Electrode Ionization System Market Research, 2033

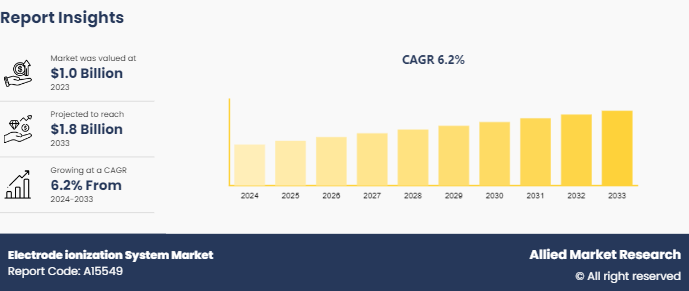

The global electrode ionization system market size was valued at $1.0 billion in 2023, and is projected to reach $1.8 billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033.

Market Introduction and Definition

An electrode ionization system is a technology that utilizes electrical fields to ionize molecules, facilitating the removal of charged particles or the analysis of samples. This process typically involves the application of a voltage across electrodes, which generates ions from a liquid or gas phase. These systems are crucial in various scientific and industrial applications due to their efficiency and precision. One prominent use of electrode ionization is in water purification, specifically through electrode ionization (EDI) . EDI combines ion exchange and electric fields to continuously remove dissolved ions from water without the need for chemical regeneration. This makes it ideal for producing high-purity water in industries such as pharmaceuticals, electronics, and power generation.

In the realm of mass spectrometry, techniques like Electrospray Ionization (ESI) and Chemical Ionization (CI) are widely employed. ESI is particularly valuable for analyzing large biomolecules, such as proteins and peptides, allowing for the sensitive detection and characterization of these complex molecules. CI provides a soft ionization method that enhances the identification of volatile organic compounds, making it useful in environmental monitoring. Gas detection is another critical application, where corona discharge ionization is used to identify trace gases in the atmosphere. This is essential for ensuring safety in industrial environments and monitoring air quality. Moreover, glow discharge ionization is applied in material analysis, providing insights into the elemental composition and surface characteristics of various materials.

Key Takeaways

- Over 1, 500 product literatures, industry releases, annual reports, and various documents from major electrode ionization system industry participants, along with credible industry journals, trade association releases, and government websites, have been reviewed to generate valuable industry insights.

- The electrode ionization system market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period 2024-2033.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

Market Dynamics

The electrode ionization system market expansion is driven by several key factors, including the growing demand for high-purity water in industries such as pharmaceuticals, electronics, and food and beverage manufacturing. Increasing regulatory pressures regarding water quality and environmental sustainability further enhances market growth, as industries seek efficient purification technologies to comply with stringent standards.

However, the market faces certain restraints, including high initial capital costs associated with electrode ionization (EDI) systems and the need for skilled personnel to operate and maintain these technologies. In addition, competition from alternative water purification methods is likely to present challenges to market expansion. Nevertheless, technological advancements are also paving the way for a more efficient Electrode Ionization System, reducing operational costs and improving performance. In addition, the growing focus on sustainability and environmental regulations creates a favorable environment for EDI adoption, as companies seek to enhance their water management practices. Emerging markets, particularly in Asia-Pacific and Latin America, offer substantial growth potential due to rising industrialization and investments in water infrastructure.

Market Segmentation

The electrode ionization system market is segmented on the basis of design, end use, and region. By design, the market is classified into plate construction, frame construction, and others. By end use, the market is divided into power generation, pharmaceuticals, electronics & semiconductors, and others. Region-wise the electrode ionization system market share is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The demand for Electrode Ionization Systems (EDI) in the Asia-Pacific region is experiencing significant growth driven by several key factors. Rapid industrialization, particularly in countries such as China, India, and Japan, is increasing the need for high-purity water in various manufacturing processes. The expanding pharmaceutical sector, which requires stringent water quality for drug production, is further propelling the adoption of Electrode Ionization System. In addition, the rise of electronics manufacturing, particularly in semiconductor production, demands ultra-pure water, making EDI an essential solution. Stricter environmental regulations on wastewater treatment and water quality are also pushing industries towards advanced purification technologies.

Competitive Landscape

Key players in the electrode ionization system market include Evoqua Water Technologies LLC, Pure Aqua Inc., Snowpure, LLC, Suez SA, Newterra Ltd., Qua Group, Mega A.S., Dowdupont Inc., Ovivo Inc., and Veolia Group.

Key Developments

- In March 2024, Veolia Water Technologies announced a partnership with a major semiconductor manufacturer to supply Electrode ionization (EDI) systems for a new production facility in China. This collaboration aims to improve water quality and minimize environmental impact. The company plans to establish a new plant in the Changshu industrial zone, which will serve as an operational and maintenance center for deionization and mobile water treatment solutions.

- In April 2021, Evoqua Water Technologies, a leading provider of critical water treatment solutions, acquired Water Consulting Specialists, Inc. (WCSI) . WCSI is renowned for its expertise in the design, manufacture, and maintenance of industrial ultra-pure water treatment systems. This acquisition enhances Evoqua's capabilities and market position in providing advanced water treatment solutions for industrial applications.

- In May 2020, Veolia introduced the new TERION standard system, which integrates ROCEDI technology into a compact skate-mounted unit. The TERION system is designed to produce softened water, specifically for use in power generation applications such as boiler feed water and turbine injection. This advanced ROCEDI system ensures high-quality water treatment, optimizing the efficiency and reliability of power generation processes.

- In January 2019, AMSA (ArcelorMittal South Africa) extended its water treatment contract with Veolia Water Technologies. Under this extended agreement, Veolia will oversee the entire wastewater treatment plant operations. This includes the monthly addition of about 100 tons of Hydrex chemicals, used to enhance the treatment process and ensure efficient and effective wastewater management.

Semiconductor Foundry Industry Facts

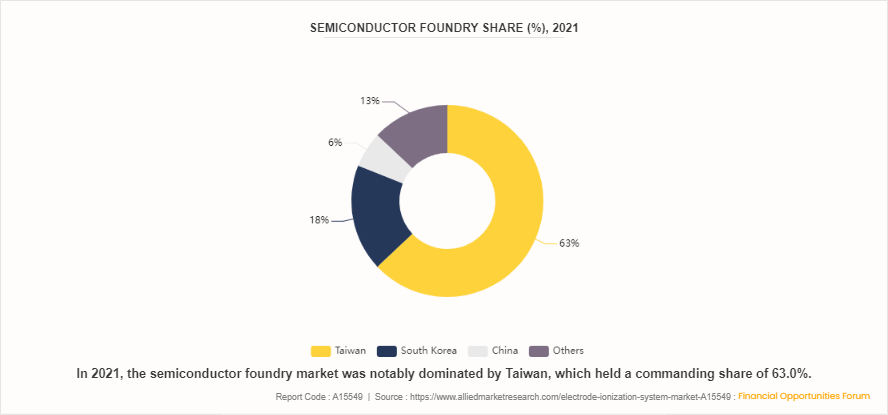

In 2021, the market was predominantly led by Taiwan, which held a commanding 63.0% share. This significant dominance is attributed to major players such as TSMC (Taiwan Semiconductor Manufacturing Company) , which is renowned for its advanced manufacturing capabilities and extensive production capacity. The Taiwan-based company reported a revenue of $45.5 billion for fiscal year 2020, an increase from $34.63 billion in 2019. The company has a comprehensive future R&D plan and invested approximately $3.8 billion in research and development, which represents 8.3% of its revenue as per Nasdaq.

South Korea followed with an 18.0% share, driven by industry giants like Samsung Electronics, which continues to invest heavily in expanding its foundry operations. In May 2021, Samsung Electronics announced plans to boost its investments in the System LSI and Foundry businesses through 2030 to $ 143.8 billion. This marks an increase of $32.0 billion from the previous commitment of $111.8 billion announced in April 2019. As part of this initiative, Samsung is constructing a new production line in Pyeongtaek, expected to be completed in the second half of 2022. This facility will be equipped to produce 14 nm DRAM and 5 nm logic semiconductors, utilizing extreme ultraviolet (EUV) lithography technology. Samsung is recognized as the largest non-U.S. investor in R&D, having spent approximately $18.75 billion in fiscal year 2020, which accounted for 9% of its sales. The company also secured 6, 415 patents in 2020, ranking it second in terms of patent grants. China held a 6.0% share of the market, reflecting its growing but still developing foundry industry, supported by companies like SMIC (Semiconductor Manufacturing International Corporation) . The remaining 13.0% of the market was distributed among other countries, encompassing a range of smaller players contributing to the global semiconductor foundry landscape.

Public Policies

The U.S. Food and Drug Administration (FDA) regulates electrode ionization systems under 21 CFR Parts 210 and 211, which cover the manufacturing, processing, packing, or holding of drugs, including the purity of water used in pharmaceuticals. The United States Pharmacopeia (USP) sets standards for water quality, such as USP <643> for Total Organic Carbon (TOC) and USP <645> for conductivity, which Electrode Ionization System must meet. The Environmental Protection Agency (EPA) regulates Electrode Ionization System under the Safe Drinking Water Act (SDWA) to ensure the systems do not introduce contaminants into potable water supplies. In addition, the International Organization for Standardization (ISO) provides guidelines through ISO 9001 for quality management systems and ISO 14001 for environmental management systems, ensuring that Electrode Ionization System are manufactured and operated within a framework of continuous improvement and environmental stewardship.

Key Sources Referred

- U.S. Food and Drug Administration (FDA)

- United States Pharmacopeia (USP)

- Environmental Protection Agency (EPA)

- International Organization for Standardization (ISO)

- American Society for Testing and Materials (ASTM)

- International Electrotechnical Commission (IEC)

- Water Quality Association (WQA)

- Association of Water Technologies (AWT)

Key Benefits For Stakeholders

- This electrode ionization system market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electrode ionization system market analysis from 2024 to 2033 to identify the prevailing electrode ionization system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electrode ionization system market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electrode ionization system market trends, key players, market segments, application areas, and electrode ionization system market growth strategies.

Electrode Ionization System Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.8 Billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 200 |

| By Design |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Snowpure, LLC, Ovivo Inc., Pure Aqua Inc., Newterra Ltd., Veolia Group, Mega A.S., Suez SA, Evoqua Water Technologies LLC, Dowdupont Inc., Qua Group |

The electrode ionization system market growth is driven by the growing demand for high-purity water in industries like pharmaceuticals and electronics, where quality is critical.

Power generation is the leading application of Electrode ionization System Market.

Asia-Pacific held the highest market share in 2023.

The electrode ionization system market was valued at $1.0 billion in 2023, and is estimated to reach $1.8 billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033.

Key players in the electrode ionization system market include Evoqua Water Technologies LLC, Pure Aqua Inc., Snowpure, LLC, Suez SA, Newterra Ltd., Qua Group, Mega A.S., Dowdupont Inc., Ovivo Inc., and Veolia Group.

Loading Table Of Content...