The global energy logistics market was valued at $351.2 billion in 2021, and is projected to reach $1,383.7 billion by 2031, growing at a CAGR of 14.7% from 2022 to 2031.

Logistics is widely known as the process of coordinating and moving resources, such as equipment, food, liquids, inventory, materials, and people, from one location to the storage of the desired destination. It is the management of the flow of goods from one point of origin to the point of consumption, to meet the requirement of customers. Energy logistics includes transportation and distribution of energy products within the energy industry by efficiently utilizing labor, infrastructure, and equipment. Products, such as freight shipping, parcel, and document shipping, come under the services provided in the energy logistics market. The energy logistics services make an important contribution to the market integration of renewables and, at the same time, improve customer profits.

Currently, increasing Internet of things (IoT) penetration in the energy logistics sector enables freight companies to directly access the company network via the internet. In addition, some energy logistics companies worldwide are increasing their spending and using technologically advanced systems for logistics enhancement, which are further expected to propel the growth of the energy logistics market. For instance, in December 2021, Rhenus Group collaborated with Geek+, a global leader in the autonomous mobile robot segment, to develop advanced logistics solutions across its warehouses in Asia, improving the warehouse's order fulfillment performance.

The factors such as rise in trade-related agreements, rise of tech-driven energy logistics services and the growing adoption of IoT-enabled connected devices, and increasing wind energy production capabilities supplement the growth of the energy logistics market. However, poor infrastructure & higher logistics costs and lack of control of manufacturers on logistics service are the factors expected to hamper the growth of the energy logistics market. In addition, emergence of last-mile deliveries coupled with logistics automation and improvement in efficiency and workforce safety creates market opportunities for the key players operating in the market.

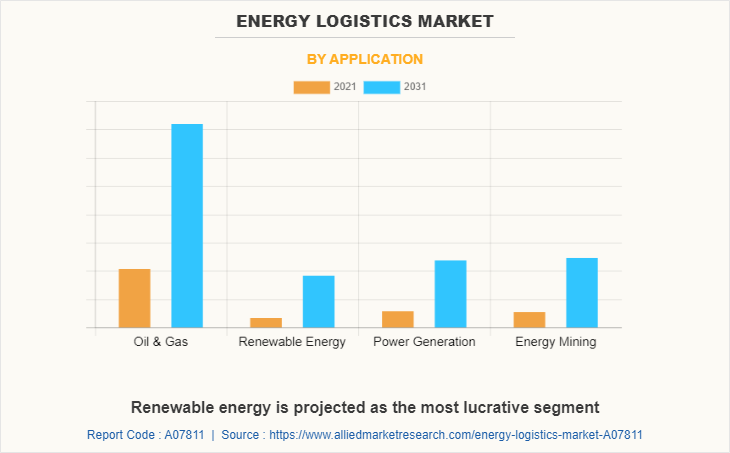

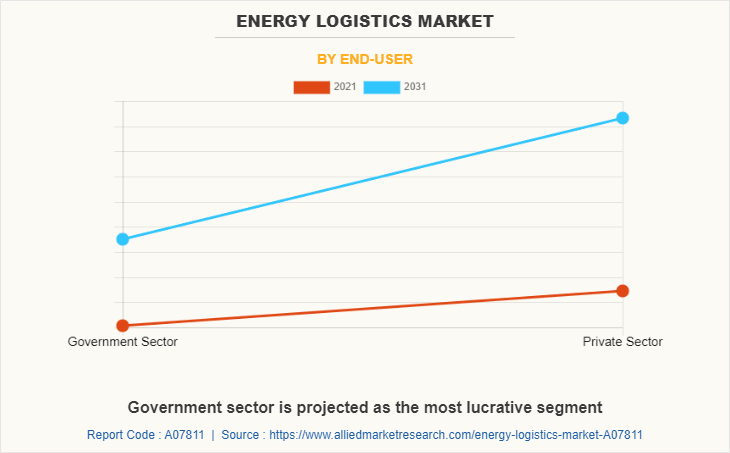

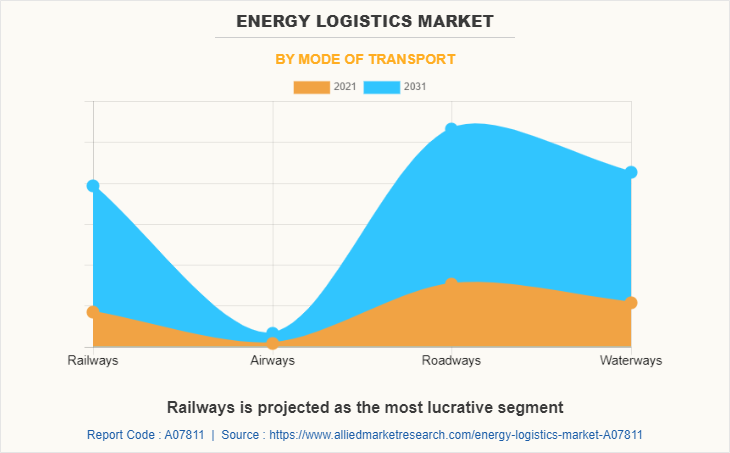

The energy logistics market is segmented into application, end-user, mode of transport, and region. By application, the market is divided into oil & gas, renewable energy, power generation, and energy mining. By end-user, it is fragmented into government sector and private sector. By mode of transport, it is categorized into railways, airways, roadways, and waterways. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the energy logistics market are A.P. Moller - Maersk, Apollo Power Ltd., Beijing Automobile Co., Ltd., BYD Motors Inc., C.H. Robinson Worldwide Inc., DB Schenker, Deutsche Post AG, Dongfeng Motor Company, DSV, Geodis, Hellmann Worldwide Logistics, Kuehne+Nagel International AG, Logistics Plus Inc., MGF, Phoenix Freight Systems, Rhenus Group, and Yusen Logistics Co., Ltd.

Rise in trade-related agreements

Dynamic market conditions and improvement in the global economy are the key factors driving globalization. Attributed to the rise in globalization, various trade-related activities are witnessing an increase. Therefore, it is becoming difficult for manufacturers or retailers to keep track of these activities efficiently. Energy logistics services are vital for price-sensitive customers who require a wider choice of high-quality products with timely delivery. This factor is expected to drive the energy logistics market for key players.

Moreover, development of the overseas market is a significant factor that fuels the market's growth. For instance, in 2019, Nepal and China signed the Protocol on Implementing Agreement on Transit and Transport along with 6 other agreements to enable Nepal to access Chinese sea and land ports. China has agreed to let Nepal use Tianjin, Shenzhen, Lianyungang, and Zhanjiang open seaports; and Lanzhou, Lhasa, and Xigatse dry ports for trading with other countries. In addition, in December 2020, India and the UK announced a plan to finalize free trade agreement (FTA) in areas such as pharmaceuticals, fintech, chemicals, defense manufacturing, petroleum, and food products by 2021. Thus, an increase in trading activities due to globalization fuels the growth of the logistics market.

Rise of tech-driven energy logistics services and the growing adoption of IoT-enabled connected devices

Increasing Internet of things (IoT) penetration in the energy logistics sector enables freight companies to directly access the company network via the Internet. Moreover, the increasing use of artificial intelligence (AI), machine learning, radio-frequency identification (RFID), and Bluetooth, coupled with other newly introduced technologies, such as driverless vehicles, act as the catalyst to the growth of the energy logistics market size. In addition, some energy logistics companies worldwide are increasing their spending and using technologically advanced systems for logistics enhancement, which are further expected to propel the growth of the market. For instance, in December 2021, Rhenus Group collaborated with Geek+, a global leader in the autonomous mobile robot segment, to develop advanced logistics solutions across its warehouses in Asia, improving the warehouse's order fulfillment performance.

Poor infrastructure and higher logistics costs

Energy logistics demands good infrastructure, supply chain, and trade facilitation. Without these, firms have to build up more stock reserves and working capital, which can strongly affect national and regional competitiveness due to high financial costs. In addition, lack of infrastructure hinders the energy logistics market, increasing costs and reducing supply chain reliability. These include significant inefficiencies in transport, poor condition of storage infrastructure, complex tax structure, low technology adoption rate, and poor energy logistics professionals' skills. For instance, according to a report by the Economist, an international newspaper, Latin America lacks adequate infrastructure. More than 60% of the region’s roads are unpaved. Thus, due to poor transport infrastructure, firms need high inventories to account for contingencies, which can result in higher overall logistics costs. Therefore, poor infrastructure, high inventory prices, and insufficient warehousing space are expected to hamper the market growth.

Emergence of last-mile deliveries coupled with logistics automation

Last mile logistics refers to the final step of the delivery process from a distribution center or facility to the end user. The rising pharmaceuticals, wind, chemical, and food & beverages industries are also witnessing a greater emphasis on last-mile delivery options across logistics industries. Furthermore, the continuous effort of energy logistics companies to offer efficient last-mile deliveries is another opportunity expected to fuel the logistics market growth in the near future. In addition, automation has also been gaining traction in the logistics industry. Thus, the inception of logistics 4.0 is one of the key logistics trends opening lucrative opportunities in the energy logistics industry. For instance, in June 2022, Hellmann Worldwide Logistics acquired OptimNet Solutions S.R.O., a Czech and Slovakian-based overnight express service provider. This acquisition successfully expanded the company`s presence in the overnight express services area and strengthened its presence in the Central and Eastern European regions. Hence, the emergence of last-mile deliveries coupled with logistics automation is expected to create lucrative opportunities for the energy logistics market during the forecast period.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global energy logistics market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall energy logistics market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global energy logistics market with a detailed impact analysis.

- The current energy logistics market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Energy Logistics Market Report Highlights

| Aspects | Details |

| By Application |

|

| By End-User |

|

| By Mode of Transport |

|

| By Region |

|

| Key Market Players | C.H.Robinson, Beijing Automotive Co., Ltd., Dongfeng Motor Corporation, Phoenix Freight Systems, Yusen Logistics Co., Ltd., A.P. Moller - Maersk, Deutsche Post DHL, Logistics Plus Inc., Kuehne+Nagel International AG, DB Schenker Logistics, Apollo Energy Automobile Industry, MGF, DSV, Rhenus Group, BYD, Hellmann Worldwide Logistics, Geodis |

Analyst Review

This section provides the opinions of various top-level CXOs in the global energy logistics market. Hence, based on the interviews of various top-level CXOs of leading companies, increase in demand for renewable energies across the globe is expected to boost the energy logistics market over the forecast period. In addition, rise of tech-driven logistics services, increasing adoption of IoT-enabled connected devices, and rise in reverse logistics operations fuel the growth of the energy logistics market. For instance, in October 2021, Geodis announced to open new multi-user facility in Luhari, India with advanced warehousing solutions that offer solutions to manage large merchandise inventory, along with the necessary tools to ensure both real-time and end-to-end visibility and strengthen its overall presence in Indian logistics market.

Furthermore, development of the overseas market is a significant factor that fuels the market's growth. For instance, in 2019, Nepal and China signed the Protocol on Implementing Agreement on Transit and Transport along with 6 other agreements to enable Nepal to access Chinese sea and land ports. China has agreed to let Nepal use Tianjin, Shenzhen, Lianyungang, and Zhanjiang open seaports; and Lanzhou, Lhasa, and Xigatse dry ports for trading with other countries. In addition, in December 2020, India and the UK announced a plan to finalize free trade agreement (FTA) in areas such as energy-based products, pharmaceuticals, fintech, chemicals, defense manufacturing, petroleum, and food products by 2021.

The market growth is supplemented by factors such as rise in trade-related agreements, rise of tech-driven energy logistics services and the growing adoption of IoT-enabled connected devices, and increasing wind energy production capabilities supplement the growth of the energy logistics market. However, poor infrastructure & higher logistics costs and lack of control of manufacturers on logistics service are the factors expected to hamper the growth of the energy logistics market. In addition, emergence of last-mile deliveries coupled with logistics automation and improvement in efficiency and workforce safety creates market opportunities for the key players operating in the energy logistics market.

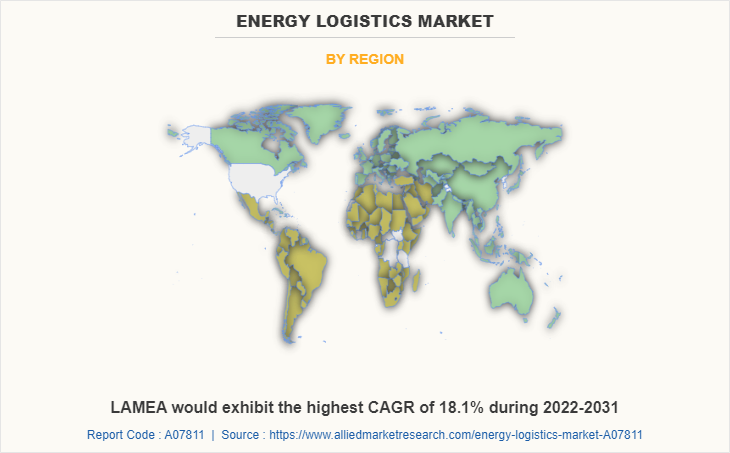

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by North America, Europe, and LAMEA. On the basis of forecast analysis, LAMEA is expected to lead during the forecast period, due to increase in demand for renewable energies across the region and rise in adoption of green logistics solutions.

Increased use in Oil & Gas transportation are the upcoming trends of Energy Logistics Market in the world

Use in private sector is the leading application of Energy Logistics Market

Asia-Pacific is the largest regional market for Energy Logistics

The global energy logistics market was valued at $351.2 billion in 2021, and is projected to reach $1,383.74 billion by 2031, registering a CAGR of 14.7% from 2022 to 2031

The leading players operating in the energy logistics market are A.P. Moller - Maersk, Apollo Power Ltd., Beijing Automobile Co., Ltd., BYD Motors Inc., C.H. Robinson Worldwide Inc., DB Schenker, Deutsche Post AG, Dongfeng Motor Company, DSV, Geodis, Hellmann Worldwide Logistics, Kuehne+Nagel International AG, Logistics Plus Inc., MGF, Phoenix Freight Systems, Rhenus Group, and Yusen Logistics Co., Ltd.

Loading Table Of Content...