Energy Efficient Motor Market Research, 2032

The global energy efficient motor market was valued at $48.5 billion in 2022, and is projected to reach $119.1 billion by 2032, growing at a CAGR of 9.5% from 2023 to 2032. Energy-efficient motor consumes less electricity, operates cooler, and lasts longer than standard motor. This motor has additional copper windings and is 2-6% more efficient than the ordinary motor. The motor generates less noise and vibration and operates at a low temperature, extending the motor's life, and lowering maintenance costs. It is appropriate for a wide range of industrial applications, including paper, cement, textiles, machine tools, and blowers.

Energy efficient motors have enhanced manufacturing procedures and superior materials, longer bearing lifetimes, greater service factors, reduced waste heat output, and less vibration, all of which improve dependability of motors .

The rising need to reduce greenhouse gas emissions is boosting demand for energy-efficient solutions, which is expected to drive the expansion of the energy efficient motor market. Companies are choosing for eco-friendly solutions for their technology and operations as energy conservation becomes more popular. Switching to energy-efficient solutions is one of the most critical factors in reducing greenhouse gas emissions from fossil-fuel-generated power. These are the major causes driving industrial end users to transition from standard to energy-efficient motors. This would allow countries to maintain natural energy supplies while reducing greenhouse gas emissions and hazardous pollution dramatically. Furthermore, the increased emphasis on the adoption of green technology is having a significant influence on global demand for energy efficient motors. The advantages that energy efficient motors have over ordinary motors, such as high-quality lamination, insulation, and minimal fan losses, are influencing customer choices. Apart from that, the implementation of environmental rules and regulations, such as the Environment Protection Act (EP Act), and the conservation of non-renewable energy, such as the Minimum Energy Performance Standards (MEPS), is significantly boosting global demand for these motors.

A major challenge in the energy-efficient motor industry is the lack of awareness and information among end-users, particularly in smaller companies and residential settings. Many potential customers either have been uninformed regarding the significant benefits offered by energy-efficient motors or are uninformed about their widespread availability. This lack of understanding and awareness is a fundamental impediment to market expansion and the widespread adoption of energy-efficient motor technology. Moreover, it hampers the ability of consumers to make informed decisions when selecting motors for various applications. This, in turn, may lead to the continued use of less efficient motor systems, perpetuating unnecessary energy consumption and higher operational costs. All these factors are predicted to restrict the market growth during the forecast period.

Many existing motor systems are outdated and consume an excessive amount of energy. The retrofitting and replacement market is expected to create substantial opportunity for energy efficient motor manufacturers to deliver cost-effective solutions that help update current systems to increase energy efficiency. In addition, collaborations and agreements are driving market evolution. This presents an opportunity for the energy efficient motor market to grow and innovate. For instance, in March 2023, Rockwell Automation announced a significant agreement with Energy Drive, focused on sustainable initiatives to accelerate the adoption of energy-efficient technologies. Similarly, Nidec Leroy-Somer's June 2023 agreement with Airbus indicates to create electric motor for hydrogen-powered fuel cell engine prototypes, therefore contributing to zero-emission aviation. All these are among the major factors projected to offer growth opportunities for market players during the forecast period.

The key players profiled in this report include ABB Ltd, Crompton Greaves, General Electric, Honeywell International, Inc., Kirlosakar Electric Company, Ltd, Microchip Technology, Inc., Magneteck, Inc., Johnson Controls Inc., Simens AG, and Weg S.A. Investment and agreement are common strategies followed by major market players. For instance, in June 2023, FLEXWAVE, a precision-control reducer and a motor, were introduced by Nidec Drive Technology Corporation. The FLEXWAVE has higher energy density and reduced backlash on its reducers, which allows the actuators to dampen the shock created during startup.

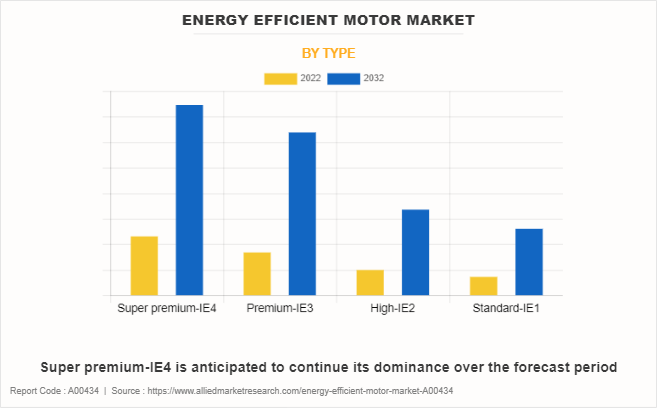

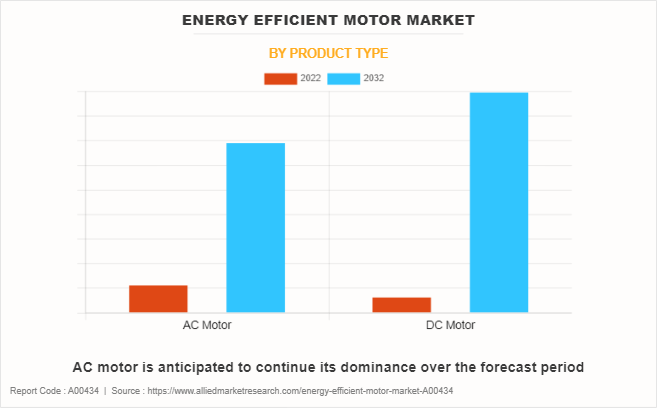

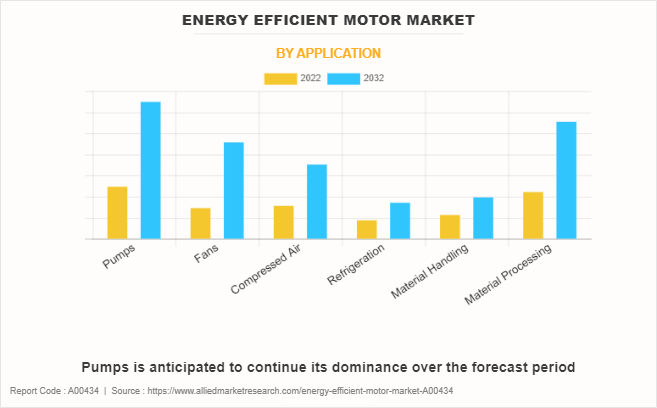

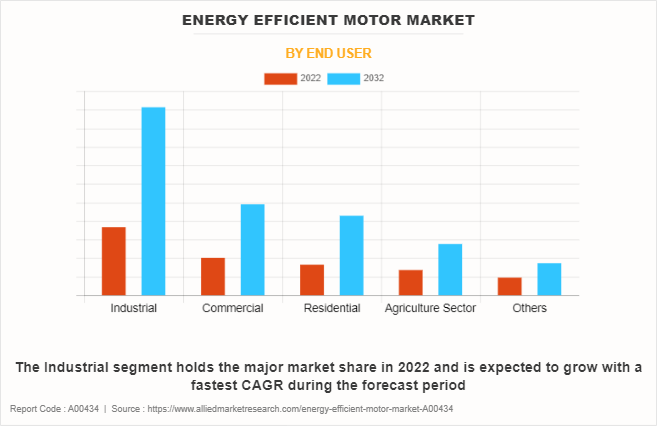

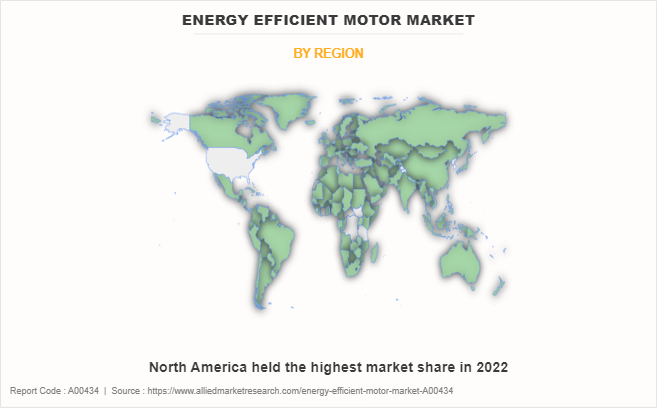

The energy efficient motor market is segmented on the basis of type, product type, application, end user, and region. By type, it is classified into super premium-IE4, premium-IE3, high-IE2, and standard-IE1. By product type, it is classified into AC motor and DC motor. By application, it is classified into pumps, fans, compressed air, refrigeration, material handling, and material processing. By end user, it is classified into industrial, commercial, residential, agriculture sector, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By product type, the AC motor sub-segment dominated the global energy efficient motor market share in 2022. The AC motor segment in the energy-efficient motor market is being primarily driven by increasing awareness regarding energy conservation and sustainability. Regulations promoting energy-efficient appliances have spurred demand for these motors. They offer superior performance, reduced energy consumption, and lower operational costs, making them an attractive choice across various industries, including manufacturing, HVAC, and automotive. In addition, advancements in motor design and control technologies have further enhanced their efficiency, making them a preferred choice for companies aiming to reduce their carbon footprint and achieve long-term cost savings. These factors are driving the growth of the AC motor segment in the energy-efficient motor market.

By application, the pumps sub-segment dominated the global energy efficient motor market share in 2022. The increased emphasis on sustainability and energy conservation has forced industries to use more efficient motor systems in order to reduce power consumption in pump applications. Furthermore, severe law enforcement and environmental standards are promoting the use of energy-efficient motors to reduce carbon emissions. Motor technology advancements, including variable frequency drives (VFDs) and permanent magnet motors, are making energy-efficient pumps more accessible and cost-effective. All these factors are projected to drive the energy efficient motor market growth during the forecast period.

By end user, the industrial sub-segment dominated the global energy efficient motor market share in 2022. Rising awareness regarding the environment and demanding energy-consumption rules have driven enterprises to use energy-efficient motors in order to decrease carbon footprints and operational expenses. Motor technology developments, such as variable frequency drives and smart motor systems, improve efficiency and provide precise control, which makes them desirable to sectors seeking increased production. Furthermore, economic benefits such as reduced utility bills and longer motor lifespan make energy-efficient motors an appealing investment. All these factors are projected to drive the energy efficient motor market forecast period.

By region, North America dominated the global energy efficient motor market in 2022. The usage of energy-efficient motors in the region is rapidly growing due to increased investment in the primary verticals such as industrial, commercial, and transportation. North American countries have been concentrating on energy efficiency through programs, collaborations, and initiatives. For example, the Industrial Efficiency and Decarbonization Office (IEDO) works to increase the energy and material efficiency, productivity, and competitiveness of companies across the industrial sector. For instance, in August 2022, ABB announced the acquisition of Siemens' low voltage NEMA motor division. This purchase includes a well-regarded product range, a long-standing North American client base, and an experienced operations, sales, and management team, with manufacturing facilities in Guadalajara, Mexico.

Impact of COVID-19 on the Global Energy Efficient Motor Industry

- The COVID-19 pandemic has had a significant impact on the energy efficient motor market. With lockdowns and social distancing measures necessitating remote work, the significance of these motor increased. Industries recognized the necessity to reduce energy consumption. Demand for energy-efficient motor increased as businesses sought ways to enhance sustainability while curbing costs.

- The pandemic disrupted global supply chains, affecting the availability of various components. This prompted industries to look for reliable and energy-efficient motor solutions that could help mitigate production interruptions and ensure a stable supply of goods and services.

- The pandemic increased awareness regarding the need for sustainability. Many governments and businesses recognized the importance of reducing carbon emissions and energy consumption. Energy-efficient motor played a pivotal role in achieving these sustainability goals, making them a preferred choice in various industries.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the energy efficient motor market analysis from 2022 to 2032 to identify the prevailing energy efficient motor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the energy efficient motor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global energy efficient motor market trends, key players, market segments, application areas, and market growth strategies.

Energy Efficient Motor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 119.1 billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Type |

|

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Schneider Electric SE, Microchip Technology, Inc., Bosch Rexroth, ABB Ltd., Johnson Controls Inc., Marathon Electric, Crompton Greaves, General Electric, AG Regal, Honeywell International, Inc. |

Growing awareness regarding sustainability and corporate social responsibility encourages companies to opt for energy-efficient technologies, which is one of the major growth factors of the energy efficient motor market. Increasing industrial automation creates demand for energy-efficient motor in manufacturing and processing industries, which is estimated to generate excellent opportunities in the energy efficient motor market.

The major growth strategies adopted by energy efficient motor market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global energy efficient motor market in the future.

ABB Ltd, Crompton Greaves, General Electric, Honeywell International, Inc., Kirlosakar Electric Company, Ltd, Microchip Technology, Inc., Magneteck, Inc., Johnson Controls Inc., Simens AG, and Weg S.A. are the major players in the energy efficient motor market.

The super premium-IE4 sub-segment of the type acquired the maximum share of the global energy efficient motor market in 2022.

Renewable energy and agriculture industries are the major customers in the global energy efficient motor market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global energy efficient motor market from 2022 to 2032 to determine the prevailing opportunities.

The adoption of energy-efficient motors is expected to surge across applications like industrial automation, HVAC systems, electric vehicles, and renewable energy. These sectors prioritize energy conservation and cost-efficiency, driving the demand for eco-friendly and high-performance motor solutions, which is estimated to drive the adoption of energy efficient motor.

The integration of Internet of Things (IoT) technology for remote monitoring and predictive maintenance will enhance motor efficiency and reliability, which is anticipated to boost the energy efficient motor market in the upcoming years.

Loading Table Of Content...

Loading Research Methodology...