Endoscopy Devices Market Research, 2032

The global endoscopy devices market size was valued at $28.1 billion in 2022 and is projected to reach $44.1 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032. Endoscopy is a minimally invasive medical procedure that diagnoses, prevents, and treats complications associated with visceral organs. Endoscopes are used in this procedure to examine interior hollow organs or cavities in the body. These devices are either placed in the body through natural openings or cavities such as the anus and mouth or through incisions, especially in the case of arthroscopy. Endoscopy devices are equipped with several other parts such as a camera or light source at the tip of endoscopes that help physicians or medical professionals, such as endoscopists, to analyze internal organs of interest. Endoscopy may be used to investigate symptoms in the digestive system, including nausea, vomiting, abdominal pain, difficulty swallowing, and gastrointestinal bleeding.

Market Dynamics

The global endoscopy devices market size is anticipated to experience significant growth during the forecast period, owing to technological advancements in endoscopes that can be used for the early detection of diseases and the rise in the prevalence rate of diseases that require endoscopy devices. In addition, favorable FDA approvals & reimbursement policies pertaining to endoscopy devices further drive the market growth.

Furthermore, the growing global population, coupled with improved access to healthcare services and an increase in the number of surgical interventions are further driving the growth of the endoscopy market size. In addition, the rise in the adoption of minimally invasive surgeries propels the use of various endoscopes in surgical procedures, such as arthroscopy, laparoscopy, bronchoscopy, and cystoscopy. These procedures result in quicker recovery and lesser trauma to patients as compared to open surgeries. Therefore, minimally invasive surgical procedures are preferred over open/invasive surgeries and are expected to increase the demand for minimally invasive endoscopic devices over the coming years which further drives the growth of the endoscopy market size.

The shift toward minimally invasive surgeries is also attributed to higher patient satisfaction, economic viability, relatively shorter hospital stay, and reduced post-surgical complications. Thus, the rise in demand for minimally invasive endoscopic surgeries is expected to increase the demand during the endoscopy devices market forecast.

However, the endoscopy equipment market faces several challenges that may hinder its growth, including a shortage of trained physicians and endoscopists, potential side effects associated with endoscopy procedures, and the high costs of endoscopy devices.

The COVID-19 pandemic led to a strain on healthcare systems globally. Hospitals and healthcare facilities were overwhelmed with COVID-19 patients, leading to a diversion of resources and attention away from non-COVID-related conditions. This disruption in healthcare services resulted in delayed diagnoses and treatments for various infections, thus decreasing the demand for the endoscope and decreasing the endoscopy market.

In addition, the UK’s National Endoscopy Database (NED) revealed a substantial decline in procedures during the pandemic as compared to the pre-COVID period. At its lowest point in March 2020, only 5% of the pre-COVID activity was being conducted. This decline was evident globally, with guidelines from the American Gastroenterological Association recommending the triaging and rescheduling of GI procedures during the pandemic.

However, as healthcare systems adapted and the situation improved, there was a gradual recovery in the demand for endoscopic procedures. Postponed procedures were rescheduled, leading to a rebound in the market. Furthermore, the post-COVID-19 period presented opportunities for innovation in endoscopy devices, such as advancements in robotics, artificial intelligence, and remote-controlled technologies. These innovations aim to enhance patient outcomes, improve procedural efficiency, and address concerns related to infection control.

Global Endoscopy Devices Market Segmental Overview

The endoscopy devices industry is segmented on the basis of product, hygiene, application, end user, and region. On the basis of product, the market is categorized into endoscopes, mechanical endoscopic equipment, visualization and documentation systems, accessories, and other endoscopy equipment. The endoscope segment is further classified into rigid endoscope, flexible endoscope, capsule endoscope, and robot-assisted endoscope. The rigid endoscope segment is further divided into laparoscopes, urology endoscopes, gynecology endoscopes, arthroscopes, cystoscopes, neuroendoscope, and other rigid endoscopes. The flexible endoscope segment is further divided into GI endoscope, ENT endoscope, bronchoscope, and others. The GI endoscope is further segmented into a gastroscope, colonoscope, sigmoidoscope, duodenoscope, and others. The ENT endoscope is further segmented into nasopharyngoscope, otoscope, rhinoscope, laryngoscope, and others.

The mechanical endoscopic equipment is further segmented by devices and by therapeutics. The mechanical endoscopic equipment, by devices, is further divided into endoscopic implants, trocars, graspers, snares, biopsy forceps, and others. The mechanical endoscopic equipment, by therapeutics, is further classified into biopsy (FNA and FNB), polypectomy (ESD and EMR), biliary stone management & drainage, hemostasis & suturing, esophageal & colon stricture management, gastroesophageal reflux disease (GERD) and obesity, and others. The visualization & documentation systems segment is further categorized into light sources, camera heads, wireless display & monitors, endoscopy cameras, carts, digital documentation systems, video processors & video convertors, transmitters & receivers, and others.

The accessories segment is further divided into biopsy valves, overtubes, mouthpieces, surgical dissectors, needle holders & needle forceps, cleaning brushes, light cables, and other accessories. The other endoscopy equipment is further fragmented into insufflators, endoscopy fluid management systems, and other electronic endoscopy equipment.

On the basis of hygiene, the market is segmented into single-use, reprocessing, and sterilization. On the basis of application, it is classified into bronchoscopy, arthroscopy, laparoscopy, urology endoscopy, neuroendoscopy, gastrointestinal endoscopy, gynecology endoscopy, ENT endoscopy, and others. By end user, it is segmented into hospitals, ambulatory surgery centers & clinics, and others. By region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

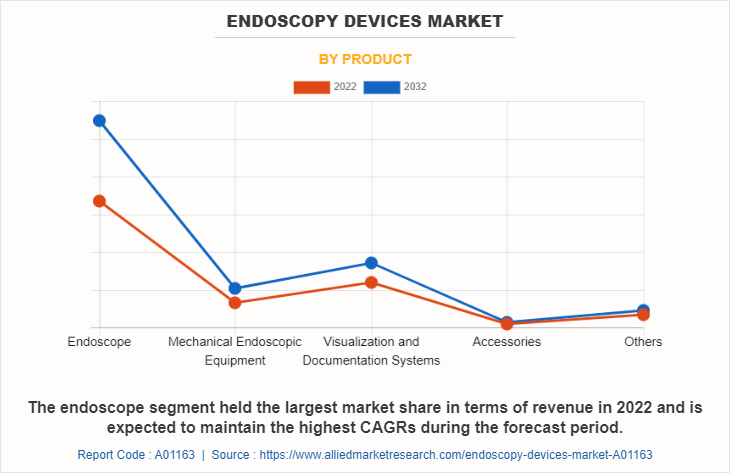

By Product

The endoscopy devices market is segmented into endoscope, visualization & documentation systems, mechanical endoscopy equipment, accessories, and others. The endoscope segment held the largest endoscopy devices market share in terms of revenue in 2022 and is expected to maintain the highest CAGRs during the forecast period. This is attributed to the increasing prevalence of chronic diseases, the growing elderly population, and the significant rise in the adoption of technologically advanced medical devices.

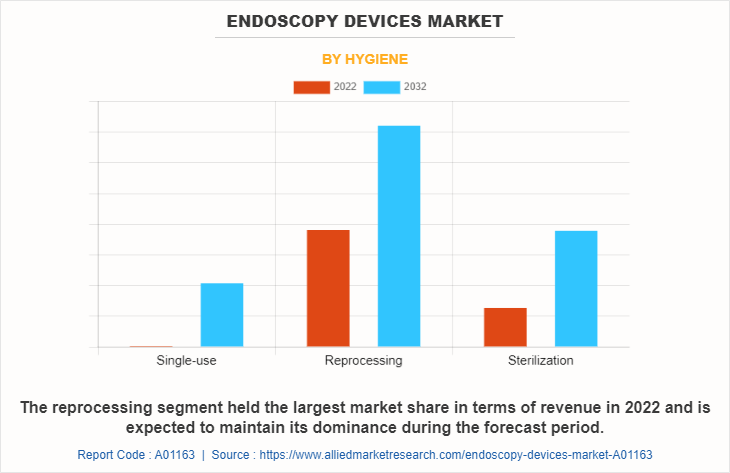

By Hygiene

The endoscopy devices market is divided into single-use, reprocessing, and sterilization. The reprocessing segment held the largest endoscopy devices market share in terms of revenue in 2022 and is expected to maintain its dominance during the forecast period, owing to the growing recognition of infection control and prevention measures, as well as an increase in demand for sustainable healthcare practices. Reprocessing allows for the reuse of endoscopy devices, making it an attractive option for healthcare facilities seeking cost-effective and eco-friendly solutions.

However, the single-use segment is projected to exhibit the highest CAGR in the endoscopy devices market during the forecast period, owing to increasing emphasis on infection control and the convenience of disposable devices, eliminating the need for reprocessing and reducing the risk of cross-contamination.

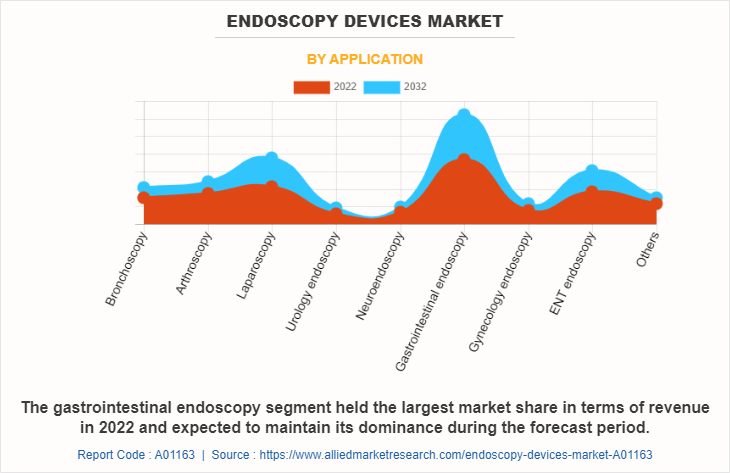

By Application

The endoscopy devices market is classified into bronchoscopy, arthroscopy, laparoscopy, urology endoscopy, neuroendoscopy, gastrointestinal endoscopy, gynecology endoscopy, ENT endoscopy, and others. The gastrointestinal endoscopy segment held the largest market share in terms of revenue in 2022 and is expected to maintain its dominance during the forecast period, owing to the high prevalence of gastrointestinal disorders, advancements in endoscopic technologies, and increasing awareness of the benefits of early detection and treatment for gastrointestinal diseases.

However, the laparoscopy segment is projected to exhibit the highest CAGR in the endoscopy devices market during the forecast period. The growth of this segment can be attributed to an increase in the routine use of laparoscopy devices in both, diagnostic and therapeutic procedures for various diseases, such as prostatectomy, pancreatic cancer, and gastrointestinal disorders. Moreover, the rise in the number of global cases of morbid obesity has significantly contributed to the segment's growth, as laparoscopic techniques are frequently employed in bariatric surgeries aimed at weight reduction.

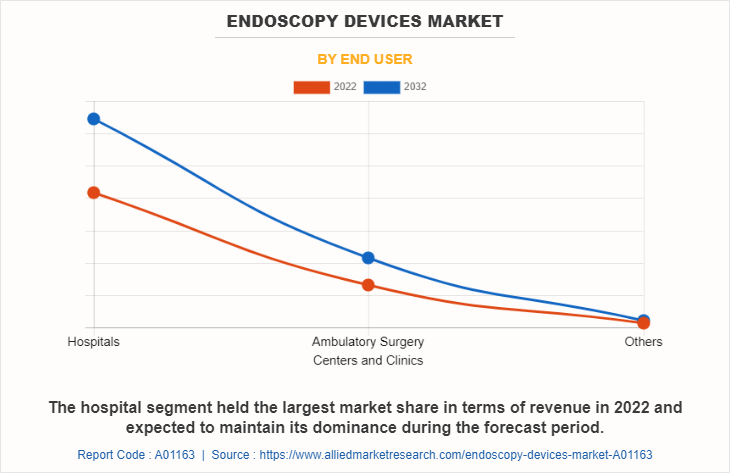

By End User

The endoscopy devices market is classified into hospitals, ambulatory surgery centers & clinics, and others. The hospital segment held the largest market share in terms of revenue in 2022 and is expected to maintain its dominance during the forecast period, owing to the availability of a wide range of endoscopy services and favorable reimbursement policies, making hospitals the preferred choice for many patients. Moreover, hospitals in developed economies are well-equipped with state-of-the-art endoscopic facilities, further contributing to their market dominance.

However, the ambulatory surgery centers & clinics segment is projected to exhibit the highest CAGR in the endoscopy devices market during the forecast period. This growth can be attributed to several factors, including the increasing preference for outpatient procedures among patients, the expansion of ambulatory surgery centers and clinics, and the continuous advancements in portable endoscopy devices. These factors make ambulatory settings more appealing and convenient for patients, driving the demand for endoscopy devices in this segment.

By Region

The endoscopy devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America held the highest market share in terms of revenue in 2022 and is expected to maintain its dominance during the forecast period. The region's leading position can be attributed to various factors, including a rise in chronic diseases that require endoscopic procedures. In addition, the presence of key market players and their innovative offerings further strengthens North America's market position, as these companies actively invest in R&D to provide effective and cutting-edge endoscopy devices.

However, the Asia-Pacific region is projected to exhibit the highest CAGR in the endoscopy market during the forecast period. This significant growth can be attributed to several factors, including an increase in the adoption of advanced technologies and a growing geriatric population. Moreover, the region's high prevalence of chronic diseases also drives the demand for endoscopy devices for improved diagnosis and treatment.

Moreover, the rise in research activities as well as the well-established presence of domestic companies in the region are expected to provide notable opportunities for market growth. In addition, the rise in contract manufacturing organizations within the region is further anticipated to drive endoscopy devices market growth.

Competition Analysis

Competitive analysis and profiles of the major players in the endoscopy equipment market such as Major players that operate in the market include HOYA Corporation, Olympus Corporation, Stryker Corporation, Boston Scientific Corporation, Fujifilm Holdings Corporation, CONMED Corporation, Medtronic Plc, Karl Storz GmbH & Co. KG, Richard Wolf GmbH, Smith & Nephew, Plc, Johnson & Johnson, and Intuitive Surgical, Inc.‐¯ Key players have adopted strategies such as product launch, agreement, product approval, and expansion to enhance their product portfolio.

Recent Agreements in Endoscopy Devices Market

- In June 2020, HOYA Corporation and Hitachi, Ltd., announced a five-year contract regarding Endoscopic Ultrasound Systems [EUS], by which it will strengthen technical collaboration, and Hitachi will continue supplying diagnostic ultrasound systems and ultrasound sensor-related parts used in EUS.

- In November 2022, Boston Scientific Corporation entered into a definitive agreement to acquire Apollo Endosurgery, Inc. for a cash price of $10 per share, reflecting an enterprise value of approximately $615 million.

Recent Product Approval in Endoscopy Devices Market

- In March 2023, PENTAX Medical, a division of HOYA Group, received CE marks for two of its latest innovations; PENTAX Medical INSPIRA, the new premium video processor, and the i20c video endoscope series. Developed with a focus on healthcare provider’s needs, the new video processor maintains compatibility with PENTAX Medical’s recent endoscope models and sets new standards in combination with the new i20c video endoscope generation.

- In May 2022, Auris Health, Inc., a subsidiary of Ethicon, Inc., a Johnson & Johnson MedTech company, announced that its MONARCH Platform received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for endourological procedures. This clearance makes MONARCH the first and only multispecialty, flexible robotic solution for use in both, bronchoscopy and urology. It is designed to enable urologists to reach and visualize areas within the kidney with precision and control.

Recent Product Launch in Endoscopy Devices Market

- In June 2023, PENTAX Medical, a division of the HOYA Group, launched its new brushless solution for automated pre-cleaning of endoscopes: the Aqua TYPHOON. The device offers an alternative to the manual pre-cleaning step in endoscope reprocessing, without the need for brushes or detergent. With this launch, PENTAX Medical takes the lead in standardizing the manual pre-cleaning phase for reusable endoscopes, promoting sustainability and infection prevention in the endoscopy suite.

- In September 2021, FUJIFILM Holdings Corporation launched a new software version of “CAD EYE”, a function that supports real-time detection of colonic polyps during colonoscopy utilizing AI technology. This updated function will be essential for colon polyp detection and characterization, which will be achieved by utilizing a type of Artificial Intelligence (AI) called deep learning.

Recent Product Expansion in Endoscopy Devices Market

- In February 2023, FUJIFILM Holdings Corporation announced the expansion of its endoscopy solutions portfolio with the new compact ultrasonic probe system PB2020-M2 at the 3rd Annual Conference on Interventional Pulmonology, “BRONCHUS 2023”.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the endoscopy devices market analysis from 2022 to 2032 to identify the prevailing endoscopy devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the endoscopy devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global endoscopy devices industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global endoscopy devices market trends, key players, market segments, application areas, and market growth strategies.

Endoscopy Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 44.1 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 508 |

| By Hygiene |

|

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Boston Scientific Corporation, Smith and Nephew plc., Stryker Corporation., Intuitive Surgical, Inc., KARL STORZ GmbH & Co. KG, Olympus Corporation, Richard Wolf GmbH, FUJIFILM Holdings Corporation, CONMED Corporation., Johnson & Johnson, HOYA Corporation, Medtronic plc |

Analyst Review

The growing prevalence of diseases that involve endoscopic procedures globally remains a key driver. Thus, the demand for efficient devices continues to rise, providing opportunities for market expansion.

The expanding global population, particularly the aging demographics, contributes to the rise in demand for minimally invasive surgical procedures and thereby, for endoscopic devices. Moreover, growing initiatives by pharma companies to advance endoscopic devices and rise in R&D significantly boost the growth of the endoscopy devices market. However, lack of trained physicians & endoscopists and infections caused by few endoscopes are expected to hinder market growth. On the contrary, improved healthcare infrastructure, especially in developing regions, enhances access to diagnosis and treatment, thus contributing to the growing demand for antibiotics.

Furthermore, in the North America region, several factors contribute to the growth of the endoscopy devices market, such as well-established healthcare infrastructure, surge in adoption of advanced technologies, and increase in geriatric population. Furthermore, Asia-Pacific is anticipated to witness notable growth during the forecast period, owing to rise in chronic diseases, improvement in awareness for early diagnosis and treatment, and rise in adoption of advanced devices by healthcare professionals.

The total market value of endoscopy devices market is $28.0 billion in 2022.

The forecast period for endoscopy devices market is 2023 to 2032

The market value of endoscopy devices market in 2032 is $44.0 billion

The base year is 2022 in endoscopy devices market.

Top companies such as Olympus Corporation, Stryker Corporation, Boston Scientific Corporation, Fujifilm Holdings Corporation held a high market position in 2022. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The endoscope segment is the most influencing segment in endoscopy devices market owing to increasing prevalence of chronic diseases, growing elderly population, and significant rise in the adoption of technologically advanced medical devices.

The major factor that fuels the growth of the endoscopy devices market are technological advancements in endoscopic devices, rise in prevalence rate of diseases that require endoscopy devices and rise in adoption of minimally invasive procedures drive the growth of the global endoscopy devices market.

Endoscopy devices are medical instruments and equipment used in endoscopic procedures. They are minimally invasive techniques for visualizing and accessing internal organs and body cavities.

Loading Table Of Content...

Loading Research Methodology...