Ethernet Switch Market Research, 2031

The Global Ethernet Switch Market was valued at $17.2 billion in 2021 and is projected to reach $26.1 billion by 2031, growing at a CAGR of 4.4% from 2022 to 2031. An Ethernet switch is a multiport network switch or a LAN switch that connects all the computer networking devices on a computer network. It forwards the data only to its destination port, unlike Ethernet hubs, which forward the data to all ports irrespective of the requirement. Industrial-grade

Ethernet switches are specifically designed for connecting devices in industrial network environments that are subject to extreme operating temperatures ranging from -40°C to 75°C, as well as shocks and vibrations. Such types of Ethernet switches find applications in industrial and factory automation; rail and intelligent transportation systems (ITSs); marine; and oil and gas sectors.

Key Takeaways

- The global Ethernet switch market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literature, industry releases, annual reports, and other such documents of major market industry participants, along with authentic industry journals, trade associations' releases, and government websites, have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global Ethernet switch markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Ethernet Switch Market Segment Overview

The Ethernet switch market is segmented into Type, Configuration, and Speed.

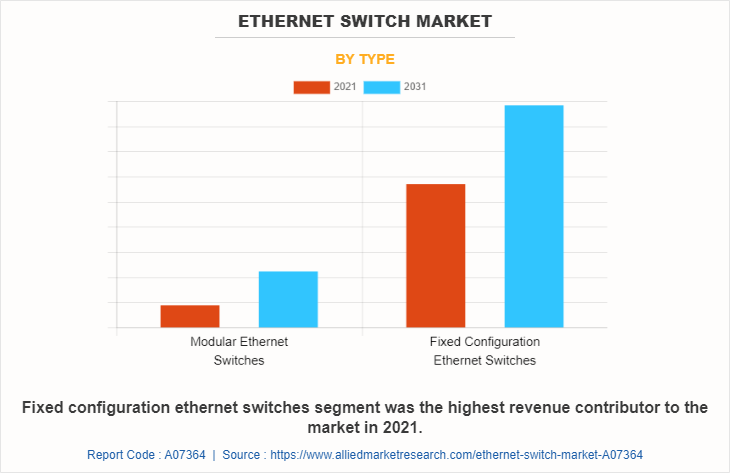

By type, the market is divided into modular Ethernet switches and fixed configuration Ethernet switches. The fixed configuration Ethernet switches segment was the highest revenue contributor to the market in 2021.

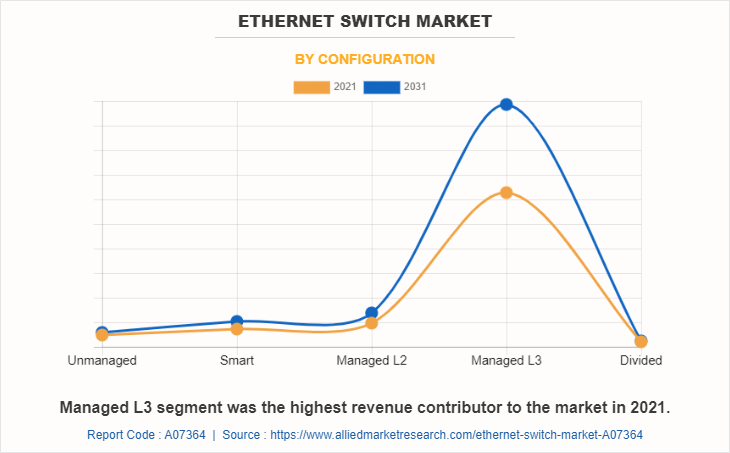

The configuration segment is divided into unmanaged, smart, managed L2, managed L3, and managed L4. The managed L3 segment was the highest revenue contributor to the market in 2021.

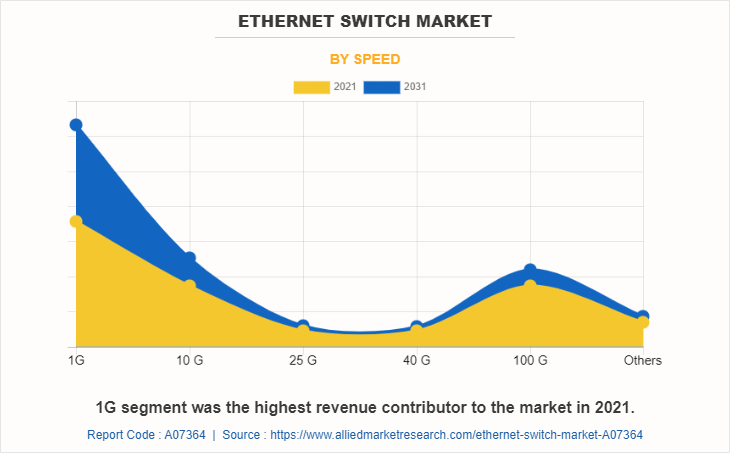

By speed, the market is analyzed across 1G, 10 G, 25 G, 40 G, 100 G, and others. The 1G segment was the highest revenue contributor to the market in 2021.

Key Market Dynamics

Factors such as an increase in the adoption of Ethernet switches due to their benefits and the rise in the need to ensure efficiency in communication infrastructure in the automotive & transport environment significantly drive the growth of the Ethernet switch industry. In addition, the rise in the application of Ethernet switches in industrial infrastructures, such as smart grid, intelligent rail & traffic, security & surveillance, and other utilities, fuels the market growth. However, the technological complexity involved in Ethernet switches that makes it vulnerable to security attacks is anticipated to restrain the market growth. On the contrary, factors such as the emergence of Industry 4.0 are anticipated to provide lucrative opportunities for market growth. In addition, the emergence of connected vehicles in the automotive & transportation industry is expected to be opportunistic for the growth of the Ethernet switch market during the forecast period.

Significant factors that impact the growth of the Ethernet switch market size include a rise in the application of Ethernet switches in industrial infrastructures, such as smart grids, intelligent rail & traffic, security & surveillance, and other utilities. Moreover, the rapid adoption of industrial Ethernet switches due to their benefits is expected to drive the market opportunity. However, the technological complexity involved in Ethernet switches that makes it vulnerable to security attacks might hamper the Ethernet switch market growth. On the contrary, the emergence of connected vehicles in the automotive & transportation industry is offering potential growth opportunities for the Ethernet switch market share during the forecast period.

Regional/Country Market Outlook

- North America: North America is a leading market for Ethernet switches, driven by high demand from sectors such as cloud computing, data centers, and IoT. The U.S. is the primary contributor due to its advanced IT infrastructure and the presence of major vendors like Cisco. Government initiatives supporting digital transformation further bolster growth.

- Asia-Pacific: Asia-Pacific is expected to witness the fastest growth in the Ethernet switch market, driven by rapid industrialization, urbanization, and the expansion of data centers in countries like China, India, and Japan. The growing adoption of cloud services and IoT applications is further propelling demand. Government initiatives to improve digital infrastructure also contribute to Ethernet switch market expansion.

- Europe: The European Ethernet switch market is characterized by increasing investments in network infrastructure and the rollout of 5G technology. Countries like Germany and the UK are at the forefront, with a strong focus on enhancing connectivity in urban areas. The rise of smart cities and digital transformation across various industries fuels the demand for high-capacity switches.

- Latin America & Middle East: The LAMEA region (Latin America, the Middle East, and Africa) shows moderate growth potential for Ethernet switches. In Latin America, increasing internet penetration and demand for connectivity drive Ethernet switch market growth, particularly in Brazil and Mexico. The Middle East is investing in smart infrastructure and digital services, while Africa is witnessing a surge in mobile broadband adoption, enhancing the need for efficient networking solutions. Challenges like political instability and economic fluctuations may impact growth rates in certain areas.

The key players in the Ethernet switch industry profiled in the report include, Alcatel-Lucent Enterprise International, Allied Telesis, Inc., Arista, Belden Inc., Black Box Network Services, Broadcom, Cisco Systems Inc., Dell Inc., H3C, Hewlett Packard Enterprise Development LP, HUAWEI, Intel Corp., Juniper Networks, Moxa Inc., Siemens, TRENDnet, Inc., and Advantech Co., Ltd. are provided in this report.

Report Coverage & Deliverables

This report delivers in-depth insights into the Ethernet switch market, by type, by configuration, by speed, and key strategies employed by major players. It offers detailed market forecasts and emerging trends.

Type Insights

The Ethernet switch market comprises modular and fixed-configuration switches. Modular switches are favored in enterprise environments for their flexibility and scalability, making them ideal for data centers and large enterprises requiring high availability. Fixed configuration switches dominate due to their simplicity and cost-effectiveness, catering to small to medium-sized businesses (SMBs) and branch offices seeking reliable connectivity.

Configuration Insights

In the configuration category, unmanaged, smart, managed L2, and managed L3 switches serve different segments. Unmanaged switches are popular for small networks due to their plug-and-play functionality, while smart switches offer basic traffic management, appealing to small to medium enterprises. Managed L2 and L3 switches provide advanced capabilities for enterprises prioritizing performance and security, and divided switches are gaining popularity for enhancing network efficiency in high-traffic environments.

Speed Insights

Ethernet switches vary in speed from 1G to 100G, addressing diverse performance needs. 1G and 10G switches are widely used in SMBs and enterprises, while demand for 25G and 40G switches is increasing in data centers due to the need for higher bandwidth. 100G switches are becoming essential for service providers and large enterprises handling data-intensive applications. Emerging configurations like 2.5G and 5G offer flexible solutions for organizations seeking incremental upgrades.

Regional Insights

The Ethernet switch market is driven by regional dynamics, with North America leading in demand due to cloud computing and IoT, particularly in the U.S. Europe is growing through investments in network infrastructure and 5G, focusing on urban connectivity, especially in Germany and the UK. Asia-Pacific is rapidly expanding with industrialization and data centers in China, India, and Japan. In LAMEA, moderate growth is seen from rising internet penetration in Latin America and smart infrastructure investments in the Middle East, despite challenges from political instability in certain areas.

Key Strategies and Developments

- In July 2024, Moxa introduced its new MRX Series Layer 3 rackmount Ethernet switches, designed to enhance data-driven transformations within industrial applications. These high-bandwidth switches support up to 64 ports, including 16 ports capable of 10GbE speeds, facilitating faster data aggregation for industrial settings. This advancement enables users to develop a high-capacity network infrastructure that supports the convergence of IT and operational technology (OT). Additionally, the MRX Series integrates seamlessly with the EDS-4000/G4000 Series Layer 2 DIN-rail Ethernet switches, which offer 2.5GbE uplink options.

- In July 2024, Red Lion, a leader in innovative electronic technologies, launched the N-Tron NT116, an unmanaged industrial Ethernet switch tailored for critical industrial applications that require reliable performance even in harsh environments. This switch is engineered to ensure dependable operation for mission-critical tasks, reinforcing Red Lion's commitment to providing robust solutions for demanding industrial settings.

- In February 2024, Westermo unveiled a new lineup of compact and user-friendly unmanaged industrial Ethernet switches. The SandCat series features five-port fast Ethernet switches that provide a cost-effective, plug-and-play solution tailored for various industrial applications. Designed to support 100 Mbit/s, these versatile devices address the growing complexities, reliability needs, and bandwidth requirements prevalent in sectors such as utilities, marine, manufacturing, and energy, complementing Westermo's existing managed switch offerings.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Ethernet switch market from 2021 to 2031 to identify the prevailing Ethernet switch market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the Ethernet switch market outlook assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global Ethernet switch market trends, key players, market segments, application areas, Ethernet switch market forecast, and market growth strategies.

Ethernet Switch Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 26.1 billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 318 |

| By Type |

|

| By Speed |

|

| By Configuration |

|

| By Region |

|

| Key Market Players | TRENDnet, Inc., Allied Telesis, Inc. , Hewlett Packard Enterprise, Arista Networks, Inc., Belden Inc., Alcatel-Lucent Enterprise International, Dell Inc., H3C Technologies Co., Ltd, Moxa Inc., Broadcom Inc., Cisco Systems Inc., Black Box, Siemens AG, Intel Corporation, Juniper Networks, Huawei Technologies Co., Ltd., Advantech Co., Ltd. |

Analyst Review

The Ethernet switch market is going through enormous transformation and growth. Increase in adoption of Ethernet-based solution in a number of industries as well as improvement of data center capacities are fueling the demand for Ethernet switches.

In addition, increase in adoption of Ethernet switches due to their benefits along with the increasing need to ensure efficiency in communication infrastructure in the automotive & transport environment significantly drives the growth of the market. Moreover, rise in application of Ethernet switch in industrial infrastructures, such as smart grid, intelligent rail & traffic, security & surveillance, and other utilities, fuels the market growth. However, the technological complexity involved in Ethernet switches makes it vulnerable toward security attacks, which is anticipated to restrain the market growth. On the contrary, factors such as the emergence of Industry 4.0 is anticipated to provide lucrative opportunities for the market growth. In addition, emergence of connected vehicles in the automotive & transportation industry is expected to be opportunistic for growth of the ethernet switch market during the forecast period.

The ethernet switch market is competitive and comprises a number of regional and global vendors competing, based on factors such as cost of solutions & services, reliability, efficiency of the product, and support services. Owing to the competition, vendors operating in the market are offering advanced industrial Ethernet switch solutions to improve the marketing strategies of enterprises. For instance, in February 2020, Advantech, the leading player in embedded, industrial, IoT, and automation solution platforms launched its latest series of 10G industrial Ethernet switches. This launch extends the coverage of Advantech’s 10G product line by delivering a variety of 10G Ethernet selections. In addition, key players are heavily investing in R&D activities to develop effective Ethernet switch technology and services offerings, which is opportunistic for the market.

The key players profiled in the Ethernet switch market players include, Alcatel-Lucent Enterprise International, Allied Telesis, Inc., Arista, Belden Inc., Black Box Network Services, Broadcom, Cisco Systems Inc., Dell Inc., H3C, Hewlett Packard Enterprise Development LP, HUAWEI, Intel Corp., Juniper Networks, Moxa Inc., Siemens, TRENDnet, Inc., and Advantech Co., Ltd.

The global Ethernet Switch Market was valued at $17.2 billion in 2021 and is projected to reach $26.1 billion by 2031, growing at a CAGR of 4.4% from 2022 to 2031.

The Ethernet Switch Market encompasses devices that connect multiple computers or devices within a network, forwarding data only to its destination port, enhancing network efficiency.

Prominent companies include Alcatel-Lucent Enterprise International, Allied Telesis, Inc., Arista, Belden Inc., Black Box Network Services, Broadcom, Cisco Systems Inc., Dell Inc., H3C, Hewlett Packard Enterprise Development LP, Huawei, Intel Corp., Juniper Networks, Moxa Inc., Siemens, TRENDnet, Inc., and Advantech Co., Ltd.

North America contributed to the major Ethernet Switch Market share, accounting for more than 42.4% in 2021.

Factors such as an increase in the adoption of Ethernet switches due to their benefits and the rise in the need to ensure efficiency in communication infrastructure in the automotive & transport environment significantly drive the market growth.

Challenges include technological complexity making Ethernet switches vulnerable to security attacks and bandwidth fluctuation and device compatibility issues.

Loading Table Of Content...

Loading Research Methodology...