EV Battery Swapping Stations Market Insights, 2032

The global electric vehicle battery swapping market size was valued at $1.8 billion in 2022, and is projected to reach $49.3 billion by 2032, growing at a CAGR of 39.6% from 2023 to 2032.

Report Key Highlighters:

- The EV battery swapping market study covers 16 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study incorporated research methodology aims to present a comprehensive outlook on global markets and aid stakeholders in making well-informed decisions to accomplish their ambitious growth goals.

- Over 1,000 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The EV battery swapping market is highly fragmented, with several players including Amara Raja Batteries Ltd., Aulton New Energy Automotive Technology Co., Ltd., ECHARGEUP, Esmito Solutions Pvt Ltd, Gogoro, Inc., KYMCO, Lithion Power Pvt Ltd, NIO, Inc., Numocity, and Oyika Pte Ltd. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the EV battery swapping market.

EV battery swapping is a process where a depleted battery or battery pack of an electric vehicle can be swiftly exchanged for a fully charged one, eliminating the need for waiting for the vehicle's battery to recharge. This system allows EV owners to drive into a swapping station or service center, where their discharged battery is replaced with a fully charged battery pack. Typically, the entire process takes just a few minutes, significantly reducing the charging time compared to traditional charging methods. Additionally, the battery-as-a-service (BaaS) model has gained popularity in the battery swapping industry by separating battery ownership, thus reducing the high upfront cost of electric vehicles. With battery swapping, customers only pay for the energy used, reducing both downtime and acquisition costs.

Battery swapping addresses various challenges faced by electric vehicle owners, including limited charging infrastructure, long charging times, and range anxiety. It provides a potential solution for drivers who lack access to home or workplace charging facilities, as well as those who require quick turnaround times for their vehicles, such as fleet operators and taxi services. While battery swapping offers the advantage of reduced charging time, it also presents certain challenges. These include the standardization of battery packs across different vehicle models, managing battery degradation, ensuring battery safety and reliability, and establishing a widespread network of swapping stations. COVID-19 has introduced unexpected complications within the automotive and electric mobility sectors. OEMs and other stakeholders are adopting innovative business models amid post-COVID-19. Sales of small format e-mobility vehicles accelerated during the pandemic and are expected to continue in the post pandemic situation. In addition, OEMs encourage growth by enabling battery swapping in new models as this will address concerns about range and battery life.

The global market share of EV battery swapping is projected to witness substantial growth driven by increased demand for electric vehicles, reduced charging time, and addressing range anxiety. However, challenges such as variations in battery technology and design, as well as high initial setup and operating costs of battery swapping stations, hinder market growth. Moreover, the rapid emergence of shared e-mobility and the introduction of innovative and advanced battery swapping models and services by industry players present lucrative opportunities for market expansion in the forecast period.

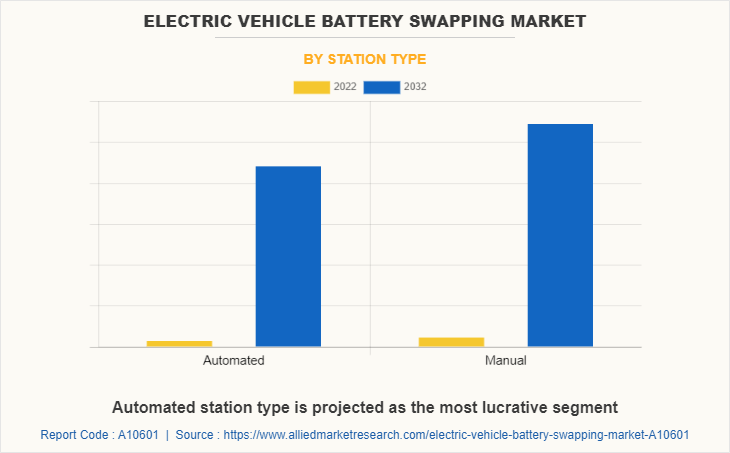

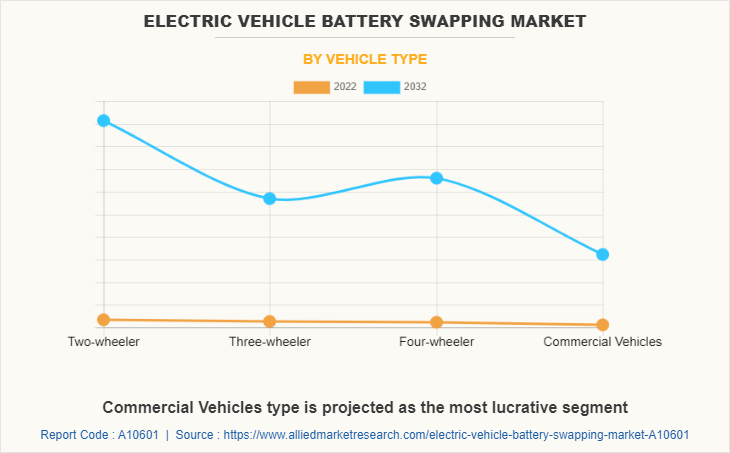

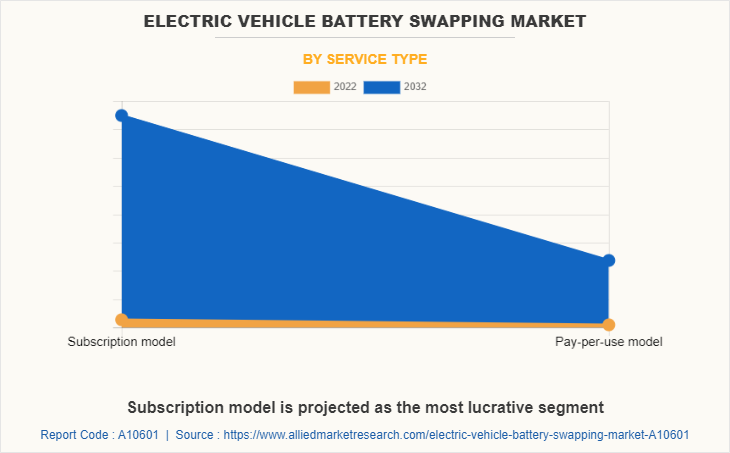

The market is segmented on the basis of station type, service type, vehicle type, application, and region. By station type, it is categorized into automated and manual. By service type, it is bifurcated into subscription model and pay-per-use model. By vehicle type, it is categorized into two-wheeler, three-wheeler, four-wheeler, and commercial vehicles. Region-wise, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in the electric vehicle battery swapping market include Amara Raja Batteries Ltd., Aulton New Energy Automotive Technology Co., Ltd., ECHARGEUP, Esmito Solutions Pvt Ltd, Gogoro, Inc., KYMCO, Lithion Power Pvt Ltd, NIO, Inc., Numocity, and Oyika Pte Ltd.

Reduced time for electric vehicle charging

Charging time is an important factor for the functioning of electric vehicles, especially in long-hauling applications. Currently, most electric vehicles employ a slow charging system to recharge their battery. This charging system usually takes up to eight hours to fully charge a battery. In addition, generally electric two-wheeler, three-wheeler, and four-wheeler have on-board chargers that charge the vehicle at the rate of 2.5–3 kW per hour. These chargers charge a two-wheeler (for a battery with an energy density up to 3 kWh) in no less than an hour. In addition, these chargers charge a four-wheeler or larger vehicle with batteries of 12 kWh or more in no less than five to six hours. Hence, battery swapping technology plays a vital role by eliminating such issues.

Battery swapping significantly decreases waiting time by interchanging batteries within three minutes. For this, the user just needs to go to a swapping station and get the depleted battery replaced with a fully charged one. Companies are developing systems that can quickly and accurately remove and replace battery packs, and minimize the time required for the swapping process. For instance, in April 2023, Gogoro, in partnership with Zypp Electric, introduced its battery-swapping platform and smart scooters in the Delhi NCR region. The Gogoro smart scooters are equipped with a six-second battery swapping capability at dedicated swapping stations. Therefore, implementation of battery swapping reduces the time for electric vehicle charging, which, in turn, drives growth of the electric vehicle battery swapping market.

Increase in demand for electric vehicles, coupled with lack of adequate public charging facilities

The popularity of electric vehicles has increased over years as they are more efficient and eco-friendlier. In addition, growth in consumer demand to maximize vehicle efficiency and minimize fuel costs has led to consistent technological advancements in electric vehicles. Moreover, rise in costs of gasoline, coupled with stringent governmental regulations pertaining to carbon dioxide emissions are pushing adoption of electric vehicles in developed regions such as North America and Europe. However, the driving range of electric vehicles per single charge is limited and may need to charge twice a day based on usages, which requires up to 6 to 10 hours to full charge a battery. Thus, battery swapping leads to near zero down time for electric vehicles as compared to 6-10 hours daily down time with traditional charging. Furthermore, lack of adequate public charging facilities for electric vehicle charging and lack of standardization of charging infrastructure also fuels demand for battery swapping stations. Therefore, such factors collectively drive growth of the electric vehicle battery swapping market.

High initial set-up and operating cost of battery swapping stations

Initial infrastructure required for battery swapping stations is immense and much more complex & expensive as compared to charging stations. In addition, the swapping station must have a number of battery packs that exceed by a certain percentage the daily requirement for each station. This means that for every car there must be at least two battery packs, one inside the car and another available in a battery swapping station. Moreover, it is essential for all battery packs to be charged as rapidly as possible, so that they are available for the next customer, which requires high speed battery chargers installed at swapping stations. These factors together rise the set-up and operating cost of battery charging stations and hinder the market growth.

However, there are ways to mitigate these costs and improve the economic feasibility of battery swapping stations. For instance, battery swapping stations can leverage renewable energy sources, such as solar or wind power, to reduce electricity costs and carbon emissions. They can also explore partnerships with other companies, such as energy utilities or charging network operators, to share infrastructure costs and increase utilization rates. Thus, the high initial set-up and operating costs of battery swapping stations may present challenges for the EV battery swapping market, there are still opportunities to improve the economics of battery swapping and make it a viable and attractive option for EV owners and operators.

Introduction of innovative and advanced battery swapping models and services

In recent years, major players in the market have taken several strategic measures, such as product launches, partnerships, and facility expansions to gain a competitive edge in the battery swapping market. In addition, in line with various technological advancements in electric vehicles, the requirement for rapid battery charging is also on the rise. Therefore, market players are introducing innovative and advanced battery charging models such as battery swapping to fulfill growing requirements. For instance, in February 2020, renewable energy company Fika Mobility announced electric vehicle battery swapping model for the Kenya market. Fika’s batteries would be GPS-linked to enable real-time tracking and monitoring. Its services have a bouquet of subscription plans for riders to choose their monthly payment packages for swaps. Moreover, use of robotic systems for the purpose to automate the procedure is one of the major technological trends being witnessed in the electric vehicle battery swapping industry. Robotic technology can swap batteries in less than 2 minutes, thus saving time and ensuring continuous mobility. Thus, introduction of innovative and advanced battery swapping models by market players to gain competitive edge in the market offer lucrative opportunities for the market growth.

Recent Developments

- In April 2023, NIO, a Chinese electric vehicle maker, opened its Power Swap Station in Europe in Denmark. This station allows drivers to replace their depleted battery with a fully charged one. The entire process is automated: the station lifts the vehicle, removes the depleted battery, and replaces it with a charged one, which provides up to 500 km of range.

- In March 2023, Esmito Solutions Pvt Ltd, a provider of battery-swapping solutions, partnered with ElectricFuel, a company that offers EV charging services, to introduce an energy-as-a-service (EaaS) platform, which offers cost-effective battery-swapping solutions.

- Gogoro has formed partnerships with DCJ and Yadea, two of China's two-wheel vehicle manufacturers, to introduce a new electric refueling system in China using Gogoro's battery swapping technology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric vehicle battery swapping market analysis from 2022 to 2032 to identify the prevailing electric vehicle battery swapping market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric vehicle battery swapping market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric vehicle battery swapping market trends, key players, market segments, application areas, and market growth strategies.

Electric Vehicle Battery Swapping Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 49.3 billion |

| Growth Rate | CAGR of 39.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 362 |

| By Station Type |

|

| By Vehicle Type |

|

| By Service Type |

|

| By Region |

|

| Key Market Players | Esmito Solutions Pvt Ltd, NIO, Numocity, Lithion Power Private Limited, Amara Raja Batteries Ltd., Aulton New Energy Automotive Technology Co., Ltd., Gogoro, Oyika, KYMCO, ECHARGEUP |

Analyst Review

The Electric vehicle battery swapping market is expected to witness significant growth due to a rise in demand for convenient charging solutions, and the adoption rate of battery swapping services. Electric vehicle battery swapping manufacturers are concentrating on developing battery swapping systems with different electric vehicle models and ensuring that the technology is reliable, efficient, and safe. Exploring advancements in battery technologies, such as longer battery life and faster swapping processes, will be essential to stay competitive in the evolving market. The market is projected to witness considerable growth, especially in China, and India, owing to growth in population along with increase in globalization and rise in purchasing power & electric vehicle production. Companies in the electric vehicle battery swapping industry are adopting various innovative techniques to provide customers with advanced and innovative feature offerings. For instance, in August 2021, KYMCO launched the Ionex Recharge, a service that offers on-demand battery delivery and swapping for electric scooters and motorcycles. This innovative solution allows riders to have their vehicle batteries replaced at a designated time and location, eliminating the need for their presence during the process.

The popularity of electric vehicles has increased over the years as they are more efficient and eco-friendlier. In addition, growth in consumer demand to maximize vehicle efficiency and minimize fuel costs has led to consistent technological advancements in electric vehicles. Moreover, rise in costs of gasoline, coupled with stringent governmental regulations pertaining to carbon dioxide emissions are pushing adoption of electric vehicles in developed regions such as North America and Europe.

Range anxiety is a significant barrier for potential EV owners and can limit the widespread adoption of electric vehicles. Battery swapping provides a solution to range anxiety by offering a quick and convenient way to replenish the vehicle's energy. Rather than waiting for an extended period at a charging station, which can be time-consuming and inconvenient, drivers can simply swap their depleted battery for a fully charged one. This significantly reduces the downtime associated with charging and allows drivers to continue their journey without the worry of running out of battery power.

The global electric vehicle battery swapping market was valued at $1.8 billion in 2022, and is projected to reach $49.3 billion by 2032, growing at a CAGR of 39.6% from 2023 to 2032.

Amara Raja Batteries Ltd., Aulton New Energy Automotive Technology Co., Ltd., ECHARGEUP, Esmito Solutions Pvt Ltd, Gogoro, Inc., KYMCO, Lithion Power Pvt Ltd, NIO, Inc., Numocity, and Oyika Pte Ltd. are the top companies to hold the market share in Electric Vehicle Battery Swapping

Asia-Pacific is the largest regional market for Electric Vehicle Battery Swapping

Reduced time for the electric vehicle charging is the leading application of Electric Vehicle Battery Swapping Market

Various technological advanced automated electric vehicle battery swapping and increasing adoption in electric vehicle to save time are the upcoming trends of Electric Vehicle Battery Swapping Market in the world.

Loading Table Of Content...

Loading Research Methodology...