Disinfectant Market Research, 2035

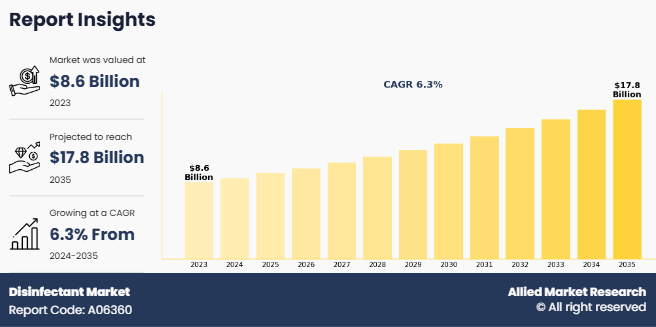

The global disinfectant market was valued at $8.6 billion in 2023, and is projected to reach $17.8 billion by 2035, growing at a CAGR of 6.3% from 2024 to 2035. Disinfectants are specialized chemical agents formulated to destroy and inhibit the growth of harmful microorganisms, such as bacteria, viruses, and fungi, on surfaces and in various environments. Disinfectants help maintain hygiene and reduce the risk of infections. These disinfectants have found wide application in healthcare facilities, food processing areas, and residential areas. These agents are available in several forms, including sprays, wipes, and liquids, and can be classified into categories such as alcohols, halogens, and quaternary ammonium compounds, each with unique mechanisms of action. The effectiveness of disinfectant depends on factors such as concentration, contact time, and the specific pathogens being targeted. Proper usage and adherence to guidelines are crucial for achieving optimal disinfection results.

Market Dynamics

The rise in rates of hospital-acquired infections has significantly driven the demand for disinfectant in healthcare facilities. According to the Office of Disease Prevention and Health Promotion, in hospitals alone, 1 in 31 hospitalized patients in the U.S. experience at least one healthcare-associated infection (HAI) at any given time. These infections account for over 6,80,000 cases annually, leading to billions of dollars in excess healthcare costs across the U.S. Thus, the growth of disinfectant market is driven by stringent infection control regulations, particularly in hospitals and clinics, highlighting the importance of effective disinfection to prevent healthcare-associated infections (HAIs). Thus, increasing the Disinfectant Market Size.

Moreover, the rise in the use of endoscope reprocessors and surgical units have significantly driven demand for disinfectants in the global market. Endoscope reprocessors, designed to clean and disinfect medical instruments such as endoscopes, require advanced disinfectant solutions to prevent infections. In addition, surgical units also contributed to the surge in disinfectant demand owing to the critical nature of sterilization in surgical environments. The increase in surgical procedures, both routine and complex have fueled the demand for disinfectant products to maintain sterile conditions. As healthcare systems expanded globally, driven by an aging population and advancements in medical technology, the demand for disinfectants continued to grow, ensuring infection control across healthcare settings, promoting the Disinfectant Market Share.

However, health hazards linked to chemical disinfectants have significantly restrained the global disinfectant market. Prolonged exposure to chemicals such as chlorine, quaternary ammonium compounds, and formaldehyde can cause respiratory issues, skin irritation, and allergic reactions, particularly for workers in hospitals and food processing facilities. These concerns have led to increased regulatory scrutiny and discouraged the overuse of chemical disinfectants, limiting disinfectant market growth. In addition, rise in consumer awareness regarding the harmful effects and toxic residues of these chemicals, especially in food processing and residential spaces, has driven a shift in preferences of consumers. Therefore, companies are now pressurized to reformulate products to reduce risks, further slowing the adoption of certain chemical disinfectants and impacting market expansion and Disinfectant Market Demand.

Along with it, difficulty in maintaining product stability under varying storage conditions restrained market demand for the global disinfectant market by creating concerns regarding product effectiveness. Disinfectants may degrade and lose their potency when exposed to extreme temperatures, humidity, or prolonged storage, which reduces their ability to kill pathogens effectively. This instability has made it difficult for manufacturers to ensure consistent quality, especially in regions with harsh climates or inadequate storage infrastructure. Thus, consumers and businesses may become cautious of purchasing disinfectants that might lose their efficacy before use, leading to a decline in trust over disinfectant manufacturing brands. Consequently, the need for specialized packaging and temperature-controlled logistics are expected to increase production and distribution costs, which in turn increases the prices of disinfectant products for consumers. As a result, demand for disinfectants has declined, as customers are inclined to shift toward more stable, long-lasting alternatives in recent years.

Furthermore, the increase in demand for eco-friendly and bio-based disinfectants has created significant opportunities in the global disinfectant market. Increased awareness of environmental sustainability has led consumers and industries to seek products made from natural, biodegradable ingredients such as Seventh Generation's disinfectant spray and CleanWell's botanical disinfectant. Moreover, regulatory support for green products in sectors such as healthcare and food processing further driven the increased manufacturing of eco-friendly and bio-based disinfectants products. For instance, Diversey launched its Oxivir range, utilizing hydrogen peroxide technology for effective disinfection along with being environmentally safer in nature. Many organizations around the globe have adopted sustainable sanitation practices to meet certifications such as Leadership in Energy and Environmental Design (LEED), which is anticipated to create a favorable market opportunity for eco-friendly disinfectant solutions. According to Disinfectant Market Forecast, as businesses and consumers prioritize sustainability, the trend for bio-based disinfectants is expected to expand, boosting the overall disinfectant market growth.

Segmental Overview

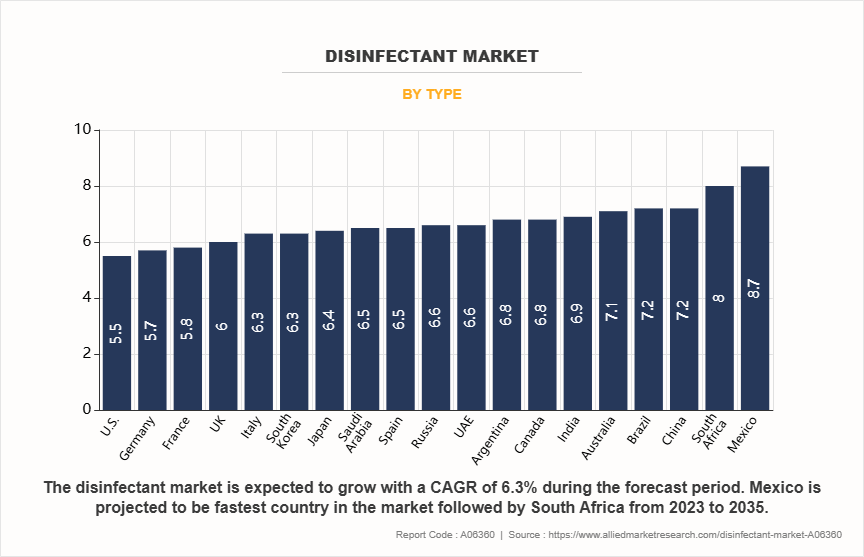

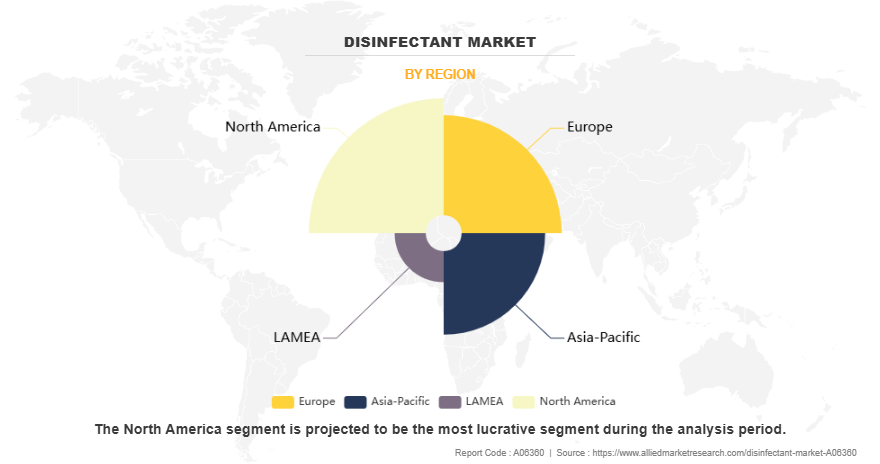

The disinfectant market is segmented into type, formulation, end user, distribution channel, and region. By type, the market is fragmented into quaternary ammonium compound, aqueous ozone disinfectants, alcohol-based disinfectants, and others. By formulation, the market is categorized into liquid, wipes, sprays, and others. By end user, the market is classified into healthcare providers, commercial users, domestic users, and others. On the basis of distribution channel, it is divided into B2B, retail outlets, online sales channel, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, UK, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, Malaysia, Indonesia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Argentina, and rest of LAMEA).

By Type

By type, the alcohol-based disinfectants segment dominated the global disinfectant market in 2023 and is anticipated to maintain its dominance during the forecast period. Alcohol-based disinfectants have gained popularity in the global disinfectant market owing to their effectiveness against a wide range of pathogens, including bacteria and viruses. The rapid action and ability of alcohol-based disinfectants to evaporate quickly has made them ideal for both healthcare facilities and everyday use. In addition, the convenience of portable gel and spray formulations has contributed to the widespread adoption of alcohol-based disinfectants. Moreover, increased public awareness of hygiene and the importance of infection control, particularly after the health crises such as COVID-19 pandemic has further propelled the demand for alcohol-based disinfectants across various sectors.

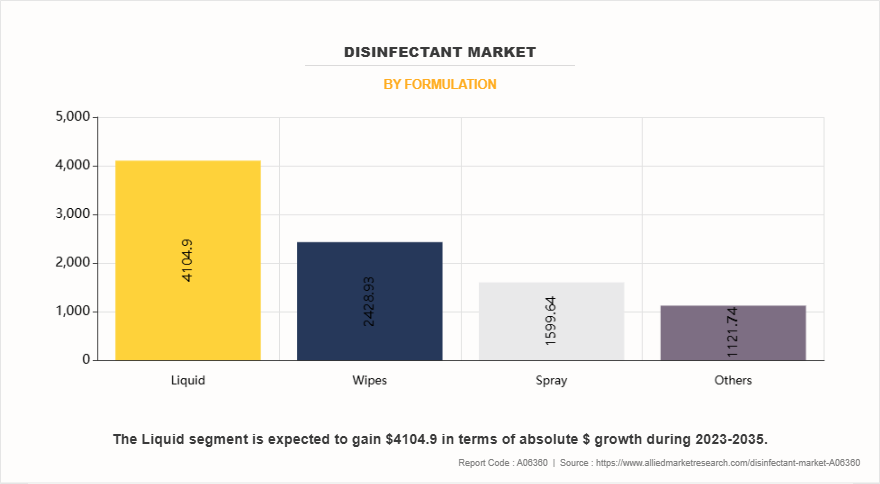

By Formulation

By formulation, the liquid segment dominated the global disinfectant market in 2023 and is anticipated to maintain its dominance during the forecast period owing to the versatility and effectiveness in various applications. Liquid disinfectants can be easily applied to a wide range of surfaces, from hard floors to soft furnishings, ensuring proper sanitation. The ease of use and quick action of liquid disinfectants had made them particularly suitable for both residential and commercial environments, including healthcare facilities, offices, and homes. Moreover, ability of liquid formulation to penetrate surfaces effectively enhances their germ-killing capabilities, making them a preferred choice for consumers seeking reliable solutions for infection control. Liquid disinfectants are also compatible with various dispensing systems, which allows for convenient application methods, such as sprays and wipes, thus driving the demand of this segment.

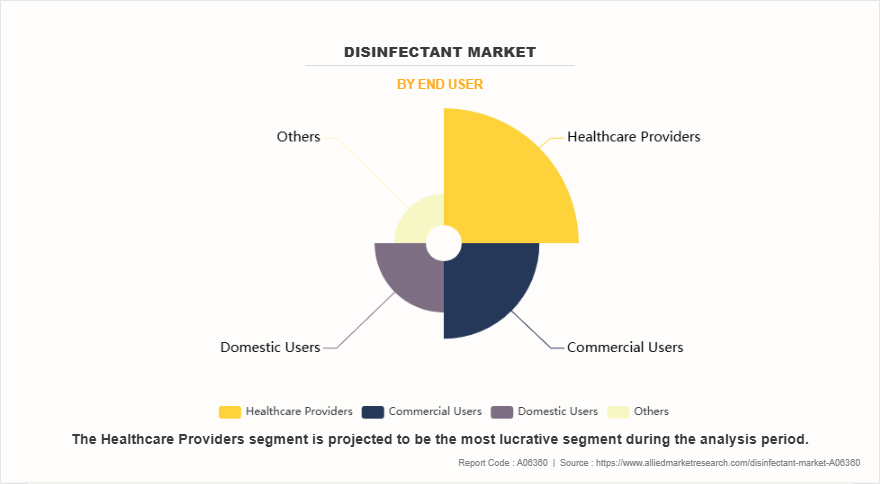

By End User

By end user, the healthcare providers segment dominated the global disinfectant market in 2023 and is anticipated to maintain its dominance during the forecast period owing to the critical need for infection control and patient safety. Healthcare facilities, such as hospitals and clinics, face a constant risk of HAIs, which can lead to severe complications and increased healthcare costs. Disinfectants play a vital role in maintenance of sterile environments by effectively eliminating pathogens on surfaces, medical equipment, and instruments. In addition, stringent regulations and guidelines from health authorities mandate the use of disinfectants to ensure safety standards are met on regular basis. Moreover, the ongoing focus on hygiene and sanitation in healthcare drives the consistent demand for effective disinfectant solutions.

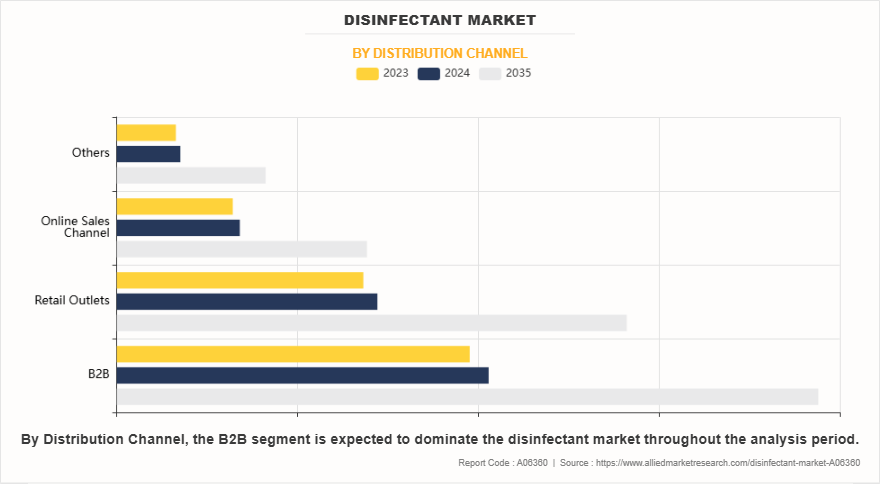

By Distribution Channel

By distribution channel, the B2B segment dominated the global disinfectant market in 2023 and is anticipated to maintain its dominance during the forecast period. Sales of disinfectants are high through B2B sales channel owing to the increase in demand from various industries that require strict hygiene standards, such as healthcare, food service, and hospitality. Businesses have recognized the importance of maintaining clean environments to prevent the spread of infections and ensure employee and customer safety. Bulk purchasing options and specialized products tailored for specific applications has made B2B sales more convenient for organizations. Moreover, long-term contracts and partnerships with suppliers helps improve reliability and access to high-quality disinfectant products, thus driving demand for disinfectant in the B2B segment.

By Region

Region-wise, North America is anticipated to dominate the global disinfectant market with the largest share during the forecast period. In North America, cities such as New York, Los Angeles, Chicago, and Toronto exhibit high demand for disinfectants owing to their dense populations and active commercial activities. Major brands operating in the region include Clorox, Lysol, Purell, and Seventh Generation, which provide a range of disinfectant products catering to residential and commercial needs. Authorities such as the Centers for Disease Control and Prevention (CDC) and the Environmental Protection Agency (EPA) in the U.S., along with Health Canada, have implemented strict regulations surrounding disinfectant use. These regulations ensure safety standards, efficacy, and compliance in both healthcare settings and general public use, further driving the demand for disinfectants in North America.

Competition Analysis

The key players operating in the disinfectant industry include Kimberly-Clark Corporation, Steris Plc, Cardinal Health, Reckitt Benckiser Group Plc., Hindustan Unilever Ltd, Whiteley Corporation Limited, Johnson & Johnson, Pal International Ltd, Bio-Cide International, Inc. and 3M Company. Several well-known and upcoming brands are vying for market dominance in the expanding disinfectant industry. Smaller, niche firms are more well-known for catering to consumer demands and preferences. Large conglomerates, however, control most of the market and often buy innovative start-ups to broaden their product lines.

Recent Developments in the Disinfectant Market

In June 2023, Lysol, a Reckitt brand, announced the launch in the U.S. of its new Lysol Air Sanitizer in the U.S. It is the first and only air sanitizing spray approved by the EPA, that kills 99.9% of airborne viruses and bacteria while eliminating odor in the air.

In April 2023, SC Johnson introduced the new FamilyGuard Brand, a lineup of disinfectant formulas, created to help protect families against germs by disinfecting hard, non-porous surfaces. This product launch is expected to increase the demand for surface disinfectants.

In November 2022, Reckitt and Essity, two leaders in the global hygiene and health sector, announced the launch of a range of co-branded disinfection products for professional hygiene.

In October 2022, Reckitt’s Lysol Pro Solutions, a science-led, business-to-business offering, launched Lysol Disinfecting Wipes in an 800-count bucket, a high-capacity solution for high volume disinfection.

In August 2022, Hindustan Unilever launched a full range of cleaning and hygiene chemicals specially formulated for professional use under its newest homecare categories, Unilever Professional India (UPro). In addition, UPro is expected to intoduce a digital distribution channel for this product category.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the disinfectant market analysis from 2023 to 2035 to identify the prevailing disinfectant market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the disinfectant market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global disinfectant market trends, key players, market segments, application areas, and market growth strategies.

Disinfectant Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 17.8 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2023 - 2035 |

| Report Pages | 398 |

| By Type |

|

| By Formulation |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Pal International Ltd., Johnson & Johnson, STERIS plc, Reckitt Benckiser Group plc., Hindustan Unilever Limited, Whiteley Corporation Limited, Kimberly-Clark Corporation, Cardinal Health, Bio-Cide International, Inc., 3M Company |

Analyst Review

This section provides the opinions of top-level CXOs in the disinfectant market. CXOs believe that the disinfectant market is expected to experience substantial growth in the coming years, driven by increased consumer awareness surrounding health and hygiene. They noted that the COVID-19 pandemic has significantly changed perceptions of cleanliness, encouraging both residential and commercial sectors to prioritize effective disinfection solutions. CXOs stated that innovative formulations, such as eco-friendly and bio-based disinfectants, are gaining traction, which significantly reflects a growing consumer preference for sustainable products. They also highlighted that companies investing in research and development will be better positioned to capture disinfectant market share as demand evolves over time.

Furthermore, CXOs indicated that the rise of e-commerce platforms has transformed distribution channels, allowing disinfectant brands to reach a large number of audiences effectively. The adoption of advanced technologies, such as artificial intelligence and internet of things (IoT) for monitoring disinfection processes, also presents unique opportunities for manufacturers to differentiate their products. Thus, CXOs anticipate a dynamic market in which innovation, sustainability, and strategic partnerships are expected to be crucial factors in driving future growth.

The global disinfectant market was valued at $8,571.7 million in 2023.

The leading application of the disinfectant market is in the healthcare sector, driven by infection control measures and hospital hygiene.

Upcoming trends in the global disinfectant market include eco-friendly products development, introduction of UV disinfectants, and increasing focus on sustainability.

By region, North America held the highest market share in 2023.

The key players operating in the disinfectant industry include Kimberly-Clark Corporation, Steris Plc, Cardinal Health, Reckitt Benckiser Group Plc., Hindustan Unilever Ltd, Whiteley Corporation Limited, Johnson & Johnson, Pal International Ltd, Bio-Cide International, Inc. and 3M Company.

Loading Table Of Content...

Loading Research Methodology...