Embedded Systems Market Research, 2031

The Global Embedded Systems Market was valued at $89.1 billion in 2021 and is projected to reach $163.2 billion by 2031, growing at a CAGR of 6.5% from 2022 to 2031.

A computer hardware and software combination created for a particular purpose is an embedded system. Additionally, embedded systems may operate as part of a bigger system. The systems may be programmable or may only perform certain functions. An embedded system is generally found in industrial equipment, consumer electronics, agricultural and processing sector equipment, automobiles, medical equipment, cameras, digital watches, home appliances, airplanes, vending machines, and others. Embedded systems engineers are revolutionizing the embedded system design process and altering the way data centers are managed. These chips allow critical tasks to be transferred from software to hardware to save power, which is critical for power-sensitive embedded systems applications.

The global embedded systems market is expected to witness notable growth during the forecast period, owing to an increase in demand for advanced driver-assistance systems (ADAS) in electric vehicles (EV) and hybrid vehicles. Furthermore, a rise in the number of embedded systems-related research and development projects will drive the global embedded systems market growth. Moreover, demand for multicore central processing units (CPUs) in military applications is expected to propel the embedded systems industry growth during the forecast period. However, the security of embedded devices is one of the main restraints that has restricted the growth of the embedded system market. On the contrary, the rise of 5G and the development of 5G based embedded devices is expected to provide lucrative opportunities for the growth of the market during the forecast period

Key Takeaways

- The global market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literature, industry releases, annual reports, and other such documents of major market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Segment Overview

The embedded systems market is segmented into Applications and Components.

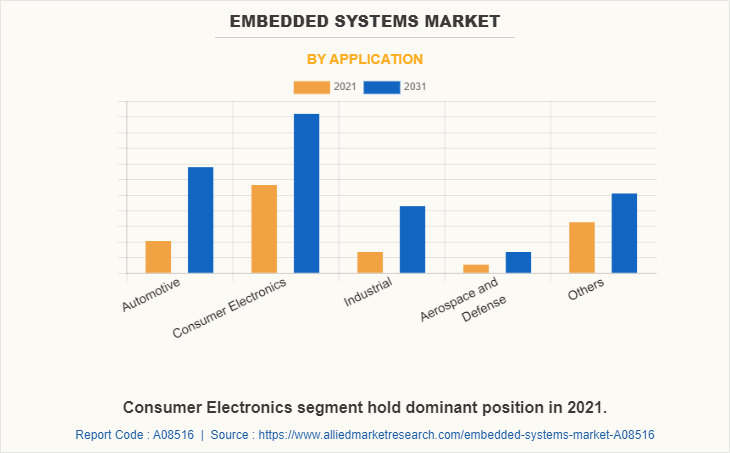

Based on application, the market is segregated into automotive, consumer electronics, industrial, aerospace and defense, and others. The consumer electronics segment acquired the largest share in 2021 and is expected to grow at a significant CAGR from 2022 to 2031 for the embedded systems market forecast.

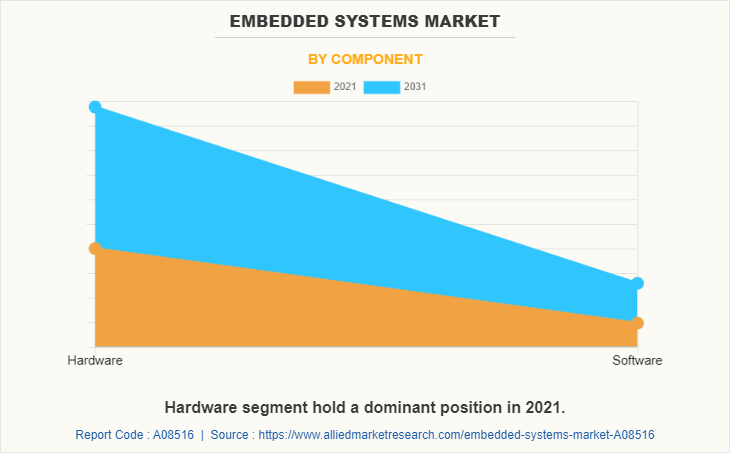

Based on components, the market is divided into hardware and software. In 2021, the hardware segment dominated the market, in terms of revenue, and is expected to follow the same trend during the forecast period.

Region-wise, the embedded systems market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). North America remains a significant participant in the embedded systems market. Major organizations and government institutions in the country are intensely putting resources into technology to grab embedded systems market opportunities during the forecast period.

Competitive analysis and profiles of the major global embedded systems market players that have been provided in the report include Analog Devices, Cypress Semiconductors, Infineon Technologies, Intel Corporation, Microchip Technology, NXP Semiconductors, Qualcomm Incorporated, Renesas Electronics, STMicroelectronics and Texas Instruments, Inc.

Key Market Dynamics

The embedded systems market is driven by increasing demand in industries such as automotive, healthcare, consumer electronics, and telecommunications. Further, the rise of IoT devices, advancements in AI and machine learning, and the development of smart cities and autonomous vehicles, all of which rely on embedded technologies have boosted the market.

However, challenges include high design complexity, security vulnerabilities, and power consumption constraints, which can slow adoption in some sectors.

Despite the challenges, there are opportunities in the growing applications of 5G networks, edge computing, and robotics, as well as the need for advanced medical devices and industrial automation. The demand for low-power, high-efficiency embedded solutions will continue to fuel innovation and market expansion.

Regional/Country Market Outlook

For the global embedded systems, the market share is expanding significantly with the North American region being particularly important. The North American region holds the highest market share due to the development of automotive goods, expanded usage of IoT applications, and strong investments in industrialization. Demand for aerospace, health-related equipment, and consumer electronics is high in the region along with a strong semiconductor industry that provides features and enhances the development of high-density, low-power embedded systems. In the Asia Pacific market, it is increasing primarily because of an increase in industrialization, increasing consumer electronics, and higher automotive production. IoT devices, improved 5G technology, and a robust semiconductor manufacturing industry, especially among key markets like China, Japan, and South Korea have pushed for large-scale use of embedded systems, and the need for a wider market application across different sectors is well realized.

Report Coverage & Deliverables

This report delivers in-depth insights into the embedded systems market covering applications, components, and key strategies employed by major players. It offers detailed market forecasts and emerging trends.

Application Type Insights

Automotive applications focus on ADAS, electric vehicles, and autonomous driving. Consumer electronics drive demand through smart devices, wearables, and home automation. Industrial applications prioritize automation, robotics, and IoT integration. Aerospace and defense rely on embedded systems for avionics and advanced security. Others include healthcare, with innovations in medical devices and monitoring systems.

Component Insights

Hardware includes microcontrollers, processors, FPGA, memories, etc., enabling system functionality. Software focuses on operating systems, firmware, and applications, ensuring efficient control, real-time operations, and system integration.

Regional Insights

North America leads the embedded systems market with advanced automotive and industrial sectors. The Asia Pacific sees rapid growth due to consumer electronics and manufacturing. Europe focuses on automotive innovation, while Latin America and MEA show emerging potential.

Key Strategies and Developments

- In March 2024, STMicroelectronics announced a significant advancement with their new 18nm Fully Depleted Silicon On Insulator (FD-SOI) technology, which includes embedded phase change memory (PCM). This technology is set to enhance the performance and power efficiency of next-generation microcontrollers.

- In May 2022, STMicroelectronics announced the integration of its ultra-low-power STM32U5 microcontrollers with Microsoft Azure RTOS & IoT Middleware, aiming to streamline the development of highly secure IoT devices.

- In September 2024, Intel launched the Xeon 6 processors with performance cores (P-cores) and Gaudi 3 AI accelerators. These advancements are designed to enhance AI and high-performance computing (HPC) workloads, offering significant improvements in performance and efficiency.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the embedded systems market size segments, current trends, estimations, and dynamics of the embedded systems market analysis from 2021 to 2031 to identify the prevailing embedded systems market opportunities.

- The embedded systems market outlook is offered along with information related to embedded systems market share key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the embedded systems market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global embedded systems market trends, key players, market segments, application areas, and market growth strategies.

Embedded Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 163.2 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 265 |

| By Application |

|

| By Component |

|

| By Region |

|

| Key Market Players | Intel Corporation, STMicroelectronics N.V., Microchip Technology Inc., Infineon Technologies, Renesas Electronics, Analog Devices Inc., Qualcomm Incorporated, Texas Instruments Inc., NXP Semiconductors, Cypress Semiconductors |

Analyst Review

Global embedded systems market is witnessing a significant growth owing to growing investments in R&D by prime original equipment manufacturers (OEM)s globally. Further, rise in government investment in 5G infrastructure which will boost the deployment of 5G embedded systems in applications such as consumer electronics, energy, healthcare, telecommunication, and others is significantly propelling the growth of the global embedded systems market. The market for embedded systems is expanding due to the rising global adoption of smart homes and smart industries.

Embedded systems are renovating the chip design process and changing the way the data centers are maintained. These chips enable the transfer of critical tasks from software onto hardware to save power, which is crucial for the power-sensitive applications. Embedded systems offer flexibility of hardware and security for custom hardwired circuits. Also, embedded systems enable the customization of system on chips (SoC)s postproduction at low cost and without the need to remanufacture the chips. Embedded systems provide essential enhancements in bandwidth, signal delays, latency, power, and cost over FPGAs. Furthermore, it also takes up a less silicon die area on organic laminate substrate.

Embedded systems are increasingly prospering into networking/data centers as well as wireless base stations, memories such as solid-state drive (SSD), Hard Drives (HDD) and other applications. For instance, in March 2021, Intel Corporation launched Solid State Drive (SSD) 670p, a 144-layer quad-level cell (QLC)-based client SSD which has its application in storage and gaming. The Intel SSD 670p is based on 144-Layer QLC 3D NAND with 128 gigabytes per die and provides up to two times better read performance, 38% better random read performance and up to 50% better latency over previous generation SSDs.

Prime market players such as Intel Corporation, Qualcomm Technologies, Texas Instrument, and others are adopting new techniques to provide customers with advanced and innovative offerings. Globally, various key players and government agencies have invested in embedded systems market that strengthens their share in the market.

Significant factors that impact the growth of the embedded systems market include increase in the demand for ADAS in EV and hybrid vehicles, and Increase in the number of embedded systems-related research and development projects.

Consumer Electronics is the leading application of Embedded Systems Market.

Asia-Pacific is the largest regional market for Embedded Systems.

The global embedded systems market was valued at $89,120.0 million in 2021, and is projected to reach $163,178.13 million by 2031, registering a CAGR of 6.5% from 2022 to 2031.

Analog Devices, Cypress semiconductors, Infineon Technologies AG, Intel Corporation, Microchip Technology, NXP Semiconductors, Qualcomm Incorporated, Renesas Electronics, STMicroelectronics and Texas Instruments, Inc are the top companies to hold the market share in Embedded Systems.

Loading Table Of Content...