Electrical Steel Market Research, 2033

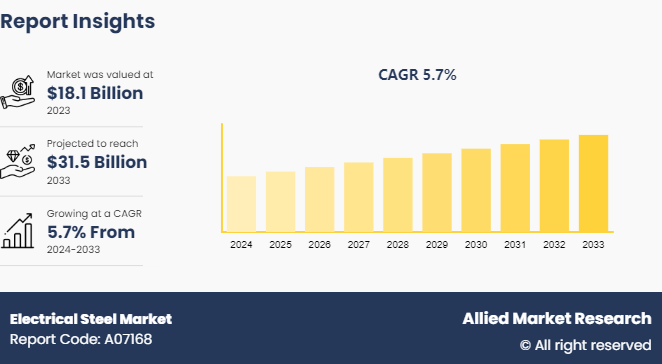

The global electrical steel market size was valued at $18.1 billion in 2023, and is projected to reach $31.5 billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

Market Introduction and Definition

Electrical steel, also known as silicon steel or lamination steel, is a specialized steel alloy primarily used in the production of magnetic cores for electrical equipment and transformers. It is designed to exhibit low core losses and high magnetic permeability that makes it ideal for applications where efficient energy conversion and minimal electromagnetic interference are essential. The alloy typically contains silicon in varying concentrations, which helps to reduce eddy current losses by increasing the electrical resistance of the material. Electrical steel is often produced in thin sheets, which are then laminated to minimize eddy current losses further.

Key Takeaways

- The electrical steel market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major electrical steel industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

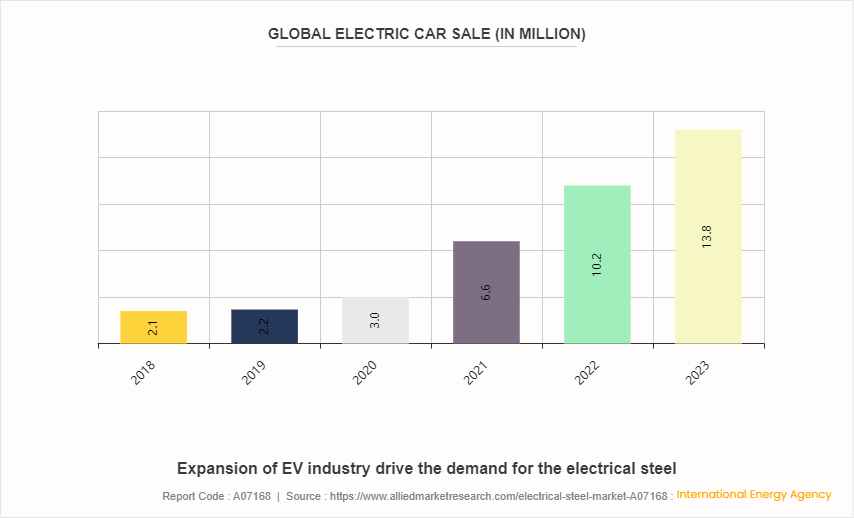

Electric motors used in EVs, and hybrid vehicles require high-performance materials that efficiently conduct electricity and minimize energy loss. Electrical steel, also known as silicon steel or laminated steel, exhibits excellent magnetic properties, including high magnetic permeability and low core loss that makes it an ideal choice for the cores of electric motors. The rise of electric vehicles (EVs) drives the demand for electrical steel in the automotive industry. According to the International Energy Agency (IEA) , electric car sales neared 14 million in 2023, 95% of which were in China, Europe and the U.S. In addition to electric motors, electrical steel is also essential for other key components of electrified automotive systems, such as transformers, inverters, and generators. All these factors are expected to drive the demand for the electrical steel market during the forecast period.

However, fluctuations in raw material prices significantly impact the production costs and profitability of electrical steel manufacturers, thereby posing challenges to the growth of the industry. Raw materials such as iron ore, coal, and various alloying elements are essential to produce electrical steel, and any volatility in their prices cascading effects throughout the supply chain. In addition, the volatility in raw material prices undermines investment confidence and capital expenditure decisions within the electrical steel industry. Uncertain market conditions and unpredictable cost structures deter companies from making long-term investments in research and development, technology upgrades, or capacity expansion initiatives that are essential for sustaining growth and competitiveness. All these factors hamper the growth of the electrical steel market.

Advancements in process optimization and automation technologies are enabling electrical steel producers to enhance production efficiency, reduce waste, and lower manufacturing costs. Automation systems and digital monitoring tools allow for real-time process control, predictive maintenance, and quality assurance, enabling tighter tolerances, higher throughput, and greater consistency in product performance. In addition, advancements in energy-efficient processing technologies such as thin slab casting and continuous annealing, help minimize energy consumption and environmental impact, aligning with sustainability goals and regulatory requirements in the industry. All these factors are anticipated to offer new growth opportunities for the global electrical steel market during the forecast period.

Market Segmentation

The electrical steel market is segmented into type, application, end use and region. By type, the market is bifurcated into grain-oriented electrical steel and non-grain-oriented electrical steel. By application, the market is divided into transformers, motors, inductors, generators, and others. By end use, the market is classified into energy and power generation, automotive, manufacturing, household appliances, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The Asia-Pacific region is witnessing a significant shift towards renewable energy sources, driven by the need to reduce carbon emissions and address climate change. Countries such as China, India, and Japan are investing heavily in wind, solar, and hydroelectric power projects. Electrical steel, particularly high-grade silicon steel, is crucial for manufacturing transformers, generators, and other electrical components essential for these renewable energy systems. The growth of renewable energy infrastructure is thus a major driver of demand for electrical steel, as these materials help improve the efficiency and reliability of energy generation and distribution. In addition, the ongoing industrialization and urbanization across many Asia-Pacific countries are driving significant demand for electrical steel. Rapidly growing economies such as India, Indonesia, and Vietnam are investing in infrastructure development, including power grids, transportation networks, and industrial facilities. Electrical steel is essential for the manufacture of transformers, motors, and other electrical equipment required for these infrastructure projects.

- According to the Invest India, India stands 4th globally in renewable energy installed capacity (including Large Hydro) , 4th in wind power capacity & 5th in solar power capacity. The country has set an enhanced target at COP26 of 500 GW of non-fossil fuel-based energy by 2030. As of 2024, renewable energy sources including large hydropower, have a combined installed capacity of 191.67 GW.

- Rapid industrialization and urbanization in emerging economies across Asia-Pacific are driving demand for electrical steel in various infrastructure projects, including power distribution networks, building construction, and industrial machinery. As the region continues to invest in modernizing its infrastructure and expanding its manufacturing capabilities, there is a growing need for reliable and energy-efficient electrical steel products to support these initiatives.

- According to the Asian Development Bank, by 2030, more than 55% of the population of Asia expected to be urban. As urban populations grow and infrastructure development accelerates, there is a corresponding increase in the demand for geopolymer.

Competitive Landscape

The major players operating in the electrical steel market include POSCO, JFE Steel Corporatio, Cleveland-Cliffs Inc., Baosteel Co., Ltd., NIPPON STEEL CORPORATION, Slovenian Steel Group, Aperam, Tata Steel, ArcelorMittal, and voestalpine Stahl GmbH.

- In October 2023, United States Steel Corporation launched of new electrical steel line with ribbon cutting in Osceola, Arkansas. This new line helps to expand its portfolio of products needed to serve growing markets and help customers meet their sustainability goals.

- In April 2023, Beijing Shougang announced the operation of a new grain-oriented (GO) electrical steel production line. The new line is expected to have an annual output of 90, 000 tons of high-performance GO electrical steel.

The Crucial Role of Electrical Steel in the Renewable Energy Sector

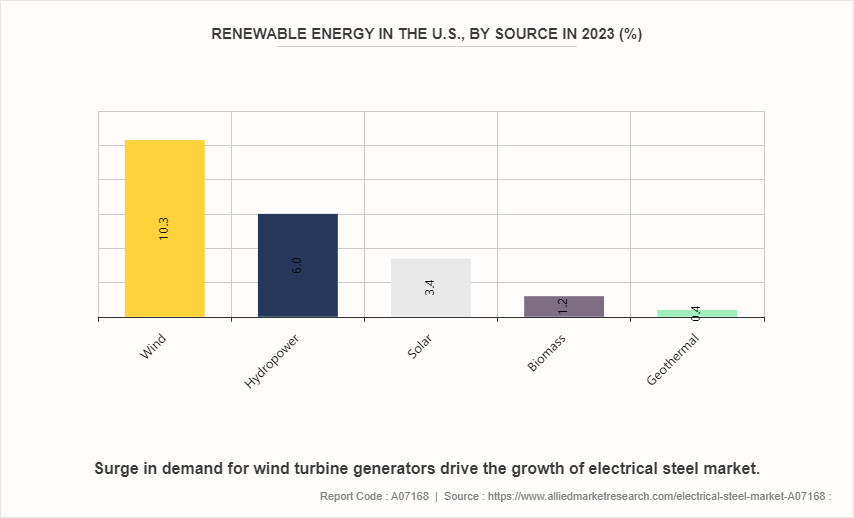

In wind energy, electrical steel is essential for the construction of wind turbine generators. These generators convert the mechanical energy from wind into electrical energy, and the efficiency of this conversion process is significantly enhanced by the use of high-grade electrical steel. The material's high magnetic permeability and low core loss reduce energy dissipation during operation, ensuring that a greater proportion of the wind's kinetic energy is converted into usable electrical power. Wind energy is the largest contributor among renewable sources in the United States, accounting for 10.3% of the energy mix. As the demand for wind energy grows, the need for advanced electrical steel that supports larger and more efficient wind turbines is also increasing. In addition, hydroelectric power generation relies on electrical steel in its turbines and generators. The material’s robustness and efficiency are critical for withstanding the demanding operational conditions of hydroelectric plants, where large volumes of water are converted into electrical energy. Electrical steel helps ensure that the turbines and generators operate with minimal energy losses and high reliability, contributing to the overall efficiency and sustainability of hydroelectric power plants.

Industry Trends

The ongoing electrification of the automotive industry is driving significant demand for electrical steel. Electric vehicles (EVs) require high-performance electrical steel for their motors, transformers, and power electronics. As governments worldwide implement stricter emissions regulations and consumers increasingly embrace EVs, the demand for electrical steel in the automotive sector is expected to continue growing rapidly.

According to the Internation Energy Agency (IEA) , electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. This is more than six times higher than in 2018. In 2023, there were over 250, 000 new registrations per week, which is more than the annual total in 2013.

The expansion of renewable energy sources such as wind and solar power is driving demand for electrical steel used in generators and transformers. Electrical steel is critical for the efficient generation, transmission, and distribution of renewable electricity. As countries aim to reduce dependence on fossil fuels and transition to cleaner energy sources, the demand for electrical steel in the renewable energy sector is expected to increase.

According to the Internation Energy Agency, solar PV and wind account for 95% of the expansion, with renewables overtaking coal to become the largest source of global electricity generation by early 2025.

Key Sources Referred

International Trade Administration

Asian Development Bank

Invest India

United Nations Development Program

U.S. Department of Energy

International Electrical Steel Sheet Summit 2024

American Iron and Steel Institute

International Energy Agency

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electrical steel market analysis from 2024 to 2033 to identify the prevailing electrical steel market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the electrical steel market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global electrical steel market trends, key players, market segments, application areas, and market growth strategies.

Electrical Steel Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 31.5 Billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 420 |

| By Type |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Baosteel Co.,Ltd., POSCO, Aperam, Slovenian Steel Group, Tata Steel, JFE Steel Corporation, ArcelorMittal, voestalpine Stahl GmbH, Cleveland-Cliffs Inc., NIPPON STEEL CORPORATION |

The global electrical steel market was valued at $18.1 billion in 2023, and is projected to reach $31.5 billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

Asia-Pacific is the largest regional market for Electrical Steel.

Transformers is the leading application of Electrical Steel Market.

Technological advancements in electrical steel production is the upcoming trends of Electrical Steel Market in the globe.

The major players operating in the electrical steel market include POSCO, JFE Steel Corporatio, Cleveland-Cliffs Inc., Baosteel Co.,Ltd., NIPPON STEEL CORPORATION, Slovenian Steel Group, Aperam, Tata Steel, ArcelorMittal, and voestalpine Stahl GmbH.

Loading Table Of Content...