Drilling Waste Management Market Research, 2033

The global drilling waste management market was valued at $4.7 billion in 2023, and is projected to reach $8.2 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

Market Introduction and Definition

Drilling waste management refers to the processes, techniques, and technologies used to handle, treat, and dispose of waste generated during drilling operations in the oil and gas industry. Drilling waste management includes a wide range of activities aimed at minimizing the environmental impact of drilling operations while ensuring compliance with regulatory standards. Drilling waste typically consists of drill cuttings, drilling fluids, and other by-products that are generated during the process of drilling a well. The management of this waste is crucial for maintaining operational efficiency, reducing environmental risks, and ensuring the sustainability of drilling activities.

One of the most significant applications of drilling waste management is in the protection of the environment. The effective management of drilling waste helps to prevent soil and water contamination, reduce air pollution, and minimize the impact of drilling operations on local ecosystems. For example, the treatment and disposal of drilling fluids and cuttings are crucial for preventing the release of harmful chemicals and heavy metals into the environment. In addition, waste management practices such as bioremediation and thermal desorption help to mitigate the environmental impact of oil-based drilling fluids and other hazardous materials.

In the oil and gas industry, drilling waste management is a critical component of operations. The industry employs various techniques and technologies to manage the waste generated during drilling, including solid control systems, thermal desorption, bioremediation, and slurry injection. These techniques are aimed at reducing the volume of waste, recovering valuable materials, and ensuring safe disposal. These systems are used to separate drill cuttings from drilling fluids, allowing the fluids to be recycled and reused. The solid control process reduces the volume of waste that needs to be treated or disposed of, thereby lowering disposal costs and minimizing environmental impact.

Key Takeaways

- The drilling waste management industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the drilling waste management market forecast period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global drilling waste management market overview and to assist stakeholders in making educated decisions to achieve drilling waste management market growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the drilling waste management market size.

- The drilling waste management market report is highly fragmented, with several players including SLB, Halliburton, Baker Hughes Company, Weatherford, NOV, SECURE ENERGY, GN Solids Control, TWMA, Scomi Group Bhd, and Clear Environmental Solutions. These playvers have adopted several strategies to make strong their position in the drilling waste management market share.

Market Segmentation

The drilling waste management market is segmented into service type, application, and region. On the basis of service type, the market is divided into treatment & disposal, containment & handling, and solids control. On the basis of application, the market is categorized into onshore, and offshore. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Innovations in waste management technologies is expected to drive the growth of the drilling waste management market during the forecast period. Technological advancements in drilling waste management are playing a crucial role in transforming how the industry handles and treats waste materials. One of the most significant innovations is the development of thermal desorption technology. This method involves heating drilling waste to a high temperature, which vaporizes the contaminants, such as oil and other hydrocarbons. The vapors are then captured, condensed, and separated from the solid material, allowing the clean solids to be safely disposed of or reused. Thermal desorption is particularly effective in treating oily cuttings, which are a common byproduct of drilling operations. This technology not only reduces the volume of waste that needs to be managed but also recovers valuable hydrocarbons that can be recycled, thereby enhancing the overall efficiency and sustainability of the waste management process. In October 2023, Veolia strengthened its commitment to Hong Kong's ecological transformation and resource regeneration by securing a landmark EUR 2 billion contract to manage the city's non-hazardous waste. With over 30 years of presence in Hong Kong and a workforce exceeding a thousand employees, Veolia is playing a pivotal role in decarbonizing the city's operations. The Group is advancing the local ecological transformation through various water, waste, and energy contracts.

Bioremediation offers a more environmentally friendly alternative to traditional waste disposal methods, as it relies on natural processes to detoxify contaminants. This approach is especially beneficial for managing water-based drilling fluids and other biodegradable materials. By leveraging the power of nature, bioremediation can reduce the environmental impact of drilling activities while also lowering the costs associated with waste disposal. The ability to treat waste on-site without the need for extensive transportation or complex processing facilities further contributes to its cost-effectiveness.

However, high operational costs of drilling waste management is expected to restraint the growth of drilling waste management market during the forecast period. The implementation of advanced drilling waste management systems often involves significant capital expenditure, which can be a considerable burden for small and medium-sized enterprises (SMEs) within the oil and gas industry. These systems, including technologies such as thermal desorption and bioremediation, require substantial investment in specialized equipment, infrastructure, and skilled personnel. The costs associated with purchasing and maintaining these advanced technologies can be prohibitive for SMEs, which may have more limited financial resources compared to larger, well-funded companies. For SMEs, the high operational costs of advanced waste management systems are not limited to initial investments alone. Ongoing expenses, such as the costs of operation, maintenance, and periodic upgrades to keep pace with technological advancements, also contribute to the financial strain. Additionally, compliance with stringent environmental regulations often necessitates continuous monitoring and reporting, adding further to the operational costs. These financial challenges can lead SMEs to opt for more basic or less efficient waste management solutions, which might not align with best practices for environmental stewardship or regulatory compliance.

Moreover, innovative waste treatment technologies are expected to offer Drilling Waste Management Market trends. The development and adoption of cutting-edge waste treatment technologies offer significant opportunities in the drilling waste management sector. Among these, plasma arc treatment stands out as a particularly innovative solution. Plasma arc treatment uses high-temperature plasma generated by an electric arc to decompose hazardous waste into its basic components. This process effectively breaks down complex and toxic compounds into simpler, less harmful substances, and can convert waste into valuable by-products, such as metals and gases. The high efficiency and effectiveness of plasma arc treatment make it a promising technology for managing challenging drilling waste streams that other methods might not handle as effectively. In November 2022, WABAG LIMITED secured an agreement with the Asian Development Bank (ADB) to raise INR 200 crores (approximately $24.6 million) through unlisted Non-Convertible Debentures. These debentures have a tenor of five years and three months, and ADB will gradually subscribe to them over a period of 12 months to support WABAG's water treatment projects.

Competitive Analysis

Key market players in the drilling waste management market analysis include SLB, Halliburton, Baker Hughes Company, Weatherford, NOV, SECURE ENERGY, GN Solids Control, TWMA, Scomi Group Bhd, and Clear Environmental Solutions.

Regional Market Outlook

In North America, particularly the U.S. and Canada, drilling waste management is essential due to extensive oil and gas exploration and production activities. The region’s drilling operations generate significant volumes of waste, including cuttings, mud, and other byproducts, which require effective management to minimize environmental impact and comply with stringent regulations. Technologies such as centrifuges, shale shakers, and thermal desorption units are commonly employed to treat and manage these wastes. All these factors is expected to driive the growth of drilling waste anagement market report

In the Asia-Pacific region, drilling waste management practices vary significantly depending on the country’s level of industrial development and regulatory framework. Countries such as China, India, and Australia are major players in the drilling industry and are investing in improving their waste management systems. In Australia, advanced treatment technologies and recycling methods are widely adopted, whereas in China and India, there is a growing emphasis on modernizing waste management practices to meet international standards. The region is experiencing increasing investments in waste management infrastructure and technology to address the environmental challenges associated with drilling activities.

Industry Trends

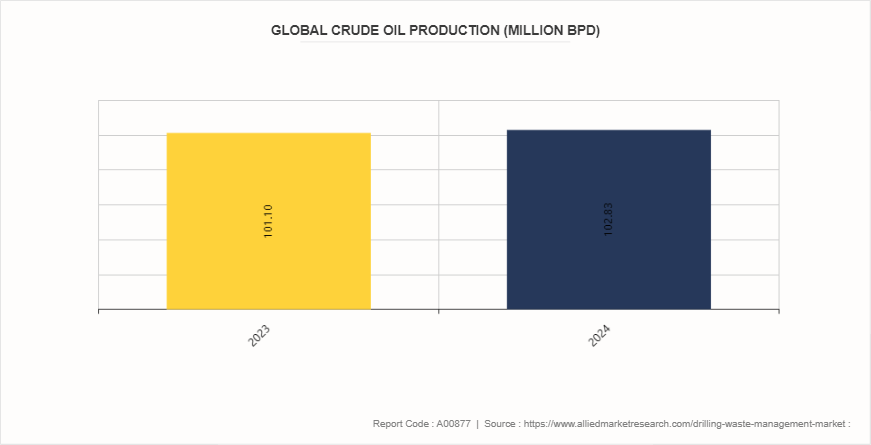

- In June 2023, as per the International Energy Agency, global investment in the upstream oil and gas sector is projected to rise by 11% in 2023, reaching an estimated $528 billion, up from $474 billion in 2022. With the current pipeline of projects and expected growth in the U.S. light tight oil (LTO) , there is an anticipated addition of 5.9 million barrels per day (mb/d) in net production capacity by 2028. Although the pace of new capacity growth is expected to slow from an average of 1.9 mb/d in 2022-23 to just 300, 000 barrels per day (kb/d) by 2028, this increase remains aligned with the projected demand growth over the forecast period.

- According to the American Petroleum Institute (API) , the U.S. generates approximately 1.21 barrels of drilling waste for every foot drilled. Of this, around 50% is solid waste. Annually, this results in about 139.96 million barrels, or 29.1 million cubic yards, of solid drilling waste enough to fill nearly 9, 000 Olympic-sized swimming pools.

- In September 2023, TWMA, a drilling waste management company, introduced the latest iteration of its RotoMill technology. This RotoMill 2.0 upgrade, developed in response to customer feedback, includes the company's XLink remote monitoring software, which enhances energy efficiency. In addition, the updated control system offers improved condition monitoring, enabling a predictive maintenance strategy.

- By 2028, the Western Hemisphere, particularly the Americas, is expected to become the largest incremental supplier of oil to global markets, with exports increasing by 4.1 mb/d. This shift in trade flows is occurring alongside the redirection of most of the 2.5 mb/d of Russian crude oil, displaced from Europe and G7 countries due to embargoes, toward Eastern markets. The lack of additional exports from the Middle East by 2028 as compared to 2022, combined with rise in demand for imports in Asia, is leading to a significant increase in oil flows from the Atlantic Basin to regions East of Suez.

Historic Trends of Drilling Waste Management Market

- The 1950s saw the development and use of more sophisticated drilling fluids. Traditional water-based muds were supplemented by oil-based and synthetic-based drilling fluids. These advanced fluids were designed to improve drilling efficiency, enhance the control of formation pressures, and reduce the risk of wellbore instability.

- The 1970s saw the introduction and increased use of synthetic drilling fluids. These fluids were designed to address specific challenges, such as improving well stability and enhancing drilling performance. Unlike traditional water-based muds, synthetic fluids often required different handling and disposal methods due to their chemical composition.

- In 1980, the Resource Conservation and Recovery Act (RCRA) was established, introducing stricter regulations for hazardous waste management. This legislation required improved practices for the treatment, storage, and disposal of waste, including drilling waste, thereby significantly influencing how the drilling industry handles waste management.

- In the 2010s marked a pivotal decade for drilling waste management due to the rise of shale gas and hydraulic fracturing (fracking) . The widespread adoption of hydraulic fracturing led to a substantial increase in drilling activities, particularly in shale formations. This resulted in a significant rise in the volume of drilling waste, including cuttings, drilling fluids, and produced water.

Key Sources Referred

- United States Environmental Protection Agency

- The Railroad Commission of Texas

- Government of Saskatchewan

- Directorate General of Trade Remedies

- Argonne National Laboratory

- California Department of Transportation

- BC Energy Regulator

Drilling Waste Management Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.2 Billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Service Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | GN Solids Control, NOV, Weatherford, SECURE ENERGY, Clear Environmental Solutions, SLB, Baker Hughes Company, Halliburton, Scomi Group Bhd, TWMA |

The global drilling waste management market was valued at $4.7 billion in 2023, and is projected to reach $8.2 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

Key market players in the drilling waste management market include SLB, Halliburton, Baker Hughes Company, Weatherford, NOV, SECURE ENERGY, GN Solids Control, TWMA, Scomi Group Bhd, and Clear Environmental Solutions.

Asia-Pacific is the largest regional market for drilling waste management.

Offshore is the leading application of drilling waste management market.

Innovations in waste management technologies are the upcoming trends of drilling waste management market.

Loading Table Of Content...