Military Logistics Market - 2032

The global defense logistics market size was valued at $203.8 billion in 2022, and is projected to reach $329.9 billion by 2032, growing at a CAGR of 5.0% from 2023 to 2032.

Report Key Highlighters:

- The defense logistics market studies more than 15 countries. The research includes a segment analysis of each country in terms of value ($ million) for the projected period 2022-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The defense logistics market share is moderately fragmented, with several players including Lockheed Martin Corporation, Colak Group, Crowley, BAE Systems, Northrop Grumman, Raytheon Technologies, General Dynamics Corporation, L3Harris Technologies, Inc., SEKO Logistics, and Leonardo S.p.A. Key strategies such as contract, and other strategies of the players operating in the market are tracked and monitored.

Defense Logistics (DL) involves supplying the necessary resources for the composition and support of the defense industry in various operational scenarios. Logistics plays a crucial role in ability of a military to sustain a continuous deployment or effectively react to unforeseen challenges by facilitating the movement of equipment, ammunition, vehicles, and other wide range of resources between different locations. Defense logistics encompasses the procedures, assets, and systems essential for creating, transporting, sustaining, and redistributing or reallocating materials and equipment. The proficiency with which a nation carries out these functions is directly correlated to its military strength. The effective execution of these processes offers strategic flexibility upon a country but also holds the potential to secure a decisive position of advantage.

Factors such as growth in the surge in government defense expenditure and military modernization programs, rise in military conflicts and geopolitical tension, and increase in the need for an effective and resilient supply chain for military drive the growth of the defense logistics market. However, lack of infrastructure, and increase in cybersecurity threats hinder the growth of the market. Furthermore, rise in the focus on sustainability and environment friendly practices in defense logistics, and technological advancements offer remarkable growth opportunities for the players operating in the defense logistics market.

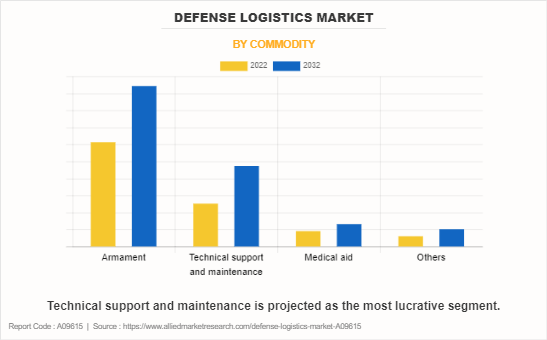

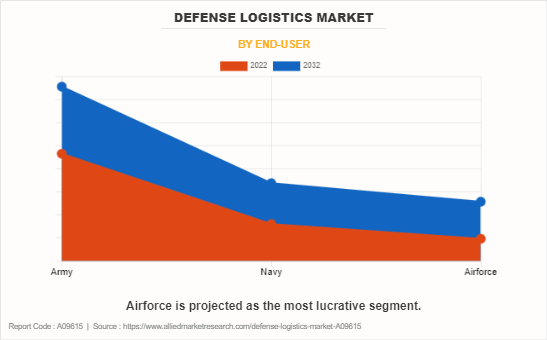

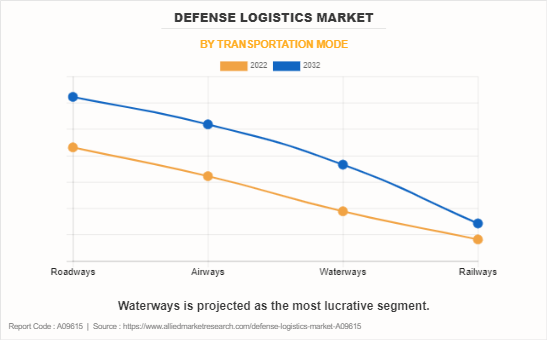

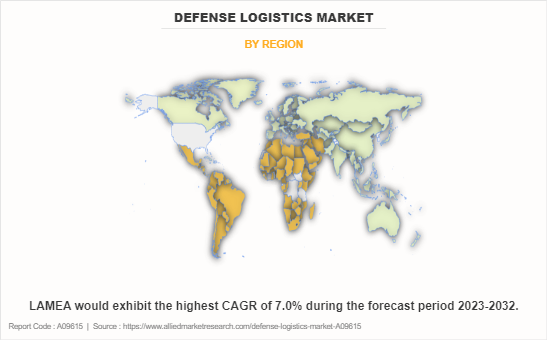

The defense logistics market is segmented on the basis of end-user, transportation mode, commodity, and region. On the basis of end-user, it is divided into army, navy, and airforce. On the basis of transportation mode, the market is classified roadways, airways, waterways, and railways. On the basis of commodity, it is fragmented into armament, technical support & maintenance, medical aid, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading companies profiled in the defense logistics report include Lockheed Martin Corporation, Colak Group, Crowley, BAE Systems, Northrop Grumman, Raytheon Technologies, General Dynamics Corporation, L3Harris Technologies, Inc., SEKO Logistics, and Leonardo S.p.A. The companies have adopted strategies such as contract, and others to improve their market positioning.

North America includes the U.S., Canada, and Mexico. The defense logistics market is often influenced by the overall increase in the defense budget of the countries in the region. The U.S., as a key participant in North American defense, consistently assigns substantial funds to military operations and logistics. The consistent upward trend in defense budgets facilitates greater investments in the development of logistics infrastructure, technology, and support services. North America holds a significant position in technological innovation, which is notably reflected in the defense logistics sector. The progress of logistics technology, encompassing automation, data analytics, and real-time tracking, plays a crucial role in enhancing the effectiveness and efficiency of defense logistics operations.

Europe includes countries such as Russia, the UK, Germany, France, and others. Over the anticipated timeframe, it is anticipated that the defense logistics market in the region will expand due to a rise in defense expenditures. A continual and substantial allocation of resources is dedicated to bolstering military operations and logistics in Europe. The increase in the defense budgets in European countries enables a focus on investments in key areas such as logistics infrastructure, advanced technology applications, and support services. Moreover, countries have focused on creating pacts to establish legal framework that facilitates joint military logistic activities.

For instance, in November 2022, Japan and Germany announced to pursue military logistics pact, to strengthen the security ties between the two nations. The pact is a result of increase in global security concerns, particularly considering invasion of Ukraine by Russia and expanding military capabilities of China. The pact is expected to include provisions detailing the rules for mutually providing essential resources such as fuel, food, and transportation during joint activities. Therefore, such developments to promote and enable transfers of defense equipment and technology are expected to drive the growth of the market in the region.

Surge in government defense expenditure and military modernization programs

There has been a significant surge in government defense expenditure and military modernization programs across the globe. This trend is attributed to several factors, including evolving geopolitical landscapes, increase in security concerns, and advancements in military technology. Governments across the globe have recognized the need to bolster their defense capabilities to ensure national security and protect their interests in the world. For instance, on March 9, 2023, the Biden-Harris Administration presented to Congress a Fiscal Year (FY) 2024 budget proposal for the Department of Defense (DoD), seeking $842 billion. This reflects a $26 billion rise from FY 2023 and a $100 billion increase compared to the FY 2022 levels.

In the year 2022, the U.S. assigned $295 billion for military operations and maintenance, $264 billion for procurement and research and development, and $167 billion for military personnel. Moreover, the total military expenditure for countries in Asia and Oceania amounted to $575 billion, showing a 2.7 percent increase from 2021 and a substantial 45 percent rise compared to the figures recorded in 2013. Defense logistics becomes important to ensure the efficient flow of these newly acquired resources as military forces increase the defense budget to modernize their equipment. Therefore, such factors are expected to drive the growth of the market.

Rise in military conflicts and geopolitical tension

A substantial rise in armed conflicts and intensified political and strategic rivalries among nations has increased. For instance, in 2022, the conflict between Russia and Ukraine created a rise in the geopolitical tension, prompting both nations and their allies to reassess and reinforce their defense capabilities. There is a surge in the escalation in military engagements, disputes over geopolitical interests, and heightened diplomatic tensions globally. Military conflicts may encompass active warfare or increased displays of military readiness. Moreover, there is a rise in geopolitical tension between nations and competition for influence among nations.

For instance, in March 2023, India and China expanded their military postures along the disputed border, Line of Actual Control. The Annual Threat Assessment of U.S. Intelligence Community suggests that the escalation increases the risk of armed confrontation between the two nations. Heightened geopolitical tensions trigger an urgent need for nations to bolster their defense capabilities and preparedness. Such geopolitical uncertainties directly influence the defense priorities, which increases the need for a strategic shift in military preparedness. Therefore, such factors significantly increase the demand for defense logistics services and solutions.

Increase in the need for effective and resilient supply chain for military

A robust supply chain plays a crucial role in ensuring the availability of vital resources such as equipment, ammunition, and provisions, thereby supporting the sustainability of military operations during periods of conflict or crises. The effectiveness of the supply chain has a direct influence on the agility and responsiveness of military forces. Well-organized and prompt logistics contribute to the timely deployment of forces, reducing the duration required to address emerging threats.

A streamlined supply chain is essential for adapting to various terrains and climates, guaranteeing the uninterrupted and timely delivery of resources to their intended destinations without encountering delays or disruptions. Robust supply chains require meticulous planning and coordination. Defense logistics providers contribute by offering strategic planning services, ensuring that resources are deployed and distributed in alignment with military objectives. Defense logistics providers play an important role in efficiently transporting, storing, and distributing essential military resources. The requirement for a robust supply chain in military operations translates into an increased demand for logistics services.

Lack of infrastructure

The lack or insufficiency of infrastructure presents a considerable challenge to the defense logistics market. In areas characterized by the absence of adequately developed transportation networks, storage facilities, and communication systems, the operational efficiency and effectiveness of military logistics are undermined. Military forces face difficulties in rapidly mobilizing personnel and resources, with limited mobility of troops and constraints in the timely deployment of equipment, especially in regions lacking well-established transportation infrastructure. Therefore, the inadequacy of infrastructure is expected to hinder the growth of the defense logistics market during the forecast period.

Increase in the cybersecurity threats

The increase in reliance of defense logistics on digital technologies and interconnected systems increases the vulnerability to cyber threats, which target sensitive data and can disrupt the visibility of the supply chain. Cybersecurity breaches have the potential to compromise the confidentiality and integrity of logistics data, influencing decision-making processes and the allocation of resources. Secure communication networks are essential for real-time coordination and information exchange in military logistics.

The surge in cybersecurity threats poses a substantial risk to these networks, with the potential for disruptions in critical communication channels essential for logistics planning and execution. Cyberattacks on defense logistics can lead to disruptions in the supply chain, affecting the timely delivery of crucial resources and equipment. Ensuring resilience against cyber threats becomes imperative to sustaining an uninterrupted flow of supplies, particularly during critical military operations. Therefore, the rise in the threats related to cybersecurity is expected to hamper the growth of the market.

Rise in sustainability and environmentally friendly practices in defense logistics

Military forces have increasingly recognized the significance of embracing sustainable practices within supply chain management. This entails the integration of considerations for sustainability at every phase of the logistics process, spanning from procurement and transportation to storage and disposal. An integral element of eco-friendly defense logistics lies in the adoption of transportation methods that prioritize energy efficiency. This encompasses the exploration of alternative fuels, the optimization of routes to curtail fuel consumption, and investments in vehicles and technologies geared toward fuel efficiency.

The traditional defense logistics operations contribute to carbon emissions, the current emphasis on sustainability involves implementing measures to reduce the carbon footprint. This includes the utilization of cleaner energy sources, the implementation of strategies to minimize emissions, and the adoption of technologies that align with eco-friendly practices. Sustainability efforts in defense logistics also extend to waste reduction initiatives and the promotion of recycling practices. Such practices are expected to provide lucrative opportunities for the growth of the market.

Recent Developments in the Defense Logistics Industry:

- In September 2023, L3Harris Technologies received a contract by the Defense Logistics Agency (DLA) for the provision of spares and repair parts for very small aperture terminal (VSAT) transmission systems. The contract is a firm-fixed-price, indefinite-delivery/indefinite-quantity (IDIQ) contract with a maximum value of $125.13 million.• In January 2022, General Dynamics, through its business unit of General Dynamics Information Technology (GDIT) received a $518 million task order from the U.S. Army Communications Electronics Command (CECOM). Under this contract, GDIT is expected to provide logistics services, ensuring the efficient and timely movement of equipment, supplies, and resources to support joint the U.S. and coalition forces.

- In March 2021, General Dynamics, through its subsidiary Gulfstream Aerospace received contracts totaling $696 million by the U.S. Air Force. The contracts involve providing engineering services and contractor logistics support to the Air Force. Gulfstream will be working on C-20 and C-37 aircraft for the Air Force Life Cycle Management Center.

- In September 2021, Lockheed Martin secured a substantial contract valued at $2.01 billion. The primary focus of the contract is to provide crucial logistics support for the F-35 air systems. This includes catering to the needs of the U.S. and foreign military sales customers.

- In September 2021, Crowley received a multi-year contract worth $192.4 million to provide fuel management and storage services for Pacific military operations. The scope of services includes energy logistics management and services related to the receipt, storage, protection, and shipment of aviation-grade JP-5 turbine fuel and commercial-grade Jet A-1 fuel.

- In May 2021, Raytheon Technologies received a potential $495 million contract by the U.S. Navy to support the U.S. Marine Corps' secondary repairable program at supply chain management centers located in various U.S. Raytheon Technologies will play a crucial role in supporting the U.S. Marine Corps by efficiently managing and optimizing the logistics and repair processes for secondary repairable items.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the defense logistics market analysis from 2022 to 2032 to identify the prevailing defense logistics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the defense logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global defense logistics market trends, key players, market segments, application areas, and market growth strategies.

Defense Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 329.9 billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Commodity |

|

| By End-user |

|

| By Transportation mode |

|

| By Region |

|

| Key Market Players | General Dynamics Corporation, Northrop Grumman, L3Harris Technologies, Inc., Crowley Maritime Corporation, Seko Logistics, Boeing, Leonardo S.p.A., Lockheed Martin Corporation, Raytheon Technologies Corporation, BAE Systems |

The global defense logistics market was valued at $203.79 billion in 2022, and is projected to reach $329.88 billion by 2032, registering a CAGR of 5.0% from 2023 to 2032

The leading companies profiled in the defense logistics report include Lockheed Martin Corporation, Colak Group, Crowley, BAE Systems, Northrop Grumman, Raytheon Technologies, General Dynamics Corporation, L3Harris Technologies, Inc., SEKO Logistics, and Leonardo S.p.A.

The largest regional market for defense logistics is North America.

The leading transportation mode of defense logistics market is roadways.

The upcoming trends of defense logistics market in the world are rise in the focus on sustainability and environment friendly practices in defense logistics, and technological advancements.

Loading Table Of Content...

Loading Research Methodology...