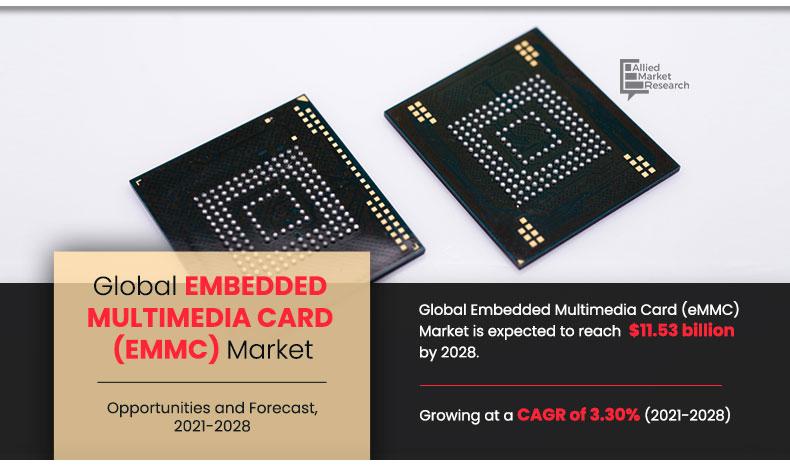

Embedded Multimedia Card (eMMC) Market Outlook - 2028

The global embedded multimedia card (eMMC) market size is expected to reach $11.53 billion by 2028 from $9.30 billion in 2019, growing at a CAGR of 3.30% from 2021 to 2028.

An embedded multimedia card (eMMC) is an embedded non-volatile memory system that comprises both flash memory and a flash memory controller, which simplifies the application interface design and frees the host processor from low-level flash memory management. Embedded multimedia cards (eMMC) are rapidly being adopted in many embedded applications, such as single board computers (SBC), robotics, medical devices, automotive, networking, and building control devices, owing to their compact size, low power consumption, and numerous enhanced features. With the rapid growth in the Internet of things (IoT) market, the eMMC is finding its way to newer applications.

Embedded multimedia cards (eMMC) are frequently used in portable electronic devices that need flash memory. There is a high demand for eMMC in electronic devices including digital cameras, digital set-up boxes, digital book readers, portable terminals, camcorders, televisions, and others. An embedded multimedia card (eMMC) is a standard solution for storing high-density memory for high-performance applications such as portable consumer electronic products. The primary usage of eMMC has been the mobile device industry that uses the technology in smartphones, tablets, and notebooks. The largest capacity eMMC available is 128GB, which is made by Samsung and used in lightweight notebook computers.

The prominent factor that drives the embedded multimedia card (eMMC) market growth include the increasing adoption of embedded multimedia cards (eMMCs) in the automotive industry, rising demand for embedded multimedia cards (eMMC) in electronic devices, and high demand for integrated memory in mobile computing devices. Increasing adoption of eMMCs in-vehicle cameras, GPS systems, and ADAS applications in the automotive industry is driving the market for the embedded multimedia card (eMMC). The demand for high-density, nonvolatile memories with a small footprint has increased dramatically. In addition, the increased consumer demand for high-tech features in automobiles, such as infotainment systems, is also one of the key factors that drive the demand for the embedded multimedia card (eMMC) market. However, one of the major restraints is the continuous development in technology and the evolution of new storage devices.

On the contrary, the surge in the development of Chromebooks fuels the growth of the global market. The high development of Chromebooks is expected to offer lucrative opportunities for the embedded multimedia cards (eMMCs) market in the coming years. Embedded multimedia cards (eMMC) are one of the preferred storage devices by Chromebooks, due to their speed, efficiency, and low-cost chip. For instance, in July 2020, AMD launched new AMD-powered Chromebooks such as ‘Zork’ that came with a massive increase in speed and efficiency.

Segment Overview

The global embedded multimedia card (eMMC) market is segmented into density, application, end user, and region.

Based on density, the market is classified into 2GB–4GB, 8GB–16GB, 32GB–64GB, and 128GB-256GB.

By Density

32GB-64GB segment is projected as one of the most lucrative segments.

Based on applications covered in the market include smartphones, digital cameras, GPS systems, medical devices, and others. Depending on end use, the market is fragmented into automotive, aerospace & defense, industrial, healthcare, public, IT & telecom, and other sectors.

By Application

GPS System segment is expected to secure leading position during forecast period.

Region-wise, the embedded multimedia card (eMMC) market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific accounted for the highest share, owing to the expansion of the electronics market and the rise in sales of smart devices.

By Region

Europe region would exhibit the highest CAGR of 4.10% during 2021-2028

Top Impacting Factors

The prominent factors that drive the growth of the embedded multimedia card (eMMC) market share include the increasing adoption of embedded multimedia cards (eMMCs) in the automotive industry, the increase in demand for embedded multimedia cards (eMMC) in electronic devices, and the high demand for integrated memory in mobile computing devices. However, continuous development in technology and the evolution of new storage devices restrict the market growth. Conversely, the surge in the development of Chromebooks is expected to create lucrative opportunities for the embedded multimedia card (eMMC) industry.

Competition Analysis

Competitive analysis and profiles of the major Samsung Electronics Co. Ltd. (South Korea), Western Digital Corporation (U.S.), SK Hynix Inc. (South Korea), Phison Electronics Corporation (Taiwan), Greenliant Systems Inc. (U.S.), Kingston Technology Company Inc. (U.S.), Micron Technology, Inc. (U.S.), Silicon Motion Technology Corporation (U.S.), Transcend Information, Inc. (Taiwan), and Toshiba Corporation (Japan) are provided in this report.

Covid 19 Impact Analysis

The global embedded multimedia card (eMMC) market size has been significantly impacted by the COVID-19 outbreak. The impact of COVID-19 on the manufacturing industry has significantly affected the global economy. Electronic components and other semiconductor devices are mostly imported from China. Attributed to the temporary shutdown of manufacturing units, the prices of semiconductor components have increased by 2-3%, owing to a shortage of supplies. In addition, reductions in various capital budgets and delays in numerous planned projects in various end-use industries have hampered the global embedded multimedia card (eMMC) market growth.

Key Benefits For Stakeholders

- This study comprises an analytical depiction of the global embedded multimedia card (eMMC) market outlook along with the current trends and future estimations to depict the imminent investment pockets.

- The overall embedded multimedia card (eMMC) market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and embedded multimedia card (eMMC) market opportunities with a detailed impact analysis.

- The current embedded multimedia card (eMMC) market forecast is quantitatively analyzed from 2019 to 2028 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and the embedded multimedia card (eMMC) market share of key vendors.

- The report includes the market trends and the eMMC market share of key vendors.

Embedded Multimedia Card (eMMC) Market Report Highlights

| Aspects | Details |

| By DENSITY |

|

| By APPLICATION |

|

| By END USER |

|

| By Region |

|

| Key Market Players | Micron Technology, Inc, Transcend Information Inc, Samsung Electronics Co. Ltd, Toshiba Corporation, Silicon Motion Technology Corporation, SK Hynix Inc, Kingston Technology Company, Inc, Western Digital Corporation, Phison Electronics Corporation, Greenliant Systems Inc |

Analyst Review

According to the insights of CXOs of leading companies, the embedded multimedia card (eMMC) market poses a steady future for market players. In the current business scenario, there is an upsurge in the adoption of eMMC products across various end users including, IT & telecom, automotive, industrial, healthcare, and others.

High adoption of mobile computing & automotive electronic devices have revolutionized the embedded multimedia card (eMMC) market. Growing need for storage devices is expected to boost the adoption of eMMC products across various verticals.

Leading players have focused on developing new technologies and advancement in eMMC products to cater to the growing demands of customers. Market players have adopted product launch, partnership, and collaboration, expansion, and product development strategies to enhance their product portfolios and expand their geographical outreach. Emerging economies are projected to provide lucrative growth opportunities to market players in the near future.

Loading Table Of Content...