Dental CAD/CAM Market Research, 2032

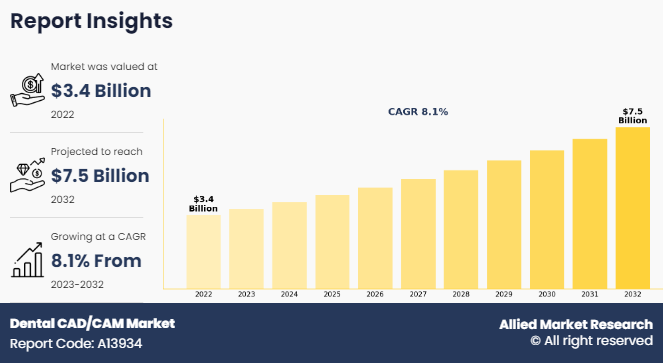

The global dental cad/cam market size was valued at $3.4 billion in 2022, and is projected to reach $7.5 billion by 2032, growing at a CAGR of 8.1% from 2023 to 2032.

The growing prevalence of dental disorders among the global population has contributed to the expansion of market growth. According to National Center for Biotechnology and Information (NCBI), the adult population with periodontal diseases was estimated to increase from 25.751 million in 2020 to 27.980 million by 2050, while those with periodontal loss of attachment was projected to increase from 18.667 million in 2020 to 20.898 million by 2050. In addition, the World Health Organization (WHO) reported that oral diseases amounted to an annual expenditure of about US$ 387 billion in direct costs and US$ 323 billion in indirect costs globally.

Dental CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) is a technology that enables the design and fabrication of dental restorations like crowns, bridges, and implants using computer software and automated machinery. It streamlines the dental prosthetic process by allowing for precise digital modeling and efficient production, resulting in accurate, customized dental solutions.

Key Takeaways

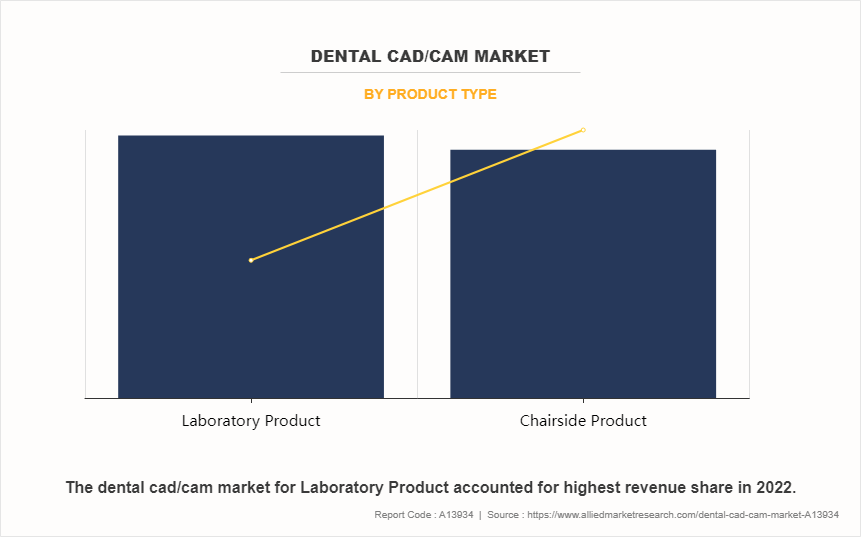

- By product type, the laboratory product segment dominated the global dental CAD/CAM market size in terms of revenue in 2022. However, the chairside products segment is expected to register the highest CAGR during the forecast period

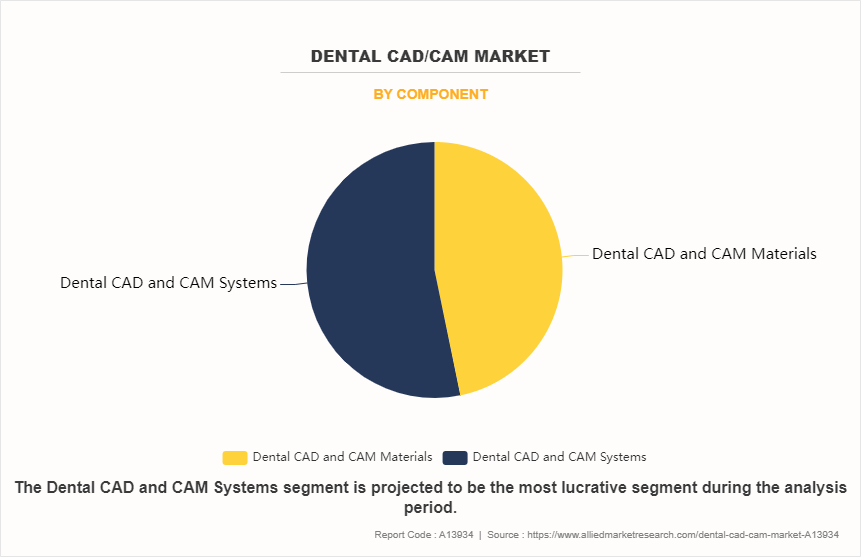

- By component, the dental CAD and CAM systems segment dominated the global dental CAD/CAM market size in terms of revenue in 2022 and is expected to register the highest CAGR during the forecast period.

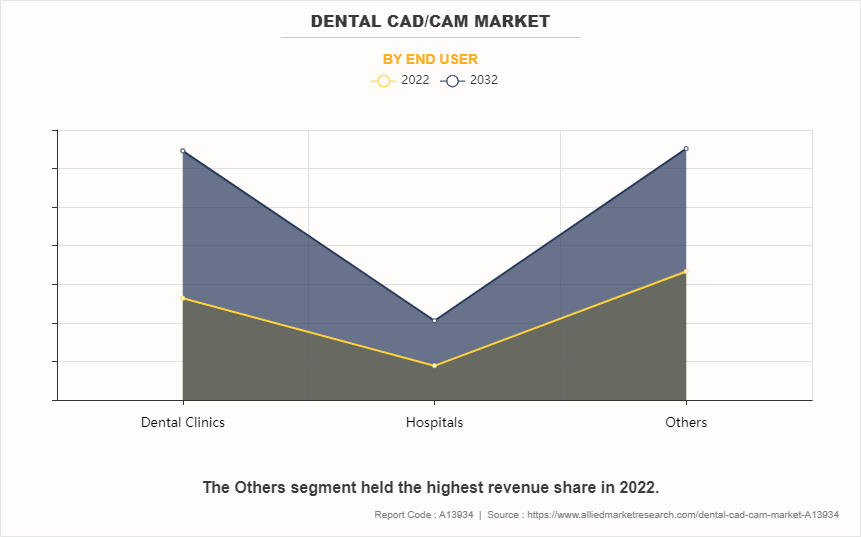

- By end user, the others segment dominated the market in terms of revenue in 2022. However, the dental clinics segment is expected to register the highest CAGR during the forecast period.

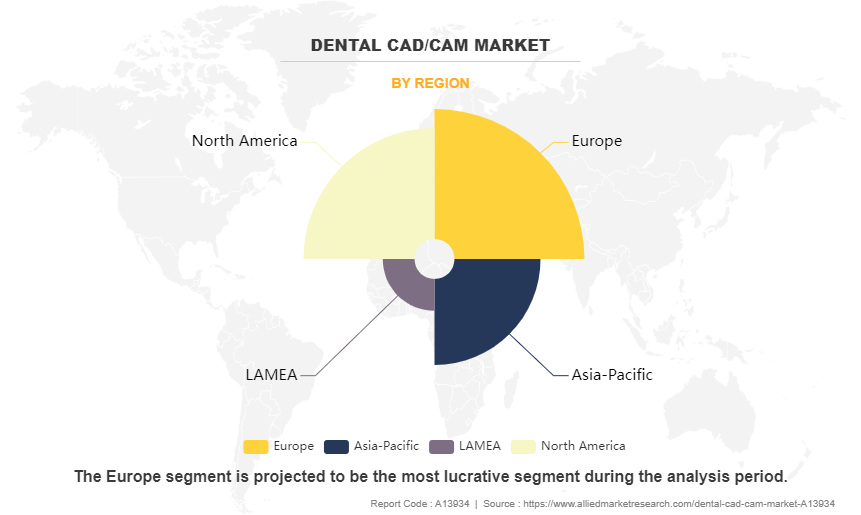

- Region wise, North America dominated the dental CAD/CAM market share in terms of revenue in 2022. However, Asia-Pacific is expected to register the highest CAGR during the dental CAD/CAM market forecast period.

Market Dynamics

The surge in prevalence of dental diseases and the rise in demand for cosmetic dentistry procedures are driving the need for dental restorations such as crowns, bridges, and implants thereby driving the dental CAD/CAM market growth. For instance, an article published by National Center for Biotechnology and Information (NCBI) in 2023, the older adult population with carious teeth estimated to rise from 32.26% in 2020 to 62.06% by 2050 in UK. The surge in cases of dental diseases requires the CAD/CAM technology which provide dentists and dental laboratories with the tools to create precise, customized restorations that meet patient needs while improving treatment outcomes which is expected to drive the dental CAD/CAM market opportunity

In addition, the continuous advancements in CAD/CAM technology have revolutionized the dental industry, offering more efficient and accurate solutions for designing and manufacturing dental restorations which fuels the market growth. These technological improvements include enhanced software capabilities, faster processing speeds, and increased automation, leading to higher productivity and better patient outcomes. For instance, in February 2023, ZimVie Inc., a global life sciences leader in the dental and spine markets, announced the launch of the RealGUIDE CAD and FULL SUITE modules, the latest innovations within ZimVie’s digital dentistry software platform. Thus, advancements in CAD/CAM technology boost market growth.

Furthermore, the rise in demand for chairside CAD/CAM systems, which allow for on-demand fabrication of restorations directly in the dental office, supports the market growth. These systems offer convenience, shorter treatment times, and enhance patient satisfaction by eliminating the need for multiple appointments and temporary restorations.

However, the upfront costs associated with purchasing CAD/CAM equipment and software can be substantial for dental practices and laboratories which may limit the adoption of CAD/CAM technology. This financial barrier may deter some smaller practices or facilities from adopting CAD/CAM technology, particularly in regions with limited financial resources or reimbursement challenges thereby restraining market growth. On the other hand, the rise in technological advancements in CAD/CAM and high growth potential in emerging countries provide lucrative opportunities to market growth.

Segments Overview

Dental CAD/CAM market analysis is segmented into product type, component, end user, and region. By product type, the market is bifurcated into chairside product and laboratory product. As per component, the market is categorized into dental CAD and CAM materials and dental CAD and CAM systems. Depending on end user, it is segregated into dental clinics, hospitals, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, LAMEA.

By Product Type

The laboratory product segment dominated the global dental CAD/CAM market share in 2022 and is also expected to register the highest CAGR during the forecast period. This is attributed to the widespread adoption of CAD/CAM systems by dental laboratories for fabricating a wide range of dental prostheses. In addition, the versatility and accuracy of CAD/CAM systems allow dental laboratories to efficiently meet the diverse needs of dental practitioners and patients, driving the dominance of the laboratory product segment.

By Component

The dental CAD and CAM systems segment dominated the global dental CAD/CAM market share in 2022 is expected to register the highest CAGR of 8.5% during the forecast period, owing to the increase in demand for integrated CAD/CAM systems that offer both design and manufacturing capabilities within a single platform. In addition, rise in technological advancements in CAD/CAM software and hardware technologies are driving the adoption of these integrated systems, which further fuels the segment growth.

By End User

The others segment held the largest market share in 2022, owing to the pivotal role of dental laboratories in the fabrication of dental prostheses using CAD/CAM technology as they utilize these systems to design and manufacture a wide range of dental restorations, including crowns, bridges, veneers, and implant components. However, dental clinics segment is expected to register the highest CAGR during the forecast period, owing to the growing demand for CAD/CAM technology by dental clinics to enhance patient care and treatment outcomes, the growing trend towards digital dentistry and the availability of more user-friendly and affordable CAD/CAM solutions which are driving the adoption of this technology among dental clinics.

By Region

The dental CAD/CAM industry is analyzed across North America, Europe, Asia-Pacific, LAMEA. North America has accounted for the largest share in the dental CAD/CAM market and is expected to remain dominant during the forecast period. This dominance is attributed to its highly developed healthcare infrastructure along with a strong emphasis on technological innovation, making it conducive to the adoption of advanced dental technologies like CAD/CAM systems.

However, the Asia-Pacific region is anticipated to register the highest CAGR during the forecast period. This is attributed to growing awareness among dental practitioners and patients about the benefits of CAD/CAM technology in terms of precision, efficiency, and customization of dental prostheses. In addition, the rise in advancements in technology and infrastructure development are making CAD/CAM systems more accessible and affordable to dental clinics and laboratories which further drive the market growth in the Asia-Pacific region.

Competitive Analysis

Key players such as Dentsply Sirona and Institut Straumann AG have adopted expansion and product launch as key developmental strategies to improve the product portfolio of the dental CAD/CAM market. For instance, in September 2022, Dentsply SIRONA Inc. launched a new product Primescan Connect, a laptop-based version of Primescan which is powered by the cloud platform DS Core, and is now getting new features.

Recent Developments in the Dental CAD/CAM Industry

- In January 2024, The Ivoclar Group, one of the world’s leading manufacturers of integrated solutions for high-quality dental applications, offers a comprehensive portfolio of products and systems for dentists, dental technicians and dental hygienists. The company launched IPS e.max Gel, a highly effective oral care gel based on a unique formula that protects valuable restorations and enhances their durability. The new oral care gel with chlorhexidine, fluoride, D-panthenol, and xylitol enables effective oral hygiene in the practice and at home. IPS e.max Gel forms a part of the IPS e.max family, a product line of high-quality allceramic dental materials from Ivoclar.

- In September 2023, Dentsply Sirona and 3Shape are expanding their workflow integrations to enable dental professionals through DS Core and 3Shape Unite to use a scan-to-lab workflow or establish design and manufacturing protocols directly in their practice. The harmonization of DS Core, Primemill and Primeprint, with the 3Shape TRIOS intraoral scanner powered by 3Shape Unite, creates more integrated workflows for digital dentistry. Dentists will be able to seamlessly connect TRIOS scanners to Primemill and Primeprint for in-office milling and printing via 3Shape Unite, DS Core and the inLab CAD software.

- In September 2023, The Straumann Group has signed an agreement to acquire AlliedStar, an intraoral scanner (IOS) manufacturer in China. It will enable the Group to offer customers in China a competitive intraoral scanner solution and to address additional price-sensitive markets and customer segments in the future. As part of the Straumann Group, AlliedStar will continue to serve existing channels. AlliedStar is a pioneering company in the field of digital dentistry, specializing in offering scanning and CAD/CAM solutions to dental clinics.

- In November 2023, Roland DGA’s DGSHAPE Americas Dental Business Group and Straumann USA, two of the most recognized and respected names in dental technology, are partnering to combine their collective talents and expertise to accelerate the awareness and acceptance of high-quality restorative solutions in the dental market. This new collaboration creates an exciting opportunity to provide world-class, full-service restorative solutions featuring Straumann’s implant solutions and DGSHAPE’s DWX Dental Milling Solutions. The partnership also enables Straumann USA to distribute Roland DGA’s state-of-the-art DGSHAPE DWX mills throughout the U.S. and Canada.

- In May 2023, Amann Girbach launched the Ceramill Motion 3 marketed as an intelligent hybrid machine which makes dental restorations even more convenient, efficient and simple: the 5-axis milling unit combines a wide variety of materials and indications as well as excellent fabrication quality with all the benefits of an end-to-end digital workflow.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dental cad/cam market analysis from 2022 to 2032 to identify the prevailing dental cad/cam market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dental cad/cam market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dental cad/cam market trends, key players, market segments, application areas, and market growth strategies.

Dental CAD/CAM Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.5 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 275 |

| By Product Type |

|

| By Component |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ivoclar Vivadent AG., Zirkonzahn GmbH., Amann Girrbach AG, Roland DGA Corporation, ZimVie Inc., Biohorizons, Planmeca Oy, 3M Company, Dentsply Sirona, Institut Straumann AG |

Analyst Review

This section provides various opinions in the global dental CAD/CAM market is expected to exhibit high growth potential attributable to rise in prevalence of oral diseases, and growing demand for advanced systems and materials. However, the high cost associated with dental CAD/CAM systems limit the growth of dental CAD/CAM market.??In addition that the key players have adopted various strategies to strengthen their foothold in the competitive market. In addition, rise in incidences of oral diseases, increase in awareness of benefits of dental CAD/CAM, and rise in geriatric population further propel the market growth. For instance, according to the United Nations department of Economic and Social Affairs, there were 703 million people aged 65 years or over in the world in 2019 and the number of older persons is expected to double to 1.5 billion in 2050.?

Furthermore, Europe dominated the market share in 2022, owing to technological innovation in the dental industry, with leading manufacturers and suppliers developing cutting-edge CAD/CAM systems and materials, availability of skilled workforce of dental professionals, including dentists, dental technicians, and dental hygienists, and well-established healthcare infrastructure. However, Asia-Pacific is anticipated to witness notable growth, owing to surge in healthcare awareness, increase in healthcare spending, growth in dental tourism, and rise in technological advancements along with an increase in aging population which are driving the growth of dental CAD/CAM market.

The total market value of dental CAD/CAM market is $3.4 billion in 2022.

The forecast period for dental CAD/CAM market is 2023 to 2032

The market value of dental CAD/CAM market in 2032 is $7.5 billion.

The base year is 2022 in dental CAD/CAM market.

Top companies such as Dentsply Sirona, Institut Straumann AG, 3M, Ivoclar Vivadent, BioHorizons, Inc.,held a high market position in 2022. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LAMEA.

The laboratory products segment is the most influencing segment in dental CAD/CAM market owing to its pivotal role in manufacturing custom-made dental devices, the advancements in CAD/CAM technology enhancing laboratory efficiency, and the increasing adoption of digital workflows in dental laboratories.

The major factor that fuels the growth of the dental CAD/CAM market are rise in prevalence of oral diseases, increase in demand for aesthetic dentistry and rise in technological advancements in dental industry.

The dental CAD/CAM method comprises high-resolution 3D scanning technologies, more accurate, quicker, and simpler design software, and precise subtractive or additive manufacture of novel materials.

Loading Table Of Content...

Loading Research Methodology...