Dental Milling Machine Market Research, 2032

The global dental milling machine market size was valued at $2.1 billion in 2022, and is projected to reach $4.6 billion by 2032, growing at a CAGR of 8.5% from 2023 to 2032. The growth of the dental milling machine market size is driven by the rise in demand for dental milling machine, rise in awareness about CAD/CAM dental milling machine and surge in cases of dental diseases. For instance, according to the World Health Organization (WHO), in 2022, it was reported that around 2 billion people suffer from dental caries of permanent teeth. As per the same source, it was reported that 7% of the global population aged 20 years and older was suffering from complete tooth loss.

Key Takeaways:

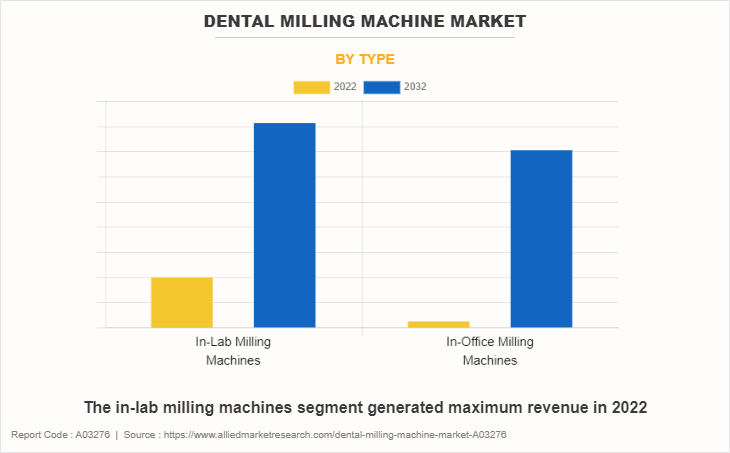

- On the basis of type, the in-lab milling machines segment held the largest share in the dental milling machine market in 2022.

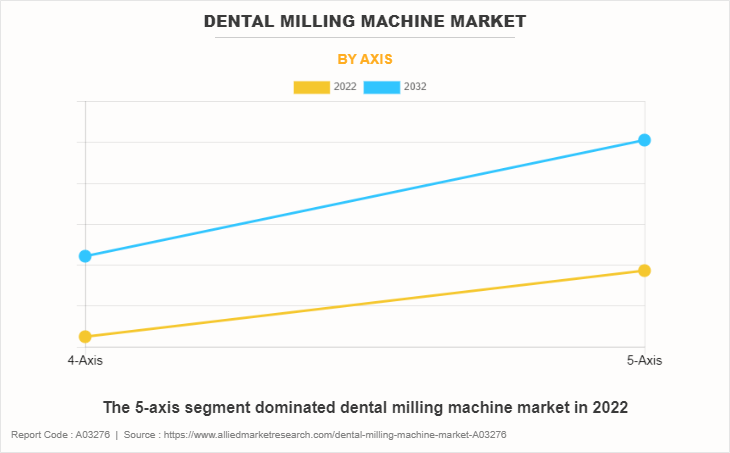

- By axis, the 5-axis dominated the dental milling machine market in 2022.

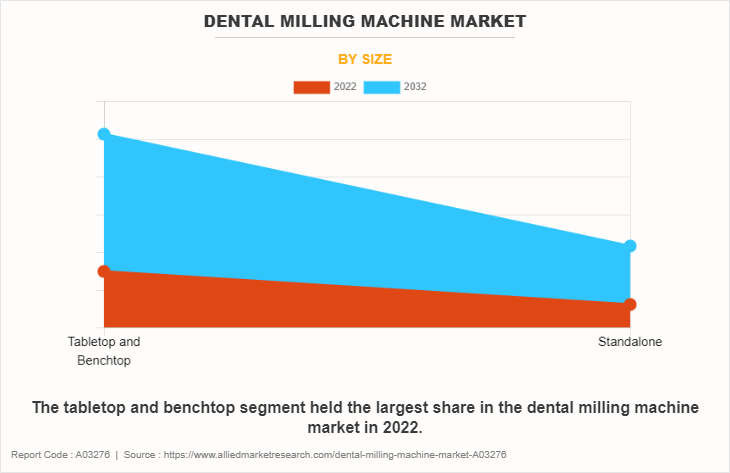

- Depending on size, in 2022, the tabletop and benchtop segment generated maximum revenue.

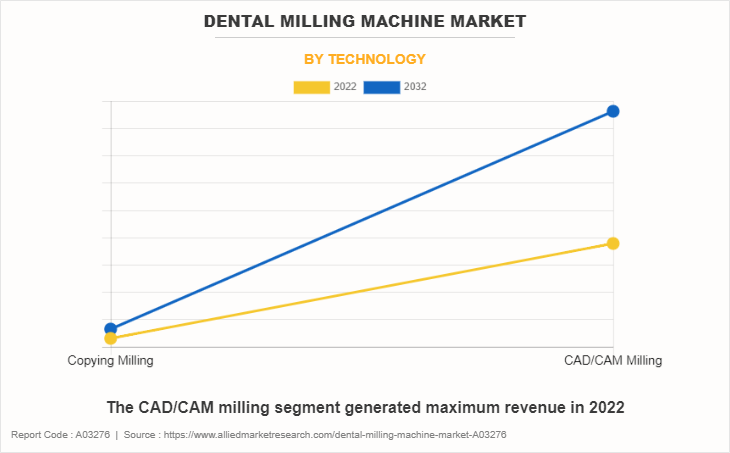

- On the basis of technology, the CAD/CAM milling segment held the largest share in the dental milling machine market in 2022.

- Region wise, Europe was the major shareholder in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The dental milling machine is used in the milling and grinding of 3D objects. Dental milling machine is used to design and manufacture artificial dental prosthetics. Dental milling machine produce highly accurate and precise dental restorations by using different materials such as ceramics, zirconia, alloys, and resins.

Market Dynamics

In addition, as per World Health Organization (WHO) 2022, it was reported that around 19% of the global population is affected by periodontal disease. Hence, dental restoration is recommended as a treatment for missing teeth, gum disease, and dental caries. Thus, the increasing need for dental restoration procedure further increases the demand for dental milling machine.

The rise in the geriatric population who are suffering from dental diseases drives the growth of dental milling machine market share. According to Henry Schein’s annual report 2021, in the dental industry, there is predicted to be a rise in oral health care expenditures as the 45-and-older segment of the population increases. There is increasing demand for new technologies that allow dentists to increase productivity, and this is being driven in the U.S. by lower insurance reimbursement rates. At the same time, there is an expected increase in dental insurance coverage. For instance, according to the U.S. Census Bureau’s International Database, between 2021 and 2031, the 45 and older population is expected to grow by approximately 11%. Between 2021 and 2041, this age group is expected to grow by approximately 22%. This compares with expected total U.S. population growth rates of approximately 7% between 2021 and 2031 and approximately 12% between 2021 and 2041.

The rise in awareness regarding oral health and digital dentistry has contributed to the growth of the dental milling machine market share. According to the Journal of Oral Biology and Craniofacial Research, in 2023, it was reported that 92.7% of technicians and 98.9% of practitioners are aware about the use of digital dentistry.

In addition, increase in research activities, technological innovations in the dental milling machine, increase in demand for dental milling machine, and rise in use of dental milling machine are the key factors that drive the dental milling machine market growth in the developing countries such as India and China. Hence, such factors drive the growth of the dental milling machine market.

Recession 2023 Impact Analysis on Dental Milling Machine Market

During a recession, dental professionals may postpone or scale back plans to upgrade their existing equipment. Instead of investing in the latest models, they might opt to maintain and repair their current machines, which could impact the sales of new machines. Dental practices and laboratories reduced the purchase of new dental milling machines. This can lead to a decrease in demand for these machines as potential buyers become more cautious about their investments.

Patients reduced disposable income during a recession may lead to a decline in the demand for dental services, including restorative and cosmetic procedures. This, in turn, could reduce the demand for dental prosthetics and restorations created using milling machines. Dental laboratories, which are significant users of dental milling machines, may face challenges as dental practices cut back on outsourcing and reduce the volume of work they send to labs. This can have a cascading effect on the demand for milling machines.

Therefore, the recession is expected to temporarily affect the growth of dental milling machine market, however the growth of dental milling machine market during the forecast period remains insignificant. Furthermore, the dental milling machine market witnessed an incline in the sales of dental milling machine during forecast period, owing to increase in number of patients suffering from dental disease, technological advancement in dental milling machine, increase in number of dental practices, and rise in oral healthcare expenditure. Thus, such trends are expected to bring stabilization in the market, and subsequently are expected to witness notable growth during the forecast period.

Segmental Overview

The dental milling machine market is segmented into type, axis, size, technology, and region. On the basis of type, the market is classified into in-lab milling machines and in-office milling machines. Depending on the axis, the market is classified into 4-axis, and 5-axis. By size, it is segregated into tabletop and benchtop, and standalone. On the basis of technology, the market is segregated into copying milling and CAD/CAM milling. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and Rest of LAMEA).

By Type

The in-lab milling machines segment generated maximum revenue in 2022, owing to high adoption of in lab milling machines, increase in number of dental laboratories, and the high cost of in lab milling machines. The in-office milling machines segment is expected to witness the highest CAGR during the forecast period, owing to reduced costs and greater flexibility and provides same-day restorations, reducing the need for multiple appointments and temporary restorations.

By Axis

The 5-axis segment led the market in 2022, owing to high use of 5-axis dental milling machine in dental laboratories and the wider availability of 5-axis dental milling machine. However, the 4-axis segment is expected to witness the highest CAGR during the forecast period, owing to the low cost of the 4-axis dental milling machine and its lower complexity.

By Size

The tabletop and benchtop segment dominated the market in 2022, owing to wider availability of tabletop and benchtop milling machine and high adoption of tabletop and benchtop dental milling machines. The same segment is expected to witness the highest CAGR during the forecast period, owing to offers various advantages such as suitable for smaller dental practices or clinics with limited space.

By Technology

The CAD/CAM milling segment dominated the market in 2022 and is expected to witness the highest CAGR during the forecast period, owing to high adoption of CAD/CAM milling machine and offers a high degree of customization, high precision, and accuracy. The same segment is expected to witness the highest CAGR during the dental milling machine market forecast period, owing to CAD/CAM dental milling machines are capable of producing restorations quickly, reducing the time patients spend in the dental chair.

By Region

Europe accounted for a major share of the dental milling machine market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Institut Straumann AG (Switzerland), Zirkonzahn GmbH (Italy), vhf camfacture AG (Germany), PLANMECA OY (Finland), Amann Girrbach AG (Austria) and Ivoclar Vivadent AG (Liechtenstein); rise in number of product launch; availability of advanced oral healthcare facilities; and high healthcare expenditure from the government organizations in the region drive the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the forecast period. This is attributable to a rise in cases of dental disease as well as increase in purchasing power of populated countries, such as China and India. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,411,778,724 population in 2020 and India being the second most populated country with 1,380,004,385 population in 2020. A rise in population along with longer life expectancy is thus expected to drive the growth of the market in Asia-Pacific during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the dental milling machine market, such as 3M Company, Amann Girrbach AG, Dentsply Sirona, Institut Straumann AG, Ivoclar Vivadent AG, PLANMECA OY, Roland DGA Corporation, vhf camfacture AG, ZimVie Inc., and Zirkonzahn GmbH are provided in the report. These players have adopted acquisition, agreement, collaboration, product launch, and partnership as their key developmental strategies to improve their product portfolio.

Recent Acquisition in the Dental Milling Machine Industry

In September 2021, Planmeca Oy, one of the largest privately held manufacturers in the dental field, entered into a binding contract to acquire the KaVo Treatment Unit & Instrument business from Envista Holdings Corporation. The acquisition is expected to strengthen Planmeca’s and KaVo’s positions as leading providers of innovative dental solutions and increase Planmeca Group’s annual revenue to more than EUR 1.1 billion. The acquisition is expected to complement Planmeca’s extensive product portfolio and enhance the growth and competitiveness of both companies, allowing them to offer the best possible modern digital workflow to dental professionals around the world.

Recent Agreement in the Dental Milling Machine Market

In August 2022, Deutsche Beteiligungs AG acquires stake in vhf Group. The vhf Group sets an important course for its growth. In the future, Deutsche Beteiligungs AG (DBAG) is expected to hold about one fifth of the shares of vhf camfacture AG. The latter is expected to act as the holding company of the group in the future. With DBAG, vhf has brought on board a strong and solid partner based in Frankfurt am Main, Germany. Under this agreement, the close and long-term commitment is based on deep mutual trust. DBAG finances long-term investments exclusively from its balance sheet and thus does not invest alongside a DBAG fund.

Recent Collaboration in the Dental Milling Machine Industry

In November 2021, Amann Girrbach, a full-service provider for digital dental prosthetics, and ModuleWorks, developer of CAD/CAM software components, announce their ongoing long-term cooperation. The collaboration enables Amann Girrbach to offer fully validated self-driving CAM workflows as part of its digital dentistry strategy. Automation and ease-of-use are key requirements for digital CAM systems operated by dentists and dental technicians. To meet these needs, Amann Girrbach supplies customers with fully integrated Scan-CAD-CAM-CNC solutions that are pre-validated for a large range of dental indications and materials.

Recent Product Launch in the Dental Milling Machine Market

In May 2023, Roland DGA announced the launch of two next-generation milling machines – the DWX-52D Plus dry mill and the DWX-42W Plus wet mill. Both devices incorporate technology and feature enhancements that maximize overall efficiency, productivity, reliability, and ease of use. The new five-axis DWX-52D Plus boasts an all-new redesigned and optimized spindle and assembly as well as material management, tool control, and improvements for optimum dry-milling performance.

In March 2023, vhf introduces milling machine E3 for cutting out occlusal appliances. With the unveiling of the E3, vhf camfacture AG has now completed its EASE CLASS. The E3 is a very compact milling machine that has been specially developed for cutting out the most diverse shapes of thermoformed splints such as aligners, bite splints, grinding splints and other variants up to sports mouthguards.

In March 2023, Planmeca OY, a company of healthcare technology, announced the launch of Planmeca PlanMill 35, which is a new chairside milling unit with both wet and dry milling capabilities. It is an integrated part of Planmeca FIT chairside CAD/CAM system, which is designed to combine the entire workflow from intraoral scanning to treatment design and milling.

In March 2023, vhf camfacture AG launched a 5-axis Milling Machine E5, groundbreaking innovation for digital dental technology at the AEEDC in Dubai. The E5 is a dry milling machine for discs which master even complex indications with the highest precision. Despite its versatility, the E5 can be operated with EASE: It does not require any compressed air and is therefore very cost-effective and particularly sustainable.

In February 2023, vhf camfacture AG launched compact milling machine E4, a highly innovative machine for wet and dry machining of blocks. This machine is expected to boost digitization and enable many practices to enter same-day dentistry easily and economically, from which dentists and patients is expected to benefit alike. The E4 offers its users maximum freedom: it can be easily combined with the preferred intraoral scanner and the materials suitable for the respective patient case.

In December 2022, Planmeca announced to introduce a brand new Planmeca PlanMill 60 S milling unit specifically designed for the needs of dental laboratories. The powerful 5-axis milling unit is capable of both wet and dry processing of discs, blocks, and prefabricated implant abutments for a variety of indications. The milling unit is also a great tool for dentists willing to produce more advanced dental restorations and applications in house.

Recent Partnership in the Dental Milling Machine Market

In April 2023, vhf camfacture AG officially announced a partnership with Digital Smile Design (DSD) for short at IDS, the world’s leading trade fair for the dental industry. The common goal of the partnership is to drive the digital future of the dental industry and to make dental workflows even more efficient.

In February 2023, vhf is now an Ivoclar authorized milling partner for the Ivotion Denture System. vhf is now consolidating its long-standing, successful cooperation with Ivoclar Vivadent AG, and can now offer monolithic full dentures. vhf was one of the first manufacturers to be certified as an Ivoclar Authorized Milling Partner for the Ivotion Denture System.

In January 2023, Dentsply Sirona announced partnership with the National Dental Association, in the U.S to promote diversity in dental education.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dental milling machine market analysis from 2022 to 2032 to identify the prevailing dental milling machine market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dental milling machine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dental milling machine market trends, key players, market segments, application areas, and market growth strategies.

Dental Milling Machine Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.6 billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Type |

|

| By Axis |

|

| By Size |

|

| By Technology |

|

| By Region |

|

| Key Market Players | AMANN GIRRBACH AG, Roland DGA Corporation, DENTSPLY SIRONA Inc., Planmeca Oy, Ivoclar Vivadent AG., VHF Camfacture AG, Zirkonzahn GmbH., Institut Straumann AG, ZimVie Inc., 3M Company |

Analyst Review

This section provides opinions of top level CXOs in the dental milling machine market. The dental milling machine market has witnessed notable growth, owing to a rise in prevalence of dental diseases such as periodontitis, tooth erosion & damage or broken teeth and tooth decay which further increases the demand for dental milling machine.

According to the perspectives of CXOs, the global dental milling machine market is expected to witness a steady growth in the future. This is majorly attributed to the rise in the demand for advanced dental solutions and increase in the number of dental restoration procedures. In addition, an increase in technological advancement in dental milling machine, rise in awareness regarding the potential benefits of CAD/CAM dental milling machine has led to an increase in demand for dental milling machine and boosted the growth of the market. Furthermore, the rise in the number of professionally active dentists to perform dental procedures boosts the growth of the dental milling machine market.

Europe is expected to witness the highest growth, in terms of revenue, owing to an increase in dental tourism, availability of robust healthcare infrastructure, strong presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in use of dental milling machine, unmet medical demands, presence of high population base, and increase in public–private investments in the healthcare sector.

The estimated industry size of Dental Milling Machine is $2.1 billion in 2022

The forecast period for dental milling machine market is 2023 to 2032.

The dental milling machine market is estimated to reach $4.6 billion by 2032.

The rapid advancements in dental milling machine; rise in prevalence of dental disorders and increase in dental tourism in emerging countries are the upcoming trends of Dental Milling Machine Market in the world.

The in-lab milling machines is the leading segment of Dental Milling Machine Market

Europe is the largest regional market for Dental Milling Machine

The Institut Straumann AG, PLANMECA OY, Dentsply Sirona, Roland DGA Corporation, and Ivoclar Vivadent AG are the top companies to hold the market share in Dental Milling Machine.

Yes, competitive analysis included in dental milling machine market report.

Loading Table Of Content...

Loading Research Methodology...