EMV Smart Cards Market Research, 2031

The global emv smart cards market was valued at $5.8 billion in 2021, and is projected to reach $14 billion by 2031, growing at a CAGR of 9.7% from 2022 to 2031.

All transactions using credit, debit, and prepaid EMV smart cards adhere to the EMV standard, a security technology. The information required to complete a transaction is stored on a smart chip rather than a magstripe in EMV cards. For credit and debit card transactions, EMV smart chip specifies a number of security criteria. In addition, NFC mobile payments can be made using EMV. Furthermore, these smart EMV chip card are in use today through several key applications such as banking, telecom, healthcare, transportation, and entertainment.

The global EMV smart card market is anticipated to witness significant growth during the forecast period. Rapid digitalization and surge in cashless transactions drive the growth of the EMV smart card market. However, high set-up cost, along with data theft & security concern, is a major restraint to the global EMV smart card market. In addition, new mode of information security for users enabled by blockchain is expected to create opportunities for the smart card industry. Additionally, EMV smart cards can efficiently manage cryptographic keys, thereby enabling secure & efficient transactions in blockchain applications.

The report focuses on growth prospects, restraints, and trends of the EMV smart cards market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers; competitive intensity of competitors; threat of new entrants; threat of substitutes; and bargaining power of buyers on the EMV smart cards market outlook.

The emv smart cards market is segmented into Type, Brand and Application.

Segment Review

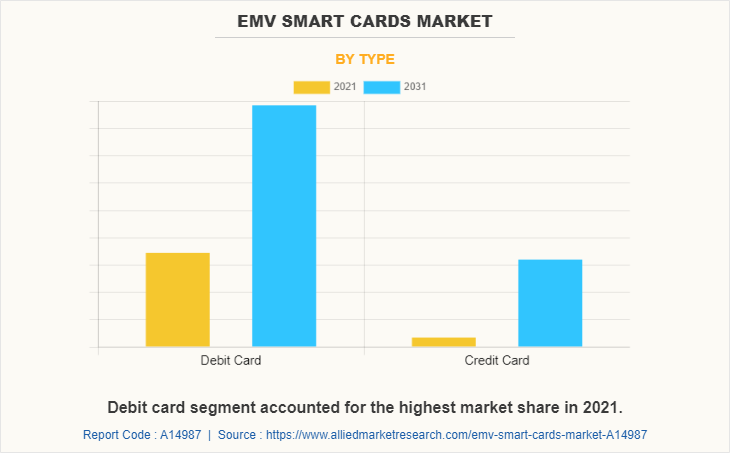

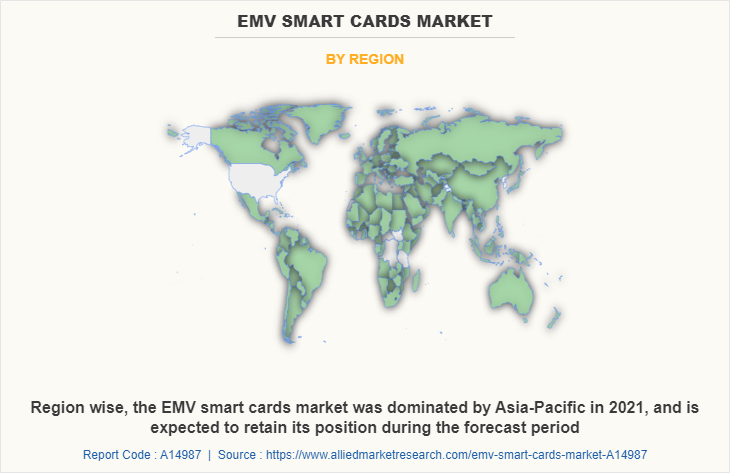

The EMV smart cards market is segmented into type, brand, application, and region. By type, the market is differentiated into debit card and credit card. The debit card segment is further segmented into contact, contactless, and dual. The contactless segment is further segregated into low-frequency cards, high-frequency cards, and ultra-high-frequency cards. The credit card segment is further segmented into general purpose credit cards and specialty & other credit cards. Depending on brand, it is fragmented into Visa, MasterCard, and others. The application segment is segmented into food & groceries, health & pharmacy, restaurants & bars, consumer electronics, media & entertainment, travel & tourism, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the debit card segment acquired the highest EMV smart cards market share in the market. This is attributed to the fact that EMV debit cards generate dynamic data every time a consumer makes a transaction, making it almost impossible for fraudsters to copy or clone the card. Moreover, customers can accumulate or use loyalty points at participating establishments owing to the ability of EMV cards to store information about loyalty programs.

Region-wise, Asia-Pacific dominated the EMV smart cards market size in 2021. This was attributed to the fact that increase in demand for EMV smart cards is attributed to the development of different industries such as hospitality, retail, and transportation.

The key players operating in the global EMV smart cards market analysis include American Express, CardLogix Corporation, CPI Card Group Inc., Equinox Payments, Giesecke + Devrient GmBH, HID Global Corporation, IDEMIA, Infineon Technologies AG, JPMorgan Chase & Co., NCR Corporation, Perfect Plastic Printing, Samsung, Thales, VeriFone, Versatile Card Technology Pvt. Ltd., Mastercard, and Visa Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the EMV smart cards industry.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a positive impact on the EMV smart cards industry owing to increase in usage and adoption of contactless payment methods among consumers globally. In addition, x2 smartcard payments are experiencing massive growth as consumers are getting familiar with the payment technology in the market. Moreover, banks and fintech industries are providing their customers with advanced card payment technologies across the globe to speed up their transaction processes and enhance digital payments in the market. As a result, this has become one of the major growth factors for the EMV smart card market during the global health crisis.

Top Impacting Factors

Surge in Demand for EMV Smart Card

Developing countries such as India and Hong Kong have a huge working population and increase in adoption of contactless payments systems among the working population is driving the growth of the EMV smart cards market. Additionally, many big companies, such as PayPal, Google Pay, and Amazon Pay, are competing globally for the lead position in money transfer market. In the last 10 years, all the banks have replaced the generally used debit and credit cards with microchips, which has led to wireless transfer. All the latest tech devices have chips embedded in them, which help to keep track of packages using the storage data. Thus, surge in demand for EMV smart cards is fueling the growth of the market.

Better Authenticity and Security Provided by EMV Cards

EMV cards include a transaction-unique digital signature or seal on the chip that ensures its authentication in an offline situation and prevents fraudsters from using fake payment cards. In addition, the use of chip cards has contributed significantly to avoiding fraud. Moreover, EMV cards can perform offline payment verification as well as offline cardholder verification since they feature microprocessors that can interface with terminals. Magstripe cards are incapable of accepting offline pin codes, whereas terminals can be programmed to accept them. Additionally, EMV cards have the ability to generate cryptograms and validate pin digits using data from their own microprocessor smart chips, which improves transaction security. Thus, better authenticity and security provided by EMV cards is boosting the growth of the market.

Increase in Adoption of EMV Smart Card in the Banking and Financial Sector

Rise in frequency & complexity of data security threats is one of the major driving factors for the growth of the EMV smart card market. With rise in frequency and complexity of data security threats, such as unencrypted data, new technology without security, third-party services, hacking, and unsecured mobile banking, there is increase in the need for implementation of a data security solution that is responsible for the assurance that the user’s data as well as assets are well protected. The smart card industry has undergone a digital transformation with the introduction of new payment methods such as EMV chips and personal identification number (PIN) cards. With surge in usage of these methods, there is a strong need to reduce fraudulent activities such as identity duplication; hence, a solution that will reduce security risks is required. The data available in EMV smart cards is difficult to decode and can only be accessed using a PIN code, which is extremely difficult to interpret and makes the transaction more secure and counterfeiting more difficult, thereby fostering the EMV smart cards market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the EMV smart cards market from 2021 to 2031 to identify the prevailing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the EMV smart cards market segmentation assists in determining the prevailing EMV smart cards market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global EMV smart cards market trends, key players, market segments, application areas, and market growth strategies.

EMV Smart Cards Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Brand |

|

| By Application |

|

| By Region |

|

| Key Market Players | Versatile Card Technology Pvt Ltd., CPI Card Group Inc., Perfect Plastic Printing, American Express, Equinox Payments, Mastercard, JPMorgan Chase & Co., IDEMIA, NCR Corporation, Infineon Technologies AG, CardLogix Corporation, HID Global Corporation, SAMSUNG, Thales, Visa Inc., VeriFone, Giesecke + Devrient GmBH |

Analyst Review

Europay, MasterCard, and Visa (EMV) smart card provides several benefits to users, including increased service effectiveness and assistance in collecting commuter travel information by governments and the transportation industry. In addition, it is widely used in transportation areas such as car parking, fueling, servicing, and washing. Furthermore, EMV smart cards use encryption to provide safety for in-memory information and are generally designed to be tamper-resistant. These cards with microcontroller chips can accomplish on-card processing functions and can manipulate data in the chip's memory.

The COVID-19 outbreak had a positive impact on the EMV smart cards market. Moreover, the pandemic led to a huge demand for EMV smart cards as they require minimal physical interaction. Moreover, banks in various countries increased the transaction limits for EMV smart card payments to promote the usage of these cards.

The EMV smart cards market is fragmented with the presence of regional vendors such as American Express, CardLogix Corporation, CPI Card Group Inc., Equinox Payments, Giesecke + Devrient GmbH, HID Global Corporation, IDEMIA, Infineon Technologies AG, JPMorgan Chase & Co., NCR Corporation, Perfect Plastic Printing, Samsung, Thales, VeriFone, Versatile Card Technology Pvt. Ltd., Mastercard, and Visa Inc. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnerships to reduce supply and demand gaps. With increase in awareness & demand for EMV smart cards across the globe, major players are collaborating on their product portfolio to provide differentiated and innovative products.

The EMV smart cards market is estimated to grow at a CAGR of 9.7% from 2022 to 2031.

The EMV smart cards market is projected to reach $14.03 billion by 2031.

Surge in demand for EMV smart card, better authenticity and security provided by EMV cards and growing adoption of EMV smart card in banking and financial sector majorly contribute toward the growth of the market.

The key players profiled in the report include American Express, CardLogix Corporation, CPI Card Group Inc., Equinox Payments, Giesecke + Devrient GmBH, HID Global Corporation, IDEMIA, Infineon Technologies AG, JPMorgan Chase & Co., NCR Corporation, Perfect Plastic Printing, Samsung, Thales, VeriFone, Versatile Card Technology Pvt. Ltd., Mastercard, and Visa Inc.

The key growth strategies of EMV smart cards market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...