereby propelling the market growth.

Competitive Landscape

The major players operating in the cytotoxic drug market include Baxter, Cipla Ltd, Eli Lilly and Company, Fresenius Kabi AG, Johnson & Johnson, Novartis AG, Viatris Inc., Pfizer Inc., Sun Pharmaceutical Industries Ltd., and Teva Pharmaceutical Industries Ltd. Other players in cytotoxic drug market include Amgen Inc., Bristol-Myer Squibb Company, Merck & Co., Inc. and so on.

Recent Key Strategies and Developments in Cytotoxic Drug Industry

In January 2023, Merck, known as MSD outside of the U.S. and Canada, announced that the U.S. Food and Drug Administration (FDA) has approved KEYTRUDA, Merck’s anti-PD-1 therapy, as a single agent, for adjuvant treatment following surgical resection and platinum-based chemotherapy for adult patients with stage IB (T2a ≥4 centimeters [cm]) , II, or IIIA non-small cell lung cancer (NSCLC) .

In May 2021, Zydus Cadila, a global innovation driven healthcare company, launched Trastuzumab Emtansine, the first Antibody Drug Conjugate (ADC) biosimilar and a highly effective drug for treating both early and advanced HER2 positive breast cancer, under the brand name ‘Ujvira’. HER2 positive breast cancer is considered an aggressive form and constitutes 20 to 25% of all breast cancers.

Key Sources Referred

- National Center for Biotechnology and Information (NCBI)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- Australian Government Department of Health and Aged Care

- Government of Canada's Health and Wellness

- Ministry of Health and Family Welfare (MoHFW)

- National Health Mission (NHM)

- Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- World Health Organization (WHO)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cytotoxic drug market analysis from 2024 to 2033 to identify the prevailing cytotoxic drug market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cytotoxic drug market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cytotoxic drug market trends, key players, market segments, application areas, and market growth strategies.

Cytotoxic Drug Market , by Drug Type Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 19.5 Billion |

| Growth Rate | CAGR of 2.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 245 |

| By Drug Type |

|

| By Application |

|

| By Route Of Administration |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Cipla Ltd, Viatris Inc., Baxter, Pfizer Inc., Fresenius Kabi AG, Johnson & Johnson, Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., Novartis AG, Sun Pharmaceutical Industries Ltd. |

The total market value of cytotoxic drug market is $15.8 billion in 2023.

The market value of cytotoxic drug market in 2033 is $19.5 billion.

The forecast period for cytotoxic drug market is 2024 to 2033.

The base year is 2023 in cytotoxic drug market.

The market growth is driven by the increasing prevalence of various cancers, advancements in drug delivery systems, and rising investments in cancer research and development.

Cytotoxic drugs are medications used to kill or inhibit the growth of cancer cells. They are commonly used in chemotherapy to treat various types of cancer by targeting rapidly dividing cells.

Key trends include increased use of combination therapies, development of less toxic and more effective cytotoxic agents, integration of nanotechnology for targeted drug delivery, and a focus on personalized cancer treatment approaches.

Loading Table Of Content...