The global digital shipyard market size was valued at $1.3 billion in 2022, and is projected to reach $7.7 billion by 2032, growing at a CAGR of 19.8% from 2023 to 2032.

Report Key Highlights:

- The report covers a detailed analysis on the digital shipyard used in transportation industry.

- The digital shipyard market has been analyzed from the year 2022 till the year 2032.

- Latest developments have been mentioned in the research study.

- Top companies operating in the industry has been profiled in the research study.

- The research study includes different segments & regions across which the market has been analyzed.

A shipyard (also called a dockyard) is a place where ships are built and repaired. The shipbuilding companies have been focusing on the automation process over the last few years. The automation process helps to save the time taken for ship building. Meanwhile, various companies are taking initiatives to implement digitization in shipbuilding. The “digital shipyard” is a term applied to the adoption of Industry 4.0 capabilities in designing, building, and maintaining ships and submarines as well as using this technology to monitor and maintain the associated infrastructure. It utilizes sensors and monitoring systems deployed by Cyber-Physical Systems (CPS) that can communicate enormous quantities of data to an IoT device, providing an enhanced capacity for predicting and planning future maintenance. This collected data can be shared with other IoT devices in an industrial environment, collectively called the Industrial IoT, or IIoT to reduce the operational downtime.

Currently, due to an expansion in global trade and tourism activities via ships, the size of the digital shipyard market is expected to grow significantly in the future years. A digital shipyard is hired to integrate various digital technologies into a shipyard, such as augmented reality/virtual reality and IoT, to boost operational efficiency. For instance, in April 2022, Wartsila revealed its virtual and augmented simulation solutions for scalable and realistic training experience using the latest augmented reality (AR) and virtual reality (VR) technology.

The solution creates real-life immersive environments to make a simulation of the operations performed on any ship, and the lifelike scenarios improve learning retention, job performance, and team collaboration. Hence, owing to a boom in process automation, the global digital shipyard market is witnessing tremendous expansion.

Factors such as increase in demand for cargo ships due to increased maritime trade, rise in environmental concerns globally to lower the carbon footprint generated in the shipping industry, and rise in adoption of digital twin technology supplement the growth of the digital shipyard market. However, the high cost of digitalization & training cost products and complexity associated with the systems are factors expected to hamper the growth of the market. In addition, rise in implementation of robot technology in the shipbuilding industry and increasing use of industrial internet of things (IIoT) are expected to create ample opportunities for the key players operating in the digital shipyard market share.

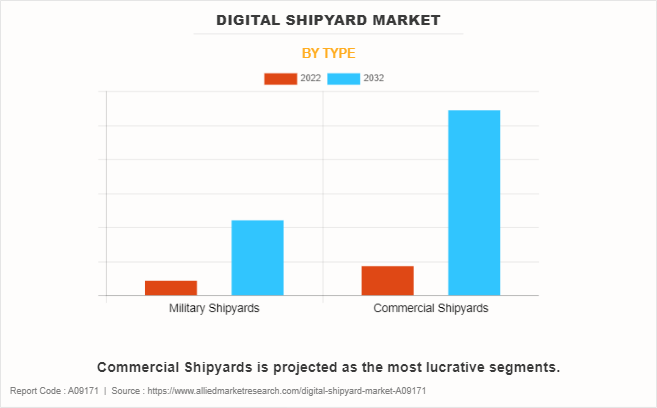

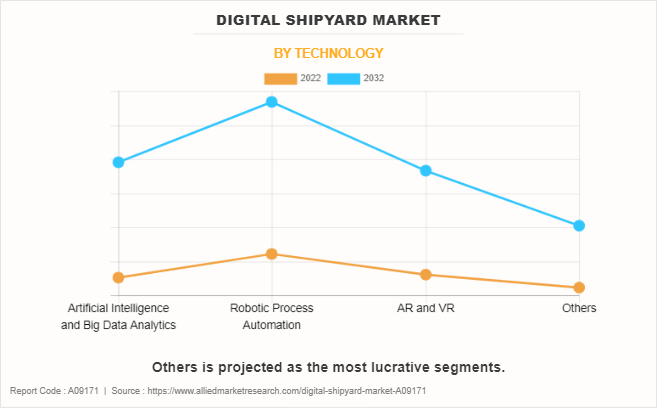

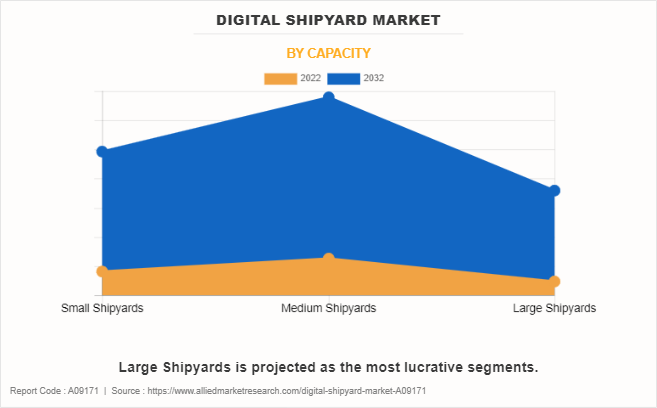

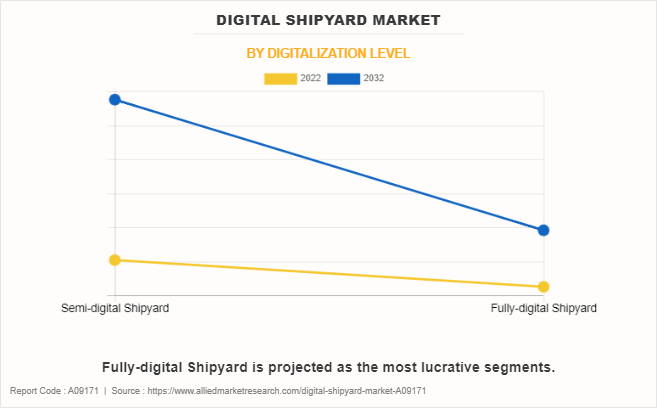

The digital shipyard market is segmented on the basis of type, technology, capacity, digitalization level, and region. By type, the market is divided into military shipyards and commercial shipyards. By technology, it is fragmented into artificial intelligence & big data analytics, robotic process automation, augmented reality (AR) & virtual reality (VR), and others (digital twin, blockchain, and industrial Internet of Things (IIOT)). By capacity, it is categorized into small shipyards, medium shipyards, and large shipyards. By digitalization level, it is fragmented into semi-digital shipyard and fully digital shipyard. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the digital shipyard industry are Accenture, Altair Engineering Inc., Aras, AVEVA Group Plc, BAE Systems Plc, Damen Shipyards Group, Dassault Systems, Hexagon AB, iBASEt, Inmarsat Global Limited, Kranendonk Production Systems BV, Kreyon Systems Pvt. Ltd., Pemamek OY, PROSTEP AG, SAP SE, Siemens, SSI, and Wartsila.

Increase in demand for cargo ships due to increased maritime trade

A rise has been witnessed in the demand for transportation of cargo through water ways as a lot of cargos are being efficiently transferred securely to the other end. Moreover, cargo ships are less expensive for shipping goods as compared to road and air transits, and more cargo can be carried from one place to another within a short span of time. As per the records of UNCTAD, approximately 1,687 million tons of cargo is transported every year in around 177.6 million containers covering 998 billion tons. The recent developments in commercial vessels and giant players’ innovation of cargo ships equipped with latest technology, such as advanced sensors, navigation system, and other components, boost the demand for the autonomous cargo ships globally. For instance, Norwegian-based Yara Birkeland planned to introduce the first autonomous cargo ship in 2020. Hence, the rise in the seaborne trade results in increase in demand for large capacity carrying ships (cargo ships) or container ships equipped with latest technologies, which is expected to foster the demand for digital shipyards, thus boosting the market growth.

Rise in environmental concerns worldwide to lower the carbon footprint generated in the shipping industry

Concerns over the impact of the shipping industry on the environment have intensified in the last few years with a number of initiatives being undertaken by various stakeholders. Meanwhile, shipping companies are implementing various initiatives to consider the impact of environmental, social, and governance factors into their strategy, among other challenging factors. For instance, in March 2023, Ministry of ports, shipping and waterways (MoPSW), Government of India launched ‘Green Tug Transition Programme’ (GTTP) to convert all tugboats working in the country into ‘Green Hybrid Tugs’, running on non-fossil fuel such as methanol, ammonia, & hydrogen to reduce carbon emissions and become the global hub of Green Ship Building by 2030. Therefore, the adoption of such measures by government and shipping companies to reduce the carbon footprint created in the shipping sector as a result of environmental concerns is likely to propel the digital shipyard market.

High cost of digitalization and training cost products

The software and hardware used in the shipbuilding industry is highly sophisticated with advanced technologies. Moreover, the early stage of automating a manufacturing requires procuring, accessories, programming, integration, and others. Hence, the huge capital expenditure at initial stage can be challenging for small players. Many small & medium scale shipbuilders find it tough to initiate huge funds owing to low production volume.

In addition, the installation of new components, such as hardware & software makes the network complex as the components are installed as per the requirement of the service providers and need to be upgraded frequently to meet the compatibility that further increases the data complexity. Thus, companies are reluctant to implement it, which hampers market growth.

Key Developments in Digital Shipyard Industry

- In August 2023, SSI launched SSI 2024 R 1.1. The software has new user interface to help the shipbuilders and designers to solve and view complex models. The launch help the company to extend its product portfolio.

- In April 2022, Wartsila revealed its virtual and augmented simulation solutions for scalable and realistic training experience using the latest Augmented Reality (AR) and Virtual Reality (VR) technology. The solution creates real-life immersive environments to make a simulation of the operations performed on board any ship, and the lifelike scenarios improve learning retention, job performance, and team collaboration.

- In September 2022, Siemens partnered with Birdon Group. The partnership allows Birdon Group to use the Siemens software application for the shipbuilding.

- In June 2021, PROSTEP, in collaboration with the Lürssen shipyard company and the Machine Tool Laboratory (WZL) at RWTH University in Aachen, has created a new planning approach based on a digital twin with the goal of offering greater support to shipyards. The initiative, which was supported by the German Federal Ministry of Economics and Climate Action (BMWK),

- In October 2021, Navantia and Pemamek signed an agreement. According to the agreement Pemamek is expected to offer shipbuilding automation technology to Navantia. The agreement will help the company to attract more customers.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital shipyard market analysis from 2022 to 2032 to identify the prevailing digital shipyard market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital shipyard market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global digital shipyard market trends, key players, market segments, application areas, and market growth strategies.

Digital Shipyard Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.7 billion |

| Growth Rate | CAGR of 19.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 357 |

| By Type |

|

| By Technology |

|

| By Capacity |

|

| By Digitalization Level |

|

| By Region |

|

| Key Market Players | Pemamek, KRANENDONK Production Systems BV, PROSTEP AG, Altair Engineering Inc., Wartsila, Accenture, Kreyon Systems Pvt Ltd., BAE Systems, Aveva Group plc, Dassault Systemes, Hexagon AB, Aras, Siemens, SSI, SAP, Damen Shipyards Group, Inmarsat Global Limited, iBase-t |

Commercial Shipyards are the upcoming trends of Digital Shipyard Market in the world

Medium Shipyards is the leading application of Digital Shipyard Market

Asia-Pacific is the largest regional market for Digital Shipyard

The global digital shipyard market was valued at $1,271.3 million in 2022, and is projected to reach $7,652.8 million by 2032, registering a CAGR of 19.8% from 2023 to 2032

The leading players operating in the digital shipyard market are Accenture, Altair Engineering Inc., Aras, AVEVA Group Plc, BAE Systems Plc, Damen Shipyards Group, Dassault Systems, Hexagon AB, iBASEt, Inmarsat Global Limited, Kranendonk Production Systems BV, Kreyon Systems Pvt. Ltd., Pemamek OY, PROSTEP AG, SAP SE, Siemens, SSI, and Wartsila.

Loading Table Of Content...

Loading Research Methodology...