Dry Natural Gas Market Research, 2031

The global dry natural gas market size was valued at $0.7 trillion in 2021, and is projected to reach $1.4 trillion by 2031, growing at a CAGR of 7.7% from 2022 to 2031.

Natural gas is predominantly methane with smaller amounts of ethane, propane, butanes, pentanes, and heavier hydrocarbons. Dry gas is obtained by extracting moisture from natural gas. It comprises of processes such as use of pressure reduction, gravity separation, and emulsion “breaking” techniques. The gas that is produced may be used directly as fuel or as feedstock for the manufacturing of petrochemicals.

Recent advancements in exploration and drilling technology have led to a surge in domestic oil and gas production in recent years with economic and geopolitical implications. Relatively long and higher-pressure transmission pipelines allow greater economies of scale in the delivery of gas from remote sources of supply to consuming markets. New forms of LNG facilities, including (FLNG) Floating LNG, open new markets and expand the possibilities for gas supply diversity in developed markets. Russia remained the largest gas exporter, with around 197.7 billion cubic meter (bcm) of natural gas exported. Most of the pipelines used by Russia are of onshore form, commuting via Belarus, Ukraine, and China. The LNG trade is expected to witness a major expansion at a global level, resulting in increasing demand for natural gas.

The Russia-Ukraine war disrupted the chances of global economic recovery from the COVID-19 pandemic, at least in the short term. The war between these two countries has led to economic sanctions in multiple countries, a surge in commodity prices, and supply chain disruptions, causing inflation across goods & services, affecting many markets across the globe. Russia is one of the biggest producers of oil and natural gas. It also produced an average of 10.5 million barrels of liquid fuel products per day in 2020.

A global disruption in oil and gas supply due to the Russia-Ukraine war affected not only the prices of these commodities but every economic activity reliant on hydrocarbons. Global demand for dry natural gas widely seen as a renewable and clean energy option to hydrocarbon-sourced energy was growing steadily to fulfill the demand of power generators and other sectors. The impact of Russian invasion of Ukraine on Europe and its consumers such as on oil and gas industry and other energy-intensive industries will depend on several factors, including the war's duration, the severity of Russian supply shocks, and the level of oil and gas shortfalls in Europe.

In addition, the Indian government authorized $774 million in January 2020 for an onshore natural gas pipeline network in the northeast region as a component of a national gas grid being constructed to connect distant areas of the nation. The 1,656 km pipeline is estimated to cost up to $1.15 billion and is expected to be completed by 2023. In 2012, production of gas in U.S. shifted to the Eagle Ford Basin in South Texas and the Marcellus Basin in Ohio and Pennsylvania. Production in the Haynesville Basin fell as producers moved toward more profitable basins.

According to analysis by the Office of Energy Policy and Systems Analysis (EPSA) of the Department of Energy (DOE), the Northeast (Marcellus and Utica) witnessed the fastest production by 2030. While the long-term production remains uncertain, the trend is expected to grow, with dry natural gas production at 66.5 Bcf/d (billion cubic feet per day) in 2014 and projected to boost more than 93.5 Bcf/d (billion cubic feet per day) by 2030. The Marcellus, Eagle Ford, Anadarko, Utica, and Haynesville Basins are anticipated to witness the highest production of gas.

Owing to societal issues, regional politics, or other behavioral economic factors, constructing new pipelines is difficult. However, despite these factors, regional price spike incentives for state and local governments are expected to take measures to address these constraints. Changes in transportation and distribution infrastructure is required to sustain the U.S. energy supply growth and the economic & security benefits. However, despite significant increase in production and infrastructural challenges, the regional variation of expected supply and demand increases and the adaptability in the existing natural gas infrastructure system lessens the level of expansion and investment.

According to U.S. Energy Information Administration, the electric power sector uses natural gas to generate electricity. In 2021, the electric power sector accounted for about 37% of total U.S. natural gas consumption, and natural gas was the source of about 32% share of the U.S. electric power sector's primary energy consumption. Most of the electricity produced by the electric power sector is used by the other U.S. end use industries, (industrial and commercial sectors also use natural gas to generate electricity). Natural gas accounted for about 38% of total utility-scale U.S. electricity generation in 2021. For instance, higher heating demand during winter required more natural gas than usual. Macroeconomic trends affect industrial activity, and therefore they affect natural gas consumption in the U.S. industrial sector.

Moreover, industrial facilities such as petrochemical, fertiliser, and steel plants increase dry natural gas demand. Dry gas is used as a fuel for power plants and a feedstock for petrochemical plants to produce fertilizer and methanol. According to the International Energy Association (IEA), petrochemical feedstock accounts for 12% of global oil demand, which is expected to increase fueled by rapid growth for plastics, fertilizers and other products. It also includes plastics, fertilizers, packaging, clothing, digital devices, medical equipment, and detergents.They are also found in modern energy systems, including solar panels, wind turbine blades, batteries, thermal insulation for buildings, and electric vehicle components.

Around 40% of the ethane-based petrochemical production capacity is situated in the U.S. Energy consumption and demand for refined petroleum products has surged significantly across India and China. In addition, refineries in the Asia-Pacific region have increased production rates as demand in the region grows. For instance, in November 2021, Indian Oil Corp, the largest state-owned refiner, operates its nine refineries with 90% utilization.

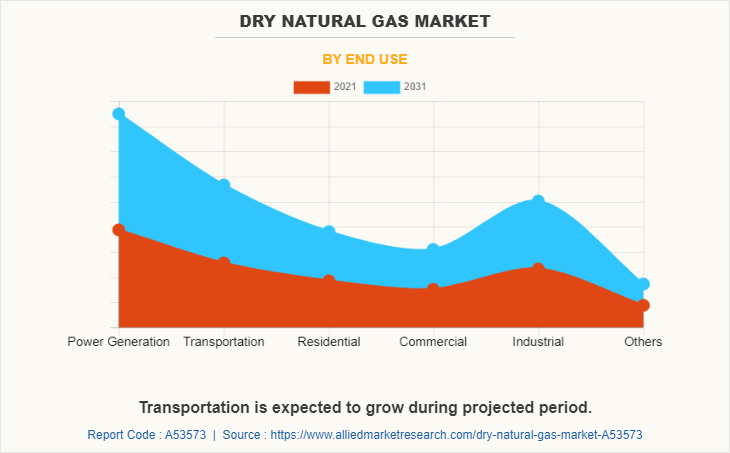

Electric power generation, industrial use, and exports account for most of the expected growth in natural gas consumption by 2030. Residential and commercial natural gas demand is projected to remain constant during the forecast period as energy efficiency counterbalances customer growth impacts on consumption. According to the report ‘Residential Energy Conservation Using Energy Efficient Appliances,’ published by the International Journal of Innovative Technology and Exploring Engineering (IJITEE), in 2020, per capita annual energy cost savings of water heaters in India reached $7.88 million. Moreover, the small-living spaces of the Japanese and Southeast Asian households facilitate the need for gas cooking appliances to fulfill their cooking needs. These factors drive the consumption rate of such products in the region.

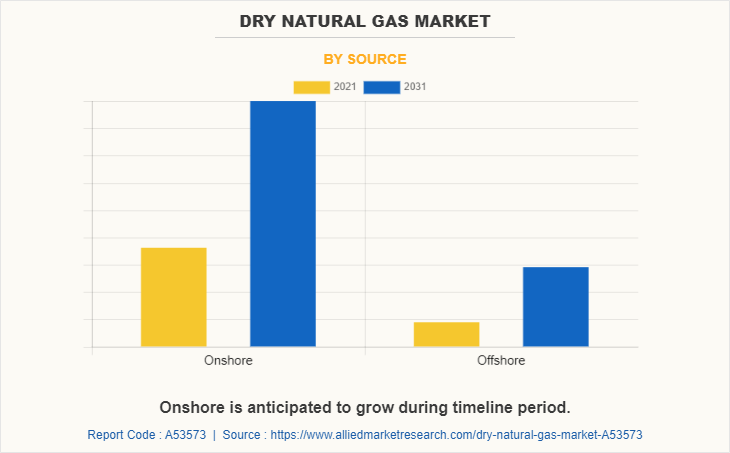

The onshore segments dominate the global market. One of the most significant sources for dry gas production is onshore. Shale gas and tight gas are primarily utilized in the commercial and household sectors for heating, cooking, and electricity generation. Throughout the projected period, it is anticipated to dominate the market. According to the International Energy Association, conventional gas production from both onshore and offshore assets is estimated to increase by close to 15% in 2030, also principally driven by the growth in associated gas output from higher oil production. EQT Corporation, a major U.S. natural gas producer, reported in 2022 a substantial increase of its share reinvesting program of $2 billion.

Other leading gas producers such as Antero Resources, Southwestern Energy, and Chesapeake Energy collectively invested $3 billion of their shares in 2022. In the U.S., the Inflation Reduction Act was signed in August 2022 to boost clean energy technologies through the provision of $370 billion of funding for energy security and climate change investments. The act is set to significantly boost the deployment of low-emission gases.

According to the International Energy Agency (IEA), natural gas is one of the fastest growing fossil fuels, which account significantly for global energy demand. Hence, the globalization of the gas market increases the demand for interconnectivity through onshore pipelines, consequently enhancing dry natural gas market industry growth. Furthermore, the development of advanced pipelines is aided by technological advancements. The development of new pipelines reshapes pipeline monitoring, lowers carbon footprints, and prevents damage to the environment. Such innovations are expected to stimulate the dry natural gas market growth.

Furthermore, discoveries of new oil & gas reserves, especially in Africa and North America, have increased the demand for pipelines to transport oil and gas, which, in turn, provide further impetus to market growth. The surge in demand for natural gas is expected to boost market growth. Moreover, the cost-effectiveness, reliability, and sustainability of natural gas and natural liquid gas (NGL) are anticipated to bolster the market growth during the forecast period.

Increase in demand for electricity has increased power generation activities across the globe. Conventional biomass combustion is expected to cause various forms of environmental pollution. It is primarily used in rural areas of developing countries to serve purposes such as cooking and small-scale agricultural activities. The solar electric power generation market is expected to be the fastest-growing segment during the forecast period.

Government initiatives and policies to control non-renewable energy consumption are expected to boost the demand for alternative sources. The economic growth observed in developing countries, such as India, China, Brazil, Thailand, Taiwan, Indonesia, Argentina, South Africa, and Mexico, has created lucrative opportunities for the future market players of the dry natural gas market. Moreover, the rise in urbanization in developing countries has resulted in a gradual rise in demand for electricity.

The U.K. became one of the European leaders in the oil and gas industry, holding around 111 oil and gas projects currently in progress, out of which 83 projects are upstream contracts to be completed by 2025. A major part of those projects is held by the offshore swathes of the North Sea. Henceforth, the British North Sea region is expected to be the major hub for the new drilling operations for gas production. The natural gas production in the country reached 4,38,330 GWh in 2020, a continuous upward trend in the previous five years. By 2025, the nation intends to increase its natural gas output by developing new gas fields, primarily in the UK Continental Shelf region.

In early 2020, dry natural gas market has faced a decline in global demand from China due to which, the demand for natural gas further decreased, which hindered the growth of the natural gas market in 2020. The industrial sector is the primary driver of demand growth and placed a heavy reliance on the rate of recovery of the local and export markets for industrial goods. Most of the gas production comes from massive conventional projects in the Middle East and the Russian Federation as well as US shale, which pose a significant downside risk due to the current price fall. This further boosted the growth of the market by the end of 2021. Henceforth, all these factors collectively led to increased growth of the global natural gas market in 2023 expected to foster market growth by the end of 2030.

The dry natural gas market forecast is segmented into source, end-use and region. On the basis of source, it is bifurcated into onshore and offshore. On the basis of end -use, the market is divided into power generation, transportation, residential, commercial, industrial, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Asia-Pacific accounts for the largest dry natural gas market share, followed by Europe and North America.

Abundant domestic natural gas supply and comparatively low natural gas prices have changed the economics of electric power generation markets. Recent environmental regulations at the local, state, regional, and federal levels have also promoted the use of lower emissions fuels, such as renewable energy and natural gas. Increased consumption of electricity in developed and developing countries is expected to boost the global power generation market during the forecast period. The rapid increase in population is the key driver for the power generation market.

The emergence of natural gas sources, like shale gas deposits, and the resulting price pressure are expanding the global market for natural gas. Hence, such developments are expected to subsequently result in increasing the demand for pipeline network expansion during the forecast period. China's state-owned firms, including CNPC and China National Offshore Oil Corporation, have strategies to maximize production at local gas fields. This is expected to provide the need for the creation of onshore gas pipelines in the country, further driving the pipeline demand in the region.

According to the International Energy Association, Natural gas consumption in the U.S experienced notable growth of 5.4% share in 2022 compared with 2021, fully recovered from the 2020 Covid-induced losses and increases to 3% compared with 2019. U.S. natural gas output increased by an estimated 3.8% share in 2022 in a context of rising demand from both domestic and export markets, despite exploration and production players attempting their conservative financial guidance on funding.

The major companies profiled in the dry natural gas market analysis include Coterra Energy, China National Petroleum Corporation, Lukoil, EQT Corporation, ExxonMobil, Chevron, Shell, TotalEnergies, Rosneft and Southwestern Energy.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dry natural gas market from 2021 to 2031 to identify the prevailing dry natural gas market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dry natural gas market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dry natural gas market trends, key players, market segments, application areas, and market growth strategies.

Dry Natural Gas Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.4 trillion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 356 |

| By End Use |

|

| By Source |

|

| By Region |

|

| Key Market Players | Lukoil, TotalEnergies, Shell, EQT Corporation, Chevron, China National Petroleum Corporation, Coterra Energy, ExxonMobil, Southwestern Energy, Rosneft |

Analyst Review

According to CXO perspective, the global dry natural gas market is expected to witness increased demand during the forecast period due to a rise in demand for power generation.

Increased innovation in natural gas drying equipment is a key market trend that offers opportunities for prominent players in the forecast period. However, the dry natural gas issue may result in significant litigation and clean up expenditure. This is projected to hamper the dry natural gas market development during the forecast period. Dry natural gas is preferable for environmental and public health. The use of natural gas as energy resource in power generation systems is anticipated to drive power generation system.

In March 2022, Comisión Federal de Electricidad (CFE), the state-owned electric utility of Mexico, issued direct awards on five projects expected to add 2.26 GW of gas-based power generation capacity. Wartsila was awarded contracts to build two internal combustion engine power plants: the 429 MW CCI Mexicali Oriente plant in Baja California, and the 202 MW CCI Parque Industrial in Sonora. The other three are combined cycle plants: CCC San Luis Potosí (442MW) in CCC San Luis Potosí and the 932MW CCC Salamanca plant in Guanajuato, both awarded to Mitsubishi Power; and finally, CCC El Sauz ll (256MW) in Querétaro, with the contract going to TSK and Siemens Energy. Increase in government investments to innovate and develop various technologies to make natural gas more efficient is projected to have positive impact over the global dry natural gas market.

The existence of abundant natural gas reserves and the lower cost compared to other fossil fuel types are the factors expected to augment the demand for natural gas from multiple end users, such as power generation, residential, industrial, and commercial & industrial

Power generation is the leading application of dry natural gas.

The Dry Natural Gas Market is estimated to reach $1.4 trillion by 2031, exhibiting a CAGR of 7.7% from 2022 to 2031.

North America is the largest regional market for dry natural gas.

The major companies profiled in this report include Coterra Energy, China National Petroleum Corporation, Lukoil, EQT Corporation, ExxonMobil, Chevron, Shell, TotalEnergies, Rosneft and Southwestern Energy.

Loading Table Of Content...

Loading Research Methodology...