Endoscope Disinfection Chemicals Market Research, 2033

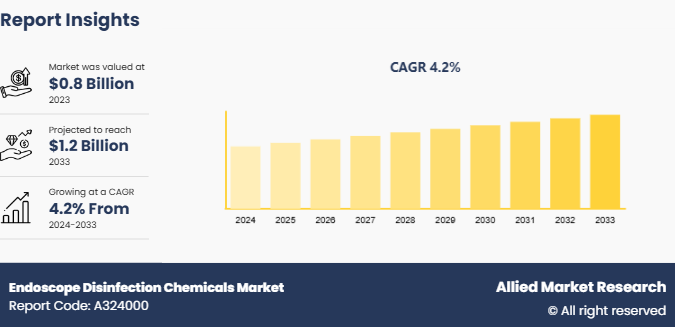

The global endoscope disinfection chemicals market size was valued at $0.8 billion in 2023, and is projected to reach $1.2 billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033. The endoscope disinfection chemicals market is driven by the increase in prevalence of endoscopic procedures for diagnostic and therapeutic purposes, rising awareness of infection control, and stringent regulations emphasizing disinfection protocols in healthcare facilities.

Market Introduction and Definition

Endoscope disinfection chemicals are specialized agents used to eliminate microorganisms from endoscopic instruments to prevent infections. These chemicals are essential in healthcare settings, as endoscopes often come into contact with mucous membranes and sterile areas of the body. Effective disinfection requires a thorough understanding of the chemical's efficacy against various pathogens, including bacteria, viruses, and fungi. Common types of endoscope disinfectants include glutaraldehyde, ortho-phthalaldehyde (OPA) , and hydrogen peroxide-based solutions, each with specific application protocols and contact times for optimal disinfection.

Key Takeaways

- The endoscope disinfection chemicals market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major endoscope disinfection chemicals industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The endoscope disinfection chemicals market growth is driven by increase in prevalence of gastrointestinal, respiratory, and other chronic diseases, leading to a rise in demand for endoscopic procedures, which in turn boosts the need for effective disinfection chemicals. In addition, there is a growing awareness about the risks of cross-contamination and hospital-acquired infections (HAIs) associated with improper cleaning of endoscopes. This awareness led to stringent regulatory guidelines imposed by health authorities such as the FDA, CDC, and WHO, mandating the use of high-level disinfectants and sterilization practices, which further propels the endoscope disinfection chemicals market growth.

In addition, rise in technological advancements in endoscopy, along with the increasing adoption of minimally invasive procedures also contributed to the demand for disinfection solutions, as these procedures require more frequent and meticulous cleaning. Furthermore, the expanding healthcare infrastructure in emerging markets, along with increasing healthcare expenditures, supports the growth during endoscope disinfection chemicals market forecast period. Moreover, the rising trend toward using eco-friendly and biodegradable disinfectants, driven by growing environmental concerns and regulatory pressures led manufacturers to innovate in the development of safer, non-toxic chemical formulations, creating new opportunities in the market.

However, the stringent regulatory requirements for the approval of new chemical disinfectants often lead to prolonged and costly certification processes, hindering the introduction of innovative solutions. On the other hand, the increasing focus on eco-friendly, biodegradable, and non-toxic disinfection chemicals driven by environmental sustainability concerns is an area ripe for innovation. Regulatory bodies are encouraging safer formulations, which presents endoscope disinfection chemicals market opportunity.

Number of Endoscopic Procedures in UK (2020)

In 2020, the endoscope disinfection chemical market in the UK experienced notable growth, driven by the increasing volume of endoscopic procedures, which totaled over 1.5 million. With the significant share of upper gastrointestinal (GI) procedures accounting for 38.6% and colonoscopy procedures at 32.1%, the demand for effective disinfection solutions became critical to ensure patient safety and prevent healthcare-associated infections. The rigorous standards for infection control in healthcare facilities necessitated the use of advanced chemical disinfectants, particularly for complex endoscopic instruments that require thorough cleaning between uses.

Moreover, the growing awareness of hygiene and the rise of minimally invasive procedures contributed to the demand for efficient disinfection practices. Various types of disinfectants, including high-level disinfectants and enzymatic cleaners, gained prominence due to their efficacy against a broad spectrum of pathogens. Regulatory bodies' stringent guidelines on the reprocessing of endoscopes further propelled the market, encouraging healthcare providers to invest in reliable disinfection solutions.

Endoscopic Procedures in UK 2020

Endoscopic procedures | 2020 |

Upper GI | 591514 |

Colonoscopy | 491593 |

Flexible sigmoidoscopy | 230266 |

Colonoscopy | 49274 |

Transnasal endoscopy | 8553 |

Capsule endoscopy | 9143 |

Enteroscopy | 3889 |

Source : BMJ Publishing Group Ltd & British Society of Gastroenterology

Market Segmentation

The endoscope disinfection chemicals market size is segmented into product type, end user, and region. On the basis of the type, the market is segmented into glutaraldehyde, peracetic acid, and others. By end user, the market divided into hospital and clinics, ambulatory surgical centers, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has significant endoscope disinfection chemicals market share owing to advanced healthcare infrastructure, the rise in prevalence of gastrointestinal disorders, and stringent infection control standards. In addition, increasing adoption of automated endoscope reprocessors (AERs) and high demand for effective disinfection chemicals? further supports the market growth. Europe holds a substantial share of the market, with Germany, France, and the UK being key contributors. The region benefits from rise in awareness of infection prevention practices and advanced medical technologies. Government regulations in the EU aimed at reducing hospital-acquired infections (HAIs) further bolster the demand for endoscope disinfection solutions?.

However, the Asia-Pacific region is anticipated to witness the fastest growth during the forecast period, driven by the rapid expansion of healthcare infrastructure in countries such as China, Japan, and India. Increasing investments in medical device manufacturing, rising incidences of chronic diseases, and a growing geriatric population contribute to the growing demand for endoscope disinfection chemicals.

Industry Trends

As per an article published by National Center for Biotechnology and Information (NCBI) in 2021, the FDA has recommended that healthcare facilities adopt supplemental measures to minimize infection risks, including culture surveillance of endoscopes and the use of sterilization methods like ethylene oxide (EtO) or liquid chemical sterilant. These recommendations led to many facilities to implement dual high-level disinfection (HLD) protocols or transition to sterilization techniques. Based on a recent survey of 249 endoscopy units, most centers had implemented at least one of the supplemental measures; the most common was repeat HLD (63%) followed by culture surveillance (53%) . This trend not only emphasize the importance of effective disinfection in maintaining patient safety but also fuels the demand for high-quality endoscope disinfection chemicals.

Competitive Landscape

The major players operating in the endoscope disinfection chemicals market are STERIS, Olympus, Getinge AB, Borer Chemie AG, Micro-Scientific, LLC., Medalkan, Cantel Medical Corp., Fortive Corporation, SteelcoBelimed AG, and 3M.

Recent Developments in Endoscope Disinfection Chemicals Industry

- In June 2021, STERIS plc announced that it had completed the previously announced acquisition of Cantel Medical, a global provider of infection prevention products and services to endoscopy, dental, dialysis and life sciences customers.

- In April 2019, Fortive Corporation announced that it had completed the acquisition of the Advanced Sterilization Products business from Ethicon, Inc., a subsidiary of Johnson & Johnson, for approximately $2.7 billion in cash. ASP is a leading global provider of innovative sterilization and disinfection solutions, and a pioneer of low-temperature hydrogen peroxide sterilization technology.

Key Sources Referred

- National Center for Biotechnology and Information (NCBI)

- Centers for Medicare & Medicaid Services (CMS)

- Government of Canada's Health and Wellness

- Ministry of Health and Family Welfare (MoHFW)

- National Health Mission (NHM)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- World Health Organization (WHO)

- European Medicines Agency (EMA)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the endoscope disinfection chemicals market analysis from 2024 to 2033 to identify the prevailing endoscope disinfection chemicals market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the endoscope disinfection chemicals market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global endoscope disinfection chemicals market trends, key players, market segments, application areas, and market growth strategies.

Endoscope Disinfection Chemicals Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.2 Billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 239 |

| By Product Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | STERIS, Borer Chemie AG, Medalkan, Getinge AB, Fortive Corporation, SteelcoBelimed AG, Micro-Scientific, LLC. , Olympus Corporation, Ecolab , Cantel Medical Corp. |

The total market value of endoscope disinfection chemicals market was $0.8 billion in 2023.

The market value of endoscope disinfection chemicals market is projected to reach $1.2 billion by 2033.

The base year is 2023 in endoscope disinfection chemicals market.

The forecast period for endoscope disinfection chemicals market is 2024 to 2033.

Endoscope disinfection chemicals are specialized cleaning and disinfecting solutions used to decontaminate endoscopes and other medical devices to prevent infections during diagnostic or surgical procedures.

Loading Table Of Content...