Diamond Market Size & Share, 2032

The global diamond market was valued at $100.4 billion in 2022, and is projected to reach $155.5 billion by 2032, growing at a CAGR of 4.5% from 2023 to 2032.Diamonds are a type of mineral that is composed of pure carbon. It is also the hardest material that exists on earth. They are present in natural and synthetic forms. Natural diamonds are found beneath the earth's surface under high temperatures and pressure while synthetic diamonds are made in laboratories. They have some physical and chemical properties such as hardness, high thermal conductivity, high electrical resistivity, high strength, and broad optical transparency along with others. Diamonds are used in various jewelry and industrial applications.

MARKET DYNAMICS

The increase in engagement of trustworthy brands in the market has surged the growth of the Diamond Market Size significantly. The quality, assurance as well as uniqueness provided by trusted brands, have attracted consumers to purchase diamonds and has increased the Diamond Market Share . Owing to the increased customer preferences toward brand purchase, the sales of diamond jewelry have also surged for the forecast period. Moreover, according to the ‘Diamond Insight Report 2022’ of De Beers Group, the contribution of brands is about 85% of the purchase value in China which illustrates the consumer affinity towards the brands. In addition, the key measuring elements such as diamond quality, cut, and origin provides reliability to the consumers to purchase from the branded sources.

The inclination of consumers toward online purchases has increased due to the constraints of a pandemic. Moreover, consumers are more interested in doing pre-purchase research before the final deal. This is attributed to the presence of phygital retail which is the integration of both the physical and digital world. According to the ‘Diamond Insight Report 2022’ of De Beers Group, the e-commerce sales of diamond jewelry in the U.S. have reached 25% by value and 31% by volume. The growing adaptation of online sites of diamond brands has boosted the overall revenue of the diamond industry and has increased Diamond Market Growth.

The ethical expertise of luxury products such as diamonds plays a big role in the purchasing decision. The growing alertness of consumers to know about the product's ethical credential has made the key operators show transparency in their services has affected Diamond Market Demand. The demand for grade reports which show the legitimate source of diamonds has increased owing to the need for a standard assurance process for the purchase that has escalated. This has affected the diamond industry significantly.

Although the demand for synthetic diamonds has increased, it still falls behind in comparison to natural diamonds. The value of a synthetic diamond cannot be retained over time as of natural diamonds. Moreover, synthetic diamond is a product of technological advancement, and the possibility of them getting rationalized and inexpensive is more in the long term. In addition, the survey by the Diamond Producer Association (DPA) and Harris Poll, states that only 16% women believe that lab-grown diamonds are real diamonds, which shows the lack of consumer preferences towards lab-grown diamonds.

The increase in popularity of Metaverse and Web3 in the luxury sector globally has given new opportunities for the brand to have new sources of revenue, brand equity, and customer purchase. Moreover, the link between the real world and digital worlds through technologies like augmented reality (AR) is providing a new floor for the key players to have more customer engagement. In addition, these technologies can improve the style of consumer buying behavior and can be helpful in avoiding any delay in purchase due to the diligent lifestyle followed by the consumers. It can provide an in-person experience digitally and can make the purchase smoother.

The new trend of following sustainability norms is being honored in every industry. In the diamond industry, sustainability means product assurance along with ethical sourcing of products. The rise in consumer preferences towards brands that follow sustainability norms has increased which has resulted in the rise in sales of brands that follow ethical values and principles. According to the ‘Diamond Insight Report 2021’ of De Beers Group, around 60% of the consumers are willing to choose a sustainable option and 85% of them are inclined to pay an average premium of 15%. The sustainable choices made by the diamond companies are providing growth opportunities for the market.

SEGMENTAL OVERVIEW

The diamond market is analyzed based on product type, application, distribution channel, and region. By product type, the market is bifurcated into natural and synthetic. By application, the market is divided into jewelry and industrial. Furthermore, the jewelry segment is classified into rings, necklaces, earrings, and others. The industrial segment is also divided into construction and machinery, mining tools, electronics, automotive, and others. By distribution channel, the market is fragmented into B2B and B2C. Furthermore, the B2C segment is bifurcated into retail stores and online stores. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

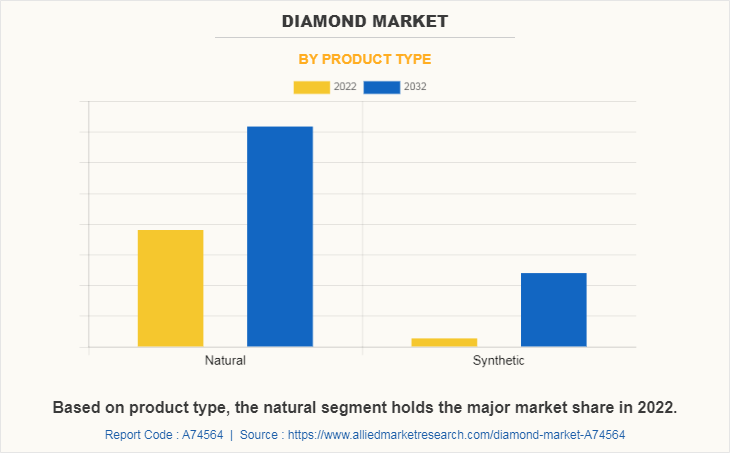

BY PRODUCT TYPE

The natural segment, as per the product type, dominated the market in 2022 and is anticipated to maintain its dominance throughout the Diamond Market Forecast period. Natural diamonds are formed below the earth’s crust at extremely high temperatures and pressure. It innates some physical and chemical properties such as hardness, longevity light reflectivity along with dispersion. It is further divided into Type Ia diamonds, Type IIa diamonds, type Ib, and type IIb diamonds. They are highly preferred by consumers as they carry more retention value over time. They are considered rare, elegant, and significant in the eyes of consumers which creates high demand in the jewelry sector. They are a considerable choice for traditional and classic styling.

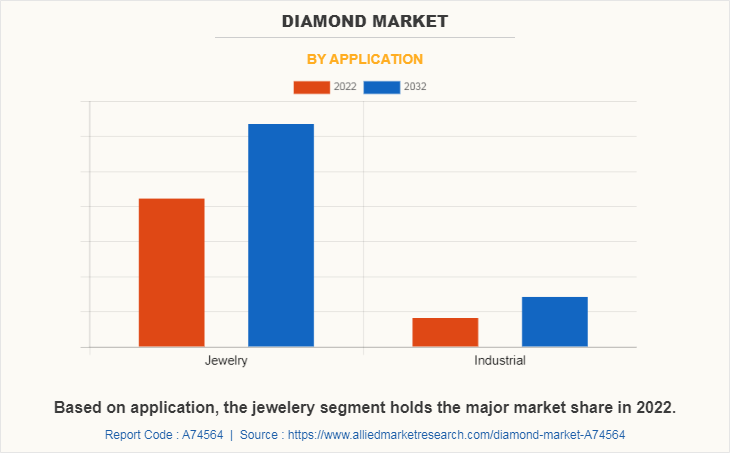

BY APPLICATION

The jewelry segment dominated the diamond market in 2022. The symbolic significance of jewelry in some cultures generates high demand for diamonds. Diamonds are used in jewelry due to their shiny lustrous property and durability. They are more in demand for traditional and bridal wear. Moreover, the rise in disposable income, the increase in Gen Z and Millennial population, along with growing consumer preference for investing in meaningful products have increased the sales of diamond jewelry. In addition, there is also an inclination of fashion trends toward the acquisition of delicate diamond pieces. The uniqueness and confidence provided by having customized diamond jewelry are also driving the market significantly.

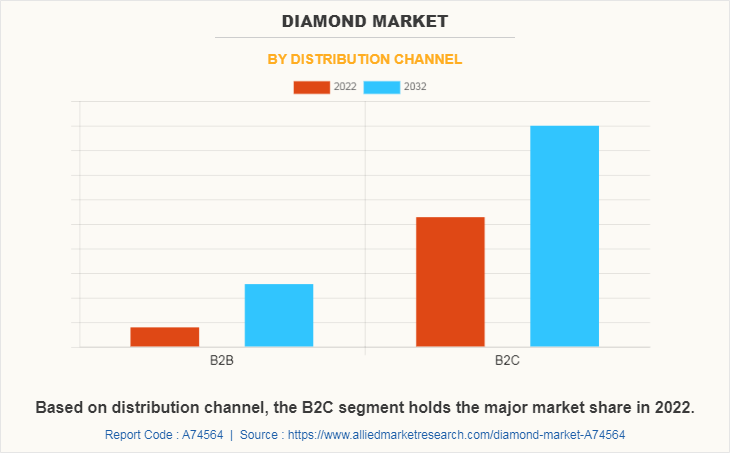

BY DISTRIBUTION CHANNEL

The B2C segment dominated the diamond market in 2022 according to Diamond Market statistics . The B2C segment is involved with the final sale of diamonds in the form of jewelry, loose diamonds for industrial purposes, or in dust form. This segment deals with both retail and online channels. The constant demand for diamond bridal jewelry, anniversaries gift, and diamond tools has resulted in significant growth in the overall market. Moreover, the growing foothold of online sales channels has also increased revenue. The growing presence of the new generation on online platforms with high purchasing power has influenced the growth of the market.

BY REGION

Region-wise, North America is dominating the market with the largest share in 2022. North America is one of the most developed regions having high purchasing power along with a growing population of millennials and Gen Z. The expansion of the diamond market has resulted in huge revenue generation by this region. Being a developed nation, there is high demand for diamonds in the jewelry and industrial sectors. Here, synthetic diamonds are highly demanded in construction, mining services, machinery production along with beauty and personal care industry. Moreover, the excessive presence of manufacturers in this region has increased the revenue of the market. Moreover, the inclination of Western culture towards diamond jewelry for special occasions and events has presented a growth opportunity for the market.

COMPETITION ANALYSIS

The major players analyzed in the diamonds market are Petra Diamonds Limited, RioTinto, Lucara Diamonds, ALROSA, Anglo American, Arctic Canadian Diamond Company (Dominion Diamond Mines), Mountain Diamonds, Gem Diamonds, Stornoway diamonds, Rosy Blue, Lucapa Diamond Company, Star Diamond Corp., Mittal Diamonds, Henan Huanghe Whirlwind CO., Ltd. and, Tsodilo Resources Limited.

Manufacturers of diamonds are always creating new innovative and stylish products to meet the changing requirements of their customers. They invest in R&D to create more efficient synthetic diamonds that can be used for industrial purposes. While developing new products, enhancing production methods, and navigating regulatory requirements, manufacturers of the market are frequently working with diamond miners, producers, regulatory organizations, and other industry players. Manufacturers can increase their capacities, pool their knowledge, and create novel solutions through these collaborations.

To keep the rising demand for diamonds in the market, manufacturers are involved in improving the mining and production capacity without creating any harmful impacts on the environment. They are engaged in providing the best ethically sourced diamonds to fulfill the consumer's appeal. Manufacturers of the diamond market are creating more stylish and elegant products along with facilities for customization and personalization. They are also involved in engaging with new technology to expand the reach of the market.

In the upcoming years, it is anticipated that the market for diamonds will expand due to reasons including rising demand for fashionable products along with increasing applications of diamonds in the construction, electronic, and automotive industries.

Some Examples of Agreement in The Market

In December 2021, Petra Diamonds Limited announced that it has reached an agreement in principle with the Government of Tanzania relating to the operations of the Williamson open pit diamond mine in Tanzania to expand its portfolio. ‐¯

In October 2020, Petra Diamonds Limited announced that it has concluded a one-year wage agreement with the National Union of Mineworkers (“NUM”)‐¯in order to cover its South African operations.

Some Examples of Acquisition in The Market

In November 2021, Rio Tinto acquired Diavik Diamonds Mine to expand its product portfolio.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the diamond market analysis from 2022 to 2032 to identify the prevailing diamond market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the diamond market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global diamond market trends, key players, market segments, application areas, and market growth strategies.

Diamond Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 155.5 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 497 |

| By Product type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Lucara Diamonds, Mittal Diamonds, ROSY BLUE, STORNOWAY DIAMONDS, Henan Huanghe Whirlwind CO.,Ltd., Arctic Canadian Diamond Company, Tsodilo Resources Limited, Alrosa, Gem Diamonds Limited, Mountain Diamonds, Anglo American Plc, Lucapa Diamond Company, RioTinto, Petra Diamonds Ltd., Star Diamond Corp. |

Analyst Review

The perspectives of the leading CXOs in the diamond industry are presented in this section.

The diamond market is a dynamic and expanding segment of the luxury goods market. Luxury goods applications include the manufacturing of stylish diamond jewelry and industrial applications involve the use of diamond tools. The hardness, resistivity, and thermal conductivity of diamond make it suitable for the fabrication of cutting and drilling tools.

The CXOs further added that many factors, including the increase in fashion and cultural trends, rise in the global economy, growth in trajectory of high-net-worth individuals along with a surge in the inclination of Gen Z and millennials toward diamonds are propelling the market for diamonds. The demand for a diamond is driven by shifting customer preferences and market dynamics, such as the effect of the COVID-19 pandemic on the luxury goods sector.

Several well-known players are active in the diamond market, which is very competitive. Although, De Beers holds a monopoly in the market. Companies should be more focused on providing reassurance regarding the ethical origins, provenance, and sustainability of natural diamonds. The value and sustainability of diamonds should be promoted by emphasizing the benefits of diamond mining in local communities along with its relatively low environmental effect. However, the unfavorable economic conditions have negatively impacted the company's financial positions including an increase in financing cost, a decrease in current income from mining operations, along with limited access to the capital market. Furthermore, the mining industry of the diamond market is extremely competitive, and the companies compete with one another based on resources and technical capacity.

Thus, the diamond market offers business prospects for manufacturers. Companies need to be adaptable, creative, and focused on serving their consumers' demands if they want to succeed in this dynamic and often changing industry.

The global Diamond market was valued at $100,427.6 million in 2022, and is projected to reach $155,480.3 million by 2032, registering a CAGR of 4.5%.

The base year calculated in the Diamond market report is 2022.

The forecast period in the Diamond market report is 2023 to 2032.

The natural segment is the most influential segment in the Diamond market report.

The top companies analyzed for global Diamond market report are Petra Diamonds Limited, RioTinto, Lucara Diamonds, ALROSA, Anglo American, Arctic Canadian Diamond Company (Dominion Diamond Mines), Mountain Diamonds, Gem Diamonds, Stornoway diamonds, Rosy Blue, Lucapa Diamond Company, Star Diamond Corp., Mittal Diamonds, Henan Huanghe Whirlwind CO., Ltd. and, Tsodilo Resources Limited.

North America holds the maximum market share of the Diamond market.

The company profile has been selected on the basis of revenue, product offerings, and market penetration.

The market value of the Diamond market in 2022 $100,427.6 was million.

Loading Table Of Content...

Loading Research Methodology...